UK E-commerce Market Report by Type (Home Appliances, Apparel, Footwear and Accessories, Books, Cosmetics, Groceries, and Others), Transaction (Business-to-Consumer, Business-to-Business, Consumer-to-Consumer, and Others), and Region 2025-2033

UK E-commerce Market Overview:

The UK e-commerce market size reached USD 297.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1,483.7 Billion by 2033, exhibiting a growth rate (CAGR) of 18.1% during 2025-2033. The growing online shopping activities among the masses, rising convenience-driven purchasing behaviors, competitive offerings from both established retailers and agile digital-native brands, and increasing user confidence in secure online transactions are some of the factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 297.0 Billion |

|

Market Forecast in 2033

|

USD 1,483.7 Billion |

| Market Growth Rate 2025-2033 | 18.1% |

UK E-commerce Market Trends:

Personalization and Customer Experience

The rising focus on creating personalized shopping journeys according to individual preferences is bolstering the market growth in the UK. By using sophisticated data analytics, artificial intelligence (AI) algorithms, and machine learning (ML), retailers can create personalized product recommendations, focused marketing strategies, and tailored promotions. This strategy not only increases user interaction but also reduces barriers to shopping, leading to higher conversion rates. E-commerce platforms enhance the shopping experience by providing relevant content based on shopper behavior and history, resulting in a more seamless and enjoyable process. Additionally, initiatives like prompt user service, simple return procedures, and loyalty schemes enhance buyer loyalty and contentment. In May 2024, Made With Intent, based in the UK, received €1.7M funding from Mercuri to introduce its segmentation platform for improving personalized e-commerce experiences with predictive intent metrics and integration with 40+ marketing tools. This financial support enhanced Made With Intent's initiatives to grow internationally and improve its range of products.

Subscription Services and Recurring Revenue Models

Subscription services and recurring revenue models are providing shoppers with personalized experiences that offer convenience and value. These strategies, such as subscription boxes, memberships, and auto-renewal programs, offer a steady income for e-commerce companies and help to retain buyers. Retailers use subscriptions to provide customized products and tailored experiences based on personal preferences, leading to better user relationships and loyalty. Brands promote continuous involvement and prevent buyer turnover by providing unique advantages and rewards, including early product access and exclusive discounts for members. Established brands seeking to expand revenue sources and startups striving for sustainable business models are attracted to the scalability and profitability of subscription services. In May 2024, Ordergroove entered the UK market, helping British stores like Hotel Chocolat and Halfords improve user lifetime value with its subscription technology, which catered to different subscriber needs and made operations more efficient in various sectors.

Strategic Partnerships Between Key Players

Businesses in different industries are working together with technology companies to improve their online shopping capabilities, streamline their inventory management processes, and enhance user satisfaction levels. By using AI-powered analytics, automated fulfillment systems, and personalized marketing tools, businesses effectively handle the challenges of online retail and meet increasing user demands for convenience and efficiency. These strategic alliances promote creativity, enabling e-commerce companies to remain competitive in a rapidly changing digital environment. For example, in January 2024, Holland & Barrett joined forces with THG Ingenuity for a significant revamp of their supply chain, establishing THG Ingenuity as their main e-commerce operational ally in the UK and Ireland. The collaboration was focused on boosting Holland & Barrett's online sales capabilities and optimizing their fulfillment processes to help with their expansion plans in the health and wellness industry.

UK E-commerce Market News:

- February 2024: International Logistics Group Limited, a subsidiary of Yusen Logistics Co., Ltd. in the U.K., purchased Noel Topco Limited, which includes Global Freight Solutions Limited (GFS), as a way for NYK Group to improve its logistics services and enter the e-commerce market. This purchase was made to combine platform services for handling product delivery and returns, expanding NYK Group's services and enhancing its market position.

- March 2024: AliExpress introduced livestream shopping in the UK through a collaboration with Vogue Business, showcasing local influencers such as former Love Island contestants and creators based in the UK. This project aimed to launch a new e-commerce platform that allowed creators to earn commissions from sales made during livestreams.

UK E-commerce Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and transaction.

Type Insights:

- Home Appliances

- Apparel, Footwear and Accessories

- Books

- Cosmetics

- Groceries

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes home appliances, apparel, footwear and accessories, books, cosmetics, groceries, and others.

Transaction Insights:

- Business-to-Consumer

- Business-to-Business

- Consumer-to-Consumer

- Others

A detailed breakup and analysis of the market based on the transaction have also been provided in the report. This includes business-to-consumer, business-to-business, consumer-to-consumer, and others.

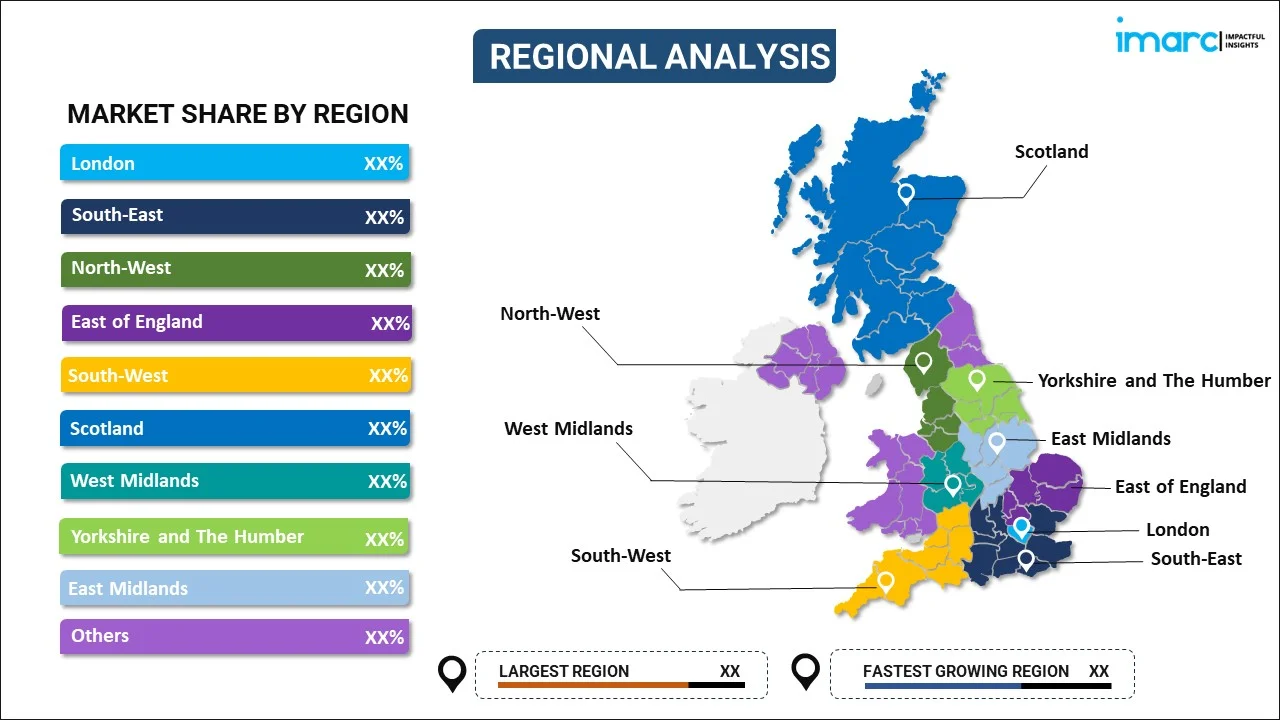

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK E-commerce Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Home Appliances, Apparel, Footwear and Accessories, Books, Cosmetics, Groceries, Others |

| Transactions Covered | Business-to-Consumer, Business-to-Business, Consumer-to-Consumer, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK e-commerce market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the UK e-commerce market?

- What is the breakup of the UK e-commerce market on the basis of type?

- What is the breakup of the UK e-commerce market on the basis of transaction?

- What are the various stages in the value chain of the UK e-commerce market?

- What are the key driving factors and challenges in the UK e-commerce?

- What is the structure of the UK e-commerce market and who are the key players?

- What is the degree of competition in the UK e-commerce market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK e-commerce market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK e-commerce market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK e-commerce industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)