UK Digital Identity Market Report by Identity Type (Biometric, Non-Biometric), Offering (Solutions, Services), Organization Size (Large Organization, SMEs), Deployment (Cloud, On-Premise), End User (BFSI, Retail and eCommerce, Government, Healthcare, IT and ITeS), and Region 2026-2034

UK Digital Identity Market Overview:

The UK digital identity market size reached USD 2.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 9.7 Billion by 2034, exhibiting a growth rate (CAGR) of 14.92% during 2026-2034. The market is propelled by the increasing internet penetration, implementation of government initiatives, rising frequency of cyberattacks and identity fraud, and growing need for secure and efficient identity verification solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.8 Billion |

| Market Forecast in 2034 | USD 9.7 Billion |

| Market Growth Rate 2026-2034 | 14.92% |

UK Digital Identity Market Trends:

Several Government Initiatives

As part of adopting digital identity, initiatives like the Digital Identity and Attributes Trust Framework are promoted by the UK government. It is mentioned by the Government of United Kingdom that over 2.2 million users have verified their identity so far using GOV.UK. These initiatives make efforts toward creating a standard and secure way for people as well as businesses to verify their identities online. The framework focuses on making accessibility, security, and interoperability. Such efforts do have an intention toward streamlining processes, reducing fraud, and increasing consumer trust in digital transactions. By setting guidelines for private companies to follow, the government is fostering an ecosystem that encourages innovation while ensuring compliance with data protection and privacy laws, such as GDPR. As more sectors adopt digital identity verification methods, the need for a robust system is increasing, pushing market growth in areas like e-commerce, banking, and public services. The emphasis on a safe and unified digital identity system is a major force behind the market’s expansion.

Increased focus on cybersecurity

With the rising frequency of cyberattacks and identity fraud, both businesses and consumers are prioritizing secure digital identification systems. As per Official Statistics Cyber Security Breaches Survey 2024, half of businesses (50%) and around a third of charities (32%) reported cyber security breach or attack in 2023. This is higher for large businesses (74%), medium businesses (70%), and high-income charities with £500,000 or more annual income (66%). Cybercrime is becoming more sophisticated, leading to significant financial losses for businesses and individuals alike. This has created a demand for advanced digital identity verification solutions that can help reduce fraud and provide a higher level of trust in online interactions. The UK digital identity market is responding by developing technologies that verify user identities and monitor and prevent fraudulent activities in real time. These solutions are gaining popularity in sectors such as banking, retail, and government services, where secure identification is essential. By integrating biometric authentication, artificial intelligence, and encryption, these systems are evolving to meet the complex needs of today’s digital landscape, contributing to the market's growth.

UK Digital Identity Market News:

- In January 2023, the Cabinet Office's Government Digital Service (GDS) worked closely with other government departments to build GOV.UK One Login. GOV.UK One Login places a strong emphasis on inclusion. The new data-sharing legislation will ensure that more people can authenticate their identity online and access government services, allowing anyone who wants to utilize them to do so. Furthermore, the government is committed to realizing the benefits of digital identification technology without creating ID cards.

UK Digital Identity Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on identity type, offering, organization size, deployment, and end user.

Identity Type Insights:

- Biometric

- Non-Biometric

The report has provided a detailed breakup and analysis of the market based on the identity type. This includes biometric and non-biometric.

Offering Insights:

- Solutions

- Services

A detailed breakup and analysis of the market based on the offering have also been provided in the report. This includes solutions and services.

Organization Size Insights:

- Large Organization

- SMEs

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes large organization and SMEs.

Deployment Insights:

- Cloud

- On-Premise

A detailed breakup and analysis of the market based on the deployment have also been provided in the report. This includes cloud and on-premise.

End User Insights:

- BFSI

- Retail and eCommerce

- Government

- Healthcare

- IT and ITeS

The report has provided a detailed breakup and analysis of the market based on the end user. This includes BFSI, retail and ecommerce, government, healthcare, and IT and ITeS.

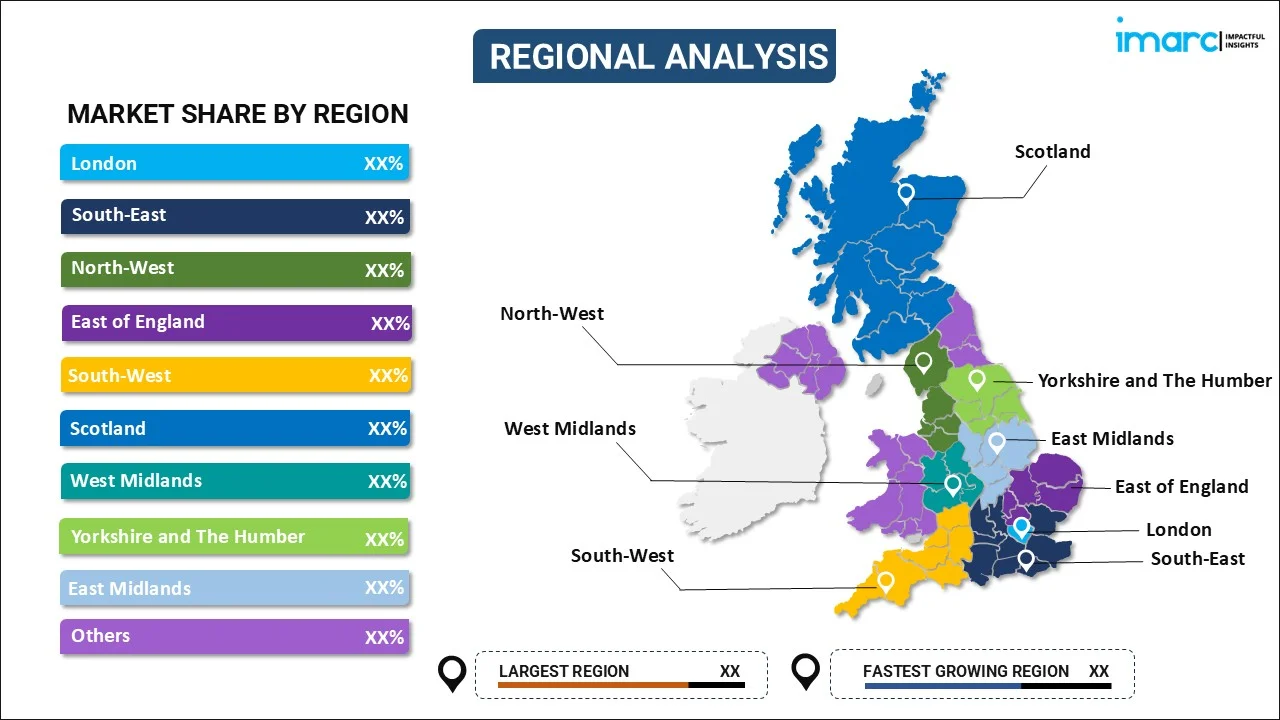

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Digital Identity Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Identity Types Covered | Biometric, Non-Biometric |

| Offerings Covered | Solutions, Services |

| Organization Sizes Covered | Large Organization, SMEs |

| Deployments Covered | Cloud, On-Premise |

| End Users Covered | BFSI, Retail and eCommerce, Government, Healthcare, IT and ITeS |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK digital identity market performed so far and how will it perform in the coming years?

- What is the breakup of the UK digital identity market on the basis of identity type?

- What is the breakup of the UK digital identity market on the basis of offering?

- What is the breakup of the UK digital identity market on the basis of organization size?

- What is the breakup of the UK digital identity market on the basis of deployment?

- What is the breakup of the UK digital identity market on the basis of end user?

- What are the various stages in the value chain of the UK digital identity market?

- What are the key driving factors and challenges in the UK digital identity?

- What is the structure of the UK digital identity market and who are the key players?

- What is the degree of competition in the UK digital identity market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK digital identity market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK digital identity market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK digital identity industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)