UK Digital Health Market Size, Share, Trends and Forecast by Type, Component, and Region, 2025-2033

UK Digital Health Market Size and Share:

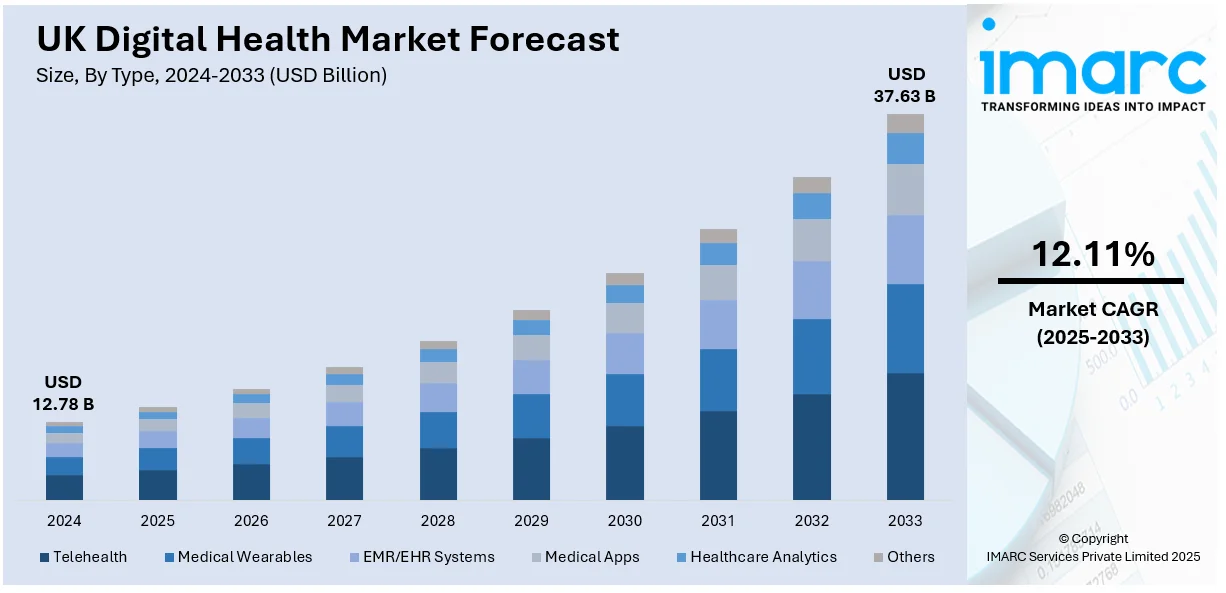

The UK digital health market size was valued at USD 12.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 37.6 Billion by 2033, exhibiting a CAGR of 12.11% from 2025-2033. South East currently dominates the market owing to its advanced healthcare infrastructure, high digital literacy, proximity to research centers, and robust regional investment in innovation, facilitating quicker adoption of telehealth, health software, and personalized digital care technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12.8 Billion |

| Market Forecast in 2033 | USD 37.6 Billion |

| Market Growth Rate 2025-2033 | 12.11% |

The UK digital healthcare sector is largely fueled by extensive government support and the calculated effort to drive healthcare delivery to a digital phase. National strategies have focused on integrating digital components into the public healthcare system, with the purpose of enhancing the outcomes of patients, simplifying administrative tasks, and alleviating the pressure from face-to-face services. Electronic health records (EHRs), teleconsultation, and mobile health applications are being embraced by regions to facilitate increased accessibility and continuity of care. Health data infrastructure and interoperability standards investment have provided an integrated and more efficient environment, especially valuable in the care of chronic diseases and the elderly. Patient-centric digital platforms highlight the larger aspirations of proactive monitoring of health and early intervention. For example, in November 2024, Affidea Group joined forces with Reset Health to introduce the Roczen platform, a clinically driven digital weight loss and diabetes care solution in Europe, providing personalized treatment, GLP-1 medications, and enhanced health outcomes for obesity and type 2 diabetes patients. Furthermore, these initiatives reform service delivery and contributes to the larger vision of building a robust and adaptable healthcare model that is data-driven and technology-based to better address emerging health needs.

The growing trend towards personalized and remote healthcare services is a primary driver of UK digital health market growth. For instance, in February 2024, Neko Health opened its AI-powered preventive health clinic in London, providing full-body scans that gather more than 50 million data points to identify early manifestations of cardiovascular, metabolic, and skin disorders. Moreover, consumers increasingly look for easy, personalized health services that easily integrate into daily lifestyles, fueling the upsurge in wearable device use, remote monitoring devices, and app-based health trackers. This is especially seen in people dealing with chronic disease, the older generation, and those looking for preventive wellness. Having the ability to track vital signs, drug compliance, and lifestyle parameters remotely has made extended care beyond traditional clinics possible. This change brings patient involvement to the forefront and gives individuals greater autonomy to assume more responsibility in maintaining their own health. Additionally, the use of data analytics and artificial intelligence (AI) technologies in remote care platforms is enabling early treatment, risk forecasting, and optimization of treatment. Research on personalized digital healthcare advances long-term public health objectives and alleviates the burden on physical healthcare infrastructure.

UK Digital Health Market Trends:

Heightening Adoption of Health Tech Solutions

The UK digital health market is experiencing significant growth driven by the heightening adoption of health tech solutions. According to a report by the UK government, digital health investments surged to £11.2 Billion in 2020, marking a notable 14% year-on-year increase. This growth is fueled by the developments such as wearable devices, telemedicine, and artificial intelligence-based diagnostics that are improving the delivery of care and organization of health systems across the country. A shift toward online health services has been observed over the last years with the constant growth of telemedicine services even in the coronavirus (COVID-19) period. Furthermore, with advancements in AI and machine learning diagnostic tools are improving and are less time-consuming and more accurate.

Favorable Regulatory Environment

A favorable regulatory environment is highly valuable in the evaluation of the growth of innovative solutions within the United Kingdom's digital health market. Action taken through government policies such as the NHS Long Term Plan is vital in promoting awareness of the need to invest in digital care transformation. According to the UK Department of Health and Social Care, the UK has significant plans for investing in digital health technology and policies, with an aspiration to attain digitally supported care services for 75% of the population by 2023. They require the integration of new technologies into the health sector and assist in transforming the regulatory measures concerning the evolution of telemedicine, AI-based diagnostics, and wearable health monitors. These regulatory initiatives reinforce cooperation between care leaders, technology inventors, and regulatory authorities to guarantee that technological interventions in digital health are secure, operative, and compliant with data privacy laws.

Increasing Healthcare Demands and Aging Population

The situation in the UK is characterized by growing levels of healthcare needs arising from increased population aging. According to the stats from the UK Office for National Statistics, it is estimated that one in four population in the UK will be 65 years and above by 2043 an element that is likely to continue exerting pressure on healthcare. These challenges can be managed by digital health technologies because the resolutions involved are easy to scale and less costly. Such solutions enable enhancements in patient care and help serve chronic illnesses. The expansion into the field of digital health is vital in increasing healthcare delivery due to demographic constraints regarding timely interventions and care of the elderly. Thus, this demographic shift only underlines the need for digital health as one of the tools for catering to future healthcare needs, independence, and improving the quality of life of elderly people thus alleviating the burden on the healthcare system.

UK Digital Health Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the UK digital health market, along with forecast at the regional, and country levels from 2025-2033. The market has been categorized based on type and component.

Analysis by Type:

- Telehealth

- Medical Wearables

- EMR/EHR Systems

- Medical Apps

- Healthcare Analytics

- Others

Telehealth is the most prominent segment in the UK digital health market because of its ability to provide timely and convenient healthcare services in both urban and rural environments. Through virtual consultations, remote diagnosis, and follow-ups through video, phone, or secure messaging platforms, telehealth has revolutionized the patient-provider relationship. Its integration in primary care, mental health treatment, and the management of chronic diseases has greatly enhanced care continuity and relieved pressures on physical health infrastructure. Broad smartphone coverage, reliable internet, and intuitive digital platforms have even further propelled uptake. Healthcare workers are making use of telehealth not only for routine consultations but also for referrals to specialists and multidisciplinary team meetings. With changing patient needs towards convenience and digital-first solutions, telehealth has become central to UK health care delivery nowadays. Its expanding role is enhanced by health care system strategies which seek to create efficiency, bring down waiting time, and widen access to the care.

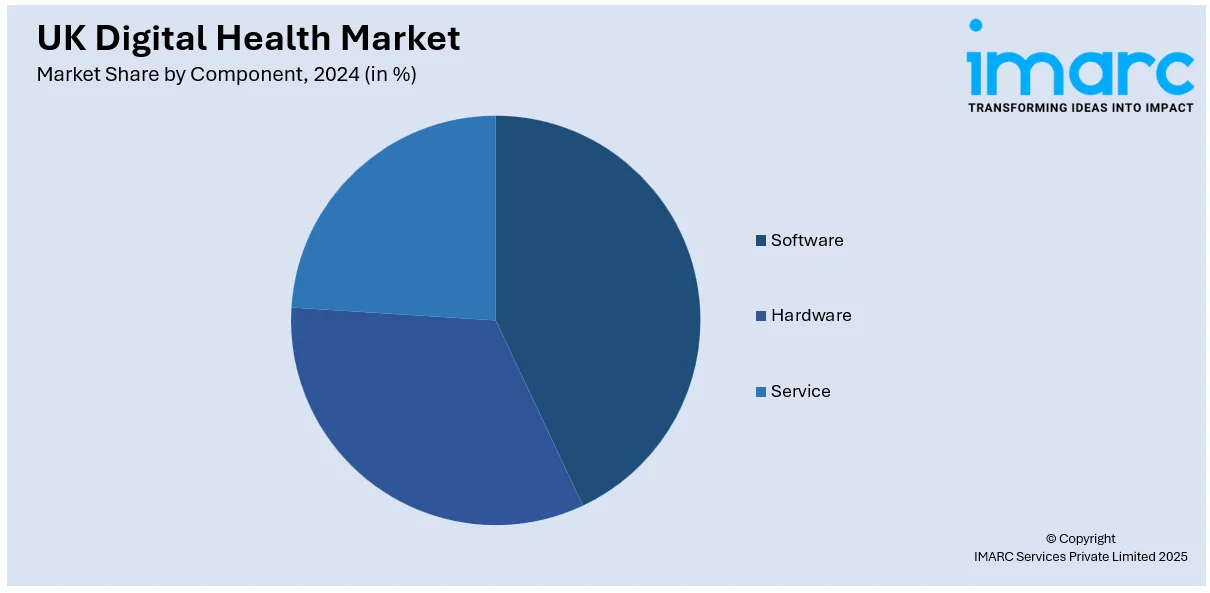

Analysis by Component:

- Software

- Hardware

- Service

Software constitutes the foundation of the UK's digital health infrastructure, serving as the most critical element by facilitating the operation of telehealth services, electronic health records, mobile health applications, and clinical decision support systems. These digital platforms are built to improve the precision, pace, and individualization of healthcare delivery. Software applications make it possible to have real-time communication between healthcare providers and patients, allow early diagnosis through data analytics, and automate administrative tasks like appointment management and billing. As the importance of patient interaction and preventive medicine grows, software solutions are becoming customized to provide interactive health tracking, medication alerting, and remote monitoring screens. Integration into existing healthcare systems, such as interoperability with national health data networks, are key functionalities fuelling adoption. Moreover, AI and machine learning advances are integrated into these platforms, enabling predictive insights as well as personalized health suggestions. With increasing demand for scalable and secure digital solutions, software remains at the forefront of innovation in the UK digital health market.

Regional Analysis:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The UK's South East stands out as the leading digital health market, driven by a robust health infrastructure, a high-density population presenting diverse medical requirements, and proximity to premium research institutions. High digital literacy and global access to internet connectivity help ease the adoption of telehealth services, remote monitoring solutions, and mobile health applications. Clinical care providers and organizations in the South East are working proactively to embed digital solutions to improve patient engagement, wait times, and long-term disease management. Furthermore, the presence of academic medical centers and hubs for innovation leads to the speedy testing and expansion of new technologies in real-world environments. The health authorities of the region have also shown forward-thinking attitudes to embracing digital innovations in public services, further driving market development. As there is an increasing focus on personalized treatment and digital-first healthcare delivery, the South East continues to be a leader in digital transformation for the UK healthcare sector.

Competitive Landscape:

The UK digital health market's competitive landscape is influenced by a heterogeneous combination of mature healthcare technology vendors, health-related startups, and academic partnerships. The ecosystem is vibrant with innovation happening in remote patient monitoring, telehealth platforms, digital therapeutics, and AI-based diagnostic solutions. There is growing emphasis on creating interoperable solutions that integrate harmoniously into existing health infrastructures for data sharing and collaborative models of care. Growth is also facilitated by collaborations between healthcare organizations and technology companies with the goal of speeding up the rollout of scalable digital solutions. Regional health programs and pilot projects often act as laboratories for new technologies prior to national implementation. The market is helped by robust talent pools in both data sciences and healthcare, as well as supportive regulatory leadership that promotes innovation while ensuring patient safety. This competitive and innovative setting continues to promote speedy developments in personalized care, data-driven decision-making, and accessibility to healthcare.

The report provides a comprehensive analysis of the competitive landscape in the UK digital health market with detailed profiles of all major companies.

Latest News and Developments:

- March 2025: The Ministry of Health in Guyana collaborated with UK-based RioMed Limited to introduce the Cellma Electronic Health Record (EHR) system, a major milestone in the country's digital health journey. A USD 3.3 million grant from the Inter-American Development Bank sponsored the 18-month project to computerize patients' records, beginning with the Georgetown Public Hospital and satellite clinics.

- October 2024: Huma purchased eConsult, a digital-first triage and automated consultation service for primary and emergency care, to add strength to the NHS's patient-first and digital way of working. The buyout, as part of Huma's earlier buyout of iPlato, is designed to drive further digital health solution take-up across the healthcare system.

- March 2024: The LEAP (Leadership, Engagement, Acceleration & Partnership) Digital Health Hub was launched in Southwest England and Wales, directed by the University of Bristol and supported by a GBP 4.11 million EPSRC grant. Working in partnership with five universities, NHS trusts, and industry partners, LEAP seeks to drive forward digital health by research, training, and innovation. Its projects involve a Skills and Knowledge Programme and fellowship programs to create future leaders in digital healthcare.

UK Digital Health Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Telehealth, Medical Wearables, EMR/EHR Systems, Medical Apps, Healthcare Analytics, Others |

| Components Covered | Software, Hardware, Service |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK digital health market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the UK digital health market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK digital health industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The UK digital health market was valued at USD 12.8 Billion in 2024.

The UK digital health market is projected to exhibit a CAGR of 12.11% during 2025-2033, reaching a value of USD 37.6 Billion by 2033.

Major drivers of the UK digital healthcare market are rising demand for distance healthcare services, more government backing for digitization of health, technological progress in AI and data analysis, high prevalence of chronic diseases, and massive impetus for individualized patient-focused care using digital platforms and linked health technologies.

South East currently dominates the UK digital health market owing to its well-developed healthcare infrastructure, high digital literacy level, robust regional investment, existence of innovation centers, and early uptake of telehealth-supporting technologies, data analytics, and digital personalized care solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)