UK Crowdsourced Delivery Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

UK Crowdsourced Delivery Market Overview:

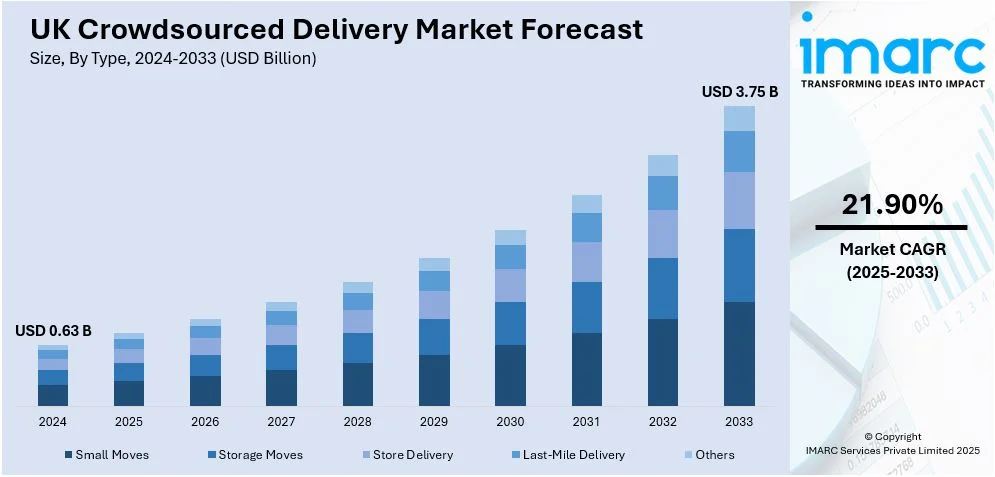

The UK crowdsourced delivery market size reached USD 0.63 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.75 Billion by 2033, exhibiting a growth rate (CAGR) of 21.90% during 2025-2033. The market is experiencing robust growth, fueled by rising consumer expectations for fast and flexible delivery solutions, the rapid growth of e-commerce channels, continual technological innovations that enhance logistics efficiency, increasing awareness of sustainability issues, and the proliferation of gig economy participation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.63 Billion |

| Market Forecast in 2033 | USD 3.75 Billion |

| Market Growth Rate (2025-2033) | 21.90% |

UK Crowdsourced Delivery Market Trends:

Surging Demand for Flexible Delivery Services

The UK's rising dependence on digital convenience has resulted in an increase in flexible and efficient last-mile delivery options. As more people use online food and grocery delivery services, app-based networks that link freelance couriers with local businesses are growing more popular. This trend reflects a need for speedier and on-demand services, especially in metropolitan regions where convenience and time efficiency are top considerations. The growing use of gig economy workers and real-time tracking is altering logistics, allowing firms to cut costs while increasing reach. To remain competitive, companies are implementing technological advancements such as AI-powered route optimization and environmentally friendly delivery techniques. As expectations shift, the industry continues to adapt, providing opportunities for firms to improve their service offerings. The increasing focus on affordability, flexibility, and sustainability is shaping the future of delivery services, ensuring they remain an integral part of the digital-first economy. According to industry reports, in 2023, the online food delivery market in the UK generated an estimated USD 40 Billion in revenue, with USD 22 Billion from grocery deliveries and USD 18 Billion from meal deliveries.

Rising Community-Driven Delivery Networks

The UK is witnessing a trend toward more efficient and sustainable delivery systems that leverage current transportation networks. Platforms that connect senders with drivers already on their way to a location are gaining popularity, providing a cost-effective and environmentally responsible alternative to traditional services. By avoiding the need for further travel, this technique helps to reduce emissions while giving customers with inexpensive alternatives. Word-of-mouth advertising and community-driven participation, such as social media groups, are critical for increasing adoption. As more individuals adopt this approach, the emphasis is on establishing smooth transactions and universal involvement. This changing picture emphasizes the growing relevance of shared mobility in improving last-mile logistics and fostering a more sustainable delivery ecosystem. For instance, in December 2023, Porta Delivery, a crowdsourced delivery service, was established in the UK, which links people who need products carried with drivers who are already on their way to the location. This strategy provides cost-effective and environmentally friendly delivery options by using existing routes, benefiting consumers and lowering emissions. The platform has gained popularity through a variety of marketing tactics, including Facebook groups and word of mouth, with the goal of reaching critical mass enabling frictionless transactions.

UK Crowdsourced Delivery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Small Moves

- Storage Moves

- Store Delivery

- Last-Mile Delivery

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes small moves, storage moves, store delivery, last-mile delivery, and others.

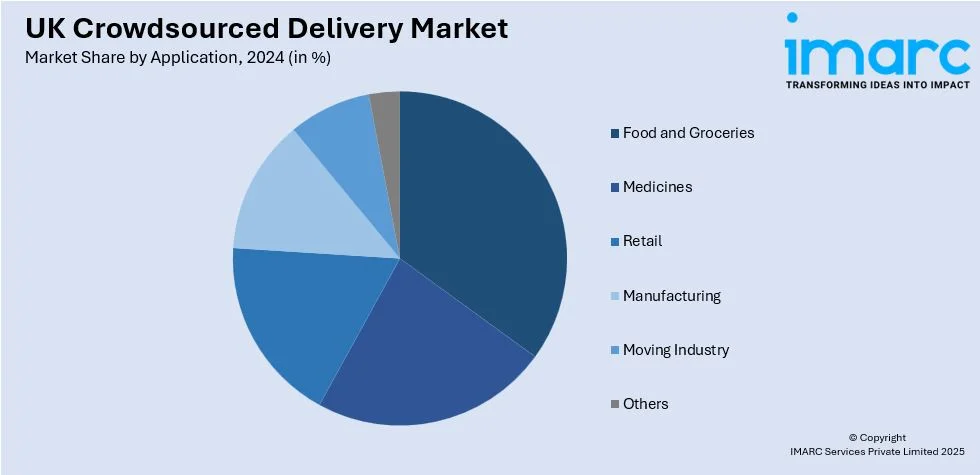

Application Insights:

- Food and Groceries

- Medicines

- Retail

- Manufacturing

- Moving Industry

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food and groceries, medicines, retail, manufacturing, moving industry, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and the Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Crowdsourced Delivery Market News:

- In February 2025, Kiuki launched a crowdsourced grocery marketplace in the UK, linking customers with local suppliers and small businesses. The platform enables gig economy workers to complete deliveries, providing a speedier and more cost-effective alternative to traditional supermarket services. This concept expands product offerings, helps small businesses, and meets the rising demand for flexible and community-driven delivery options.

- In September 2024, Just Eat collaborated with Boots to offer on-demand delivery of beauty and wellness items from 50 UK locations, with plans to grow to 150 by spring 2025. This agreement demonstrates the UK crowdsourced delivery market's rapid diversity, which now includes health and beauty retail services in addition to food.

UK Crowdsourced Delivery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Small Moves, Storage Moves, Store Delivery, Last-Mile Delivery, Others |

| Applications Covered | Food and Groceries, Medicines, Retail, Manufacturing, Moving Industry, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and the Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK crowdsourced delivery market performed so far and how will it perform in the coming years?

- What is the breakup of the UK crowdsourced delivery market on the basis of type?

- What is the breakup of the UK crowdsourced delivery market on the basis of application?

- What are the various stages in the value chain of the UK crowdsourced delivery market?

- What are the key driving factors and challenges in the UK crowdsourced delivery?

- What is the structure of the UK crowdsourced delivery market and who are the key players?

- What is the degree of competition in the UK crowdsourced delivery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK crowdsourced delivery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK crowdsourced delivery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK crowdsourced delivery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)