UK Commercial Real Estate Market Report by Type (Rental, Sales), End Use (Offices, Retail, Leisure, and Others), and Region 2025-2033

UK Commercial Real Estate Market Overview:

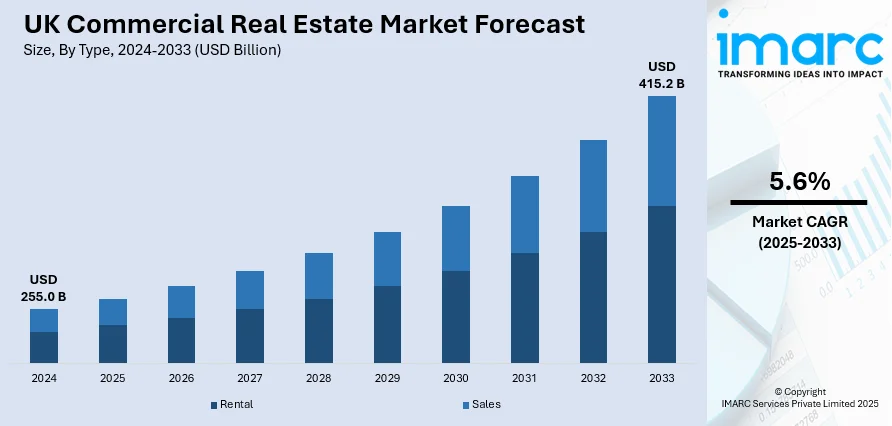

The UK commercial real estate market size reached USD 255.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 415.2 Billion by 2033, exhibiting a growth rate (CAGR) of 5.6% during 2025-2033. The market is experiencing steady growth driven by demographic shifts, such as rapid urbanization and the increasing aging population, the increasing usage of big data analytics, continual advancements in remote work technologies, and the augmenting demand for flexible office solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 255.0 Billion |

| Market Forecast in 2033 | USD 415.2 Billion |

| Market Growth Rate (2025-2033) | 5.6% |

UK Commercial Real Estate Market Trends:

Changing Economic Conditions

The market is majorly influenced by the general economic performance that is directly impacting the demand for commercial real estate units. During times of economic gains, business expand which, therefore, create the need to cater to more office spaces, retail outlets, and industrial properties. Real estate investors base their work on such key intermediaries of economic performance as GDP growth, employment, and consumer spending. Government policies, such as increasing economic performance with infrastructure investments or tax incentives, stimulate commercial real estate development. For instance, transport link development can render some zones more attractive to commercial activities. Along with this, the economic adjustment occurring post-Brexit, with the devastating effects of the COVID-19 pandemic are further complicating and altering the market confidence among diverse investors. These economic conditions are essential in predicting future market trends and investment decisions that are made in regard to commercial real estate.

To get more information on this market, Request Sample

Continuous Technological Advancements

The impact of technology is significantly supporting the growth of the market. Digital technologies are changing the way that commercial property is designed, constructed, and operated through the rise of smart building solutions. Smart buildings equipped with IoT devices contribute to enhanced energy efficiency, improved security, and better occupant comfort, due to which they are consequently more lucrative for tenants and investors. Therefore, the increasing adoption of technologies such as AI and big data analytics is also changing the way market participants analyze and interpret trends. AI helps owners understand the behavior of their tenants in order to enable them to tailor their properties to meet evolving needs. Furthermore, the increasing number of companies shifting from traditional office spaces and seeking flexible office solutions, such as coworking spaces, are creating a positive market outlook.

Stringent Regulatory Environment

The regulatory environment is another key driver of the UK market. Government policies on land use, zoning, and building construction standards have the potential to influence development and investment in property. This comprises changes in tax policy, covering property and capital gains taxation and economic policy impacting the profitability of real estate investment. Additionally, the environmental regulations focused on reducing carbon emissions and increasing sustainability are propelling the growth of the market. In addition, the commitment of the UK government to net-zero carbon emissions is contributing to the drive for green building practices and sustainable development.

UK Commercial Real Estate Market News:

- June 06, 2024: Digital infrastructure specialist NCG has partnered with Locale, a leading occupier experience platform in the UK, to create smarter commercial buildings. NCG, an ISP and systems integrator, provides infrastructure and SaaS systems for commercial real estate. Locale's software streamlines building operations and enhances occupier experiences. Locale will be NCG's preferred partner for occupier experience solutions outside the flexible workspace market. This partnership aims to strengthen the occupier experience across the UK commercial real estate market.

- October 04, 2023: British Land has received planning permission for a c. 140,000 sq ft multi-level last-mile logistics scheme on Mandela Way, Southwark, to address the acute undersupply of sustainable, modern warehousing in Greater London. The scheme will provide flexible, sustainable logistics space with excellent access to local consumers and central London. It will target a BREEAM Excellent rating and implement low-carbon materials, reflecting the company’s focus on creating sustainable and high-quality spaces for customers and communities.

UK Commercial Real Estate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and end use.

Type Insights:

- Rental

- Sales

The report has provided a detailed breakup and analysis of the market based on the type. This includes rental and sales.

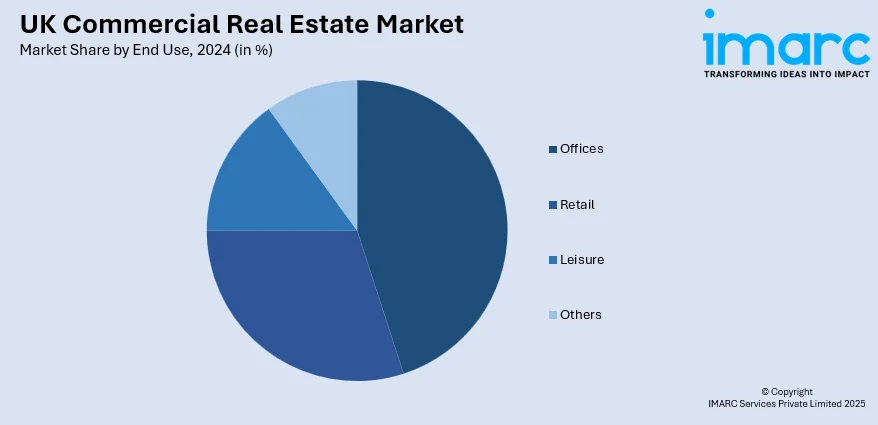

End Use Insights:

- Offices

- Retail

- Leisure

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes offices, retail, leisure, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Commercial Real Estate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Rental, Sales |

| End Uses Covered | Offices, Retail, Leisure, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK commercial real estate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK commercial real estate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK commercial real estate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The commercial real estate market in the United Kingdom was valued at USD 255.0 Billion in 2024.

The United Kingdom commercial real estate market is projected to exhibit a CAGR of 5.6% during 2025-2033, reaching a value of USD 415.2 Billion by 2033.

The market is driven by demographic shifts such as urbanization and an aging population. Additionally, the increasing usage of big data analytics and advancements in remote work technologies are pushing demand for flexible office solutions. Government policies supporting infrastructure investments and sustainable development are also key drivers of growth in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)