UK Cloud Security Market Size, Share, Trends and Forecast by Component, Deployment, Enterprise Size, End Use, and Region, 2025-2033

UK Cloud Security Market Size and Share:

The UK cloud security market size was valued at USD 2.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 7.1 Billion by 2033, exhibiting a CAGR of 11.75% from 2025-2033. The market is expanding rapidly due to rising cybersecurity threats and accelerated cloud security adoption, especially across large enterprises. The demand for robust solutions is increasing, with organizations prioritizing AI-driven cloud security tools and embracing zero trust architecture. Private deployment models are gaining traction among enterprises that require greater control and data sovereignty. In parallel, the surge in managed security services is addressing the need for expert-driven protection, reinforcing the role of scalable and tailored security solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.6 Billion |

| Market Forecast in 2033 | USD 7.1 Billion |

| Market Growth Rate 2025-2033 | 11.75% |

The UK cloud security market is driven significantly by the rising prevalence of cybersecurity threats, including data breaches, ransomware, and sophisticated hacking attempts. With the increasing reliance on cloud services, organizations face heightened risks associated with storing sensitive data online. For instance, in 2024, according to the Microsoft research report, 87% of UK organizations are vulnerable to cyberattacks, with 39% classified as "At High Risk," based on a new academic cyber resilience model. As a result, there is an increasing need for cutting-edge cloud security solutions to safeguard vital company data and ensure business continuity. Furthermore, businesses must put strong security measures in place to comply with strict data protection laws like the General Data Protection Regulation (GDPR). Guidelines from the NCSC cloud security principles are becoming more influential in shaping enterprise cloud strategies, encouraging secure architectural design and risk-based access controls. Businesses choose cloud security solutions to protect their operations while adhering to regulatory standards because non-compliance can result in harsh penalties.

The widespread adoption of cloud technologies across various industries, including finance, healthcare, and retail, is another key driver of the UK cloud security market. Companies are transitioning to cloud-based infrastructure to enhance scalability, reduce costs, and improve collaboration. However, this shift necessitates effective security measures to mitigate potential vulnerabilities. The growing trend of remote work has further accelerated cloud adoption, increasing the need for secure access management and threat detection systems. For instance, in November 2024, SAP SE launched its Sovereign Cloud in the UK, supported by a €1/4 billion investment, offering secure, localized solutions for regulated industries, aligning with UK data sovereignty and cybersecurity standards. Industry groups such as the cloud security alliance are playing a larger role in defining best practices and certification frameworks for cloud environments, giving enterprises structured paths to improve their security postures. As businesses continue to integrate cloud solutions into their operations, the demand for comprehensive cloud security services is projected to rise, driving market growth.

UK Cloud Security Market Trends:

In-App Payments Acceleration

The sharp rise in mobile-first retail and financial platforms across the UK has led to significant growth in in-app payment services. With brands and fintech apps pushing for frictionless user experiences, cloud environments are being reconfigured to handle secure, high-frequency transactions. This shift puts pressure on cloud security vendors to build solutions that defend against session hijacking, credential stuffing, and synthetic fraud. Financial service providers and e-commerce apps are adopting private cloud deployments with robust encryption, multi-factor authentication, and container-based isolation to safeguard payment data. Large enterprises in sectors like online retail and digital banking are leading this trend, demanding scalable security tools that don’t compromise app performance. As embedded finance continues to grow, the market is expected to see stronger demand for cloud-native solutions tailored to payment workflows, especially where regulatory compliance with UK data protection laws and cloud security standards is a concern. Local UK cloud providers are also stepping in to offer trusted platforms aligned with domestic security expectations.

Social Commerce Payment Growth

Social commerce is growing fast in the UK, with platforms like Instagram, TikTok, and Facebook integrating checkout features. As consumers pay within social apps, large enterprises are facing new security demands—protecting user identities, managing embedded payment tools, and securing real-time data transfers. These transactions rely on cloud infrastructure that can handle high traffic and dynamic data access, creating more opportunities for breaches if not properly secured. Private deployment models are being used more frequently by UK brands that want better oversight of data processing and fraud controls. Cloud security providers are developing targeted solutions that incorporate tokenization, API-level firewalls, and zero-trust enforcement to secure these interactions. The rise of influencer-led shopping and one-click purchases means businesses must protect payment workflows at the platform level. These efforts increasingly align with evolving cloud security standards, while UK cloud providers are being selected for their compliance-ready infrastructure and localized support models.

Integration of Artificial Intelligence in Cloud Security

Artificial intelligence (AI) is transforming the UK cloud security market by enabling advanced threat detection and response mechanisms. AI-based security technology utilizes machine learning algorithms to identify unusual patterns and predict potential cyberattacks in real time. This proactive approach reduces response times and enhances overall information security posture. Businesses increasingly adopt AI-powered cyber security services for automated monitoring, anomaly detection, and risk assessment. The integration of AI is becoming a standard feature in modern security solutions, ensuring robust protection against sophisticated threats in dynamic cloud environments. For instance, in 2024, the Bank of England reported that 75% of firms already use artificial intelligence, with an additional 10% planning adoption within the next three years.

Zero Trust Security Framework Adoption

The Zero Trust security model is gaining significant traction in the UK cloud security market as organizations move away from traditional perimeter-based approaches. This framework emphasizes continuous verification of users and devices, assuming no entity can be fully trusted. Companies are implementing zero-trust strategies to minimize risks associated with unauthorized access, enhancing compliance with stringent data protection regulations, and reinforcing their overall cyber security posture. The shift also reflects a broader transformation in security technology deployment, where identity-based controls and micro-segmentation are becoming standard practices. For instance, in 2024, the Chartered Institute of Information Security (CIISec) reported that 80% of UK businesses have adopted hybrid or fully remote work models, reflecting a significant shift in operational structures. Additionally, the UK government is adopting frameworks that align with Zero Trust principles, emphasizing least privilege access and real-time validation as central tenets of modern information security.

Growth in Managed Security Services

The increasing complexity of cloud environments has driven the demand for managed security services in the UK. Managed service providers offer a comprehensive suite of security solutions, including monitoring, threat intelligence, and incident response, allowing businesses to focus on core operations while maintaining strong cyber security practices. For instance, in December 2023, AWS's recent 36-month government contracts, including a £350m deal with HMRC and a £94m agreement with DWP, highlight the increasing reliance on cloud infrastructure with integrated managed security services. These contracts reflect how government entities are leveraging third-party security technology to safeguard mission-critical systems. The rise of managed services illustrates the trend of outsourcing information security functions to trusted partners who can deliver scalable, responsive protection tailored to the evolving cloud landscape.

UK Cloud Security Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the UK cloud security market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on component, deployment, enterprise size, and end-use.

Analysis by Component:

- Solution

- Cloud Access Security Broker (CASB)

- Cloud Detection and Response (CDR)

- Cloud Security Posture Management (CSPM)

- Cloud Infrastructure Entitlement Management (CIEM)

- Cloud Workload Protection Platform (CWPP)

- Services

- Professional Services

- Managed Services

Solutions in the component segment of the UK cloud security market encompass software tools and platforms designed to protect cloud-based assets and data. Intrusion detection systems (IDS), data loss prevention (DLP), and identity and access management (IAM) are some of these solutions. They are essential in protecting confidential data, making sure rules are followed, and thwarting online attacks. These solutions enable enterprises to improve their security posture and foster confidence in cloud adoption across a range of industries by providing innovative capabilities like automated responses and real-time threat monitoring.

Services in the component segment of the UK cloud security market encompass expert-led solutions for implementing, managing, and optimizing cloud security. Professional services that assist firms in customizing and integrating strong security frameworks include training, deployment, and advising. To provide real-time protection and business continuity, managed services offer continuous monitoring, threat detection, and incident response. By reducing the workload for internal IT departments, improving adherence to legal requirements, and providing proactive defenses, these services enable companies to successfully and confidently traverse the constantly changing cybersecurity environment.

Analysis by Deployment:

- Private

- Hybrid

- Public

Private deployment in the UK cloud security market refers to the use of dedicated cloud environments tailored for a single organization's exclusive use. This model provides enhanced control, customization, and security, making it ideal for industries with stringent data protection requirements, such as finance and healthcare. Private cloud deployments ensure compliance with UK-specific regulations like GDPR while offering robust encryption, access management, and threat detection capabilities. By prioritizing data sovereignty and minimizing exposure to external risks, private deployment serves as a trusted solution for organizations managing sensitive information.

Hybrid deployment in the UK cloud security market combines private and public cloud environments, allowing organizations to leverage the scalability of public clouds while retaining sensitive data in secure private infrastructures. Flexibility, economic effectiveness, and improved control over vital assets are guaranteed by this strategy. Businesses can efficiently handle different compliance and security needs thanks to hybrid models, which provide smooth data transfer and task management between environments. Hybrid deployment offers a well-rounded option for UK businesses looking for agility without sacrificing data security and regulatory compliance by incorporating strong security measures.

Public deployment in the UK cloud security market refers to cloud services hosted on shared infrastructure, accessible to multiple organizations. Because of its scalability, affordability, and quick deployment, it appeals to companies looking for flexibility. Strong security features like identity management, data encryption, and compliance assistance are integrated by public cloud providers to guarantee defense against online attacks. Public deployment is a workable option for UK businesses looking to improve cloud security while minimizing operating expenses and resource usage since it gives them access to innovative security capabilities without requiring a sizable upfront investment.

Analysis by Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises

Large enterprises in the enterprise size segment of the UK cloud security market are organizations with extensive operations, significant resources, and complex IT infrastructures. To secure enormous amounts of sensitive data, guarantee adherence to strict rules, and defend against sophisticated cyberthreats, these organizations require all-encompassing cloud security solutions. Large businesses propel the adoption of innovative cloud security solutions by investing in strong security frameworks that include identity management, data encryption, and advanced threat detection. Their emphasis on compliance and resilience makes a substantial contribution to the general expansion and advancement of the UK cloud security sector.

Small and medium enterprises (SMEs) in the enterprise size segment of the UK cloud security market are businesses with limited resources and moderately scaled operations. These businesses are using scalable and priced cloud security solutions more frequently to comply with regulations and safeguard confidential information. To reduce risks without putting a strain on internal IT workers, SMEs rely on managed services, automated threat detection, and streamlined security technologies. Their increasing use of cloud platforms fuels need for specialized security solutions, which in turn fuels industry growth and innovation in the UK.

Analysis by End-Use:

- BFSI

- Retail and E-commerce

- IT and Telecom

- Healthcare

- Manufacturing

- Government

- Aerospace and Defense

- Energy and Utilities

- Transportation and Logistics

- Others

In the end-use sector of the UK cloud security industry, businesses that deal with extremely sensitive financial data are represented by BFSI (Banking, Financial Services, and Insurance). To safeguard against cyberattacks, maintain data privacy, and adhere to strict laws like GDPR and PCI DSS, this industry needs cutting-edge security solutions. To protect consumer data and stop fraud, cloud security solutions like intrusion detection, identity management, and data encryption are essential. Innovation and expansion in the UK cloud security industry are fueled by the BFSI sector's crucial reliance on safe, scalable cloud infrastructure.

To protect sensitive consumer data, such as payment and personal information, the end-use retail and e-commerce sectors mostly rely on cloud security. Online commerce and digital transactions are growing quickly in the UK, which puts this industry at higher risk of cyberattacks like fraud and data breaches. Secure storage, real-time threat detection, and adherence to data protection laws such as GDPR are all guaranteed by cloud security solutions. Retailers and e-commerce platforms may protect their operations, build consumer trust, and foster the market's ongoing expansion by implementing strong cloud security measures.

One important end-use category in the UK cloud security market is the IT and telecom sector, which uses innovative solutions to safeguard confidential information and guarantee smooth operations. Because this industry depends so largely on cloud platforms for connection and scalability, strong security measures are crucial. By reducing the risks of cyberattacks, data breaches, and service outages, cloud security solutions protect infrastructure and client data. The need for improved security in the UK's telecom and IT industries is spurring innovation and raising the market's level of sophistication.

One of the main factors propelling the UK cloud security market is the healthcare industry within the end-use segment. Healthcare businesses must increasingly safeguard sensitive patient data from cyber risks as digital health technologies and electronic health records become more widely used. Cloud security solutions guarantee data integrity and regulatory compliance by offering strong encryption, compliance management, and threat detection. This segment facilitates the wider adoption of cloud technologies by safeguarding vital healthcare infrastructure, allowing for innovation while upholding confidence in the digital transformation of the UK healthcare sector.

Companies using cloud-based technologies for supply chain management, operational efficiency, and smart factory initiatives are included in the manufacturing end-use section of the UK cloud security market. To protect confidential information, maintain continuity, and defend against cyberattacks that target industrial systems, these companies depend on cloud security solutions. To reduce the threats linked devices and IoT infrastructure pose, advanced security solutions like encryption, access controls, and real-time monitoring are essential. The use of cloud security by the manufacturing sector improves operational resilience and makes a substantial contribution to the expansion and innovation of the market.

The government sector in the end-use segment is a key driver of the UK cloud security market, focusing on protecting sensitive data and ensuring secure communication across public services. As government agencies increasingly adopt cloud solutions to enhance efficiency and data accessibility, they face growing cybersecurity threats, including breaches and cyber espionage. Cloud security solutions provide advanced protection, real-time threat monitoring, and compliance with strict regulations like GDPR. By implementing robust security measures, the government safeguards critical information, ensures operational continuity, and bolsters public trust in digital services.

The aerospace and defense sector in the UK plays a pivotal role in driving the adoption of advanced cloud security solutions within the end-use segment. This industry relies on cloud technology to streamline operations, enhance data analysis, and manage sensitive information. Robust cloud security ensures the protection of classified data, intellectual property, and critical communication channels against cyber threats. As cybersecurity remains a priority in defense strategies, this sector significantly contributes to the growth of the UK cloud security market by fostering innovation and emphasizing the importance of resilient, secure cloud infrastructure.

The energy and utilities sector in the end-use segment is significantly influencing the growth of the UK cloud security market. With increasing reliance on smart grids, IoT devices, and digital infrastructure, this sector faces heightened risks of cyberattacks. Cloud security solutions provide advanced threat detection, data encryption, and secure access management to protect critical systems and operational data. By ensuring the resilience and integrity of energy and utility networks, these solutions support the sector’s digital transformation while meeting regulatory requirements and safeguarding the UK's essential services.

Transportation and logistics in the end-use segment of the UK cloud security market involve companies managing supply chains, fleet operations, and logistics networks through cloud-based platforms. These organizations require robust cloud security solutions to protect sensitive data, such as shipment details, customer information, and operational analytics, from cyber threats. Security measures, including encryption, identity management, and threat detection, ensure seamless and secure operations. By adopting advanced cloud security technologies, the transportation and logistics sector enhances efficiency, safeguards critical information, and contributes to the growth of the UK cloud security market.

Regional Insights:

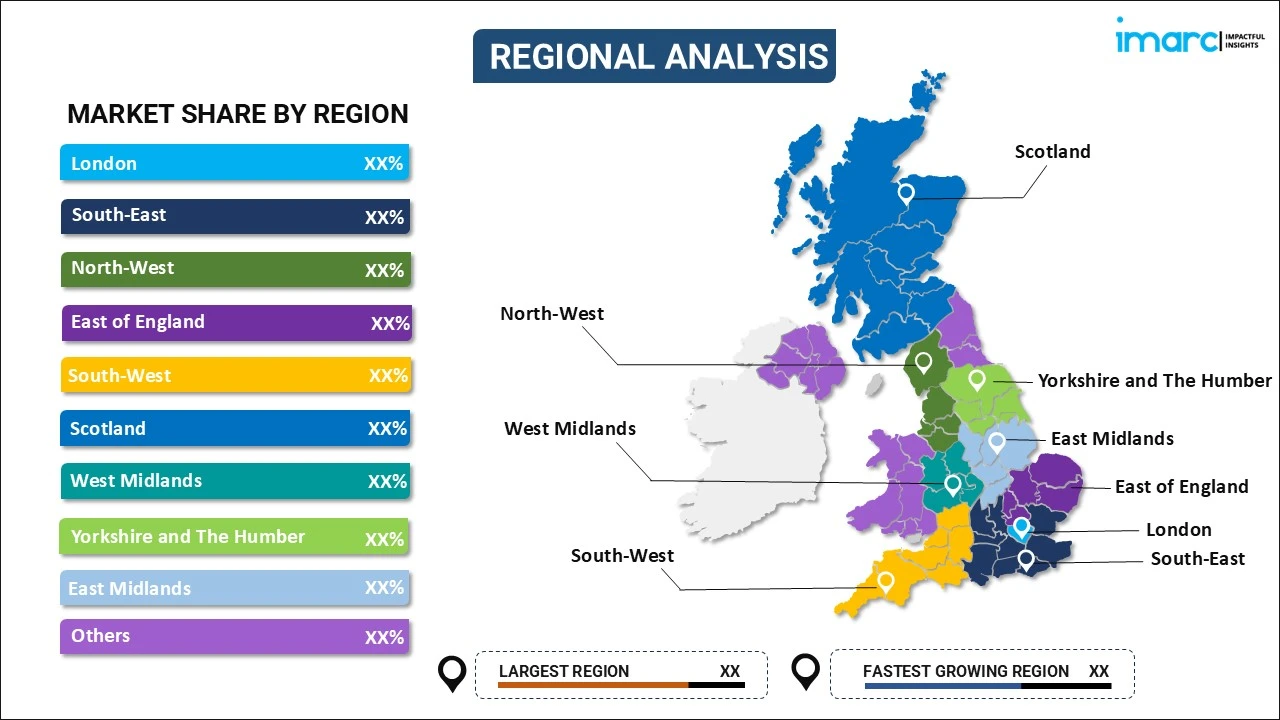

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The London region plays a pivotal role in the UK cloud security market as a hub for financial institutions, multinational corporations, and tech enterprises. Its concentration on high-value industries demands advanced cloud security solutions to protect sensitive data and ensure regulatory compliance. London’s status as a global business center attracts significant investment in cybersecurity infrastructure, fostering innovation and collaboration. The region’s robust digital ecosystem and skilled workforce further enhance its capacity to drive the adoption of cloud security technologies, positioning it as a critical contributor to the UK’s cloud security market growth.

The South East region plays a pivotal role in the UK cloud security market due to its concentration of technology hubs, financial institutions, and enterprises heavily reliant on secure cloud infrastructure. Home to numerous startups and established firms, the region fosters innovation in cybersecurity solutions and services. Its proximity to London enables collaboration between businesses and government entities, further driving advancements in cloud security. Additionally, the South East’s skilled workforce and access to cutting-edge research contribute significantly to addressing the regions and nation’s growing cloud security demands.

The North West region is a significant contributor to the UK cloud security market, driven by its thriving technology hubs and growing adoption of cloud services across industries. Home to several IT firms, data centers, and innovative startups, the region emphasizes robust cybersecurity measures to safeguard digital operations. Regional initiatives supporting digital transformation and workforce development further bolster cloud security adoption. By fostering collaboration between public and private sectors, the North West region enhances the UK's cloud security ecosystem, driving innovation and ensuring data protection for businesses and institutions.

The East of England region is actively contributing to the UK cloud security market through its growing technology sector and innovation hubs. The region is home to several cybersecurity firms and research institutions focusing on advanced cloud security solutions. Collaboration between academic institutions and businesses fosters the development of innovative technologies, such as threat detection and data protection systems. By supporting cloud security initiatives and providing skilled talent, the East of England enhances the market's growth while bolstering the cybersecurity capabilities of industries across the UK.

The South West region is contributing to the UK cloud security market through its growing network of technology companies, SMEs, and academic institutions specializing in cybersecurity research. With an increasing number of businesses adopting cloud-based solutions, the region has seen rising demand for robust security measures to safeguard sensitive data and ensure operational continuity. The presence of innovation hubs and government-backed initiatives further supports the development and adoption of cloud security technologies. This dynamic environment positions the South West as a vital player in strengthening the UK’s cloud security landscape.

Scotland is a key contributor to the UK cloud security market, leveraging its growing technology sector and strong focus on innovation. The region hosts a number of cybersecurity firms, research centers, and academic institutions, fostering advancements in secure cloud technologies. Government-backed initiatives and collaborations with global tech companies enhance Scotland's capability to address cybersecurity challenges. With increasing adoption of cloud solutions across industries such as finance, healthcare, and public services, Scotland provides robust cloud security expertise and solutions, strengthening the overall resilience of the UK cloud security market.

The West Midlands region plays a crucial role in supporting the UK cloud security market through its dynamic technology sector and focus on digital innovation. With a strong presence of tech startups, established enterprises, and academic institutions, the region fosters advancements in cybersecurity solutions. Local government initiatives promoting digital transformation and cybersecurity awareness further strengthen the adoption of cloud security measures. By addressing the needs of diverse industries, including manufacturing and services, the West Midlands region contributes significantly to the growth and resilience of the UK cloud security market.

The Yorkshire and The Humber region is making significant contributions to the UK cloud security market through its expanding digital infrastructure and emphasis on technological innovation. With a growing number of tech-focused businesses and cybersecurity firms, the region is fostering advancements in cloud security solutions, including threat intelligence and data encryption. Local universities and training programs are cultivating skilled professionals to meet industry demands. By hosting tech events and supporting collaborative initiatives, Yorkshire and The Humber strengthens the UK’s cloud security landscape while driving regional economic development.

The East Midlands region supports the UK cloud security market through its expanding base of manufacturing, logistics, and technology sectors. As businesses in these industries increasingly adopt cloud-based solutions, the demand for advanced security frameworks to protect sensitive operational and customer data has grown significantly. The region’s academic institutions and innovation centers contribute by fostering cybersecurity expertise and research. Additionally, government initiatives and local enterprise collaborations are driving the adoption of scalable cloud security technologies, positioning the East Midlands as a key player in strengthening the UK’s cybersecurity ecosystem.

Competitive Landscape:

The competitive landscape of the UK cloud security market is characterized by the presence of key global players, regional firms, and emerging startups. Companies dominate through innovative offerings and extensive service portfolios. Local providers enhance competition by addressing specific regulatory and industry needs. Continuous advancements in technologies such as AI-driven threat detection and compliance solutions drive competitiveness, fostering partnerships, acquisitions, and market growth in the dynamic UK cloud security. For instance, in 2024, Microsoft invested USD 4 million into a "Zero Day Quest" bug bounty program, emphasizing AI and cloud security. This program encourages cooperation with researchers and provides incentives to improve product security.

The report provides a comprehensive analysis of the competitive landscape in the UK cloud security market with detailed profiles of all major companies.

Latest News and Developments:

- June 2025: London-based Maze raised Euro 21.8 Million in Series A funding to enhance its AI-powered cloud security platform. The platform uses AI agents to prevent vulnerabilities and breaches, significantly improving cloud security by autonomously identifying and resolving issues, thus advancing the UK's cloud security market.

- June 2025: the UK government launched its Cyber Growth Action Plan, investing Euro16 Million into cybersecurity programs. This initiative aimed to strengthen the country’s cyber resilience, enhance innovation, and support startups, significantly boosting the UK’s cloud security sector and fostering long-term growth in the market.

- In November 2024, Domino Data Lab unveiled key upgrades to its enterprise AI platform, integrating Amazon Web Services (AWS), NetApp, and NVIDIA to enhance AI deployment and data management. These upgrades include support for NVIDIA’s NIM microservices, new project templates, and Domino Volumes for NetApp ONTAP (DVNO), which can reduce costs and processing times by up to 50%. The platform also allows AI models to be deployed to Amazon SageMaker, streamlining governance across hybrid cloud environments. Additionally, Domino has launched Domino Governance to automate compliance processes and reports significant growth in customer interest.

- In November 2024, Versa aunched a pay-as-you-go version of its Versa Cloud Firewall for AWS, available through the AWS Marketplace. This new pricing model offers enterprises increased flexibility in scaling their cloud firewall protection within AWS environments. Versa Cloud Firewall provides high-performance, enterprise-grade protection for cloud-based workloads. The solution supports automated scalability and streamlined deployment, with advanced features like threat prevention and AI-driven network security. This offering enhances operational efficiency for AWS users and integrates seamlessly with the AWS infrastructure, aligning with modern enterprise needs for dynamic cloud environments.

UK Cloud Security Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployments Covered | Private, Hybrid, Public |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| End-Use Covered | BFSI, Retail and E-commerce, IT and Telecom, Healthcare, Manufacturing, Government, Aerospace and Defense, Energy and Utilities, Transportation and Logistics, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK cloud security market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the UK cloud security market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK cloud security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The UK cloud security market is expected to grow at a CAGR of 11.75% during 2025-2033.

The UK cloud security market is driven by increasing cloud adoption, data privacy concerns, and the need to safeguard sensitive information. Regulatory compliance requirements, such as GDPR, also fuel demand for advanced security solutions, as businesses seek to protect against cyber threats and breaches.

COVID-19 accelerated the shift to remote work, leading to higher reliance on cloud services and boosting demand for cloud security solutions. The rise in cyber threats, including phishing and data breaches, emphasized the need for robust cloud security frameworks to ensure business continuity.

Based on the component, the UK cloud security market has been segmented into solution and services.

Based on the deployment, the UK cloud security market has been segmented into private, hybrid, public.

Based on the enterprise size, the UK cloud security market has been segmented into large enterprise and small and medium enterprises.

Based on the end-use, the UK cloud security market has been segmented into BFSI, retail and e-commerce, it and telecom, healthcare, manufacturing, government, aerospace and defense, energy and utilities, transportation and logistics, and others.

On a regional level, the UK cloud security market has been segmented into London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)