UK Cloud Computing Market Size, Share, Trends and Forecast by Service, Deployment, Workload, Enterprise Size, End-Use, and Region, 2025-2033

UK Cloud Computing Market Size and Share:

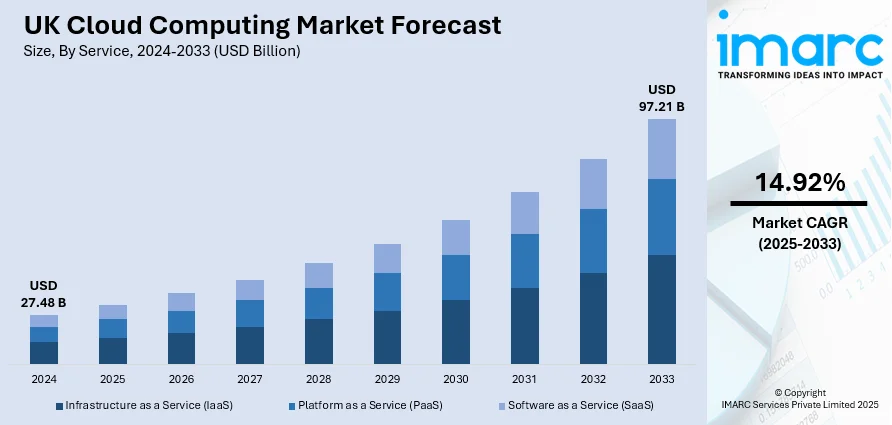

The UK cloud computing market size was valued at USD 27.48 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 97.21 Billion by 2033, exhibiting a CAGR of 14.92% from 2025-2033. London currently dominates the market owing to the growing demand for elastic and affordable IT infrastructure, elevated use of remote work, and continued digital transformation of industries. Development of cloud technologies, such as hybrid and multi-cloud architectures, further fosters market growth. Government investments and cloud-friendly policies also fuel emerging demand. All these factors together empower businesses to improve operational efficiency and agility and hence reinforce the UK cloud computing market share position in a more digital economy.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 27.48 Billion |

| Market Forecast in 2033 | USD 97.21 Billion |

| Market Growth Rate 2025-2033 | 14.92% |

The primary drivers for the growth of cloud computing across the UK is the amplified focus on data sovereignty and regulatory compliance. With changing data privacy regulations, especially with the implementation of the UK General Data Protection Regulation (UK GDPR), organizations are compelled to ensure that data storage and processing is compliant with national legal frameworks. Cloud providers are meeting this by setting up data centres within the nation, so that businesses can have control over data residency and also fulfill compliance requirements. This local infrastructure helps companies keep data handling transparent, thus establishing customers' and regulatory agencies' trust. In addition, industry-specific compliance regulations in healthcare, finance, and public administration are promoting a move to compliant cloud infrastructure that provides strong encryption, access control, and auditing capabilities. The need for secure and regulation-compliant cloud infrastructure is supporting adoption across sectors and raising the strategic importance of cloud computing in the UK digital landscape. For instance, in August 2024, Cybersecurity company Wiz launched its first European headquarters in London with the aim to recruit 100 UK staff by the end of the year and achieve 35% of EMEA revenue by the end of 2025.

To get more information on this market, Request Sample

Moreover, another important driver of the development of cloud computing within the UK is the spread of artificial intelligence (AI) and machine learning (ML) technologies. As data-driven strategies become the ever-growing reliance of organizations across industries, the demand for high-performance computational infrastructure for processing and analysis of large datasets becomes ever more acute. Cloud platforms provide scalable resources that support real-time processing of data, model training, and deployment of AI and ML applications with no capital outlay for high-performance on-premise systems. According to the sources, in September 2024, AWS made a five-year £8 billion investment to extend UK data centers in support of cloud computing and AI adoption by UK's leading businesses and government agencies. Moreover, embedding AI-as-a-Service (AIaaS) in cloud environments enables businesses to test and deploy sophisticated analytics solutions in a cost-efficient and flexible manner. These capabilities are being leveraged for use cases like predictive maintenance, customer behavior predictions, and process optimization. By making it easier to adopt AI by mitigating both the technical and financial hurdles, cloud computing is emerging as an essential driver of smart business transformation within the UK, yet further driving its market growth and technological adoption.

UK Cloud Computing Market Trends:

Growing Demand for Scalable and Economical IT Solutions

Increased need for scalable and affordable IT solutions has become a key driver of the fast growth in the UK's cloud computing sector. During the 2024 Global Investment Summit, the UK Government pledged a further £25 billion of investment in national data centre infrastructure, taking the total to £39 billion in just six months. This investment in finance confirms the government's appreciation of cloud technology as a pillar of economic and technological development. Conventional on-premises IT infrastructure entails significant capital outlay for hardware, software licensing, security, and maintenance. By comparison, cloud computing presents an elastic, pay-as-you-go framework where enterprises can maximize expenditure and utilization. Businesses dynamically resize IT operations dependent on demand, minimizing the threat of excess capacity and inefficiency. Moreover, the lesser requirement for in-house IT infrastructure management and support considerably reduces operational expenses, making cloud migration desirable for small businesses as well as large corporations.

Breakthroughs in Cloud Infrastructure and Services

Faster breakthroughs in cloud infrastructure and services have been key to driving UK cloud computing market growth throughout the UK. Another key trend is the growing use of hybrid and multi-cloud models, by which companies can strategically allocate workloads across public and private environments, typically through multiple cloud providers. This helps increase operational agility, reduces the dangers of vendor lock-in, and allows organizations to optimize cost and performance. Supporting this shift, the UK Government has sanctioned a large contract of up to USD 1.3 billion to facilitate public sector organizations in moving to cloud services. This move emphasizes cloud computing's pivotal position in the digital revolution of public services. Hybrid solutions enable organizations to place sensitive or mission-critical information safely in private clouds, yet draw on public cloud services for less sensitive applications. Such infrastructure enables enhanced system reliability, nimble deployment, and improved data governance, all of which together are driving the increasing adoption of cloud services.

Remote Work and Digital Transformation

The mass move toward remote work and the overall push toward digital transformation are strongly driving the development of cloud computing in the UK. Sparked by the COVID-19 pandemic, the call for companies to seamlessly shift to remote work has accentuated the key role of flexible, secure, and accessible IT environments. Recent statistics show that approximately 44% of the UK working population now spends at least half their time working from home. Cloud computing has facilitated this shift through remote access to business-critical applications, storage, and collaboration software from anywhere with an internet connection. In addition, digital transformation programs are encouraging businesses to rethink and update their IT infrastructure, and cloud technologies are at the forefront of this. By enabling automation, real-time analytics, and scalable infrastructure, cloud services are not only enhancing business efficiency but also fueling innovation and competitiveness in a more digital economy.

UK Cloud Computing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the UK cloud computing market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on service, deployment, workload, enterprise size, and end-use.

Analysis by Service:

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

- Software as a Service (SaaS)

Software as a Service (SaaS) was 55.9% in UK cloud computing market forecast in 2024 and was the leading segment. Leadership is due to rising demand from businesses for flexible, subscription-based software models that minimize initial expenditure and make IT easier to manage. SaaS solutions enable organizations to utilize fundamental applications like customer relationship management (CRM), enterprise resource planning (ERP), and collaboration tools in the cloud without investing in internal infrastructure. The ease of deployment, automatic upgrades, and scalability offered by SaaS solutions make them especially appealing across various sectors like education, healthcare, retail, and professional services. Also, the increasing trend of working remotely has magnified the demand for scalable, cloud-based software that facilitates collaboration and productivity across dispersed areas. With companies focusing on digital transformation and operational agility, SaaS is playing an important part in designing the future of enterprise IT in the UK.

Analysis by Deployment:

- Public

- Private

- Hybrid

Public cloud deployment is the most prevalent form in the UK cloud computing market outlook because it is cost-effective, versatile, and easily accessible. Public sector organizations and businesses support public cloud solutions since they can rapidly increase resources without significant capex. The model allows organizations to procure computing capacity, storage, and services on-demand through third-party vendors, which minimizes the demand for local infrastructure. It enables business agility, promotes innovation, and enables instant application deployment across geographies. In the UK, small and medium businesses especially use public cloud platforms for automating operations and staying competitive. Public cloud also makes integration with new-age technologies like artificial intelligence, machine learning, and big data analytics easy. Since both the private sector and the government are making digital transformation their top priority, the need for secure, scalable public cloud infrastructure keeps increasing, making it an indispensable part of the UK's IT landscape evolution.

Analysis by Workload:

- Application Development and Testing

- Data Storage and Backup

- Resource Management

- Orchestration Services

- Others

Data storage and backup represent a major workload segment in the UK cloud computing market, as businesses highly prioritize data security, disaster recovery, and regulatory compliance. Cloud-based storage solutions offer organizations scalable capacity, allowing them to manage growing volumes of structured and unstructured data efficiently. Cloud backup provides data redundancy and rapid recovery in the event of system failure, ransomware infections, or accidental loss—a critical need for organizations that do business in extremely regulated environments like healthcare and finance. The heightened focus on analytics and data-driven decision-making has further increased demand for storage solutions that can be counted upon. UK cloud service providers are extending their storage capabilities with encryption, tiered storage, and automated backups to address customers' needs. Growing numbers of hybrid work arrangements and dispersed teams have also expanded remote access requirements for data, and cloud-based storage and backups became essential to business continuity and organizational success in the UK market.

Analysis by Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises

Large enterprises controlled 58.6% of UK cloud computing market share in 2024, which indicates their high investment levels and intricate IT infrastructure requirements. Large businesses need solid cloud services to maintain international operations, huge data processing, and sophisticated analytics. The capability to streamline operations, improve flexibility, and deliver business continuity has inspired increased use of cloud platforms among large businesses. Additionally, big companies tend to be the first to adopt innovative technologies like artificial intelligence (AI), machine learning (ML), and data lakes—capabilities delivered more and more through cloud infrastructure. Strategic adoption of cloud enables such companies to stay competitive, innovate rapidly, and scale cost-efficiently. Security, compliance, and governance capabilities provided by cloud vendors also complement the risk management processes of larger companies. As digital transformation becomes at the forefront of long-term strategy, large organizations should continue to hold a large percentage of the UK cloud computing market for the coming years.

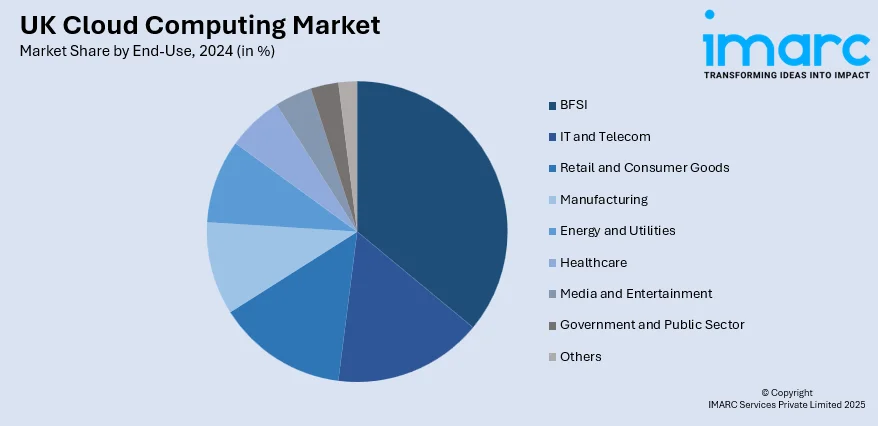

Analysis by End-Use:

- BFSI

- IT and Telecom

- Retail and Consumer Goods

- Manufacturing

- Energy and Utilities

- Healthcare

- Media and Entertainment

- Government and Public Sector

- Others

The Banking, Financial Services, and Insurance (BFSI) vertical accounted for 21.7% of the UK cloud computing market in 2024, highlighting the vertical's continuous digital transformation initiatives. Banks increasingly are utilizing cloud technology to automate operations, improve customer experience, and meet changing regulatory compliances. Cloud platforms offer scalability and reliability, allowing for quick deployment of banking products and services, real-time analytics, and stronger cybersecurity controls. In a data-driven sector such as BFSI, cloud computing facilitates processing and storage of massive amounts of financial data with enhanced efficiency and lower operational expenses. Additionally, the emergence of fintech technologies and mobile banking has propelled the industry's adoption of flexible, cloud-native designs to remain competitive. The regulatory authorities have also become more receptive to cloud usage, pressurizing financial institutions to shift away from legacy architectures. These forces cement the leadership of the BFSI sector in propelling the UK cloud computing market.

Regional Analysis:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

London is the UK cloud computing market's top regional hub, supported by its density of financial institutions, multinational companies, and government organizations. The city is the center for digital innovation, and it has been at the receiving end of massive investments in data center facilities and cloud services. Its robust regulatory environment, highly qualified IT professionals, and high-speed connectivity position London as a prime location for cloud service providers to initiate operations. London businesses are cloud technology early adopters to accelerate digital transformation, cybersecurity, and cost savings. In addition, the location of key industry players and a dynamic startup ecosystem drives technological innovation and cloud usage across sectors like banking, healthcare, and e-commerce. Demand for hybrid and multi-cloud solutions is also strong, an emphasis of the region on agility and resilience. Being the economic and technological hub of the UK, London still leads the country in cloud computing take-up and innovation.

Competitive Landscape:

The UK cloud computing market's competitive landscape is shaped by a fluid combination of worldwide hyperscalers and local providers delivering an extensive range of services across Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). Major players have data centres in the UK in order to enable data sovereignty and adherence to local regulation. Strategic partnerships with government agencies, schools, and businesses are routine, enabling customized solutions to public and private sector needs. Innovation with hybrid and multi-cloud approaches is an area of focus, with providers making interoperability and scalability between platforms stronger. The focus on integrating AI and machine learning capabilities in cloud environments to automate and enhance advanced analytics is also on the rise. Competitive differentiation comes through pricing models, cyber security upgrades, customer service offerings, and ongoing investment in next-gen infrastructure to serve latency-critical applications and high-performance computing demands across industries.

The report provides a comprehensive analysis of the competitive landscape in the UK cloud computing market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: EY introduced its Integrated Finance Managed Service in the UK, merging SAP S/4HANA Cloud with AI functionalities to simplify business operations. The offering facilitates quick scalability, minimizes technology burdens, and ensures compliance.

- March 2025: Google Cloud announced "Gemini for the United Kingdom," bringing cutting-edge AI technologies and cloud computing programs to aid UK businesses. Key features are the Gemini 1.5 Flash model with UK data residency, the Agentspace platform for enterprise AI agents, and up to GBP 280,000 of cloud credits for AI startups. These programs are designed to improve cloud-based AI development and innovation throughout the UK.

- January 2025: CoreWeave opened its inaugural UK data centers in London Docklands and Crawley, signaling a major expansion of its cloud computing facilities. The centers, which are fitted with NVIDIA H200 GPUs and Quantum-2 InfiniBand networking, are intended to accommodate high-performance AI workloads. This is in line with CoreWeave's GBP 1 billion investment aimed at boosting AI infrastructure in the UK, looking to strengthen the region's capabilities in high-end cloud computing.

UK Cloud Computing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS) |

| Deployments Covered | Public, Private, Hybrid |

| Workloads Covered | Application Development and Testing, Data Storage and Backup, Resource Management, Orchestration Services, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| End-Uses Covered | BFSI, IT and Telecom, Retail and Consumer Goods, Manufacturing, Energy and Utilities, Healthcare, Media and Entertainment, Government and Public Sector, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK cloud computing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK cloud computing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK cloud computing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cloud computing market in the UK was valued at USD 27.48 Billion in 2024.

The UK cloud computing market is projected to exhibit a CAGR of 14.92% during 2025-2033, reaching a value of USD 97.21 Billion by 2033.

Key drivers for the UK cloud computing market are growing demand for scalable and economical IT solutions, wider adoption of hybrid and multi-cloud ecosystems, and faster pace of digital transformation for industries. The increase in remote working and huge investments by public and private sectors in data infrastructure are also among the key market growth drivers and technological innovations expected to propel the market forward.

The Software as a Service (SaaS) segment has the largest market share in the UK cloud computing market, fueled by expansive enterprise adoption of cloud applications for customer relationship management, collaboration, and productivity. SaaS is cost-effective, flexible, and easiest to scale, which makes it the most popular choice across different business functions and industries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)