UK Carbon Credits Market Size, Share, Trends and Forecast by Type, System, End-Use Industry, and Region, 2025-2033

UK Carbon Credits Market Overview:

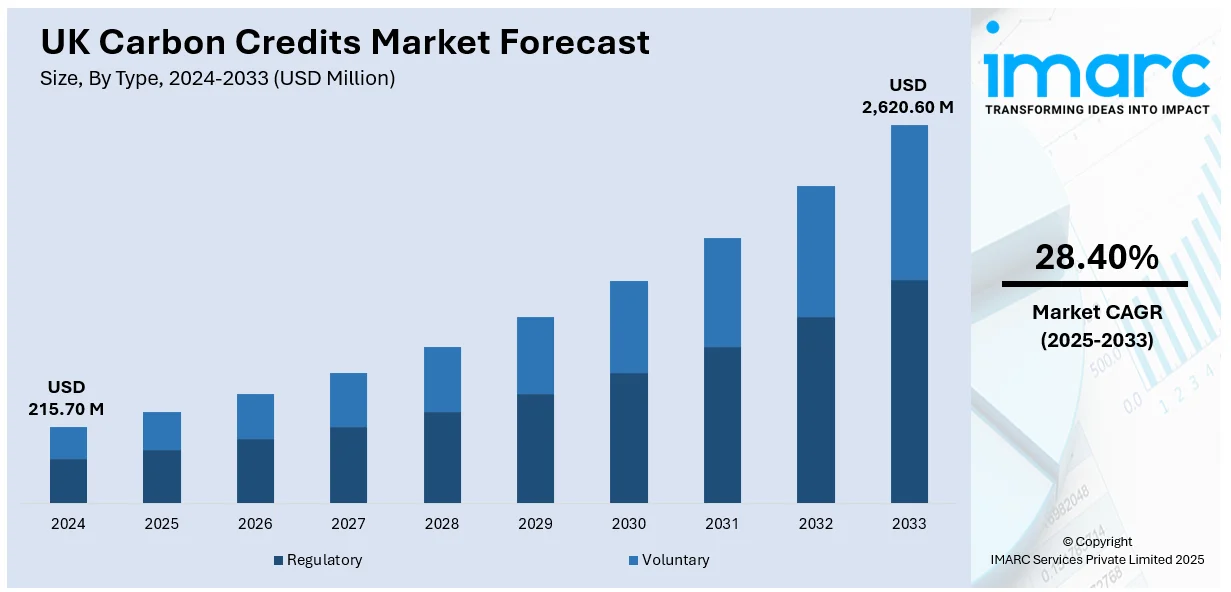

The UK carbon credits market size reached USD 215.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,620.60 Million by 2033, exhibiting a growth rate (CAGR) of 28.40% during 2025-2033. The market is driven by tightening emission regulations, corporate sustainability goals, investor pressure for climate risk disclosure, and government-backed net-zero commitments. Rising carbon prices and participation in voluntary offset schemes further support market growth, alongside advancements in carbon measurement, reporting technology, and nature-based sequestration solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 215.70 Million |

| Market Forecast in 2033 | USD 2,620.60 Million |

| Market Growth Rate 2025-2033 | 28.40% |

UK Carbon Credits Market Trends:

Increasing Corporate Demand for Voluntary Offsets

UK-based corporations are increasingly engaging in voluntary carbon credit purchases to meet internal net-zero targets and align with stakeholder expectations. For instance, in November 2024, the UK Government introduced new “Principles for Voluntary Carbon and Nature Market Integrity” to strengthen oversight of carbon and biodiversity credit use. A public consultation in early 2025 will explore implementation measures, including regulation and guidance. The initiative addresses concerns over misleading green claims and unreliable credits. It aims to restore trust by enforcing claims accuracy, transparency, and biodiversity integration, and allowing limited use of high-integrity credits for Scope 3 emissions within corporate climate strategies. Additionally, this shift is driven by the recognition that operational emissions alone cannot be entirely eliminated. Many firms now incorporate offset strategies into ESG reporting, particularly for Scope 3 emissions. As environmental disclosures become more scrutinized by regulators and investors, voluntary offsets offer a measurable and verifiable pathway to climate accountability. Additionally, carbon credits are being bundled with sustainability-linked financial instruments, creating new asset classes. The demand is expanding beyond traditional sectors to include retail, technology, and services, leading to higher transaction volumes and diversified offset portfolios featuring reforestation, renewable energy, and biochar-based credits.

Integration of Digital MRV Tools in Project Validation

The UK carbon credit market is experiencing a notable shift toward integrating digital MRV (Measurement, Reporting, and Verification) tools for validating offset projects. Emerging platforms use satellite imagery, blockchain, and AI to verify emissions reductions and removals with greater speed and accuracy. These innovations enhance transparency, reduce verification costs, and enable faster credit issuance. Digital MRV is particularly influential in scaling nature-based solutions such as afforestation and soil carbon capture, where manual verification was previously cost-prohibitive. This development also supports small-scale or community-led projects by making certification more accessible. The UK government and independent registries are showing growing interest in adopting tech-based MRV frameworks to maintain market integrity and avoid greenwashing. For instance, in March 2025, Snugg launched Carbon Cashback, an initiative allowing UK homeowners to earn up to £2,000 over 10 years by improving home energy efficiency. Developed under the UK’s Green Home Finance Accelerator, the program converts carbon savings tracked via smart meters into verified carbon credits for sale on the Voluntary Carbon Market. Backed by Verra methodology, the initiative helps reduce Scope 3 emissions for partner businesses and supports the UK’s $323 billion home decarbonization target, with VCM expected to contribute 5–10% of the funding needed.

Rise of Domestic Nature-Based Offset Projects

There is growing emphasis on developing domestic carbon credit projects in the UK, particularly those tied to nature-based solutions such as peatland restoration, rewilding, and regenerative agriculture. These projects not only sequester carbon but also deliver co-benefits such as biodiversity enhancement and flood prevention. Investors and buyers are showing a preference for local offsets, citing traceability, community engagement, and alignment with UK regulatory frameworks. Programs like the Woodland Carbon Code and Peatland Code have provided standardized methodologies for project validation, encouraging landowners and corporates to participate. This trend signals a strategic shift toward sovereign carbon credit ecosystems, allowing the UK to reduce dependency on international offsets while reinforcing national climate policy goals. For instance, in March 2025, the UK government launched a new maritime decarbonisation strategy targeting net zero emissions from domestic shipping by 2050. Key goals include a 30% emissions cut by 2030 and 80% by 2040. The strategy introduces vessel "chargeports," integrates the maritime sector into the UK Emissions Trading Scheme, and promotes clean fuels like hydrogen and ammonia. Backed by £206 million in UK SHORE funding, the plan aims to drive private investment, create green jobs, and support coastal economies, reinforcing the UK’s clean energy ambitions.

UK Carbon Credits Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, system, and end-use industry.

Type Insights:

- Regulatory

- Voluntary

The report has provided a detailed breakup and analysis of the market based on the type. This includes regulatory and voluntary.

System Insights:

- Cap-and-Trade

- Baseline-and-Credit

A detailed breakup and analysis of the market based on the system have also been provided in the report. This includes cap-and-trade and baseline-and-credit.

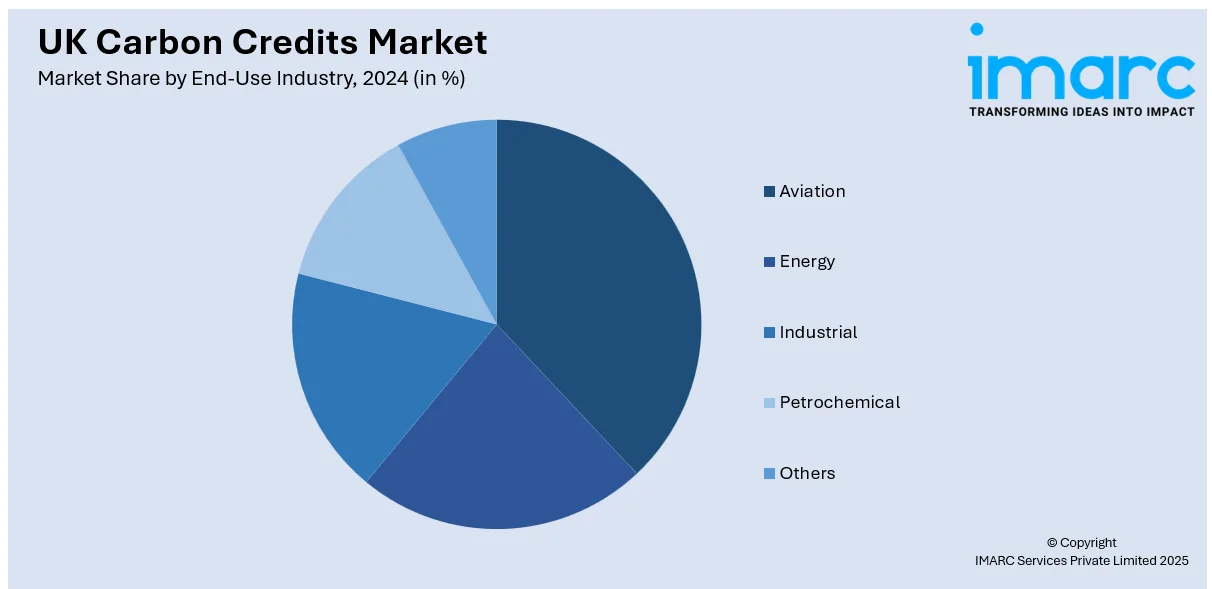

End-Use Industry Insights:

- Aviation

- Energy

- Industrial

- Petrochemical

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes aviation, energy, industrial, petrochemical, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Carbon Credits Market News:

- In September 2024, British Airways became the UK’s largest purchaser of carbon removal credits, investing over £9 million through a six-year deal. Working with CUR8 and other partners, the airline is supporting projects in the UK, Canada, India, and Iceland. These include enhanced rock weathering, reforestation, and direct air capture. Roughly one-third of its emissions reductions by 2050 will rely on carbon removals. The initiative is part of British Airways' broader net-zero strategy, which includes sustainable aviation fuels and low-emission ground operations.

- In August 2024, ITMO Ltd and BancTrust Investment Bank, in partnership with the Republic of Suriname, launched the world’s first sovereign carbon credits under Article 6 of the Paris Agreement. Representing 1.5 million tonnes of CO₂e, these ITMOs are fully UNFCCC-verified and support rainforest conservation, biodiversity, and all 17 SDGs in Suriname. At least 95% of proceeds return to the issuing country. Announced at the London Climate Investment Summit, the credits aim to meet growing global demand for high-integrity carbon offsets.

UK Carbon Credits Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Regulatory, Voluntary |

| Systems Covered | Cap-and-Trade, Baseline-and-Credit |

| End-Use Industries Covered | Aviation, Energy, Industrial, Petrochemical, Others |

| Regions Covered | London, South East, North West, East Of England, South West, Scotland, West Midlands, Yorkshire And The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK carbon credits market performed so far and how will it perform in the coming years?

- What is the breakup of the UK carbon credits market on the basis of type?

- What is the breakup of the UK carbon credits market on the basis of system?

- What is the breakup of the UK carbon credits market on the basis of end-use industry?

- What are the various stages in the value chain of the UK carbon credits market?

- What are the key driving factors and challenges in the UK carbon credits market?

- What is the structure of the UK carbon credits market and who are the key players?

- What is the degree of competition in the UK carbon credits market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK carbon credits market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK carbon credits market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK carbon credits industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)