UK Blockchain Market Size, Share, Trends, and Forecast by Component, Provider, Type, Deployment Mode, Organization Size, Vertical, and Region, 2025-2033

UK Blockchain Market Overview:

The UK blockchain market size reached USD 0.66 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 54.63 Billion by 2033, exhibiting a growth rate (CAGR) of 63.26% during 2025-2033. The market is driven by the increasing need for data privacy and cybersecurity solutions, the rising collaboration between blockchain startups and large enterprises, the emergence of blockchain in energy and utilities sector, the growing use of blockchain in legal and real estate sectors, the significant growth in non-fungible tokens (NFTs) market, and the escalating demand for transparent business processes.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.66 Billion |

| Market Forecast in 2033 | USD 54.63 Billion |

| Market Growth Rate (2025-2033) | 63.26% |

UK Blockchain Market Trends:

Increasing adoption of Blockchain-as-a-Service

The growing reliance on cloud-based platforms, accelerated by remote working trends, has fueled demand for BaaS across multiple sectors, including finance, healthcare, and logistics. In the UK, BaaS is enabling SMEs to overcome barriers in trade finance and global supply chains, supporting economic growth. For instance, in May 2024, UK Economic Secretary announced new stablecoin and crypto laws by July, regulating licensing, taxation, and security, as the UK crypto market grows to $2.53 billion in 2024. Consequently, the need for sophisticated software is rising in various sectors in order to guarantee employment stability. BaaS addresses global trade financing gaps by allowing small and medium-sized enterprises (SMEs) to optimize their supply chain operations on a global scale. Small and medium-sized businesses are using cloud technology to integrate blockchain services, ensuring the security of digital assets and verifying individual identities, resulting in a rise in the need for BaaS offerings. The flexibility of BaaS in offering blockchain development tools and seamless integration with existing systems makes it an attractive solution for businesses looking to adopt blockchain technology efficiently and affordably.

Rising cryptocurrency adoption and regulatory support

As most cryptocurrencies rely on blockchain as their foundational technology, the increasing fame of digital currencies such as Bitcoin and Ethereum has inevitably drawn significant focus to the technology. Numerous organizations are currently investigating the potential of blockchain technology in developing and controlling digital assets, such as Central Bank Digital Currencies (CBDCs), which is helping to drive the growth of the market. For instance, in September 2024, Barclays proposed a digital pound integration framework, aligning with the UK’s CBDC efforts to enhance payments, strengthen security, and improve merchant transactions through blockchain-like features for fraud prevention and reliability. Moreover, the increasing demand for secure and efficient cross-border payments and remittances drives the adoption of blockchain technology. Old-fashioned global payment systems frequently require numerous middlemen, causing delays and high expenses. Also, blockchain solutions are providing quicker, more affordable, and transparent international transactions, leading to their increased use in finance and remittance industries. Furthermore, government and regulatory agencies in the UK are also acknowledging the transformative potential of blockchain technology. This clear regulation not only encourages large investments but also promotes the creation of innovative blockchain solutions in various sectors. Furthermore, the growing involvement of large companies and technology behemoths has a substantial impact on the blockchain industry.

UK Blockchain Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, provider, type, deployment mode, organization size, and vertical.

Component Insights:

- Platforms

- Services

- Professional Services

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes platforms and services (professional services, managed services)

Provider Insights:

- Application Providers

- Infrastructure Providers

- Middleware Providers

A detailed breakup and analysis of the market based on the provider have also been provided in the report. This includes application providers, infrastructure providers, and middleware providers.

Type Insights:

- Public

- Private

- Hybrid

- Consortium

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes public, private, hybrid, and consortium.

Deployment Mode Insights:

- On-Premises

- Cloud

- Hybrid

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises, cloud, and hybrid.

Organization Size Insights:

- SMES

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes SMES and large enterprises.

Vertical Insights:

- Transportation and Logistics

- Agriculture and Food

- Manufacturing

- Energy and Utilities

- Healthcare and Life Sciences

- Media, Advertising, and Entertainment

- Banking and Financial Services

- Insurance

- IT and Telecom

- Retail and Ecommerce

- Government

- Real Estate and Construction

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes transportation and logistics, agriculture and food, manufacturing, energy and utilities, healthcare and life sciences, media, advertising, and entertainment, banking and financial services, insurance, IT and telecom, retail and ecommerce, government, real estate and construction, and others.

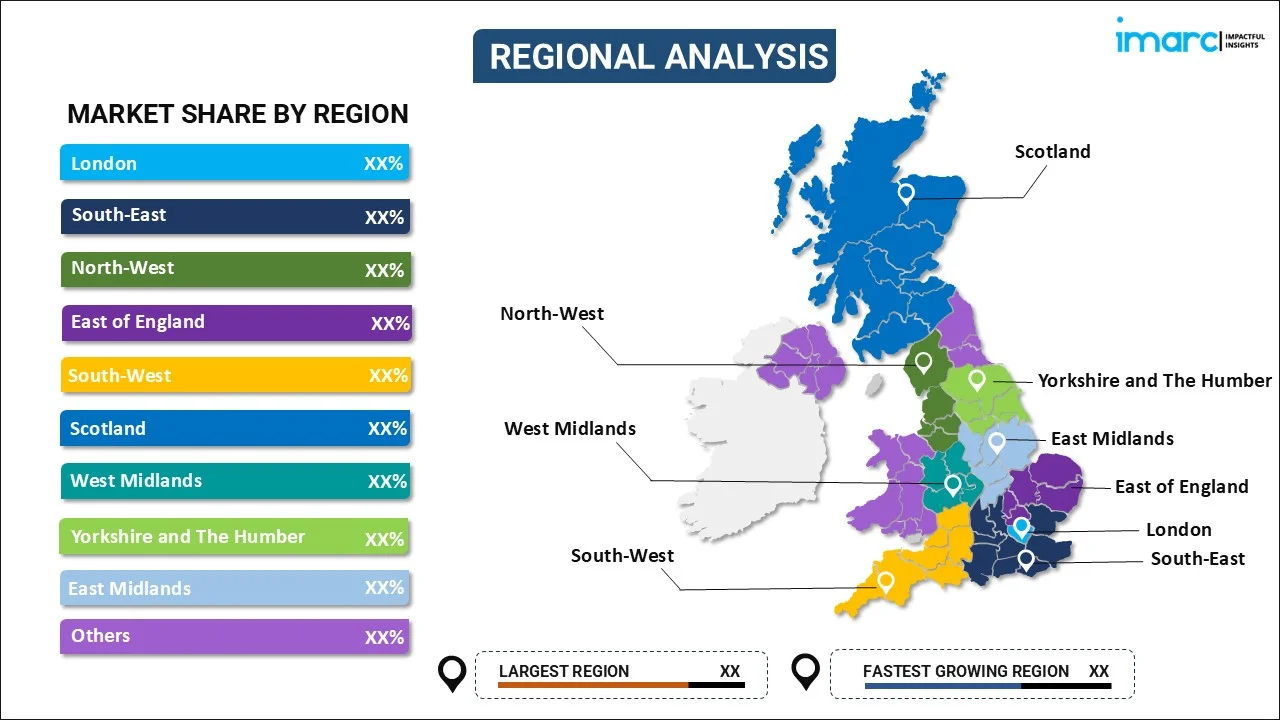

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Blockchain Market News:

- February 26, 2024: Blockchain.com announced the successful first close of its $110 million Series E strategic funding round, led by Kingsway Capital. Key investors include Baillie Gifford, Lakestar, Lightspeed Venture Partners (LSVP), GV, Access Industries, Moore Capital, Coinbase Ventures, and others. This latest funding round highlights continued confidence in the London-based blockchain company's growth, with industry experts Manny Stotz and Nicolas Brand also joining its board.

- January 10, 2024: SETL announced the launch of its LedgerSwarm RLN test network, Tranquility, designed to allow participants to test Regulated Liability Network (RLN) applications. The network aims to drive innovation in the financial sector by enabling banks, financial institutions, and tech providers to explore RLN technology. This initiative is expected to accelerate the development of real-time settlement solutions for global banks, positioning the UK as a leader in blockchain innovation and digital financial infrastructure.

UK Blockchain Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Providers Covered | Application Providers, Infrastructure Providers, Middleware Providers |

| Types Covered | Public, Private, Hybrid, Consortium |

| Deployment modes Covered | On-Premises, Cloud, Hybrid |

| Organization sizes Covered | SMES, Large Enterprises |

| Verticals Covered | Transportation and Logistics, Agriculture and Food, Manufacturing, Energy and Utilities, Healthcare and Life Sciences, Media, Advertising, and Entertainment, Banking and Financial Services, Insurance, IT and Telecom, Retail and Ecommerce, Government, Real Estate and Construction, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK blockchain market performed so far and how will it perform in the coming years?

- What is the breakup of the UK blockchain market on the basis of component?

- What is the breakup of the UK blockchain market on the basis of provider?

- What is the breakup of the UK blockchain market on the basis of type?

- What is the breakup of the UK blockchain market on the basis of deployment mode?

- What is the breakup of the UK blockchain market on the basis of organization size?

- What is the breakup of the UK blockchain market on the basis of vertical?

- What is the breakup of the UK blockchain market on the basis of region?

- What are the various stages in the value chain of the UK blockchain market?

- What are the key driving factors and challenges in the UK blockchain?

- What is the structure of the UK blockchain market and who are the key players?

- What is the degree of competition in the UK blockchain market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK blockchain market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK blockchain market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK blockchain industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)