UK Autonomous Vehicles Market Size, Share, Trends and Forecast by Component, Level of Automation, Application, and Region, 2025-2033

UK Autonomous Vehicles Market Overview:

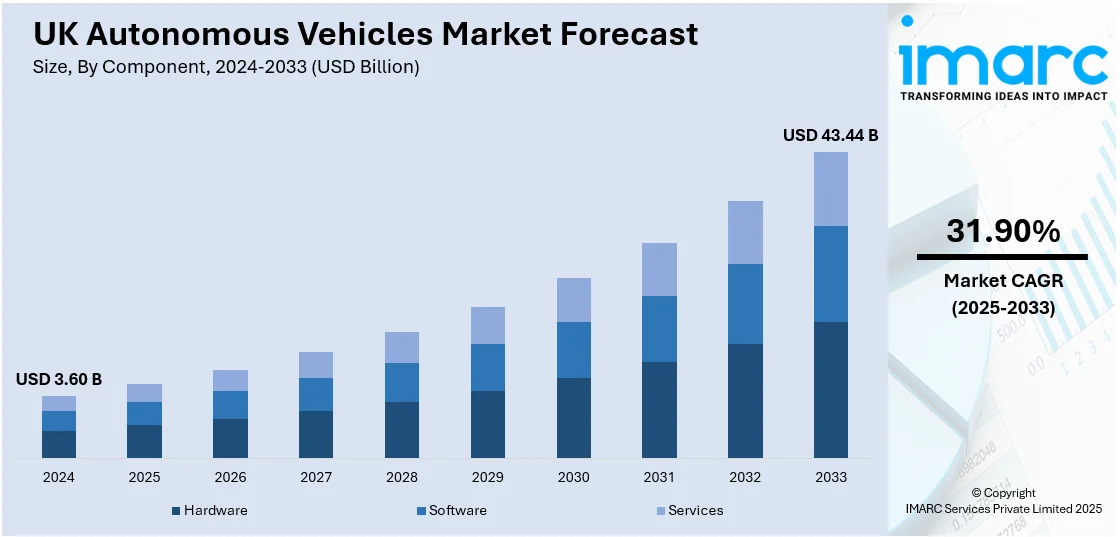

The UK autonomous vehicles market size reached USD 3.60 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 43.44 Billion by 2033, exhibiting a growth rate (CAGR) of 31.90% during 2025-2033. Advancements in AI and machine learning (ML), government support for innovation, the rising demand for smart mobility solutions, the push for reducing traffic congestion and emissions, increased investments in research and development (R&D), partnerships between tech firms and automakers, and favorable regulations are some of the major factors propelling the market growth across the UK.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.60 Billion |

| Market Forecast in 2033 | USD 43.44 Billion |

| Market Growth Rate 2025-2033 | 31.90% |

UK Autonomous Vehicles Market Trends:

Government Support and Regulation

The UK government promotes autonomous vehicle development through funding, policy support, and creating a legal framework for testing and deployment. According to reports published in 2024, self-driving vehicles could be on British roads by 2026, after the government’s world-leading Automated Vehicles (AV) Act became law (20 May 2024). As announced in the King’s Speech, the AV Act enables advanced technology to drive vehicles safely on British roads. The new law puts Great Britain firmly at the forefront of self-driving technology regulation, unlocking the potential of an industry estimated to be worth up to £42 billion and creating 38,000 more skilled jobs by 2035. Road safety is at the heart of the legislation, with automated vehicles expected to improve road safety by reducing human error, contributing to 88% of road collisions. The law will require self-driving vehicles to achieve a level of safety at least as high as careful and competent human drivers, as well as meeting rigorous safety checks before being allowed onto roads.

The government’s proactive approach extends beyond legislation, with significant investments in research and infrastructure to support autonomous vehicle deployment. Funding for AI, robotics, and sensor technology is accelerating the development of highly reliable self-driving systems. Collaboration between public and private stakeholders is fostering innovation, allowing major automotive manufacturers and tech firms to test and refine autonomous capabilities. The expansion of smart road infrastructure, including connected traffic management systems and real-time data networks, is ensuring smoother integration of self-driving vehicles into existing transport systems. Individual awareness campaigns and public consultations are addressing concerns related to trust and cybersecurity, ensuring transparency in the regulatory process. The UK’s strategic focus on becoming a global leader in autonomous mobility is expected to attract further international investments, positioning the country as a hub for advanced vehicle technologies and sustainable transportation solutions in the coming years.

Advancements in AI and Technology

Progress in artificial intelligence (AI), sensor technology, and machine learning enables better vehicle autonomy and fosters market growth. For instance, in May 2024, the UK-based AI firm Wayve has revealed a $1.05 billion investment aimed at advancing the next generation of AI-driven autonomous vehicles. Supported by major tech companies like Microsoft, Wayve plans to utilize this funding to create and introduce the UK's first embodied AI technology for autonomous vehicles. Embodied AI will allow self-driving cars to learn from and engage with their surrounding real-world environment. This encompasses the capability to maneuver and gain insights from scenarios that deviate from rigid patterns or regulations, like unforeseen behaviors of drivers or pedestrians – far exceeding the functionalities of current AV technology. Besides this, the increasing sophistication of AI-driven perception systems, including deep learning algorithms and neural networks, is enhancing autonomous vehicle decision-making and adaptability. High-resolution LiDAR, radar, and advanced computer vision technologies are improving obstacle detection, reducing response times, and ensuring safer navigation in complex environments. AI-powered predictive analytics and real-time data processing allow self-driving systems to anticipate potential hazards, enhancing reliability and safety. The integration of cloud computing and edge AI ensures seamless connectivity, enabling vehicles to process vast amounts of data while maintaining low latency in decision-making. Autonomous mobility companies are collaborating with academic institutions and AI research centers to refine self-learning models, improving their ability to operate efficiently in diverse urban and rural settings. These advancements are accelerating the commercialization of autonomous driving technology, positioning the UK as a leader in AI-driven mobility solutions.

UK Autonomous Vehicles Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on component, level of automation, and application.

Component Insights:

- Hardware

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and services.

Level of Automation Insights:

- Level 3

- Level 4

- Level 5

A detailed breakup and analysis of the market based on the level of automation have also been provided in the report. This includes level 3, level 4, and level 5.

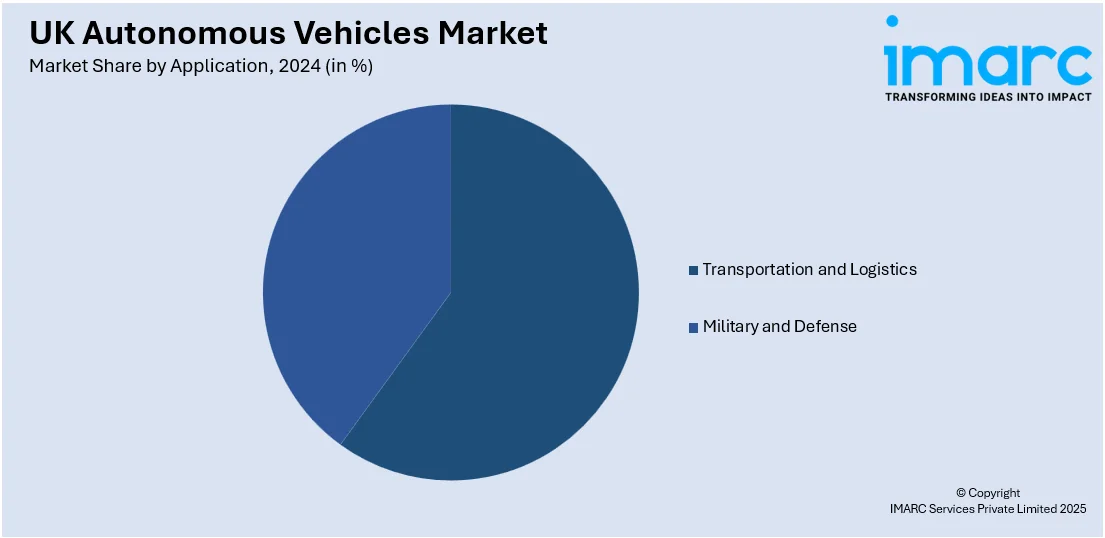

Application Insights:

- Transportation and Logistics

- Military and Defense

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes transportation and logistics and military and defense.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Autonomous Vehicles Market News:

- In November 2024, Oxa launched autonomous Ford E-Transit vehicles in the UK and US. The self-driving vans and minibuses, equipped with Oxa Driver software and sensors, were designed for logistics and passenger transport. Oxa's innovative Spatial AI technology ensured safe and efficient deployment, marking a significant milestone in autonomous vehicle development.

- In May 2024, The Greater Cambridge Partnership (GCP) revealed the inclusion of Alexander Dennis and Fusion Processing in its self-driving bus project, known as the Connector initiative. This pilot program sought to launch self-driving buses in Cambridge, UK, improving transportation choices for locals and tourists..

UK Autonomous Vehicles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Level of Automations Covered | Level 3, Level 4, Level 5 |

| Applications Covered | Transportation and Logistics, Military and Defense |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK autonomous vehicles market performed so far and how will it perform in the coming years?

- What is the breakup of the UK autonomous vehicles market on the basis of component?

- What is the breakup of the UK autonomous vehicles market on the basis of level of automation?

- What is the breakup of the UK autonomous vehicles market on the basis of application?

- What is the breakup of the UK autonomous vehicles market on the basis of region?

- What are the various stages in the value chain of the UK autonomous vehicles market?

- What are the key driving factors and challenges in the UK autonomous vehicles?

- What is the structure of the UK autonomous vehicles market and who are the key players?

- What is the degree of competition in the UK autonomous vehicles market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK autonomous vehicles market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK autonomous vehicles market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK autonomous vehicles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)