UK Asset Management Market Size, Share, Trends, and Forecast by Component, Type, Function, Application, and Region, 2025-2033

UK Asset Management Market Overview:

The UK asset management market size reached USD 12.30 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 22.50 Billion by 2033, exhibiting a growth rate (CAGR) of 6.20% during 2025-2033. The market is expanding owing to rapid economic recovery and expansion, rising wealth among individuals and institutions, increasing geriatric population, recent financial innovation, and altering investing trends.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12.30 Billion |

| Market Forecast in 2033 | USD 22.50 Billion |

| Market Growth Rate (2025-2033) | 6.20% |

UK Asset Management Market Trends:

Economic Recovery and Growth

The UK asset management market's growth is significantly driven by the ongoing economic recovery. For instance, according to industry reports, it is projected that the UK GDP is expected to increase by 1.7% in 2025 from 0.8% in 2024, supporting the ongoing economic recovery. As the economies across the globe have begun to stabilize, confidence among investors has recovered, propelling more activity in asset management. This recovery is characterized by a restoration to pre-pandemic economic factors, and its effects have boosted several sectors of the economy, including the financial markets. Higher consumer expenditure, improved business profits, and overall enhancement of financial stability are the consequences of the economic growth revival. Consequently, investors will be more inclined to invest in asset management solutions to capitalize on growth opportunities in numerous asset classes. Low interest rates have also been a feature of the recovery period, which has led investors to pursue greater returns in equities, real estate, and alternative assets compared to traditional fixed-income securities.

Growing Geriatric Population

The growing geriatric population in the UK is profoundly shaping the asset management market. For instance, as per industry reports, more than 10 million people in England are aged 65 and older, accounting for 18% of the population. As the demographic profile shifts towards geriatric population, there is a heightened need for investment solutions that cater to retirement planning and income generation. With rising life expectancy and a larger population approaching retirement age, there is a growing focus on ensuring financial security during retirement years. Asset management firms are responding to this demographic shift by developing products and strategies specifically designed for retirement planning, such as annuities, retirement funds, and income-generating investments.

UK Asset Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on component, type, function and application.

Component Insights:

- Solution

- Real-Time Location System (RTLS)

- Barcode

- Mobile Computer

- Labels

- Global Positioning System (GPS)

- Others

- Service

- Strategic Asset Management

- Operational Asset Management

- Tactical Asset Management

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and service.

Type Insights:

- Digital Assets

- Returnable Transport Assets

- In-transit Assets

- Manufacturing Assets

- Personnel/ Staff

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes digital assets, returnable transport assets, in-transit assets, manufacturing assets, and personnel/ staff.

Function Insights:

- Location and Movement Tracking

- Check In/ Check Out

- Repair and Maintenance

- Others

A detailed breakup and analysis of the market based on the function have also been provided in the report. This includes location and movement tracking, check in/ check out, repair and maintenance, and others.

Application Insights:

- Infrastructure Asset Management

- Transportation

- Energy Infrastructure

- Water & Waste Infrastructure

- Critical Infrastructure

- Others

- Enterprise Asset Management

- Healthcare Asset Management

- Aviation Asset Management

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes infrastructure asset management, enterprise asset management, healthcare asset management, aviation asset management, and others.

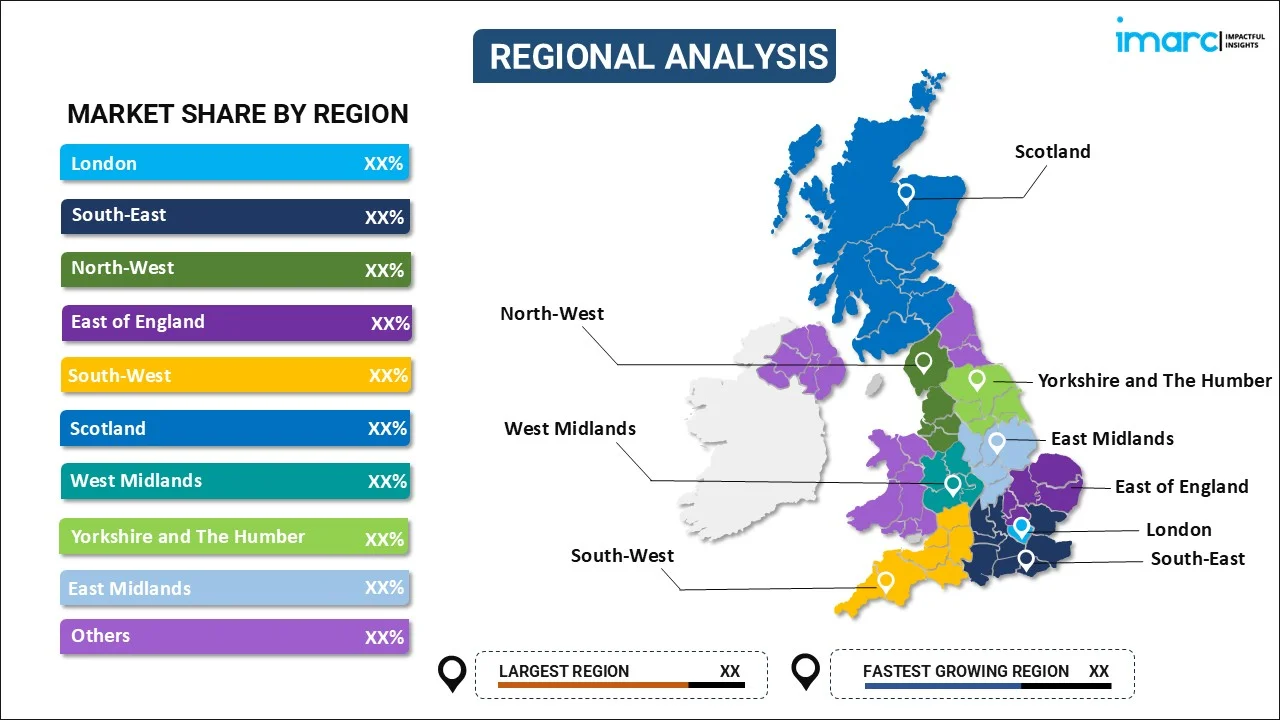

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Asset Management Market News:

- In July 2024, Vanguard announced that its UK platform assets have increased by 53% to 24 billion pounds. This is on account of a boost in investment from young investors with 40% aged 30 or under.

- In July 2024, Macquarie Asset Management exercised the option to purchase the remaining 20% shareholding in National Gas from National Grid, gaining full ownership.

UK Asset Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Types Covered | Digital Assets, Returnable Transport Assets, In-transit Assets, Manufacturing Assets, Personnel/ Staff |

| Functions Covered | Location and Movement Tracking, Check In/ Check Out, Repair and Maintenance, Others |

| Applications Covered |

|

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK asset management market performed so far and how will it perform in the coming years?

- What is the breakup of the UK asset management market on the basis of component?

- What is the breakup of the UK asset management market on the basis of type?

- What is the breakup of the UK asset management market on the basis of function?

- What is the breakup of the UK asset management market on the basis of application?

- What is the breakup of the UK asset management market on the basis of region?

- What are the various stages in the value chain of the UK asset management market?

- What are the key driving factors and challenges in the UK asset management market?

- What is the structure of the UK asset management market and who are the key players?

- What is the degree of competition in the UK asset management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK asset management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK asset management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK asset management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)