UK Alcoholic Beverages Market Size, Share, Trends and Forecast by Category, Distribution Channel, and Region, 2026-2034

UK Alcoholic Beverages Market Summary:

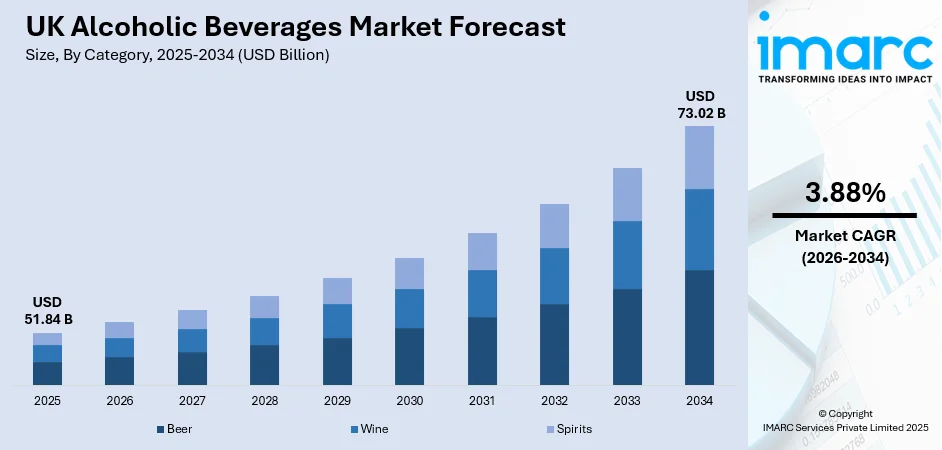

The UK alcoholic beverages market size was valued at USD 51.84 Billion in 2025 and is projected to reach USD 73.02 Billion by 2034, growing at a compound annual growth rate of 3.88% from 2026-2034.

The UK alcoholic drinks market is registering steady growth, backed by the premiumization trend, shifting consumer behavior for craft and artisanal drinks, and historical brewing roots in the country. The UK alcoholic drinks market gets support from the established pub culture, extensive product lines for beers, wines, and spirits, and rising innovation in low and no alcoholic drinks alternatives. The rising demand for sustainable and responsibly made drinks, along with enhanced online platforms, is supporting the UK alcoholic drinks market share.

Key Takeaways and Insights:

-

By Category: Beer dominates the market with a share of 71.02% in 2025, driven by the country's strong brewing heritage, extensive pub culture, and growing demand for craft and premium beer varieties.

-

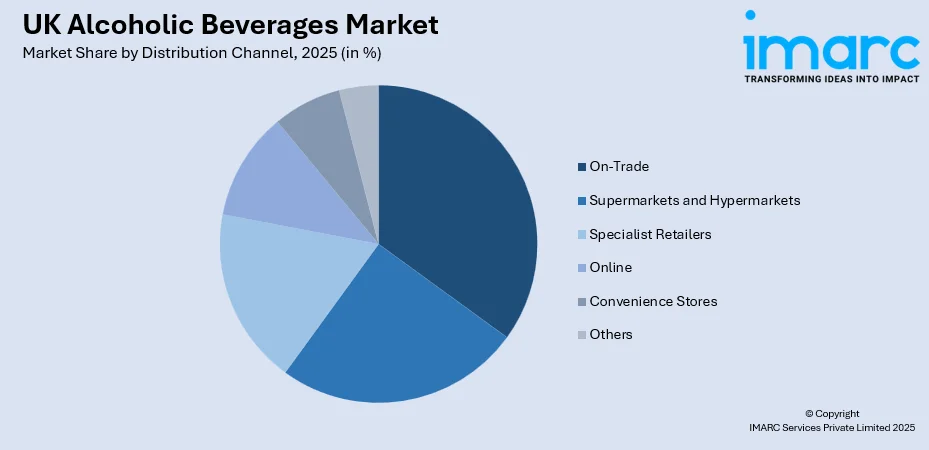

By Distribution Channel: On-trade leads the market with a share of 28.1% in 2025, reflecting the significance of pubs, bars, and restaurants in British drinking culture despite cost-of-living pressures.

-

By Region: London dominates the market with a share of 18% 2025, driven by its large population, thriving hospitality sector, and concentration of craft breweries and premium venues.

-

Key Players: The UK alcoholic beverages market is led by a mix of multinational and regional companies, which sustain a strong presence by offering diverse brands and a wide range of products to cater to varying consumer preferences.

To get more information on this market Request Sample

The UK alcoholic beverages market is vibrant, combining a rich drinking tradition with innovation and shifting consumer tastes. In December 2025, the UK saw a record consumption of over 200 million pints of low- and non-alcohol beer, with major brewers like AB InBev opening a new de-alcoholisation facility in Wales to support local alcohol-free production. Beer continues to dominate, with increasing interest in low- and no-alcohol options alongside popular stout varieties. Changing lifestyles and mindful consumption are reshaping the industry, encouraging premium products, non-alcoholic alternatives, and more selective drinking occasions. Consumers are increasingly seeking quality over quantity, reflecting a broader trend toward health-conscious choices and experiences that emphasize enjoyment, craftsmanship, and authenticity in every sip.

UK Alcoholic Beverages Market Trends:

Premiumization and Craft Beverage Growth

The UK alcoholic beverages market is increasingly influenced by premiumization, with consumers favoring high-quality products over mass-produced alternatives. Craft beer and spirits play a central role in this shift, supported by demand for authentic production methods, distinctive flavors, and strong provenance narratives. The UK craft beer market reached USD 4.71 billion in 2024 and is forecast to grow to USD 11.26 billion by 2033, at a CAGR of 9.12%. Craft festivals and taprooms further strengthen consumer engagement and community appeal.

Rise of Low and No-Alcohol Alternatives

Growing health awareness and mindful drinking habits are accelerating demand for low- and no-alcohol beverages in the UK. Consumers are increasingly embracing alcohol-free options as part of balanced lifestyles, supported by wider availability and significantly improved taste profiles. Reflecting this trend, the UK non-alcoholic beer market reached USD 152.4 million in 2024 and is projected to reach USD 216.9 million by 2033, growing at a CAGR of 4% during 2025–2033. Younger demographics are especially influential, adopting flexible consumption patterns across social occasions.

Sustainability and Ethical Consumption

Sustainability is becoming a decisive factor in UK alcoholic beverage purchasing. According to reports, pub operator Marston’s partnered with circular-economy specialist Reconomy Connect to implement a glass reuse initiative, processing over 102,000 bottles and planning expansion across nearly 600 pubs, reducing waste and collection costs. Consumers increasingly prefer brands demonstrating responsible sourcing, eco-friendly packaging, and ethical operations. Producers are responding with local ingredients, innovative packaging, and a growing focus on organic, responsibly produced wines and spirits.

Market Outlook 2026-2034:

The UK alcoholic beverages market is positioned for continued growth throughout the forecast period, supported by premiumization trends, product innovation, and the expansion of low and no-alcohol categories. The market will benefit from the country's strong hospitality sector recovery, ongoing craft beverage innovation, and increasing digital retail adoption. E-commerce growth presents significant opportunities as consumers increasingly embrace online purchasing. However, the market faces challenges from economic pressures affecting consumer spending, evolving taxation policies, and intensifying competition. The market generated a revenue of USD 51.84 Billion in 2025 and is projected to reach a revenue of USD 73.02 Billion by 2034, growing at a compound annual growth rate of 3.88% from 2026-2034.

UK Alcoholic Beverages Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Category | Beer | 71.02% |

| Distribution Channel | On-Trade | 28.1% |

| Region | London | 18% |

Category Insights:

- Beer

- Wine

- Spirits

The beer dominates with a market share of 71.02% of the total UK alcoholic beverages market in 2025.

Beer remains the largest and most significant category in the UK alcoholic beverages market, reflecting the country's deep-rooted brewing heritage and strong pub culture. In October 2025, Spanish brewer Damm officially opened its £70 million Bedford brewery, its first outside the Iberian Peninsula, nearly doubling production capacity to meet growing UK demand for premium lagers and demonstrating continued investment in the UK beer sector. The segment benefits from diverse product offerings spanning traditional ales, lagers, and stouts to innovative craft varieties.

The segment is characterized by continuous innovation, with craft breweries experimenting with unique flavor profiles, barrel-aged varieties, and fruit-infused ales. Additionally, seasonal and limited-edition releases are driving consumer excitement, while premiumization trends encourage higher-quality ingredients and artisanal brewing methods. Collaborations between breweries and local producers are also gaining traction, enhancing brand storytelling and authenticity. These developments, combined with the growing interest in sustainable and locally sourced products, are helping the UK beer market remain dynamic and resilient.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- On-Trade

- Specialist Retailers

- Online

- Convenience Stores

- Others

The on-trade leads with a share of 28.1% of the total UK alcoholic beverages market in 2025.

The on-trade drinks market covers all pubs, bars, restaurants, and clubs where alcoholic drinks are drunk on the premises, and it has been seen that despite intense pressure from cost-of-living pressures, this drinks channel is very essential for the UK alcoholic drinks market. The unique drinking experiences, quality of draft beers, and superior levels of service delivered in the on-trade channel are simply irreplaceable in home drinking. Premium drinks consumption has been rising in pubs, where fewer but superior drinking experiences are being delivered.

Extending the theme of the on-trade sector, pubs and bars are now diversifying their products. There are many pubs that have incorporated craft and premium lines, theme nights, and food and beer pairings. Additionally, there are live events and loyalty schemes that are being incorporated. All these strategies ensure that the venues have more customers and that they spend more.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

London exhibits a clear dominance with a 18% share of the total UK alcoholic beverages market in 2025.

London represents the largest regional market for alcoholic beverages in the UK, driven by its substantial population, diverse demographics, and thriving hospitality sector. The capital serves as a hotspot for craft breweries, premium bars, and innovative drinking concepts, with consumers actively seeking out local and international craft beers, artisanal spirits, and premium wines. London's cosmopolitan character supports diverse product offerings catering to varied cultural preferences and taste profiles.

The region benefits from high tourism volumes, a concentration of affluent consumers, and numerous premium venues and exclusive bars. London leads in the adoption of emerging trends including craft cocktails, natural wines, and low-alcohol alternatives. The city's dense population of young professionals drives demand for innovative products and experiential drinking occasions. This dynamic environment encourages both local and international brands to experiment with flavors, presentation, and sustainable practices, further shaping the city’s premium beverage landscape.

Market Dynamics:

Growth Drivers:

Why is the UK Alcoholic Beverages Market Growing?

Expanding Premiumization and Product Innovation

The UK alcoholic beverages market is benefiting from strong premiumization trends, with consumers increasingly seeking high-quality, craft, and specialty products. In May 2025, Majestic agreed to acquire leading premium wines and spirits supplier Enotria&Coe, strengthening its position as the UK’s foremost provider of premium drinks to restaurants, hotels, and pubs and underscoring the strategic importance of high‑end products in the market. Demand for unique flavors, artisanal production methods, and premium packaging is rising across spirits, beer, and wine categories. Producers are responding through continuous product innovation, limited editions, and enhanced brand storytelling, supporting higher value growth across the market.

Evolving Social Drinking and Lifestyle Preferences

Changing lifestyle patterns and social behaviors are supporting steady consumption of alcoholic beverages in the UK. In 2025, UK pub and bar visits rose about 4.3 % year‑on‑year, with younger, affluent consumers averaging more than one visit per week, driven by city‑centre socialising and sporting occasions that reinforce alcohol’s role in leisure and entertainment activities. Alcohol remains closely associated with socializing, dining, and celebrations, particularly in urban settings. The growth of on-trade channels such as pubs, bars, and restaurants, along with experiential drinking formats, continues to reinforce alcohol’s role in leisure and entertainment activities.

Strong Retail Infrastructure and Digital Sales Channels

The UK benefits from a well-developed retail ecosystem that supports widespread alcohol availability and consumer access. From 2025 onward, UK legislation will allow consumers to use secure digital IDs on their phones to verify age when purchasing alcohol in pubs, bars, clubs, and shops, streamlining digital purchase experiences and reflecting how technology is reshaping alcohol retail and online sales access. Supermarkets, convenience stores, and specialist retailers offer extensive product ranges, while e-commerce and direct-to-consumer platforms are gaining traction. Improved digital engagement, home delivery services, and promotional strategies are enhancing purchase convenience and sustaining market growth.

Market Restraints:

What Challenges the UK Alcoholic Beverages Market is Facing?

Cost-of-Living Pressures and Consumer Spending Constraints

Ongoing cost-of-living pressures are reshaping how consumers approach alcohol spending. Tighter household budgets are encouraging people to cut back on discretionary social outings, particularly pub and bar visits. As a result, consumption is increasingly shifting toward more affordable at-home occasions, creating sustained pressure on on-trade sales and the wider hospitality sector.

Rising Taxation and Operational Costs

Alcohol producers and hospitality operators are facing mounting financial strain from higher taxation, labour expenses, and day-to-day operating costs. These pressures are compressing profit margins and limiting investment capacity, particularly for smaller businesses. Many producers are prioritising cost control and operational efficiency simply to maintain viability in an increasingly challenging trading environment.

Declining On-Trade Venue Numbers

The gradual decline in pubs and other on-trade venues continues to reshape the UK alcohol landscape. Fewer outlets reduce visibility and distribution opportunities for producers while weakening traditional social drinking occasions. Combined with shifting consumer habits and economic uncertainty, this contraction poses long-term challenges for a sector historically central to British drinking culture.

Competitive Landscape:

The UK alcoholic beverages market is highly competitive, shaped by the presence of large international groups, established regional brewers, and a growing number of craft-focused producers. Market participants compete across beer, spirits, and cider categories through broad product portfolios and strong brand positioning. Smaller and independent brewers add dynamism by emphasizing creativity and local identity. Overall competition is driven by frequent product launches, sustainability-focused practices, and increasing investment in low- and no-alcohol offerings to align with changing consumer lifestyles and preferences.

Recent Developments:

-

In January 2025, the merger of Carlsberg UK and Britvic was officially completed, creating Carlsberg Britvic, the UK’s largest multi-beverage supplier. The combined entity brings together beers, ciders, and soft drinks, strengthening its market reach, distribution scale, and cross-category portfolio strategy.

UK Alcoholic Beverages Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Categories Covered | Beer, Wine, Spirits |

| Distribution Channels Covered | Supermarkets and Hypermarkets, On-Trade, Specialist Retailers, Online, Convenience Stores, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia luxury perfume market size was valued at USD 130 Million in 2025.

The Saudi Arabia luxury perfume market is expected to grow at a compound annual growth rate of 4.90% from 2026-2034 to reach USD 200 Million by 2034.

Above $200 commands 54% market share, driven by Saudi consumers' cultural preference for ultra-premium fragrances featuring rare ingredients like pure oud extracts, premium rose absolutes, and exotic amber formulations that signify sophistication, wealth, and elevated social status.

Key factors driving the Saudi Arabia luxury perfume market include rapid e-commerce expansion with 33.6 million users, strategic brand partnerships enhancing premium positioning, rising influence of younger demographics with a large number of social media users, and government Vision 2030 initiatives supporting luxury sector development.

Major challenges include intense competition from diverse brands creating market saturation, high import costs from tariffs and shipping expenses inflating retail pricing, complex Saudi FDA regulatory requirements causing compliance delays, and counterfeit products compromising brand reputation and consumer safety.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)