UK Aerospace and Defense Market Size, Share, Trends and Forecast by Sector and Region, 2025-2033

UK Aerospace and Defense Market Size and Share:

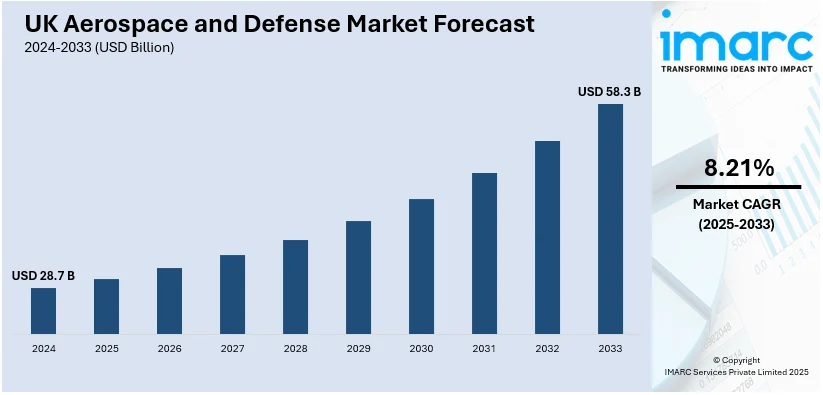

The UK aerospace and defense market size was valued at USD 28.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 58.3 Billion by 2033, exhibiting a CAGR of 8.21% from 2025-2033. The market revenue continues to grow due to advanced manufacturing, innovative technologies, and strong export capabilities. Supported by government initiatives, the sector focuses on military modernization, sustainability, and space exploration, maintaining its competitive edge and contributing significantly to national economic growth and security.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 28.7 Billion |

| Market Forecast in 2033 | USD 58.3 Billion |

| Market Growth Rate (2025-2033) | 8.21% |

The UK aerospace and defense market growth is driven by continuous investment in research and development to maintain technological superiority. Advancements in artificial intelligence, robotics, and autonomous systems are key priorities, enabling the industry to meet evolving defense and commercial aerospace demands. The government's focus on modernizing military capabilities through initiatives such as the Tempest fighter jet program and increased spending on space technologies further propels growth. For instance, as per industry reports, in November 2024, the government of UK approved BAE Tempest sixth-generation fighter program that will include manufacturing of next-gen combat aircraft in partnership with Italy and Japan. Additionally, the industry's emphasis on sustainability, including the development of fuel-efficient aircraft and green propulsion systems, aligns with global trends, enhancing its competitiveness on an international scale.

Global requirement for aerospace and defense products is another crucial factor that significantly impacts the UK market, aided by the nation’s well-established export abilities. The UK’s robust trade collaborations, especially with the Middle East, Europe, and the United States, coupled with the accelerating defense expenditure fortifies its leadership in civil aerospace components and defense exports. For instance, according to the International Trade Administration, the UK government has committed an additional $6.4 billion to defense over 2023/24 and 2024/25, with a further $2.5 billion annually until 2027/28. This represents a total defense budget increase of $14 billion over five years, reinforcing long-term investment in national security. Furthermore, the growing need for cybersecurity and advanced surveillance systems in response to rising geopolitical tensions bolsters the market. The sector's integrated supply chain, with a robust network of SMEs, facilitates efficient production and innovation, ensuring the UK remains a key player in the global aerospace and defense landscape.

UK Aerospace and Defense Market Trends:

Rising Focus on Sustainability

The UK aerospace and defense market is increasingly prioritizing sustainability, driven by regulatory mandates and public demand for eco-friendly solutions. Companies are investing in the development of sustainable aviation fuels (SAFs), lightweight materials, and energy-efficient technologies to reduce carbon emissions. For instance, as per industry reports, in January 2025, the government of UK officially implemented SAF. As per the new law, SAF must comprise at least 2% of jet fuel for U.K. flights, increasing to 10% by 2030 and 22% by 2040. Furthermore, electrification of aircraft and hybrid propulsion systems are gaining traction, supported by government initiatives and funding. In addition, the push towards green defense technologies, such as renewable energy-powered systems and eco-conscious manufacturing practices, highlights the industry's commitment to achieving net-zero targets while maintaining competitiveness in a rapidly evolving global market.

Advancements in Digital Technologies

Digital transformation is a key trend shaping the UK aerospace and defense sector, with widespread adoption of advanced technologies such as artificial intelligence (AI), machine learning, and digital twins. For instance, in November 2024, UK announced the development of new laboratory for AI security research purposes, which will be allocated initial government funding of £8m. This lab will focus on developing improved cyber defense tools and boost nation's stance in the AI arms segment. Moreover, these technologies enable predictive maintenance, optimize supply chain operations, and improve manufacturing processes. In addition, the use of big data analytics enhances decision-making, while blockchain ensures secure and transparent supply chain management. Cybersecurity has also become a focal area, as companies strengthen their digital infrastructure to safeguard sensitive data and critical systems against evolving threats in the digital era.

Growth in Space and Defense Technologies

The UK’s space and defense segments are experiencing substantial expansion, bolstered by increase in defense modernization initiatives, heightening investments in satellite technology, and amplifying interest in space exploration. The proliferation of the UK’s space sector, encompassing satellite launch as well as manufacturing abilities, establishes the nation as a crucial global player. In defense, there is magnifying requirement for AI-powered defense services, upgraded unmanned systems, and precision-guided weaponry. Additionally, partnership efforts between private firms, government, and academia, are fueling advancements, while export opportunities for defense technologies further elevate the market’s expansion prospect. For instance, in May 2024, the National Satellite Test Facility (NSTF) announced the commencement of its operations by signing a contract with its first customer UK Space Agency. NSTF will test the agency's minibus-sized satellites.

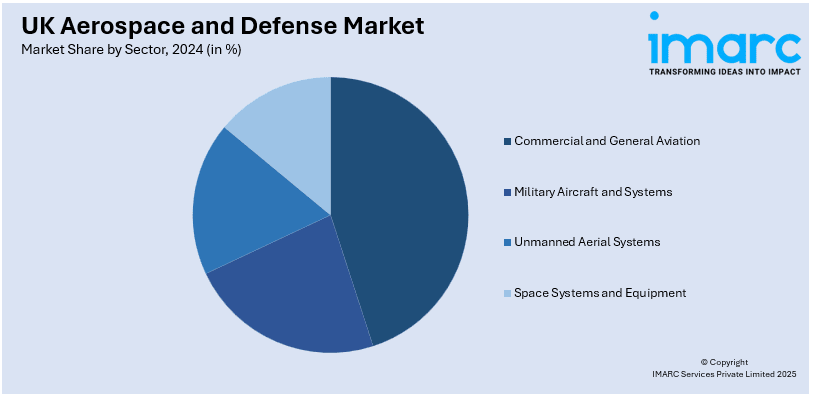

UK Aerospace and Defense Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the UK aerospace and defense market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on sector.

Analysis by Sector:

- Commercial and General Aviation

- Commercial Aircraft

- Air Traffic

- Training and Flight Simulators

- Airport Services (Ground Support Equipment and Logistics)

- Structures

- Airframe

- Engine and Engine Systems

- Cabin Interiors

- Landing Gear

- Avionics and Control Systems

- Electrical Systems

- Environmental Control Systems

- Fuel and Fuel Systems

- MRO

- General Aviation

- Air Traffic

- Training and Flight Simulators

- Airport Services (Ground Support Equipment and Logistics)

- Structures

- Airframe

- Engine and Engine Systems

- Cabin Interiors

- Landing Gear

- Avionics and Control Systems

- Electrical Systems

- Environmental Control Systems

- Fuel and Fuel Systems

- MRO

- Commercial Aircraft

- Military Aircraft and Systems

- Combat Aircraft

- Structures

- Airframe

- Engine and Engine Systems

- Landing Gear

- Avionics and Control Systems

- General Avionics

- Mission Specific Avionics

- Missiles and Weapons

- Structures

- Non-Combat Aircraft

- Structures

- Airframe

- Engine and Engine Systems

- Landing Gear

- Avionics and Control Systems

- General Avionics

- Mission Specific Avionics

- Missiles and Weapons

- Structures

- Combat Aircraft

- Unmanned Aerial Systems

- Commercial

- Military

- Space Systems and Equipment

- Space Launch Vehicle

- Spacecraft

- Ground Systems

- Satellites

- By Subsystem

- Command and Control System

- Telemetry, Tracking, Commanding and Monitoring (TTCM)

- Antenna System

- Transponders

- Power System

- By Application

- Military

- Commercial

- By Subsystem

Commercial and general aviation represent a significant sector in the UK aerospace market. Increasing air traffic drives demand for modern aircraft and enhanced air traffic management systems to ensure efficiency and safety. Training and flight simulators play a crucial role in pilot proficiency, supported by advancements in realistic simulation technologies. Moreover, airport services, including ground support equipment and logistics, are vital for smooth operations and handling growing passenger and cargo volumes. On the other hand, aircraft structures, emphasizing lightweight materials and aerodynamic efficiency, continue to evolve to meet stringent performance and environmental standards, making commercial and general aviation a cornerstone of the UK aerospace industry.

Military aircraft and systems are a prominent segment in the UK defense market. Combat aircraft, equipped with advanced avionics and control systems, enable precision operations and air dominance, whereas non-combat aircraft, such as transport and surveillance models, support logistical and reconnaissance missions. Furthermore, structures incorporating stealth materials and aerodynamic designs ensure performance and survivability. The segment also includes missiles and weapon systems, with a focus on precision guidance and advanced propulsion technologies. These developments cater to national defense strategies, ensuring the UK remains at the forefront of military aviation innovation and global operational capabilities.

Unmanned aerial systems (UAS) are a rapidly growing sector in the UK aerospace market, with applications in both commercial and military domains. Commercial UAS are used for aerial surveying, delivery services, and environmental monitoring, driving efficiency and reducing operational costs. On the other hand, military UAS serve intelligence, surveillance, and reconnaissance purposes, offering high precision and minimizing risks to personnel. Moreover, technological advancements in payload capacity, endurance, and autonomous navigation enhance their utility. The integration of artificial intelligence and real-time data processing further underscores their significance, solidifying UAS as a key segment in both commercial and defense markets.

Space systems and equipment constitute a vital segment that plays a crucial role in expanding the UK aerospace and defense market share. This includes space launch vehicles, spacecraft, ground systems, and satellites for military and commercial applications. Subsystems such as command and control, telemetry, tracking, and monitoring ensure seamless operations. Moreover, antenna systems, transponders, and power systems are integral to satellite functionality and communication. Furthermore, ground systems manage satellite deployment and data exchange, while military applications focus on secure communication and reconnaissance. In addition, commercial uses include broadcasting and navigation. The sector's growth reflects the increasing reliance on space technologies for both defense and civilian purposes.

Regional Analysis:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

London serves as a pivotal hub for the UK's aerospace and defense industry, hosting numerous corporate headquarters, including major defense contractors and aerospace firms. The city's financial services sector provides essential support for industry operations, facilitating investment and funding for large-scale projects. Additionally, London's proximity to government institutions enables effective collaboration on defense policies and procurement strategies. The concentration of legal and consulting services further enhances the region's capacity to manage complex international contracts and regulatory compliance, solidifying London's integral role in the national aerospace and defense market.

The South East region is a significant contributor to the UK's aerospace and defense market, characterized by a robust manufacturing base and advanced research facilities. Home to key industry players and a skilled workforce, the area excels in producing high-precision components and systems. Moreover, the presence of leading universities and research institutions fosters innovation, driving advancements in aerospace technology and defense capabilities. Additionally, strategic transport links, including major airports and seaports, facilitate efficient supply chain operations and export activities, reinforcing the South East's vital role in the sector's national prominence.

The North West region holds a prominent position in the UK's aerospace and defense industry, with a rich heritage in aircraft manufacturing and engineering excellence. The area hosts major production facilities and a network of specialized suppliers, contributing significantly to both military and civil aerospace projects. Furthermore, collaborations between industry and academic institutions support a continuous pipeline of innovation and skilled talent. Besides this, the region's commitment to research and development in advanced materials and manufacturing processes enhances its competitiveness, ensuring the North West remains a key player in the UK's aerospace and defense market.

The East of England is a vital region for the UK's aerospace and defense sector, known for its strengths in avionics, propulsion systems, and maintenance services. The presence of leading aerospace companies and a network of high-tech SMEs drives economic growth and employment. Research parks and innovation centers in the region facilitate the development of cutting-edge technologies, including unmanned aerial systems and cybersecurity solutions. In addition, proximity to London and major transport corridors enhances the East of England's strategic importance, supporting efficient logistics and international collaboration within the aerospace and defense industry.

The South West region is integral to the UK's aerospace and defense market, renowned for its expertise in aircraft design, systems integration, and defense manufacturing. The area hosts significant facilities for both commercial and military aerospace projects, supported by a skilled workforce and strong engineering capabilities. Moreover, collaborations with regional universities and research institutions promote innovation in aerospace technologies, including advancements in composite materials and autonomous systems. The South West's strategic coastal location also supports naval defense activities, contributing to the region's comprehensive role in the national defense infrastructure.

Scotland contributes to the UK's aerospace and defense sector through its specialized focus on space technologies, defense electronics, and maritime systems. The region's growing space industry is marked by satellite manufacturing and launch capabilities, positioning Scotland as a key player in the UK's space ambitions. Defense electronics and sensor systems developed in Scotland support both national and international defense programs. Additionally, the region's shipbuilding heritage and ongoing naval projects underscore Scotland's importance in maritime defense, enhancing its strategic contribution to the UK's overall defense capabilities.

The West Midlands region plays a crucial role in the UK's aerospace and defense market, with a strong emphasis on advanced manufacturing and engineering. The area's industrial base includes the production of high-performance materials and components essential for aerospace applications. Collaboration between industry and leading universities fosters innovation in manufacturing technologies, such as additive manufacturing and automation. Furthermore, the region's central location and well-developed transport infrastructure facilitate efficient distribution and supply chain management, reinforcing the West Midlands' significance in supporting the UK's aerospace and defense industry.

Yorkshire and The Humber contribute to the UK's aerospace and defense sector through a combination of manufacturing expertise and emerging technological development. The region's manufacturing firms produce components and assemblies for both aerospace and defense applications. Moreover, investment in research and development, particularly in materials science and digital technologies, supports the evolution of advanced aerospace solutions. Furthermore, educational institutions in the area provide specialized training programs, ensuring a skilled workforce to meet industry demands. Strategic initiatives aimed at enhancing infrastructure and innovation capacity continue to bolster Yorkshire and The Humber's role in the national aerospace and defense market.

The East Midlands region is a key contributor to the UK's aerospace and defense industry, with strengths in aerospace component manufacturing and engineering services. The presence of major aerospace companies and a network of suppliers underpins the region's industrial capabilities. Research collaborations with local universities drive advancements in aerospace engineering and materials technology. Additionally, the region's transport infrastructure, including proximity to major airports and road networks, supports efficient logistics and supply chain operations. Furthermore, ongoing investment in skills development and innovation ensures the East Midlands remains competitive within the UK's aerospace and defense sector.

UK Aerospace and Defense Companies:

The UK aerospace and defense market features a competitive landscape dominated by global leaders and innovative small-to-medium enterprises (SMEs). Prominent players like BAE Systems, Rolls-Royce, and Airbus maintain strong market positions through advanced technologies and robust export strategies. For instance, as per industry reports, BAE Systems is the biggest manufacturer and provider of several combat technologies and defense aircrafts across the UK, whereas Airbus is a crucial large aircraft supplier for the Royal Air Force. Moreover, in March 2024, Rolls-Royce announced significant investment of EUR 55 million for its shop visit, test, and assembly capacity in the UK to cater to the heightening need for its Trent engines deployed in aircrafts. Furthermore, the industry heavily profits from an extensively integrated supply chain, facilitating partnership between specialized SMEs and major corporations. In addition, heavy investment in segments like green aviation, AI, and autonomous system fortifies the competitive edge. Tactical funding efforts and government collaborations further enhance the industry’s abilities, guaranteeing sustained expansion and robustness in an evolving global environment.

The report provides a comprehensive analysis of the competitive landscape in the UK aerospace and defense market with detailed profiles of all major companies.

Latest News and Developments:

- In January 2025, Hadean, a UK-based startup announced a strategic partnership with Faculty Science, a London-based company specializing in AI safety for defense, to develop leading-edge technology for military drones. This will encompass object movement tracking, navigating autonomous swarming development, and subject identification.

- In November 2024, Teledyne Technologies announced a $710 million cash acquisition of select aerospace and defense electronics units from Excelitas Technologies. The deal includes the UK-based Optical Systems (OS) business, operating under the Qioptiq brand, specializing in advanced optics for heads-up displays, helmet-mounted systems, tactical night vision, and space applications.

- In September 2024, BAE Systems announced strategic acquisition of Kirintec, a UK-based cyber and electromagnetic activities firm that is specialized in counter-uncrewed air system and counter-improvised explosive device technology. This acquisition blends the defense capabilities of both the companies and will facilitate BAE Systems to aid increasing user needs for cybersecurity and military-based services.

- In September 2024, Airbus Helicopters inaugurated a £55 million facility at London Oxford Airport. The center focuses on helicopter servicing, overhauls, and repairs, along with customizing airframes for UK-based clients. It also functions as a completions hub for VIP aircraft under the Airbus Corporate Helicopters division.

- In August 2024, Rolls-Royce, a major UK-based aerospace and defense company, announced a deal with Cathy Pacific to supply its 60 Trent 7000 engines for powering 30 Airbus A330-900 aircraft. The company will also offer its maintenance and wing services to Cathay Pacific.

UK Aerospace and Defense Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered |

|

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK aerospace and defense market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the UK aerospace and defense market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK aerospace and defense industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Aerospace and defense encompass the design, development, and production of aircraft, spacecraft, and military systems. Applications include commercial aviation, space exploration, and national security, such as advanced weaponry, surveillance technologies, and communication systems, ensuring efficient transportation, global connectivity, and defense capabilities for governments and industries worldwide.

The UK aerospace and defense market was valued at USD 28.7 Billion in 2024.

IMARC estimates the UK aerospace and defense market to exhibit a CAGR of 8.21% during 2025-2033.

Key factors driving the market include increased defense spending, advancements in military technology, rising demand for sustainable aviation solutions, and strong export capabilities. Government initiatives supporting research, innovation, and modernization further bolster growth, alongside expanding global demand for aerospace and defense products.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)