UHT Milk Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2026-2034

UHT Milk Market Size and Share:

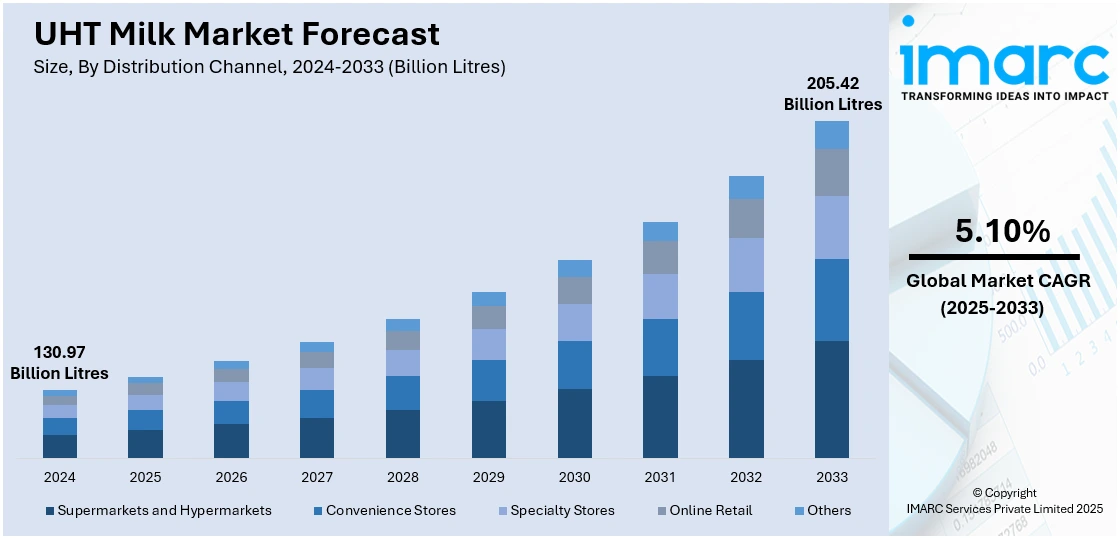

The global UHT milk market size was valued at 130.97 Billion Litres in 2025. Looking forward, IMARC Group estimates the market to reach 205.42 Billion Litres by 2034, exhibiting a CAGR of 5.10% during 2026-2034. Asia currently dominates the market, holding a significant market share of 42.00% in 2024. The rising demand for convenience foods with a long shelf-life, inflating disposable incomes, and advancements in processing technologies represent some of the key factors driving the UHT milk market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

130.97 Billion Litres |

|

Market Forecast in 2034

|

205.42 Billion Litres |

| Market Growth Rate 2026-2034 | 5.10% |

The market for UHT milk is primarily driven by rising demand for long-shelf-life dairy, especially in regions with limited refrigeration. Busy lifestyles and increasing urbanization contribute to growing consumption, as consumers seek convenient, ready-to-drink options. Health trends also boost demand for organic, lactose-free, and fortified UHT milk. Technological advancements in processing and aseptic packaging improve product safety and quality, making UHT milk more appealing. Additionally, expanding retail channels and rising disposable incomes in emerging markets fuel growth. UHT milk’s role in reducing food waste and transport frequency aligns with sustainability goals, attracting environmentally conscious consumers. These factors together support steady global market expansion.

The UHT milk market growth in the United States is expanding due to consumers' preference for longer shelf-life dairy products aligns with their busy lifestyles, as UHT milk offers convenience and reduces the need for frequent grocery trips. The rise in e-commerce grocery sales has further facilitated access to UHT milk, making it a popular choice among urban households and institutions. Additionally, the demand for lactose-free and organic UHT milk variants caters to health-conscious consumers seeking nutritious options. Innovations in packaging, including eco-friendly and smart packaging solutions, enhance product appeal and sustainability. The foodservice sector's reliance on UHT milk for its extended shelf life and ease of storage also contributes to market expansion. For instance, in March 2023, Good Culture and the largest US dairy co-op collaborated to introduce Good Culture Probiotic Milk, a long-lasting, lactose-free milk product enhanced with the BC30 probiotic. It is claimed that the ingredient, which is added after the milk undergoes UHT treatment, supports immune and digestive health when 12oz (approximately 350ml) of the product is consumed, with each 12oz serving containing one billion probiotic cultures.

UHT Milk Market Trends:

Urbanization and Changing Lifestyles

Rapid urbanization and evolving consumer habits have boosted demand for convenient food and beverage options, including UHT milk. According to the United Nations, 68% of the global population is expected to reside in urban areas by 2050. As people migrate to cities, their lifestyles become faster-paced, leaving less time for traditional grocery routines or meal preparation. UHT milk fits this shift, offering a quick, nutritious dairy solution without the need for refrigeration. Working professionals and nuclear families particularly favor products that align with their schedules. Urban retail infrastructure, such as supermarkets and convenience stores, also makes UHT milk more accessible. These socio-demographic changes create a fertile market for long-life dairy products, especially in emerging economies experiencing population growth.

Health and Wellness Trends

Health-conscious consumers are increasingly turning to functional dairy products like UHT milk fortified with added nutrients, probiotics, or lactose-free formulations. According to the UHT milk market forecast, these products cater to individuals with dietary restrictions, such as lactose intolerance, or those seeking immune and digestive health benefits. Innovations like organic, low-fat, and high-protein UHT milk appeal to various health-focused segments. The pandemic further accelerated interest in nutritional and immune-supportive foods, leading to a rise in probiotic and fortified UHT milk options. As consumers demand more from what they eat and drink, the UHT segment is evolving to offer not just convenience but also health and wellness benefits. For instance, in July 2023, Akshayakalpa Organic, the first certified organic dairy company in India, announced its expansion into the market of 42 cities nationwide. Additionally, the company is introducing a new packaging for UHT milk that aims to enhance the convenience of organic milk for consumers.

Technological Advancements in Processing and Packaging

Innovations in UHT processing and aseptic packaging have greatly enhanced product quality, safety, and consumer appeal. Modern UHT methods ensure milk is heat-treated without compromising taste or nutrients, making it more competitive with fresh milk. Aseptic, tamper-proof packaging extends shelf life and supports easy storage and transportation. Eco-friendly packaging innovations also attract environmentally aware consumers. These technological improvements allow for wider distribution, even in remote areas, and reduce dependence on cold storage, which is creating a positive impact on the UHT milk market outlook. By ensuring consistent quality and safety, technology enables producers to meet rising global demand and penetrate new markets, reinforcing UHT milk’s growth trajectory across regions. For instance, in April 2025, the French company Malo Dairy, which is part of SILL Enterprises, launched ultra-high-temperature milk in Pure-Pak cartons made by Elopak, a worldwide provider of carton packaging and filling machinery. The UHT milk, which is a new product in the Malo range, is made using the aseptic filling line that SILL installed in 2024.

UHT Milk Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global UHT milk market, along with forecasts at the global and regional levels from 2026-2034. The market has been categorized based on type and distribution channel.

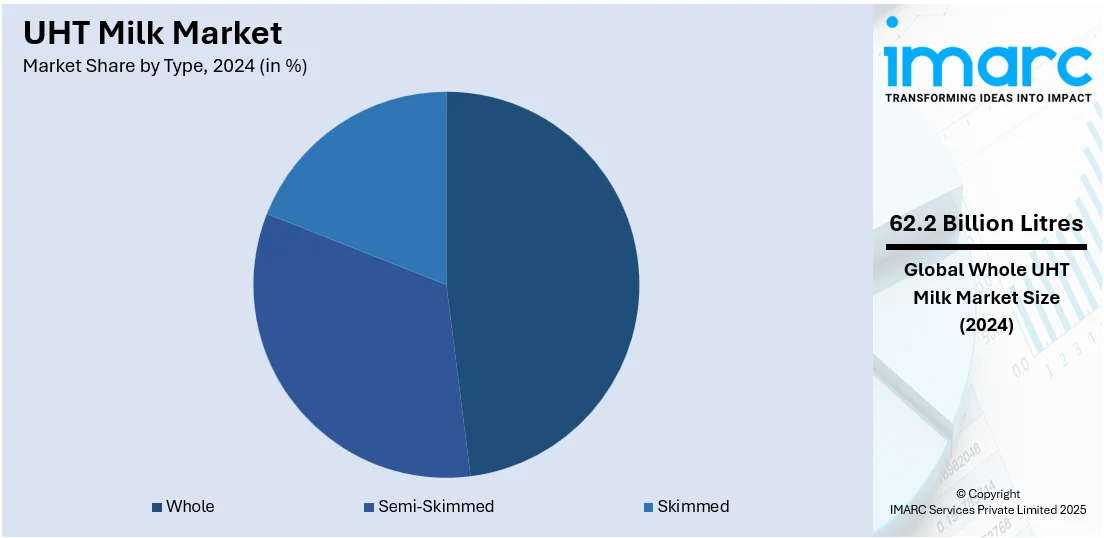

Analysis by Type:

- Whole

- Semi-Skimmed

- Skimmed

Whole stand as the largest type in 2024, holding around 47.5% of the market due to its rich taste, creamy texture, and higher nutritional value, especially for children and health-conscious consumers. It contains essential fats and vitamins like A and D, making it a preferred choice for families. In many developing countries, consumers associate whole milk with higher quality and better health benefits. Additionally, its use in cooking and beverages adds to its popularity. As UHT milk’s long shelf life enhances convenience, whole variants remain in demand among consumers seeking both nutrition and convenience, especially in regions with limited refrigeration and cold-chain infrastructure.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Others

Supermarkets and hypermarkets leads the market with around 41.5% of market share in 2024 due to their wide product variety, convenient shopping experience, and strong distribution networks. These retail formats offer consumers easy access to multiple UHT milk brands and packaging sizes, often at competitive prices. Their ability to maintain inventory and shelf space for long-life products like UHT milk makes them ideal for both regular and bulk purchases. Additionally, attractive in-store promotions, discounts, and product visibility influence consumer choices. In urban areas, the growing preference for one-stop shopping further strengthens supermarkets and hypermarkets as dominant distribution channels in the UHT milk market.

Regional Analysis:

- European Union

- Asia

- North America

- Latin America

- Eastern Europe

- Middle East and Africa

In 2024, Asia accounted for the largest market share of over 42.00%. The UHT milk market demand in Asia is driven by rapid urbanization, rising disposable incomes, and increasing consumer demand for convenient and hygienic dairy products. Many Asian countries face challenges with cold chain infrastructure, making UHT milk ideal due to its long shelf life without refrigeration. The growing awareness of food safety and nutrition is also boosting preference for processed and packaged milk over loose milk. Busy urban lifestyles and the popularity of on-the-go consumption further contribute to UHT milk’s appeal. Additionally, government initiatives promoting food quality and expanding retail and e-commerce networks make UHT milk more accessible. The availability of flavored, fortified, and lactose-free UHT variants also helps attract health-conscious consumers across diverse age groups in Asia.

Key Regional Takeaways:

North America UHT Milk Market Analysis

The UHT milk market in North America is experiencing steady growth, primarily driven by consumers' preference for long shelf-life dairy products aligns with their busy lifestyles, as UHT milk offers convenience and reduces the need for frequent grocery trips. The rise in e-commerce grocery sales has further facilitated access to UHT milk, making it a popular choice among urban households and institutions. Additionally, the demand for lactose-free and organic UHT milk variants caters to health-conscious consumers seeking nutritious options. Innovations in packaging, including eco-friendly and smart packaging solutions, enhance product appeal and sustainability. The foodservice sector's reliance on UHT milk for its extended shelf life and ease of storage also contributes to market expansion.

United States UHT Milk Market Analysis

In 2024, the United States accounted for 89.50% of the UHT milk market in North America. The United States UHT milk market is primarily fueled by growing demand for shelf-stable dairy products, changing consumer lifestyles, and increased focus on food safety and convenience. As more consumers seek products with longer shelf life that require minimal refrigeration, UHT milk offers a practical solution for households, particularly in urban areas with smaller living spaces or limited refrigeration capacity. Rising interest in emergency preparedness and pantry stocking, influenced by recent global disruptions, has also led to increased adoption of UHT milk as a dependable, non-perishable dairy option. Furthermore, health-conscious consumers perceive UHT milk as safe due to its high-temperature sterilization process, which eliminates pathogens without the need for preservatives. The rising consumer preference for organic and natural food has led to the expansion of organic and lactose-free UHT milk varieties, which are helping to meet the needs of niche dietary groups and supporting broader market appeal. For instance, according to the United States Economic Research Service, organic retail sales accounted for 5.5% of total retail food sales in 2021, surpassing USD 52 Billion. Of this, dairy and eggs accounted for 13% of total organic food sales. As consumer awareness about food waste reduction grows, the long shelf life and reduced spoilage associated with UHT milk further enhance its value proposition in the U.S. market.

Asia Pacific UHT Milk Market Analysis

The Asia Pacific UHT milk market is expanding due to rapid urbanization, rising disposable incomes, and increasing demand for convenient, shelf-stable dairy products. As per recent estimates, in 2025, 53.6% of the population of Asia lives in urban areas, equating to 2,589,655,469 individuals. As cities grow and refrigeration access remains inconsistent in some regions, UHT milk offers a practical solution with its long shelf life and ambient storage. Busy lifestyles and growing middle-class populations in countries such as China, India, Indonesia, and Vietnam are also fueling demand for ready-to-consume and low-maintenance food options, making UHT milk a preferred choice for households and individuals. Furthermore, expanding organized retail, including supermarkets and online grocery platforms, is also enhancing product availability and visibility. Additionally, growing awareness about food safety and hygiene has led consumers to prefer sterilized, packaged options over loose or fresh milk. Fortified and flavored UHT variants further attract younger demographics.

Europe UHT Milk Market Analysis

The Europe UHT milk market is experiencing significant growth, fueled by long-standing consumer familiarity with shelf-stable dairy, strong distribution infrastructure, and the product’s alignment with convenience-oriented lifestyles. In numerous European countries, particularly France, Germany, Italy, and Spain, UHT milk is widely accepted and often preferred due to its extended shelf life and minimal need for refrigeration before opening. The prevalence of small retail formats, such as convenience stores and local grocers, also supports the circulation of ambient milk products, which do not require chilled display units. Additionally, governments and health agencies promote UHT milk for public nutrition programs and food aid, particularly in schools and remote regions with limited cold chain infrastructure. Furthermore, cross-border trade of UHT milk within the European Union benefits from streamlined regulations and harmonized standards, supporting efficient movement and consistent supply throughout the region’s diverse retail and food service channels. Overall, international exports in the European Union increased by 1.1% in 2024. Moreover, cross-border trade within the EU reached € 4025 Billion in terms of exports in 2024, which was 56% higher than exports to non-EU member nations. Other than this, innovation in organic, lactose-free, and fortified UHT milk options is also expanding the consumer base, catering to diverse dietary preferences and health needs.

Latin America UHT Milk Market Analysis

The Latin America UHT milk market is significantly influenced by the region’s growing e-commerce penetration and changing consumption patterns influenced by urbanization. For instance, the e-commerce growth rate in Brazil is 14.3% and is expected to surpass USD 200 Billion by 2026, as per the International Trade Administration (ITA). As more consumers shift to digital grocery platforms, UHT milk is increasingly favored for its durability during transport and longer usability once delivered. The rise of single-person households and busy urban lifestyles is also driving demand for convenient, ready-to-store dairy products, with UHT milk offering a no-refrigeration solution before opening.

Middle East and Africa UHT Milk Market Analysis

The Middle East and Africa UHT milk market is being increasingly propelled by rising urbanization, limited cold chain infrastructure, and growing demand for long-lasting, hygienic dairy options. In numerous parts of the region, inconsistent refrigeration and high ambient temperatures make UHT milk a practical alternative to fresh milk. Rapid population growth, particularly in urban centers, is increasing the consumption of packaged foods, including UHT milk, which fits well with fast-paced, convenience-focused lifestyles. For instance, the population of Africa is estimated to be growing at a yearly rate of 2.29% in 2025, as per industry reports. Moreover, the urban population in the region reached 698,148,943 individuals in 2025, accounting for 45% of the total population in Africa. Other than this, the expanding retail sector, both supermarkets, and e-commerce, has improved access to UHT products, further facilitating industry expansion across the region.

Competitive Landscape:

The global UHT milk market is highly competitive, dominated by multinational corporations. To preserve market share, such companies make use of wide distribution networks and well-known brands. Urbanization and rising demand for convenient dairy products are driving significant growth in emerging economies, especially in Asia-Pacific. In India, local players like Amul and Milky Mist are expanding their UHT offerings to meet rising consumer demand. The market also faces challenges from private label brands and plant-based alternatives, prompting traditional dairy companies to innovate with fortified and flavored UHT milk variants. Strategic partnerships, acquisitions, and investments in technology are common strategies employed by key players to stay competitive in this evolving landscape.

The report provides a comprehensive analysis of the competitive landscape in the UHT milk market with detailed profiles of all major companies, including:

- Amul (GCMMF)

- Arla Foods amba

- China Mengniu Dairy Company Limited

- Dairy Group South Africa

- Dana Dairy Group

- FrieslandCampina

- Hochwald Foods GmbH

- Lactalis International

- Saputo Dairy Australia Pty Ltd.

- Sodiaal

Latest News and Developments:

- February 2025: Arla Foods announced an investment proposal of EURO 107.7 Million at its Lockerbie UHT milk production facility in Scotland in order to support the company’s future expansion plans. With this capital investment, the company intends to establish a Center of Excellence in Lockerbie for the manufacturing of Lactofree and UHT milk.

- June 2024: Arla Foods Bangladesh, the regional division of the international dairy corporation Arla Foods, inaugurated a new UHT milk manufacturing plant in Gazipur, Bangladesh. With a combined investment estimated at €15 Million in partnership with Mutual Group, the facility is expected to set a new standard for the safe and ecological manufacturing of dairy products in the nation, with a dedication to affordable nutrition.

- March 2024: Harry Davis & Company (HDC) announced that it has successfully mediated the sale of HP Hood's extended shelf-life UHT dairy processing facility in Philadelphia, Pennsylvania, to Maola Local Dairies. The acquisition will preserve over 160 local union jobs in Pennsylvania, the home state of 80% of Maola’s family farms.

- March 2024: Heritage Foods successfully inaugurated a new UHT milk facility in Sampanbole Village, Shamirpet Mandal, Medchal District, Telangana, India. The new factory is equipped with the latest SIG packaging equipment and will produce a variety of delicious products, including milkshakes, flavored lassi, rich cold coffee, and whey-based energy drinks using UHT milk.

UHT Milk Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion Litres |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Whole, Semi-Skimmed, Skimmed |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, Others |

| Regions Covered | European Union, Asia, North America, Latin America, Eastern Europe, Middle East and Africa |

| Companies Covered | Amul (GCMMF), Arla Foods amba, China Mengniu Dairy Company Limited, Dairy Group South Africa, Dana Dairy Group, FrieslandCampina, Hochwald Foods GmbH, Lactalis International, Saputo Dairy Australia Pty Ltd., Sodiaal, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UHT milk market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global UHT milk market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UHT milk industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The UHT milk market was valued at 130.97 Billion Litres in 2024.

The UHT milk market is projected to exhibit a CAGR of 5.10% during 2025-2033, reaching a value of 205.42 Billion Litres by 2033.

Key factors driving the UHT milk market include rising demand for longer shelf-life dairy, urbanization, busy lifestyles, lack of refrigeration in developing regions, and growing health awareness. Additionally, expanding retail infrastructure, increasing disposable incomes, and advancements in UHT processing technologies contribute to the market's growth across both developed and emerging economies.

Asia currently dominates the UHT milk market due to urbanization, rising incomes, busy lifestyles, limited cold storage, and demand for long-shelf-life dairy.

Some of the major players in the UHT milk market include Amul (GCMMF), Arla Foods amba, China Mengniu Dairy Company Limited, Dairy Group South Africa, Dana Dairy Group, FrieslandCampina, Hochwald Foods GmbH, Lactalis International, Saputo Dairy Australia Pty Ltd., Sodiaal, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)