Uganda Mobile Money Market Size, Share, Trends and Forecast by Technology, Business Model, and Transaction Type, 2025-2033

Uganda Mobile Money Market Size and Share:

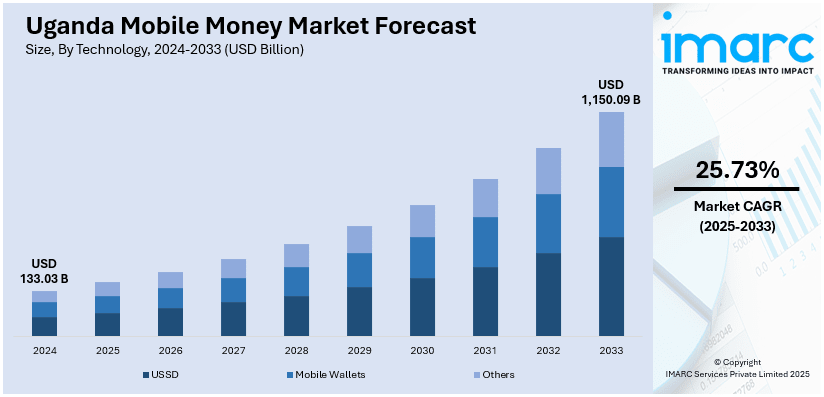

The Uganda mobile money market size was valued at USD 133.03 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,150.09 Billion by 2033, exhibiting a CAGR of 25.73% during 2025-2033. The market is driven by rising mobile and internet penetration, limited access to traditional banking, increasing smartphone adoption, and growing demand for digital financial services. Enhanced security features, urbanization, and innovative lending solutions also boost usage. These factors significantly contribute to Uganda mobile money market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 133.03 Billion |

| Market Forecast in 2033 | USD 1,150.09 Billion |

| Market Growth Rate 2025-2033 | 25.73% |

The growth of Uganda's mobile money market is largely driven by limited access to traditional banking services and the increasing availability of mobile phones. For instance, as per industry reports, mobile connections in Uganda represented 67.7 percent of the total population in January 2024. Between the beginning of 2023 and the start of 2024, the number of mobile connections grew by 2.2 million, reflecting a 6.9 percent increase. Many Ugandans, especially in rural areas, lack proximity to physical bank branches, making mobile money a practical alternative. These services allow users to send and receive money, pay bills, and manage savings directly from their phones, without the need for a formal bank account. The convenience, affordability, and security of mobile money transactions have made them more appealing than cash, especially in areas where banking infrastructure is underdeveloped. Mobile phones serve as an easy entry point into digital finance, empowering users with simple tools for managing daily financial activities.

In addition to these structural factors, the rise of internet access and urbanization has played a critical role in Uganda mobile money market growth. As more people gain digital literacy and shift toward tech-driven lifestyles, especially in urban areas, mobile money becomes an essential part of everyday transactions. The ease of using mobile applications for payments, transfers, and financial management supports the growing demand for more efficient and flexible financial services. Regulatory support from government institutions has also helped establish a secure environment for mobile financial transactions. The evolution of mobile money platforms to include services such as savings, credit access, and utility payments further deepens user engagement. As digital familiarity spreads and mobile platforms continue to innovate, mobile money is becoming increasingly embedded in both personal finance and broader economic activity across Uganda.

Uganda Mobile Money Market Trends:

Rising Mobile and Internet Penetration Fueling Mobile Money Usage

The surge in mobile phone ownership and internet connectivity represents one of the pivotal Uganda mobile money market trends. In a country where traditional banking infrastructure is often limited, especially in rural and remote areas, mobile money platforms provide a practical and scalable solution for financial inclusion. As of early 2024, Uganda reported 13.3 million internet users, equating to a 27% internet penetration rate. This growing digital access is enabling more Ugandans to engage with financial services that were previously out of reach. Mobile money facilitates a wide range of functions including peer-to-peer transfers, bill payments, merchant transactions, and cross-border remittances—all through mobile phones. The simplicity, affordability, and security of these platforms are particularly appealing to the unbanked population. Moreover, as mobile applications become more sophisticated and user-friendly, adoption continues to rise across demographics, making mobile money a cornerstone of Uganda's evolving digital economy.

Urbanization and Shifting Consumer Preferences Driving Adoption

Uganda's rising urbanization is significantly transforming consumer preferences and accelerating the adoption of mobile money services. According to the UN Habitat, approximately 26% of Uganda's population is now classified as urbanized. This demographic shift typically brings about greater exposure to digital technologies, higher income levels, and increased demand for efficient financial services. In urban centers, residents often require faster, more secure, and convenient methods to handle financial transactions, needs that mobile money platforms are well-positioned to meet. As a result, mobile money has overtaken conventional channels such as bank deposits and cash pickups to become the preferred method for receiving and sending money. The trend is also driven by growing awareness campaigns, improvements in mobile app design, and technological literacy, particularly among younger populations. Mobile money’s role is further solidified by its integration with daily urban lifestyles, allowing users to pay for utilities, transportation, and retail purchases directly through their mobile devices.

Uganda Mobile Money Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Uganda mobile money market, along with forecast at the country level from 2025-2033. The market has been categorized based on technology, business model, and transaction type.

Analysis by Technology:

- USSD

- Mobile Wallets

- Others

USSD stands as the largest technology in 2024. Its widespread adoption can be attributed to its compatibility with basic mobile phones, which are still commonly used across both rural and urban regions. Unlike smartphone applications that require internet connectivity, USSD operates over the GSM network, allowing users to access financial services without data or smartphones. This inclusivity makes it a critical tool for financial access, especially for the unbanked and underbanked population. USSD enables users to send and receive money, check balances, and pay bills through simple codes, offering a cost-effective and user-friendly interface. Its accessibility and simplicity continue to underpin mobile money’s growth and financial inclusion in Uganda.

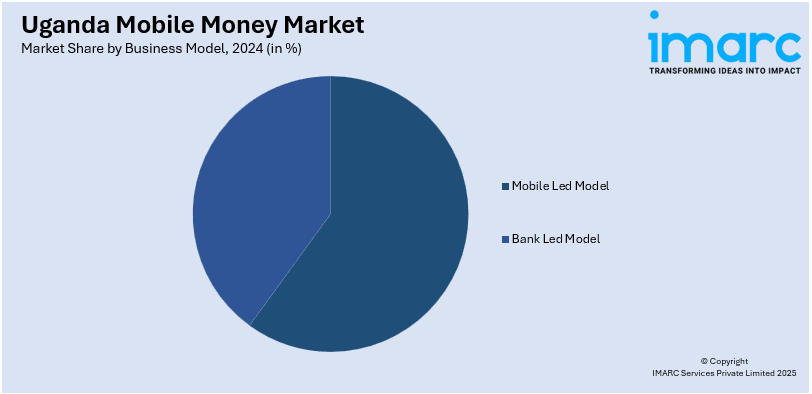

Analysis by Business Model:

- Mobile Led Model

- Bank Led Model

Mobile led model led the market in 2024. The mobile-led model is the cornerstone of Uganda's mobile money market, driving widespread adoption and financial inclusion. In this model, telecom operators play a central role by directly offering mobile money services through their existing mobile networks. This approach leverages the extensive reach of mobile phones across both rural and urban areas, ensuring that financial services are accessible to a broader population. By bypassing traditional banking institutions, the mobile-led model simplifies account setup, reduces service costs, and eliminates the need for physical infrastructure. Users can easily perform transactions such as sending money, paying bills, and purchasing goods directly from their mobile phones. This model’s efficiency, affordability, and accessibility have made it the dominant force in positively shaping the Uganda mobile money market outlook.

Analysis by Transaction Type:

- Peer to Peer

- Bill Payments

- Airtime Top-ups

- Others

Peer to peer led the market in 2024 by allowing users to transfer funds to friends, family, or business contacts using their mobile phones without the need for intermediaries. The P2P system enhances financial inclusion, especially in areas with limited access to traditional banking services, by offering a convenient and secure way to transact. With the widespread use of mobile phones, Uganda’s population, particularly in rural regions, benefits from this easy method of transferring money, paying bills, and accessing financial services. The P2P model is crucial for facilitating everyday transactions and remittances, driving the growth of mobile money in Uganda.

Competitive Landscape:

The Uganda mobile money market forecast expects the competitive landscape to remain intense, with multiple providers offering a wide array of services aimed at meeting the varied needs of a growing and increasingly digital-savvy consumer base. Companies focus on providing secure, fast, and affordable money transfer solutions, particularly targeting underserved populations with limited access to traditional banking. Competition is driven by factors such as convenience, service coverage, transaction fees, and the ability to offer innovative features like cross-border transfers and bill payments. Additionally, the rise of mobile wallets and digital platforms has spurred differentiation in services, with companies striving to capture both urban and rural users. The emphasis on customer acquisition and retention, driven by competitive pricing and convenience, fuels ongoing market growth and innovation. For instance, in May 2025, Airtel Uganda expanded its 4G network coverage to Kazo District, launching new base stations in Rwemikoma as part of its efforts to enhance digital inclusion and support the local economy. The new infrastructure is expected to improve access to services, create employment opportunities, and provide residents with better network connectivity. The expansion will also enable security enhancements, as residents can install 4G-powered cameras to monitor properties. Airtel Uganda encourages the community to adopt its services and ensure the security of their accounts by safeguarding PIN information.

The report provides a comprehensive analysis of the competitive landscape in the Uganda mobile money market with detailed profiles of all major companies, including:

- MTN Group Limited (MTN Uganda)

- Bharti Airtel Limited

Latest News and Developments:

- March 2025: MTN Uganda’s Mobile Money introduced a virtual prepaid card in collaboration with Mastercard, Diamond Trust Bank, and Network International. This feature allows MoMo users to make safe online payments on Mastercard-accepting sites, fostering e-commerce growth in Uganda while improving financial inclusion and transaction security.

- December 2024: Western Union and PostBank Uganda integrated international money transfers into the Wendi mobile money wallet. This collaboration enables users to send and receive funds globally via Western Union’s network, thereby expanding access to secure, digital financial transactions and promoting financial inclusion in Uganda.

- October 2024: PostBank Uganda and MTN Mobile Money launched XtraCash, a digital micro-lending service. This service provides short-term loans to MTN mobile wallet users, aiming to support millions of subscribers across Uganda, thus offering a convenient, accessible digital credit solution.

- September 2024: Airtel Money partnered with Letshego Uganda to introduce "LetsGo Pesa," a mobile money loan service. The service offers quick, collateral-free loans using advanced credit-scoring technology, helping both individuals and small businesses in Uganda, thus improving financial accessibility and inclusion.

- February 2024: Mastercard and MTN Group Fintech formed a multi-market agreement to extend secure mobile money payments across Africa, including Uganda. This partnership enhances digital transactions for millions of users and small businesses, positioning MTN to be Africa’s leading fintech platform, promoting a cashless economy and financial inclusion.

Uganda Mobile Money Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Technologies Covered | USSD, Mobile Wallets, and Others |

| Business Models Covered | Mobile Led Model, Bank Led Model |

| Transaction Types Covered | Peer to Peer, Bill Payments, Airtime Top-ups, and Others |

| Companies Covered | MTN Group Limited (MTN Uganda), Bharti Airtel Limited |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Uganda mobile money market from 2019-2033.

- The Uganda mobile money market research report provides the latest information on the market drivers, challenges, and opportunities in the regional market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Uganda mobile money industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Uganda mobile money market was valued at USD 133.03 Billion in 2024.

The Uganda mobile money market is projected to exhibit a CAGR of 25.73% during 2025-2033, reaching a value of USD 1,150.09 Billion by 2033.

Key factors driving the Uganda mobile money market include widespread mobile phone usage, limited access to traditional banking, increasing internet penetration, growing urbanization, and rising awareness of digital financial services. Additionally, the convenience, affordability, and security of mobile money transactions contribute to its rapid adoption and market growth.

Some of the key players in the Uganda mobile money market include MTN Group Limited (MTN Uganda), Bharti Airtel Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)