UAE Telecom Market Report by Services (Voice Services, Data and Messaging Services, OTT and Pay-Tv Services), and Region 2025-2033

UAE Telecom Market Overview:

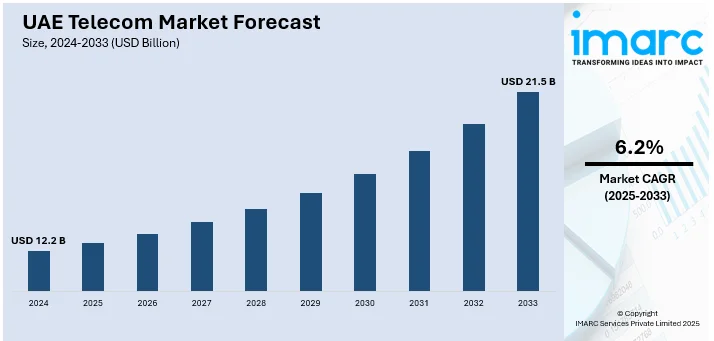

The UAE telecom market size reached USD 12.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 21.5 Billion by 2033, exhibiting a growth rate (CAGR) of 6.2% during 2025-2033. Ongoing technological advancements, rising government support for digital transformation, increasing mobile and internet penetration, growing demand for fifth-generation (5G) services, and strategic investments by telecom operators are some of the key factors supporting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 12.2 Billion |

|

Market Forecast in 2033

|

USD 21.5 Billion |

| Market Growth Rate (2025-2033) | 6.2% |

UAE Telecom Market Trends:

Rapid deployment of 5G technology:

The UAE is establishing itself as a leader in the global telecom scene by being at the forefront of the adoption of 5G technology. Major telecom operators like Etisalat and Du are investing heavily in the rollout of 5G networks, aiming to provide ultra-fast internet speeds, low latency, and enhanced connectivity. This rapid deployment is driven by the country's vision to become a global hub for technology and innovation. 5G technology is expected to revolutionize various sectors, including healthcare, transportation, and entertainment, by enabling advanced applications such as smart cities, autonomous vehicles, and augmented reality. The increasing availability of 5G devices and the growing demand for high-speed, reliable internet services are bolstering the adoption of 5G technology in the UAE.

To get more information on this market, Request Sample

Government initiatives supporting digital transformation:

The UAE government plays a crucial role in driving the telecom market through its strong support for digital transformation. Initiatives such as the UAE Vision 2021 and the National Innovation Strategy aim to create a knowledge-based economy by leveraging advanced technologies. Besides this, the government is actively promoting the adoption of digital services and infrastructure, including the development of smart cities, e-government services, and digital healthcare solutions. These initiatives are designed to enhance the quality of life for citizens, improve business efficiency, and attract foreign investment. Additionally, the Telecommunications and Digital Government Regulatory Authority (TDRA) is implementing policies and regulations that encourage innovation and competition within the telecom sector, creating a positive outlook for market expansion.

Increasing consumer demand for high-speed internet and advanced mobile services:

The UAE's consumer preferences are changing rapidly, with a rise in the need for advanced mobile services and high-speed internet. The proliferation of smartphones, tablets, and other connected devices has led to a surge in data consumption, driving telecom operators to enhance their network capabilities. Moreover, telecom companies are investing in network expansion and upgrades as a result of consumers' demands for lag-free connectivity, excellent streaming, and robust online experiences. Furthermore, the COVID-19 pandemic has spurred a shift towards remote work, online education, and digital entertainment, highlighting the need for reliable and high-speed internet services. Apart from this, the growing popularity of over-the-top (OTT) services, such as video streaming and online gaming, which require high bandwidth and low latency is also driving the UAE telecom market growth.

UAE Telecom Market News:

- In June 2024, Du revealed its plan to launch 5G-Advanced (5G-A) technology in Dubai by 2024, expanding to major UAE cities and achieving national coverage by 2026. Following successful trials in October 2023, the commercial launch is set for January 2024. Du targets a 40% market share in Fixed Wireless Access (FWA) using 5G-A within three years. The technology will enhance both consumer and business services, including network slicing and a 5G-to-B suite.

- In October 2023, Nedaa and Du, part of Emirates Integrated Telecommunications Company (EITC), signed an MoU to enhance their telecommunication collaboration. This agreement focuses on utilizing Du's IoT and mobile coverage to expand Nedaa's network for seamless UAE connectivity. The partnership will explore key projects and outline detailed collaboration terms in a future Long Form Agreement.

UAE Telecom Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on services.

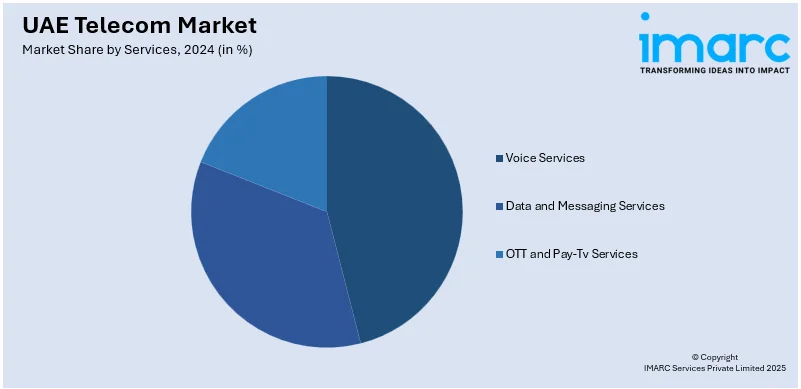

Services Insights:

- Voice Services

- Wired

- Wireless

- Data and Messaging Services

- OTT and Pay-Tv Services

The report has provided a detailed breakup and analysis of the market based on the services. This includes voice services (wired and wireless), data and messaging services, and OTT and pay-tv services.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. The companies in the market are adopting various strategic initiatives including new service launches and business alliances to gain a significant UAE telecom market share.

UAE Telecom Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Services Covered |

|

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE telecom market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the UAE telecom market?

- What is the breakup of the UAE telecom market on the basis of services?

- What are the various stages in the value chain of the UAE telecom market?

- What are the key driving factors and challenges in the UAE telecom?

- What is the structure of the UAE telecom market and who are the key players?

- What is the degree of competition in the UAE telecom market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE telecom market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE telecom market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE telecom industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)