UAE Solar Energy Market Size, Share, Trends and Forecast by Type and Region, 2025-2033

UAE Solar Energy Market Size and Share:

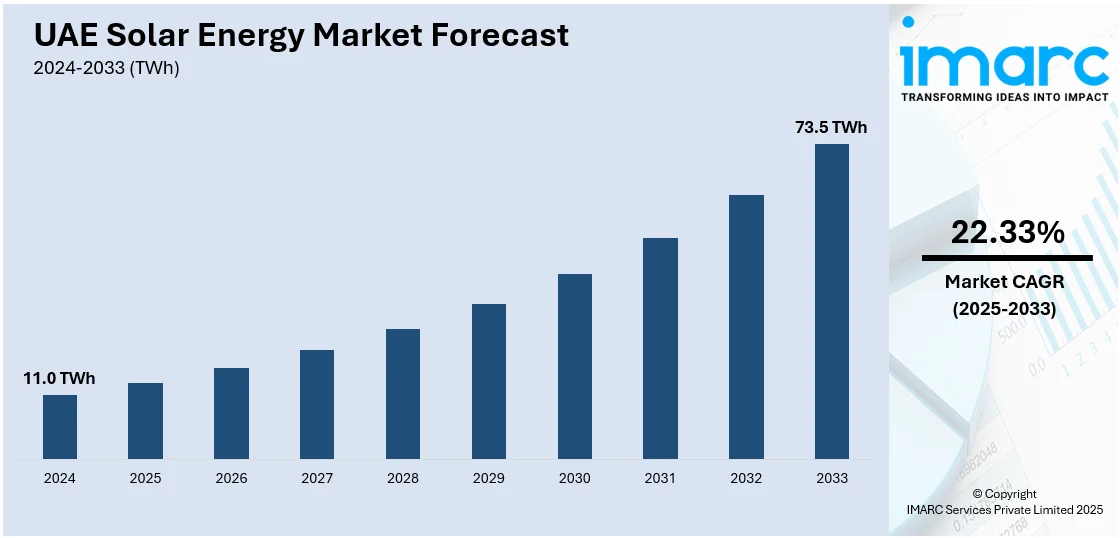

The UAE solar energy market size was valued at 11.0 TWh in 2024. Looking forward, IMARC Group estimates the market to reach 73.5 TWh by 2033, exhibiting a CAGR of 22.33% from 2025-2033. The market is driven by the growing investment in clean energy infrastructures in the UAE, and the increasing adoption of solar energy in the hospitality sector, where it assists in reducing energy costs and meeting sustainability goals.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 11.0 TWh |

| Market Forecast in 2033 | 73.5 TWh |

| Market Growth Rate (2025-2033) | 22.33% |

The UAE is striving for 50% clean energy by 2050 under its renewable energy goals. Initiatives such as the Dubai Clean Energy Strategy 2050 and Energy Strategy 2050 seek to enhance the share of renewable energy. These initiatives aim to decrease carbon emissions and increase energy efficiency, while also expanding the proportion of solar energy. The government also provides financial support and incentives for solar energy systems in various industries. Additionally, the government encourages public-private collaborations, fostering collaboration between local entities and international investors. This accelerates the uptake of innovative technologies and promotes rapid growth in the solar energy sector. The IMARC Group’s report indicates that by 2032, the renewable energy market in the UAE is projected to reach US$ 11.2 Billion.

To get more information on this market, Request Sample

The growing adoption of solar energy in the private sector, particularly in hospitality, is strengthening the market growth. Appealing to environmentally conscious tourists, hotels and resorts utilize solar energy systems to reduce energy expenses and achieve sustainability objectives. The hospitality sector consumes significant energy, making solar energy an economical option for lowering costs. Government initiatives like Shams Dubai are encouraging private companies to set up solar and heating systems on rooftops. Thus, assisting businesses in producing clean energy that lowers expenses and supports the renewable energy goals of the country. High end resorts in secluded locations employ solar energy to maintain a consistent power supply, minimizing dependence on diesel. As per the IMARC Group’s report, the UAE hospitality market is expected to reach USD 36.4 Billion by 2032.

UAE Solar Energy Market Trends:

Government Initiatives and Vision 2030

The UAE Government’s proactive policies and Vision 2030 strategy regarding clean energy usage are pivotal in fueling the market growth. According to a statement released in November 2024 by Suhail Al Mazrouei, Minister of Energy and Infrastructure, the United Arab Emirates was set to invest up to AED200 Billion (USDD 54.5 Billion) to meet its targets to significantly increase clean energy capacity and production over the coming several years and to move closer to its 2050 climate goals. The government is aiming to diversify energy sources, reduce carbon emissions, and enhance sustainability through large-scale renewable energy adoption. Initiatives are setting ambitious targets for solar capacity, promoting both utility-scale and distributed solar projects. Substantial funding, tax incentives, and streamlined regulations are encouraging private investments in photovoltaic (PV) systems, solar parks, and rooftop installations.

Rising Energy Demand and Grid Modernization

The UAE’s rapid urbanization, industrial growth, and population expansion are leading to rising electricity demand, making solar energy a key solution. As per the DataReportal, there were 11.2 Million people living in the United Arab Emirates, as of January 2025. Traditional fossil fuel-based generation is facing challenges related to supply stability, environmental concerns, and operational costs. Solar energy provides a sustainable, scalable, and cost-effective alternative to meet the growing power needs. Concurrently, grid modernization projects incorporating smart grids, energy storage, and demand-response systems are supporting the integration of intermittent solar energy. Industrial, commercial, and residential sectors are adopting distributed solar solutions, reducing dependency on conventional power. The combination of increasing energy utilization and a modernized grid is encouraging investments in both utility-scale and rooftop solar projects, ensuring continuous market growth.

Increasing Environmental Awareness and Carbon Reduction Goals

The growing environmental consciousness among people, businesses, and policymakers is a crucial driver of the market growth. Concerns about air pollution, climate change, and rising carbon emissions are encouraging the shift from conventional fossil fuels towards clean solar energy. National targets to reduce greenhouse gas emissions, including commitments under the Paris Agreement, are motivating large-scale adoption of renewable energy solutions. In November 2024, in the third Nationally Determined Contribution (NDC) to the Paris Agreement, the United Arab Emirates (UAE) aimed to cut its greenhouse gas emissions from 2019 levels by 47% by 2035. Public campaigns, awareness programs, and incentives for residential and commercial solar adoption are promoting sustainable energy behavior. Additionally, environmentally responsible investments and corporate social responsibility initiatives are emphasizing renewable energy integration.

Key Growth Drivers of UAE Solar Energy Market:

Declining Costs of Solar Technology

The significant reduction in solar PV module prices, inverters, and balance-of-system components has made solar energy more accessible and financially viable in the UAE. Technological advancements, economies of scale, and increased competition among manufacturers contribute to falling installation and maintenance costs. This affordability enables both private and public sector entities to invest in large-scale solar parks, rooftop systems, and hybrid renewable projects. Lower costs also facilitate faster payback periods and higher returns on investment, attracting more developers and investors. Additionally, financing options, green bonds, and leasing models make solar projects feasible for residential and commercial users. As the economic barrier is decreasing, the adoption is expanding across multiple sectors, accelerating the market growth.

Corporate Sustainability Initiatives

Firms in the UAE are setting sustainability goals to lower carbon emissions and comply with environmental, social, and governance (ESG) criteria, boosting solar energy demand. Corporate entities are putting money into on-site solar setups, power purchase agreements (PPAs), and renewable energy certificates to fulfill clean energy commitments. Industries, including real estate, manufacturing, hospitality, and logistics, are deploying solar solutions to optimize energy costs while promoting eco-friendly practices. Multinational corporations operating in the UAE are aligning with global renewable energy targets, driving large-scale adoption of solar technologies. Additionally, sustainability certifications and green building requirements are encouraging the integration of solar energy into commercial and residential projects. These corporate-oriented initiatives are catalyzing long-term demand and supporting the UAE’s broader environmental goals.

International Investments and Partnerships

Foreign investments and international collaborations play a critical role in expanding the UAE solar energy market. Global renewable energy developers and technology providers bring expertise, advanced solar solutions, and financing models to local projects. Strategic partnerships between UAE-based firms and international stakeholders enable technology transfer, joint ventures, and large-scale project execution. Such collaborations increase the efficiency, scale, and reliability of solar plants while reducing project risks. Multilateral funding and global clean energy initiatives are further supporting large-scale solar deployment. As the UAE is positioning itself as a renewable energy hub, international participation is enhancing innovations, infrastructure development, and market competition, creating opportunities for new solar projects and accelerating overall growth in the solar energy sector.

UAE Solar Energy Industry Segmentation:

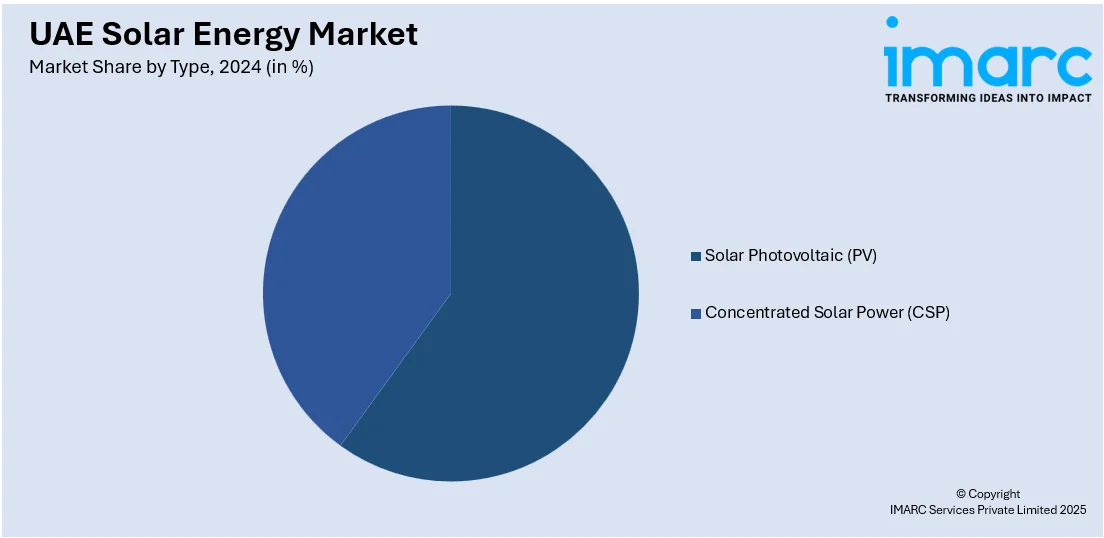

IMARC Group provides an analysis of the key trends in each segment of the UAE solar energy market, along with forecast at the country and regional levels from 2025-2033. The market has been categorized based on type.

Analysis by Type:

- Solar Photovoltaic (PV)

- Concentrated Solar Power (CSP)

Solar photovoltaic (PV) technology transforms sunlight into electrical energy through the use of semiconductor materials. Apart from this, its demand is growing due to its operational efficiency and extensive implementation. It is adaptable and suitable for both small home setups and large-scale utility solar projects.

Concentrated solar power (CSP) utilizes mirrors or lenses to focus sunlight on a receiver, producing heat for generating electricity. This technology features thermal storage functionalities, allowing CSP to deliver energy post-sunset.

Regional Analysis:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Dubai is one of the prominent players with ambitious clean energy goals including the Dubai Clean Energy Strategy 2050. The Mohammed bin Rashid Al Maktoum Solar Park, one of the largest solar parks in the world, is located in the city. Dubai's lucrative regulatory framework and tremendous investments in solar infrastructure are driving city’s adoption of solar technology.

As the capital of the UAE, Abu Dhabi plays an important role in the country’s transition to renewable energy. The city holds the Noor Abu Dhabi solar plant, one of the largest solar plants across the globe. Focusing on energy diversification, it is emerging as a leader in solar energy with its Vision 2030.

Due to its focus on sustainability and diversification of energy sources, Sharjah is emerging as an important region. Although not large like Dubai or Abu Dhabi it is making strides by implementing solar projects in both public and private sectors. Its proximity to Dubai allows for the sharing of infrastructure and expertise, facilitating spread of solar energy technologies.

Competitive Landscape:

The primary players in the UAE are transforming the market through enhanced innovation in solar energy generation. Renewable energy initiatives, which include the Noor Abu Dhabi and Mohammed bin Rashid Al Maktoum Solar Park are set up. Global corporations and investors are funding extensive solar initiatives, promoting public-private collaborations that speed up market growth. Major contributors are concentrating on innovation to enhance solar PV systems and energy storage options. To increase energy efficiency and production capacity, significant contributors are spending money into infrastructure development. For example, in October 2024, Abu Dhabi’s Emirates Water and Electricity Company sought expressions of interest for a solar project with a capacity of 1.5 GW in Al Dhafra. The initiative will provide energy for 160,000 residences and cut down 2.4 million tons of CO₂ each year.

The report provides a comprehensive analysis of the competitive landscape in the UAE solar energy market with detailed profiles of all major companies.

UAE Solar Energy Market News:

- August 2025: Emerge, a collaboration between Masdar and the EDF Group, signed a memorandum of understanding with EDB. The accord sought to identify partnership possibilities in the financing and development of distributed solar energy initiatives throughout the United Arab Emirates.

- July 2025: The emirate of Sharjah initiated its first large-scale solar facility to supply energy to the Sajaa Gas Complex and send excess electricity to the grid. The SANA facility, with a capacity of 60 MWp, was created through a partnership between Masdar and EDF and was one of the initial projects in the area to incorporate solar energy into oil and gas functions. This solar plant would improve energy security and minimize emissions.

- January 2025: Masdar, the UAE state-owned renewable energy company, revealed plans to develop a new solar and battery energy plant capable of providing 1 Gigawatt of consistent clean energy, with an estimated cost of approximately USD 6 Billion. Started in collaboration with the Emirates Water and Electricity Company, it would merge 5 GW of solar capability with 19 GWh of storage, ensuring continuous provision of 1 GW of electricity.

UAE Solar Energy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | TWh |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Solar Photovoltaic (PV), Concentrated Solar Power (CSP) |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE solar energy market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the UAE solar energy market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE solar energy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The solar energy market in the UAE reached a volume of 11.0 TWh in 2024.

The UAE solar energy market is projected to exhibit a CAGR of 22.33% during 2025-2033, reaching a volume of 73.5 TWh by 2033.

Ambitious goals under the UAE Energy Strategy 2050, which emphasizes clean energy, are boosting investments in solar projects. Additionally, large-scale infrastructure developments and corporate sustainability initiatives are catalyzing the demand for solar energy. The integration of advanced solar technologies and storage solutions is further supporting the adoption, positioning solar as a key energy source in the UAE’s transition toward sustainability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)