UAE Power Market Size, Share, Trends and Forecast by Generation sources, and Region, 2025-2033

UAE Power Market Overview:

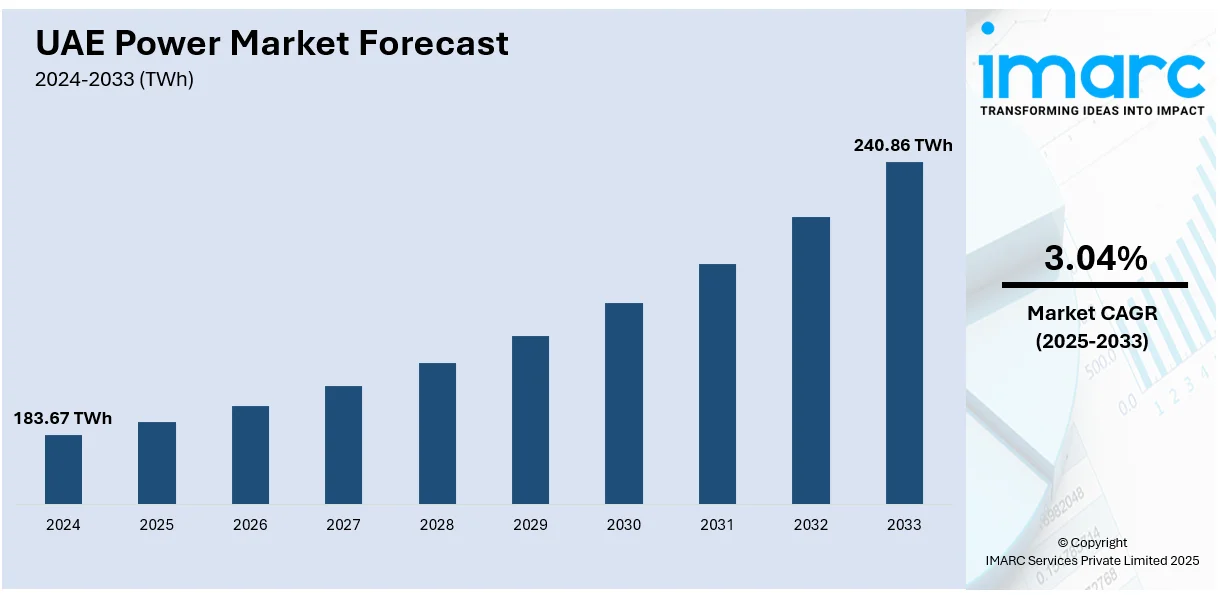

The UAE power market size was valued at 183.67 TWh in 2024. Looking forward, IMARC Group estimates the market to reach 240.86 TWh by 2033, exhibiting a CAGR of 3.04% from 2025-2033. The UAE power market is driven by increasing demand for electricity due to population growth, ongoing industrialization, and urbanization. The government's push for renewable energy, particularly solar, alongside investment in infrastructure and advanced grid technologies, further accelerates growth in the power sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 183.67 TWh |

| Market Forecast in 2033 | 240.86 TWh |

| Market Growth Rate (2025-2033) | 3.04% |

The UAE is increasingly using renewable energy, particularly solar, to diversify its energy mix and reduce fossil fuel dependency. Projects such as the Mohammed bin Rashid Al Maktoum Solar Park have cemented their commitment to sustainability; it's one of the largest single-site solar parks in the world. The growth is encouraged by the fact that the United Arab Emirates follows its National Energy Strategy 2050, striving for a 50% clean energy share. This is leading to investments in infrastructure for solar energy, supported by technological enhancements in energy efficiency and driving up growth in the power market for a greener and sustainable energy shift for the country.

Another prominent factor for growing electricity demand due to rapid growth in population with urbanization and development in UAE is that infrastructure continues to grow where the population mainly expands in various cities, thus increasing residential and commercial and some industrial sectors consuming more power or energy. As the government maintains focus on building infrastructure and is developing industries with tourism, estate, and real estate, amongst which construction is emerging as a source of power-demanding activity that supports the meeting of power and energy demands to ensure reliability. The rise in energy consumption driven by urbanization is a key factor in shaping the UAE’s power market expansion.

UAE Power Market Trends:

More investment in renewable energy

The power market in the UAE is experiencing a fast-paced shift towards renewable energy, with solar and wind power leading the way, under the country's broader sustainability goals. The country aims to achieve 50% of its energy from clean sources by 2050, with projects like the Mohammed bin Rashid Al Maktoum Solar Park and the Barakah nuclear plant leading the way. This investment also aligns the country with national climate commitments and places the country at the forefront of energy transition in the Middle East. These investments are supposed to spur the long-term growth of the power market through decreased reliance on fossil fuels, encouraging energy diversification, and improving energy security.

Smart Grid and Advanced Metering Infrastructure

A main trend of the UAE power market research report was the use of smart grid technology and advanced metering systems. The inclusion of smart meters, sensors, and data analytics allows real-time monitoring of consumption, making this more operationally efficient and eliminating wastage in the distribution of energy. Smart grids help to balance better demand and supply integration with renewable sources of energy. The UAE is investing heavily in upgrading its electrical infrastructure, aimed at improving grid reliability, reducing outages, and optimizing energy distribution across the nation. These advancements are critical for enhancing energy management, improving customer experience, and supporting the country's transition to smart cities.

Energy Efficiency Programs and Regulatory Reforms

The UAE government has put in place different policies and programs to improve energy efficiency throughout the country. In this regard, the DSM Strategy was launched to cut down energy usage in residential, commercial, and industrial sectors by adopting energy-efficient technologies and practices. Regulatory reforms, such as building codes that enforce sustainability and energy-saving measures, are gaining momentum. The demand of efficient energy system is further being increased by the UAE's promotion in the use of electric vehicles and energy-efficient appliances. These initiatives aim at bringing down carbon emissions, decreasing energy costs, and supporting long-term energy sustainability goals for the country, thus strengthening the power market.

UAE Power Industry Segmentation:

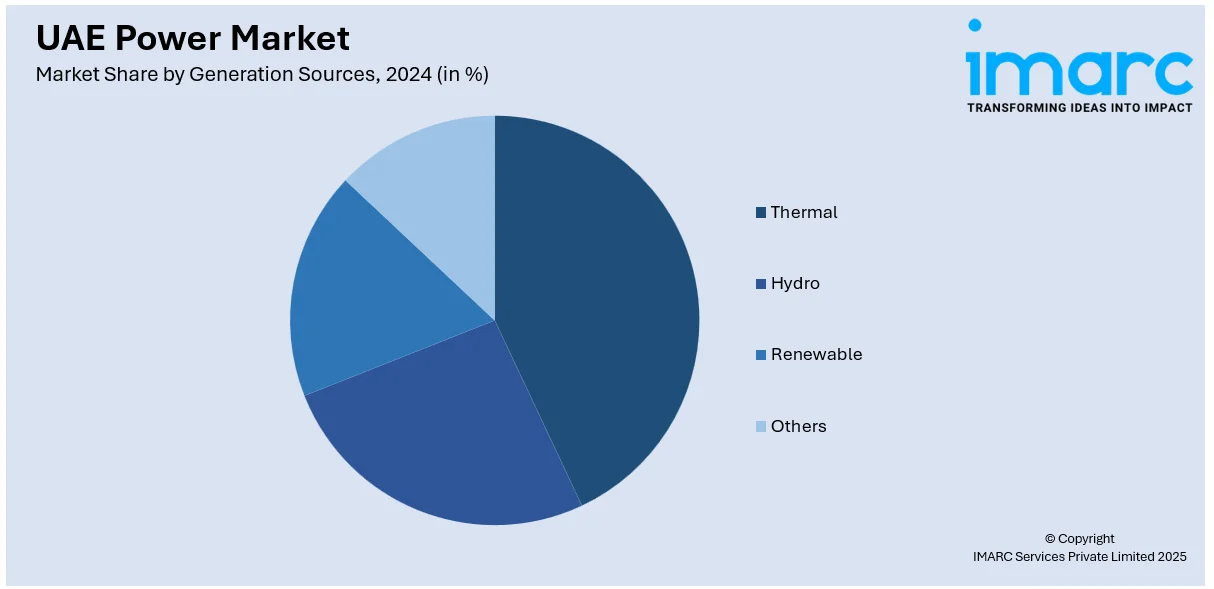

IMARC Group provides an analysis of the key trends in each segment of the UAE power market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on generation sources.

Analysis by Generation Sources:

- Thermal

- Hydro

- Renewable

- Others

Thermal energy dominates the UAE power market, contributing 76.5% of the market share primarily due to the country's abundant natural gas reserves. Natural gas is the preferred fuel source for thermal power plants, given its cost-effectiveness, efficiency, and lower emissions compared to other fossil fuels. The UAE's well-developed infrastructure for natural gas extraction, processing, and distribution supports the widespread use of thermal energy. Additionally, thermal power plants provide a reliable and consistent energy supply, which is crucial for meeting the country’s growing electricity demand driven by industrialization, urbanization, and population growth. Despite the increasing focus on renewables, the dependency on thermal energy persists, as it ensures grid stability and complements the intermittent nature of renewable energy sources.

Regional Analysis:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Based on the UAE power market forecast report, Abu Dhabi holds a leading position in the UAE power market, accounting for 70% market share of the country’s total electricity generation capacity. This dominance is attributed to its extensive investments in large-scale energy projects, including the Barakah Nuclear Energy Plant, which significantly boosts its power production capabilities. Abu Dhabi’s focus on sustainability and renewable energy initiatives, such as the Noor Abu Dhabi Solar Plant, also contributes to its leadership in the sector. The emirate’s proactive approach to modernizing its energy infrastructure, including the integration of smart grid technologies, enhances operational efficiency and reliability. Additionally, Abu Dhabi’s role as an industrial hub, coupled with its commitment to meeting rising energy demand from urbanization and economic growth, solidifies its market-leading position.

Competitive Landscape:

The competitive landscape of the is characterized by a mix of state-owned and private entities driving the sector. Key players focus on providing electricity generation, transmission, and distribution services, with an increasing emphasis on renewable energy sources such as solar and wind power. Competition is intense as companies invest in advanced technologies, such as smart grids and energy storage solutions, to improve efficiency and reliability. Additionally, regulatory frameworks encourage innovation and growth, leading to the emergence of new players and joint ventures. The market is also influenced by government policies, which aim to balance energy security, sustainability, and cost-effectiveness while promoting clean energy adoption across the country.

The report provides a comprehensive analysis of the competitive landscape in the UAE power market with detailed profiles of all major companies.

Latest News and Developments:

- In January 2025, The UAE unveiled the world’s first renewable energy facility delivering 24/7 clean power, combining 5.2 GW of solar capacity with 19 GWh of energy storage. This innovative project ensures a consistent 1 GW renewable baseload, addressing energy intermittency challenges. Developed in partnership with Emirates Water and Electricity Company, the facility highlights the UAE’s commitment to sustainable energy, advancing its leadership in global renewable energy innovation and round-the-clock power solutions.

- In January 2025, Esyasoft announced its acquisition of UK-based Good Energy for £99.4 million, subject to shareholder approval. This strategic move aligns with Esyasoft's ambition to expand its presence in the UK and strengthen its position as a leader in renewable energy. The deal reflects Esyasoft's commitment to driving green energy solutions and enhancing its customer base in one of Europe’s key renewable energy markets.

- In November 2024, ENEC and ADNOC joined forces to study the application of high-tech nuclear power, including small modular reactors, to diversify the energy mix in the UAE. The two companies will also look into using waste heat from the Barakah nuclear power plant in oil and gas production by ADNOC. This cooperation is part of the UAE's efforts to embrace sustainable energy sources and solidify its status as a front-runner in the development of new energy technologies.

- In November 2024, The UAE launched the "Global Energy Efficiency Alliance" at COP29 in Azerbaijan, aiming to double global energy efficiency by 2030 and reduce emissions. Building on the UAE Consensus from COP28, the initiative focuses on knowledge sharing, capacity building, and public-private partnerships. The UAE will lead the alliance, promoting sustainable resource use, sharing expertise, and supporting African nations with financing and technological solutions for energy sustainability.

- In March 2024, India and the UAE have intensified their cooperation in renewable energy by strengthening policy frameworks both in the nations. India's National Solar Mission and Green Energy Corridor and the UAE's Energy Strategy 2050 are two initiatives that emphasize commitment to clean energy. According to a new report by the UAE-India Business Council and Nangia Andersen, both nations have much to gain from increased collaboration, with each likely to redefine the global energy sector, as the UAE commits to investing $75 billion in sovereign funds in clean energy projects by India.

UAE Power Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | TWh |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Generation Sources Covered | Thermal, Hydro, Renewable, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE power market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the UAE power market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE power industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The UAE Power market was valued at 183.67 TWh in 2024.

The UAE power market was valued at 240.86 TWh in 2033 exhibiting a CAGR of 3.04% during 2025-2033.

The UAE Power market's growth is driven by rising electricity demand from population growth, industrialization, and urbanization. Investments in renewable energy, particularly solar projects, and advancements in smart grid technologies support energy transition goals. Government initiatives promoting energy efficiency and sustainability further enhance the market’s expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)