UAE Pharmaceutical Market Size, Share, Trends and Forecast by Type, Nature, and Region, 2025-2033

UAE Pharmaceutical Market Size and Share:

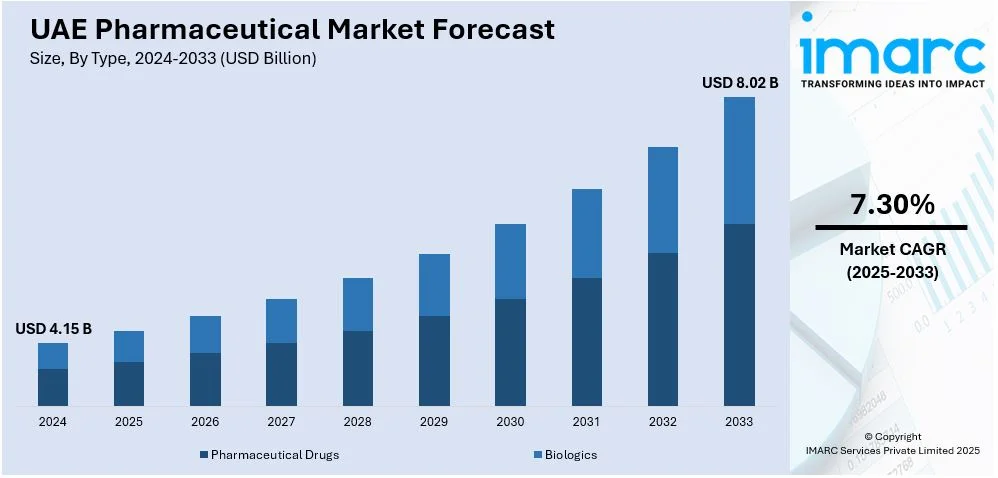

The UAE pharmaceutical market size was valued at USD 4.15 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.02 Billion by 2033, exhibiting a CAGR of 7.30% from 2025-2033. The market is propelled by heightened healthcare investments, an increase in chronic disease prevalence, and the growing need for novel medications. Government initiatives, enhanced healthcare infrastructure, and expanding medical tourism contribute significantly. Collaborations with international pharmaceutical companies and advancements in local manufacturing capabilities further support the growth of the UAE pharmaceutical market, ensuring better accessibility and high-quality care.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.15 Billion |

| Market Forecast in 2033 | USD 8.02 Billion |

| Market Growth Rate (2025-2033) | 7.30% |

The governing body in UAE is actively allocating substantial resources to healthcare infrastructure and services. Public and private investments aim to improve accessibility and quality of healthcare, directly increasing the demand for pharmaceuticals. State-of-the-art hospitals, clinics, and diagnostic centers are being established, creating a robust healthcare ecosystem that supports growth in medicine usage and innovation. Furthermore, chronic conditions such as diabetes, cardiovascular diseases, and cancer are becoming more common due to lifestyle changes and aging populations. These health challenges require long-term treatments, driving demand for specialized medications, biologics, and innovative therapies. In addition, the growing popularity of e-commerce and digital platforms is extending to the pharmaceutical industry with the rise of e-pharmacies. These platforms offer convenience, competitive pricing, and a wider range of products, increasing user access to medicines, supplements, and wellness products.

Besides this, to reduce dependency on imports and strengthen supply chain resilience, the UAE is emphasizing local pharmaceutical manufacturing. Investments in production facilities and technology transfer partnerships between international and local companies are strengthening the domestic market. This strategy not only ensures consistent supply but also enhances the self-sufficiency in critical medicines. Moreover, advances in genomics and biotechnology are driving the demand for personalized medicine tailored to individual patient needs. The healthcare system is adopting precision treatments, which require specialized pharmaceuticals, contributing to the market growth. Investments in genetic research and collaboration with international biotech companies are supporting this trend. Additionally, the adoption of telemedicine, e-prescriptions, and digital health platforms is transforming healthcare delivery in the UAE. These technologies enable easier access to medicines and enhance patient compliance, leading to higher pharmaceutical sales.

UAE Pharmaceutical Market Trends:

Growing Prevalence of Chronic Diseases

The UAE is seeing a rise in chronic diseases such as diabetes, cardiovascular issues, and obesity, primarily due to lifestyle changes and an aging demographic. This shift is catalyzing the demand for long-term medications and therapies. Enhanced efforts in disease screening and early diagnosis are also intensifying the need for specific pharmaceutical solutions tailored to these chronic conditions. To further support this demand, the governing body is dedicated to enhancing healthcare quality and access by expanding medical facilities and investing in healthcare professional training and awareness campaigns. These initiatives not only improve public health outcomes but also support growth within the pharmaceutical sector by increasing the demand for specialized treatments and preventive medications. In 2024, the UAE Ministry of Health and Prevention partnered with Novo Nordisk to develop a national guide for obesity management and weight control. The initiative focuses on reducing obesity-related health risks and raising awareness about cardiovascular complications. It aligns with the UAE’s strategy to enhance public health and well-being.

Strategic Government Initiatives

The governing body is launching several initiatives to support the healthcare sector, including substantial investments in healthcare infrastructure and incentives for pharmaceutical companies. These initiatives aim to transform the region into an international platform for knowledge-based, sustainable, and innovative industries, including pharmaceuticals. These policies are strategically designed to attract foreign investment, encourage local production of pharmaceuticals, and reduce dependency on imports, which in turn supports the market growth. These efforts are also part of a broader economic vision to enhance the competitiveness of the UAE in the international market, focusing on technological advancement and sustainability in the pharmaceutical sector. This proactive approach ensures a robust framework for the growth and development of the healthcare industry in the region. In line with this, in 2024, Dubai Industrial City revealed a partnership with MD Pharma Factory to build a new AED 130 million facility for pharmaceutical and innovative medicine production. Spanning 223,000 sq. ft., the facility will produce intravenous solutions for the GCC and African markets. This endeavor is in harmony with UAE's Operation 300bn and Dubai Economic Agenda ‘D33’.

Strategic Collaborations to Expand Market Reach

The formation of strategic partnerships between local manufacturers and international pharmaceutical firms is a crucial factor impelling the market growth. These collaborations leverage the strengths of each partner to enhance the distribution and accessibility of high-quality medicines across the region. By combining local manufacturing capabilities with extensive international marketing and sales networks, these alliances ensure a wider reach and deeper penetration into the market. This strategy not only facilitates the rapid introduction of diverse healthcare products but also supports the growth of the UAE's pharmaceutical industry by optimizing resource use and maximizing market coverage. Such partnerships are instrumental in advancing the UAE’s vision to become a leader in the pharmaceutical landscape, driving innovation and ensuring that cutting-edge treatments are accessible to a broader population. In 2024, STADA Arzneimittel and ADCAN Pharma announced a strategic partnership to enhance access to high-quality medicines in the UAE. This partnership enables STADA to exclusively promote and sell 15 consumer healthcare items and two prescription drugs supplied by ADCAN. The agreement focuses on utilizing ADCAN's manufacturing capabilities and STADA's extensive marketing and sales network in the region.

UAE Pharmaceutical Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the UAE pharmaceutical market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type and nature.

Analysis by Type:

- Pharmaceutical Drugs

- Cardiovascular Drugs

- Dermatology Drugs

- Gastrointestinal Drugs

- Genito-Urinary Drugs

- Hematology Drugs

- Anti-Infective Drugs

- Metabolic Disorder Drugs

- Musculoskeletal Disorder Drugs

- Central Nervous System Drugs

- Oncology Drugs

- Ophthalmology Drugs

- Respiratory Diseases Drugs

- Biologics

- Monoclonal Antibodies (MAbS)

- Therapeutic Proteins

- Vaccines

Pharmaceutical drugs (cardiovascular drugs, dermatology drugs, gastrointestinal drugs, genito-urinary drugs, hematology drugs, anti-infective drugs, metabolic disorder drugs, musculoskeletal disorder drugs, central nervous system drugs, oncology drugs, ophthalmology drugs, and respiratory diseases drugs) hold a significant share of the market due to their affordability, proven efficacy, and broad application in managing common and complex ailments. The continuous development of innovative formulations, availability of generic alternatives, and integration of advanced drug delivery systems are strengthening the growth of this segment in the UAE. Regulatory support ensures the consistent supply of high-quality and accessible medications.

Biologics (monoclonal antibodies (MAbS), therapeutic proteins, and vaccines) represent a cutting-edge approach to healthcare, offering innovative treatments. These products are vital for managing complex diseases like cancer, autoimmune conditions, and rare genetic disorders. MAbs offer focused therapy, enhancing results for individuals with particular health requirements. Therapeutic proteins target long-term issues like diabetes and growth hormone shortages, whereas vaccines are vital for preventive healthcare, especially in fighting infectious illnesses. With progress in biotechnology and an increasing focus on precision medicine, biologics are becoming a pivotal aspect of the UAE pharmaceutical industry.

Analysis by Nature:

- Organic

- Conventional

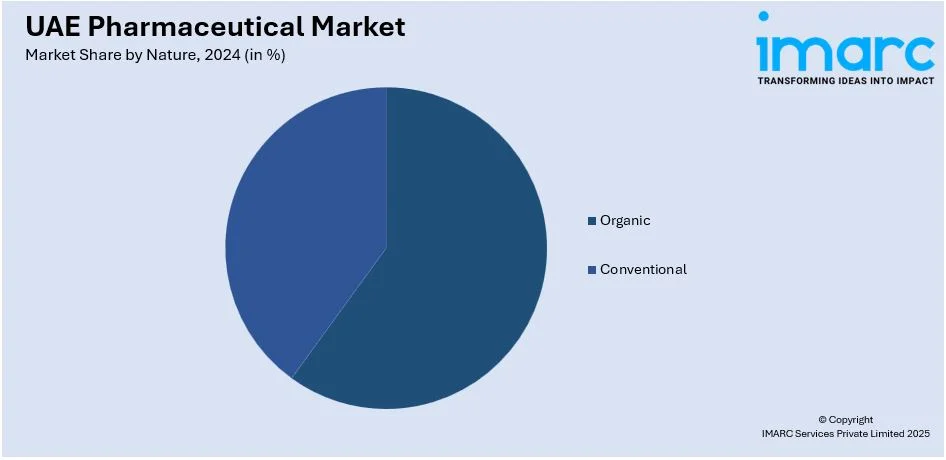

The organic segment medications and therapies sourced from natural origins. The increasing understanding of the advantages of organic products is fueling the demand for herbal remedies, plant-derived supplements, and less processed pharmaceuticals. This segment addresses individuals looking for natural and sustainable solutions for health management, backed by research advancements, enhanced extraction methods, and the creation of certified organic healthcare items.

Conventional, which offers a wide range of synthetic drugs and chemically formulated treatments, holds a notable UAE pharmaceutical market share. Conventional include products that are crucial in the market due to their widespread use, reliability, and rapid results. Advances in technology, such as precision formulation and extended-release systems, along with strong regulatory support, ensure the continuous production, availability, and accessibility of high-quality conventional medicines throughout the UAE.

Regional Analysis:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Dubai holds a significant share of the market with its advanced healthcare infrastructure and strong focus on innovation. The city is home to several pharmaceutical companies and research centers, fostering local manufacturing and distribution. Dubai’s strategic position as an international business hub supports the import and export of medicines, making it a crucial player in the pharmaceutical sector.

Abu Dhabi plays a vital role in the market due to its emphasis on healthcare excellence and government-backed initiatives. The emirate invests heavily in research operations to enhance local production capabilities. Advanced medical facilities and collaborations with international pharmaceutical companies further boost Abu Dhabi's presence in the market.

Sharjah contributes to the market with its growing healthcare facilities and focus on expanding access to medications. The emirate promotes initiatives supporting pharmaceutical manufacturing and research, creating opportunities for growth. Sharjah’s regional connectivity enables efficient distribution, ensuring the availability of essential drugs.

Others, including Ajman, Fujairah, and Ras Al Khaimah, support the market through regional healthcare expansions and local initiatives. These areas focus on improving healthcare services and fostering collaborations with pharmaceutical companies to ensure consistent drug supply and address public health needs effectively.

Competitive Landscape:

Major participants in the market are using cutting-edge technologies to enhance production efficiency and guarantee top-quality medicines. Initiatives are underway to meet various therapeutic requirements, encompassing chronic and intricate ailments, via novel drug formulations. Furthermore, industry leaders are highlighting sustainable production methods and promoting education and awareness regarding their products to enhance their stance and align with changing healthcare priorities in the UAE. Major players are utilizing technology transfer and establishing strategic partnerships to improve local competencies in advanced diagnostics and healthcare solutions. These partnerships provide access to advanced technologies, encourage knowledge exchange, and facilitate the creation of joint ventures, enhancing the region’s standing in innovative healthcare and increasing the market's international competitiveness. In 2024, South Korea’s NGeneBio entered into an agreement to transfer its next-generation sequencing (NGS) technology to Euro Alliance, based in the UAE. The agreement encompasses precision diagnostic products, software, and manufacturing expertise, alongside royalties spanning a decade. The collaboration also includes joint ventures in India and the UAE for NGS activities.

The report provides a comprehensive analysis of the competitive landscape in the UAE pharmaceutical market with detailed profiles of all major companies, including:

- Gulf Pharmaceutical Industries (JULPHAR)

- Neopharma

- GLOBALPHARMA

- LIFEPharma Dubai, UAE

- Pharmax Pharmaceuticals FZ LLC

- Bayer AG

- Novartis AG

- Pfizer Gulf FZ LLC

Latest News and Developments:

- October 2024: Mubadala's Kelix bio obtained four pharmaceutical assets from GlobalOne Healthcare Holding to strengthen the UAE's life sciences sector. The acquisition bolsters pharmaceutical infrastructure, tackles important health issues, and backs government efforts such as Operation 300bn. This action corresponds with the UAE's plan to enhance domestic manufacturing and healthcare abilities.

- August 2024: Quest Nutra Pharma collaborated with Kissflow to digitize more than 30 quality management and operational processes through a Low-Code platform. This effort boosted efficiency, strengthened compliance, and facilitated automation throughout essential workflows. The solution facilitates efficient, paperless processes in Quest’s facilities located in the UAE, UK, and EU.

- August 2024: RedHill Biopharma introduced Talicia in the UAE for the treatment of Helicobacter pylori infections. Talicia is a therapy based on low-dose rifabutin that tackles antibiotic resistance and provides a more efficient option compared to conventional treatments.

- June 2024: Abu Dhabi signed a Memorandum of Understanding (MoU) at the BIO International Convention to position itself as an international center for pharmaceutical and life sciences distribution. The pact includes Depart of Health (DoH), Abu Dhabi Investment Office (ADIO), Etihad Cargo, and AD Ports Group, utilizing sophisticated logistics and investment prospects. This initiative promotes healthcare advancements, local accessibility, and economic development.

- May 2024: The Emirates Drug Establishment conducted its fourth board meeting to create strategies for overseeing the healthcare and pharmaceutical industries in the UAE. The strategy involves incorporating more than 160 services and establishing a solid organizational framework to improve standards and foster innovation. The aim is to establish the UAE as an international center for the healthcare sector.

UAE Pharmaceutical Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Natures Covered | Organic, Conventional |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE pharmaceutical market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the UAE pharmaceutical market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE pharmaceutical industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Pharmaceuticals are drugs developed to diagnose, treat, or prevent diseases. They include prescription medicines, over-the-counter drugs, and biologics like vaccines. These products undergo strict research and testing to ensure safety and efficacy. The pharmaceutical industry is essential to healthcare, offering solutions for chronic and acute conditions, improving patient outcomes, and enhancing the quality of life.

The UAE pharmaceutical market was valued at USD 4.15 Billion in 2024.

IMARC estimates the UAE pharmaceutical market to exhibit a CAGR of 7.30% during 2025-2033.

The UAE pharmaceutical market is driven by the growing healthcare investments, an increasing prevalence of chronic diseases, and a rising demand for advanced medications. Supportive government policies, robust healthcare infrastructure, and the influx of medical tourism further support the market growth. Additionally, partnerships with international pharmaceutical companies and a focus on local drug manufacturing enhance market accessibility.

Some of the major players in the UAE pharmaceutical market include Gulf Pharmaceutical Industries (JULPHAR, Neopharma, GLOBALPHARMA, LIFEPharma Dubai, UAE, Pharmax Pharmaceuticals FZ LLC, Bayer AG, Novartis AG, and Pfizer Gulf FZ LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)