UAE Paints and Coatings Market Size, Share, Trends and Forecast by Product, Material, Application, and Region, 2025-2033

UAE Paints and Coatings Market Size and Share:

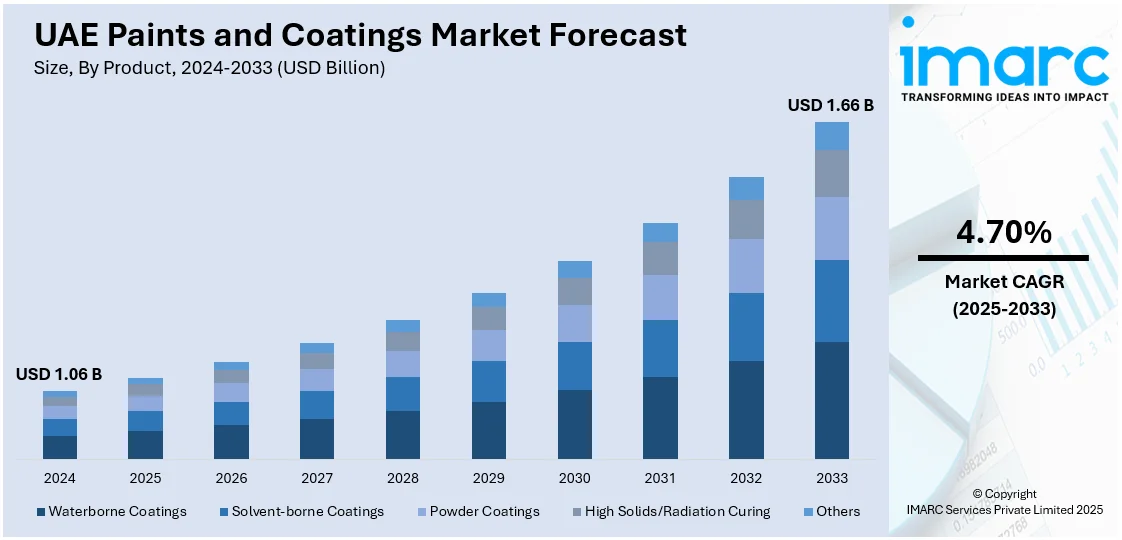

The UAE paints and coatings market size was valued at USD 1.06 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1.66 Billion by 2033, exhibiting a CAGR of 4.70% from 2025-2033. The UAE paints and coatings market is driven by robust construction growth, sustainability initiatives, rising demand for innovative coatings, focus on eco-friendly products, smart coatings, and decorative solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.06 Billion |

| Market Forecast in 2033 | USD 1.66 Billion |

| Market Growth Rate (2025-2033) | 4.70% |

The rapid expansion of construction projects in the UAE, driven by large-scale developments such as luxury residential projects, commercial complexes, and iconic structures like museums and skyscrapers, significantly fuels the paints and coatings market. This growth is further supported by government initiatives like UAE Vision 2030, which emphasizes urbanization and sustainability. The tourism industry’s contribution of AED 167 billion to the UAE’s GDP in 2022 highlights its role in driving investments in new facilities. As tourism thrives, demand for decorative coatings rises, supporting infrastructure development and boosting the paints and coatings market. These coatings are essential for both aesthetic appeal and durability against harsh conditions.

Besides this, the Middle East paints and coatings market, valued at $4.5 billion, is projected to grow to $7.2 billion by 2030, with the construction sector driving 75% of the demand. As this sector expands, the increasing focus on environmental sustainability and green building standards in the UAE has further boosted the demand for eco-friendly coatings. Regulations promoting low- volatile organic compounds (VOC) products and innovations like heat-reflective and anti-corrosive coatings cater to the eco-conscious preferences of developers and consumers. These advanced, energy-efficient solutions are essential for both construction and industrial applications, highlighting the region's preference for sustainable and high-performance coatings.

UAE Paints and Coatings Market Trends:

Increased adoption of smart coatings

The UAE paints and coatings market is gaining mileage in smart coatings, which offer functionalities not traditionally associated with paints or coatings. Some of these futuristic solutions include self-healing products, anti-graffiti finishes, and temperature-sensitive product lines, which primarily target top-end residential and commercial properties. Smart coatings increase the durability of assets, mitigate maintenance costs, and are energy-efficient-a perfect fit into the UAE's focus on advanced technologies. Their application is particularly prominent in automotive, aerospace, and infrastructure projects where superior performance is required. As industries prioritize efficiency and long-term cost savings, the adoption of smart coatings continues to rise, influencing the market's evolution.

Decorative coatings for luxury interiors are growing

With the UAE considered a luxury real estate hub and premium commercial space, decorative coatings have been on the rise. High net worth individuals and luxury businesses seek unique, beautiful finishes in line with the region's architectural splendor. Textured paints, metallic finishes, and bespoke color palettes are the orders of the day with regard to current interior design trends that focus on opulence and personalization. Further, there is increasing demand for eco-friendly decor options. Low-VOC solutions have been meeting their requirements of sustainability. Again, this is due to the focus on iconic structures and interior design in the region. Thus, the decorative coating market has been enhanced to greater levels.

Increasing demand for industrial coatings

The growth of the industrial base of the UAE in oil and gas, automotive, and aerospace is a main driver for industrial coatings demand. The critical functionalities the coatings provide are corrosion resistance, chemical protection, and durability in extreme conditions. Infrastructure investments in ports, power plants, and refineries also boost this trend. Advanced industrial coatings, which enhance energy efficiency, such as thermal barrier coatings, are becoming increasingly sought after. The focus on infrastructure modernization and compliance with stringent safety standards ensures consistent demand for high-performance industrial coatings, solidifying their importance in the UAE’s paints and coatings market.

UAE Paints and Coatings Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the UAE paints and coatings market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product, material and application.

Analysis by Product:

- Waterborne Coatings

- Solvent-borne Coatings

- Powder Coatings

- High Solids/Radiation Curing

- Others

Waterborne coatings dominate due to their eco-friendly nature, low VOC content, and compliance with stringent environmental regulations. Widely used in architectural and industrial applications, these coatings offer excellent durability and aesthetic appeal. Their ability to provide high-quality finishes while addressing sustainability concerns makes them a preferred choice in the UAE market.

In line with this, the solvent-borne coatings are valued for their durability, quick drying, and superior adhesion, making them ideal for harsh conditions and industrial applications. Environmental problems concerning VOC emissions notwithstanding, they remain in favor wherever there is a demand to resist extreme temperatures and even chemicals, as in vehicle manufacture and oil and gas applications.

Also, the powder coatings are gaining traction for their eco-friendly properties, as they produce negligible waste and contain no VOCs. Known for their excellent finish, durability, and resistance to corrosion, they are widely used in appliances, automotive parts, and metal fabrications. Their cost-effectiveness and efficiency further drive their demand in the UAE.

However, the high solids and radiation-curing coatings are preferred due to low solvent content and fast curing times, in line with the sustainability and efficiency objectives. Industrial and automotive applications make use of this coating for its superior performance and durability. The innovative technology meets the growing demand in the UAE market for high-performance and environmentally responsible solutions.

Besides, other types of coatings like specialty and anti-corrosion coating cover niche needs in various areas including marine, aerospace, and health care. They are differentiated through specific properties, for example, chemical resistance, thermal insulation, and antifouling. Increasing demand for specialty and advanced coatings in specific sectors continues to fuel the growth of this category in the UAE.

Analysis by Material:

- Acrylic

- Alkyd

- Polyurethane

- Epoxy

- Polyester

- Others

Acrylic-based paints and coatings are most commonly preferred in the UAE as it is highly resistant, quick-drying, and exhibits weather resistance. Being versatile, it finds usage extensively in construction and automotive fields, with the advantages being superior adhesion and excellent aesthetic appeal. Further adding to the market growth for acrylic formulations in the UAE is the increase in infrastructure projects and demand for low-VOC coatings.

At the same time, alkyd coatings are in demand for their affordability, durability, and ease of application. Primarily used in industrial and protective coatings, they provide superior adhesion and a glossy finish. Although the higher VOC content of alkyds has been a factor against them, low-VOC alkyds have continued to be relevant in the UAE, especially in infrastructure and maintenance projects.

Besides this, the polyurethane coatings are valued for their toughness, abrasion resistance, and flexibility that makes them well-suited for demanding applications in the automotive, aerospace, and construction sectors. They give a smooth finish and superior resistance to weather that makes them excellent for outdoor applications in extreme climate conditions prevalent in the UAE.

Furthermore, these epoxy coatings are very strength, chemical resistant, corrosion resistant, and offer several protective features that are applicable in industrial and marine services. Their durability and toughness in harsh environments have seen many of them applied in the UAE, especially in oil and gas, construction, and infrastructural maintenance projects.

Moreover, polyester powder coatings have a wide applications in the powder coating where it possesses excellent durability resistance to weather and colorfastness. It is much favored by the automotive industries, appliance, and metal working industries. The attributes of ecological and cost-effectiveness further match with the increasing demand within the UAE market for both sustainable and efficient coating products.

In addition, the other materials, like silicone, fluoropolymer, and specialty resins, are niche applications that need high-performance attributes such as heat resistance, anti-corrosion, or chemical stability. These materials are critical to industries such as aerospace, healthcare, and marine, responding to the specific needs of this diverse and innovation-driven market landscape in the UAE.

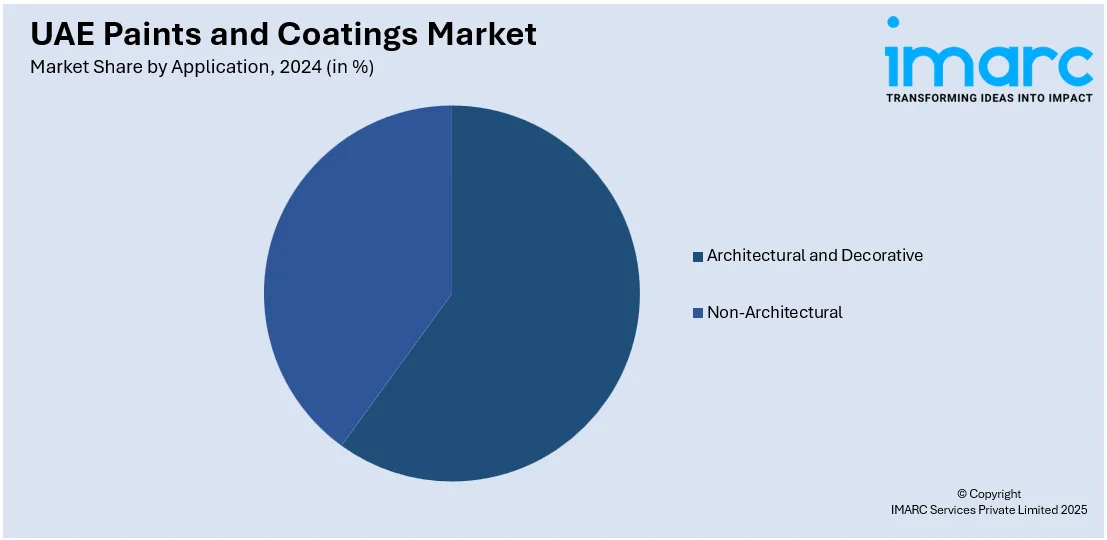

Analysis by Application:

- Architectural and Decorative

- Non-Architectural

- Automotive and Transportation

- Wood

- General Industrial

- Marine

- Protective

- Others

Architectural and decorative coatings dominate the UAE market, driven by booming construction and luxury real estate development. These coatings enhance aesthetics and protect surfaces from environmental factors like UV radiation and humidity. Eco-friendly, low-VOC options are increasingly preferred, aligning with sustainability goals and modern design trends in residential and commercial projects.

Meanwhile, the non-architectural coatings cater to industrial, automotive, and marine applications, providing essential protective features like corrosion resistance, chemical stability, and durability. They are crucial for infrastructure projects, oil and gas facilities, and manufacturing sectors. Innovations in performance coatings, such as heat resistance and anti-corrosion, address the UAE’s challenging environmental and industrial demands.

Regional Analysis:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Dubai holds a string position in the UAE paints and coatings market due to its extensive construction projects, luxury real estate developments, and focus on sustainable urban planning. The city’s status as a global business and tourism hub drives demand for decorative and high-performance coatings in residential, commercial, and infrastructure projects, emphasizing innovation and eco-friendliness.

Additionally, Abu Dhabi's paints and coatings market is fueled by large-scale infrastructure projects, industrial growth, and oil and gas sector demands. The capital's focus on economic diversification and sustainable initiatives boosts demand for industrial coatings, protective solutions, and eco-friendly decorative products, aligning with its vision for modernity and environmental stewardship.

Moreover, the Sharjah’s market is driven by its growing industrial base, affordable housing developments, and educational institutions. Demand for cost-effective and durable coatings is high, especially for small-to-mid-scale construction and maintenance projects. The emirate’s emphasis on heritage and cultural projects also contributes to the demand for decorative and protective coatings.

Also, the other emirates, including Ajman, Fujairah, and Ras Al Khaimah, contribute to the market with infrastructure, tourism, and industrial projects. These regions demand both protective and decorative coatings for smaller-scale developments, port expansions, and manufacturing units. Growing investments in renewable energy and eco-friendly initiatives further boost regional demand for sustainable coatings.

Competitive Landscape:

The UAE paints and coatings market is highly competitive with international and regional giants vying for market share. Major companies are dominating due to their vast product portfolio, technological innovation, and brand presence. Regional firms rely on local manufacturing capabilities and tailored solutions to cater to specific market needs. Competition is driven by advancements in eco-friendly and high-performance coatings, with companies investing in research and development (R&D) to meet sustainability goals and withstand harsh climatic conditions. Strategic collaborations with construction firms, distributors, and government bodies, coupled with localized marketing, are pivotal for market players. The increasing demand for smart and decorative coatings intensifies the competitive dynamics.

The report provides a comprehensive analysis of the competitive landscape in the UAE paints and coatings market with detailed profiles of all major companies.

Latest News and Developments:

- In August 2024, Qemtex Chemical Holding introduced a new powder coatings plant in the UAE, located in the Umm Al Quwain Free Trade Zone. The facility will produce architectural, industrial, and specialized coatings, with an initial capacity of 5,000 tons per year, set to expand to 10,000 tons. At least 30% of production will serve the UAE market, while 70% will be exported to GCC, MENA, EU, and US markets.

- In June 2024, Jotun Paints Abu Dhabi announced the grand unveiling of an innovative and customer-centric retail concept that promises to redefine the shopping experience. One standout feature of the new concept is the “New Product Activation Unit,” which highlights the latest product finishes, trending colors, and actual product cans. In addition to the activation unit, the showroom features larger samples for both interior and exterior paint finishes.

- In July 2023, the leading paints and coatings manufacturers in the Middle East have officially launched Middle East Paints and Coatings Association (MEPCA) and received necessary government approvals. Founding member companies include Akzo Nobel, Altakamol (Sheibani Group), Asian Paints, Axalta, Caparol Paints, Hempel, Jotun, National Paints, PPG, RAR Holding and Kaizen Paints Middle East (KPME) with the backing and support from the World Coatings Council and Vincentz Network.

UAE Paints and Coatings Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Waterborne Coatings, Solvent-borne Coatings, Powder Coatings, High Solids/Radiation Curing, Others |

| Materials Covered | Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, Others |

| Applications Covered |

|

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE paints and coatings market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the UAE paints and coatings market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE paints and coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The UAE paints and coatings market encompasses a range of products used for decorative, protective, and industrial purposes. These coatings enhance aesthetics, provide durability, and safeguard surfaces against environmental factors. They are widely applied in construction, automotive, and industrial sectors, they cater to the region's high demand for innovation and sustainability.

The UAE paints and coatings market was valued at USD 1.06 Billion in 2024.

IMARC estimates the UAE paints and coatings market to exhibit a CAGR of 4.70% during 2025-2033.

Key factors driving the UAE paints and coatings market include rapid construction and infrastructure development, rising demand for sustainable and low-VOC coatings, and increased adoption of innovative products like smart and decorative coatings. Additionally, industrial growth and harsh climatic conditions boost demand for high-performance protective solutions tailored to local environmental challenges.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)