UAE Online Grocery Market Report by Product Type (Vegetables and Fruits, Dairy Products, Staples and Cooking Essentials, Snacks, Meat and Seafood, and Others), Business Model (Pure Marketplace, Hybrid Marketplace, and Others), Platform (App-based, Web-based), Purchase Type (One-time, Subscription), and Region 2025-2033

UAE Online Grocery Market Overview:

The UAE online grocery market size reached USD 3,426.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 18,353.4 Million by 2033, exhibiting a growth rate (CAGR) of 20.50% during 2025-2033. The market is experiencing significant growth driven by convenience, busy lifestyles, expanding e-commerce infrastructure, rising number of tech-savvy consumers, rapid urbanization, coronavirus (COVID-19) induced shifts in shopping behavior, and heightening smartphone penetration.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3,426.4 Million |

|

Market Forecast in 2033

|

USD 18,353.4 Million |

| Market Growth Rate 2025-2033 | 20.50% |

UAE Online Grocery Market Trends:

Rising Penetration of E-commerce

In 2023, the UAE witnessed a rapid increase in e-commerce rates and especially in the grocery delivery sector. As per the reports of the UAE National Bureau of Statistics claims that UAE citizens and residents spend 46% more on e-commerce in 2020, and this type of retail is increasingly popular in food delivery. This is mainly due of convenience seeking consumers who prefer the comfort of shopping online. Furthermore, the availability of various grocery stores across online platforms enhances this growth. Due to the busy and increasingly demanding schedules of the populace, and the need for convenience, more people in UAE are opting for grocery purchases through the internet. This transformation highlights the changing face of retail in the UAE where e-commerce is slowly becoming the new order as it transforms the way consumers shop. With enhanced technology, better internet connectivity, and easy availability of smart devices, the future of online grocery shopping looks promising for the coming years.

Heightening Dominance of Mobile Shopping

Mobile shopping remains dominant in the UAE's online grocery market. For instance, as per VISA MIDDLE EAST, 65% of UAE consumers used smartphones at some point throughout their most recent retail journeys, regardless of whether they were shopping in-store or remotely online. This statistic underscores the widespread adoption of mobile devices for shopping purposes. As consumers increasingly turn to their smartphones for convenience, online grocery retailers must prioritize mobile-friendly interfaces and apps to meet evolving preferences. The ease of browsing and purchasing groceries via smartphones has become a key factor driving consumer behavior. Therefore, ensuring a seamless and user-friendly mobile shopping experience is paramount for online grocery retailers seeking to maintain their competitiveness and cater to the preferences of the tech-savvy UAE consumer base.

Escalating Demand for Fresh and Organic Products

The online grocery market of UAE is experiencing a shift of consumers’ preference toward more fresh, organic, and locally sourced food products. According to the survey conducted by the Research Gate, awareness about organic food consumption rose by 76% in 2023. This trend is consistent with other changed public perceptions towards cleaner and healthier choices on what to consume and from where. Therefore, the number of outlets selling food online is now trying to include more fresh and organic products in their range to satisfy these customers. Due to consumer awareness of their health and the environment, such products create an added advantage since their availability online will make retailers distinguish themselves to capture the fast-changing market of the UAE.

UAE Online Grocery Market News:

- In February 2024, Deliveroo UAE announced strong growth in its on-demand grocery sector, with a significant increase in grocery order volumes across the UAE. In 2023, the on-demand grocery sites doubled, and orders increased by 62% in Dubai and 135% in Abu Dhabi, showing a commitment to evolving customer needs.

- In October 2023, Due to a busy lifestyle, residents are demanding more and more efficient grocery delivery in Abu Dhabi, Dubai, and other cities. As a result, Almaya Group is addressing this need by providing express delivery options that get essential items to customers' doorsteps in record time.

UAE Online Grocery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, business model, platform, and purchase type.

Product Type Insights:

To get more information on this market, Request Sample

- Vegetables and Fruits

- Dairy Products

- Staples and Cooking Essentials

- Snacks

- Meat and Seafood

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes vegetables and fruits, dairy products, staples and cooking essentials, snacks, meat and seafood, and others.

Business Model Insights:

- Pure Marketplace

- Hybrid Marketplace

- Others

A detailed breakup and analysis of the market based on the business model have also been provided in the report. This includes pure marketplace, hybrid marketplace, and others.

Platform Insights:

- Web-based

- App-based

The report has provided a detailed breakup and analysis of the market based on the platform. This includes web-based and app-based.

Purchase Type Insights:

- One-Time

- Subscription

A detailed breakup and analysis of the market based on the purchase type have also been provided in the report. This includes one-time and subscription.

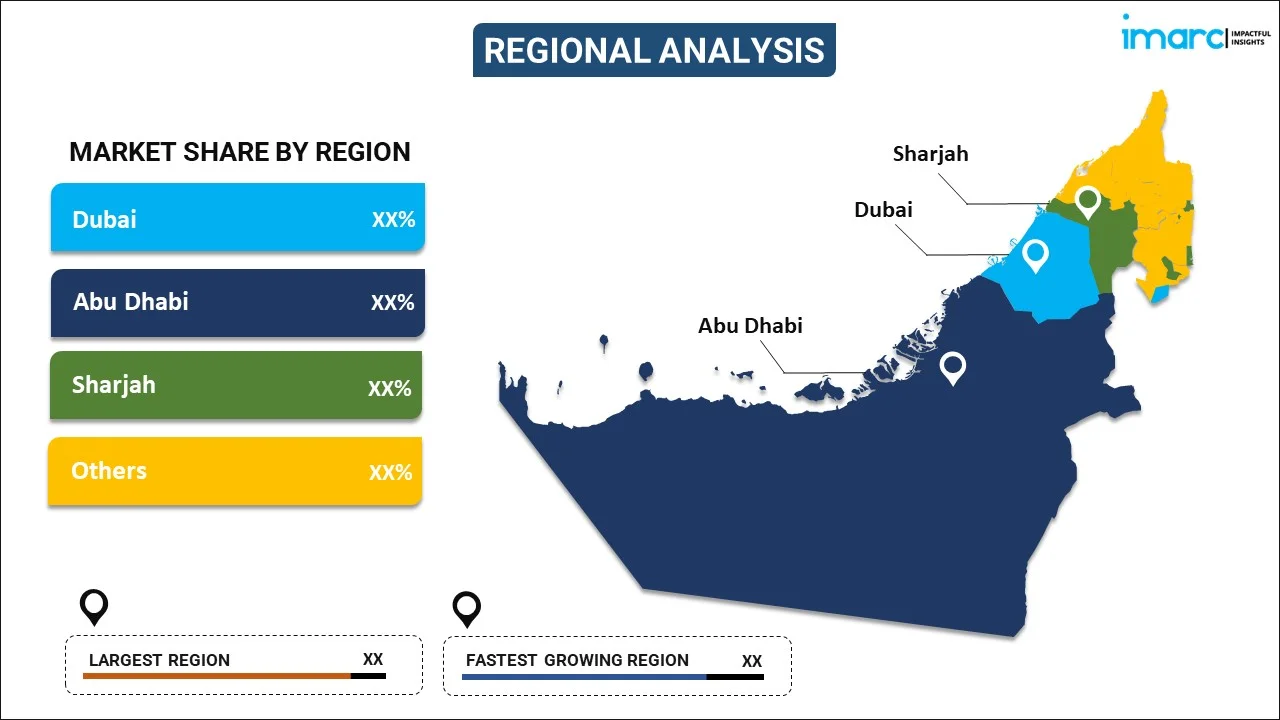

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Online Grocery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Vegetables and Fruits, Dairy Products, Staples and Cooking Essentials, Snacks, Meat and Seafood, Others |

| Business Models Covered | Pure Marketplace, Hybrid Marketplace, Others |

| Platforms Covered | App-based, Web-based |

| Purchase Types Covered | One-time, Subscription |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE online grocery market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE online grocery market on the basis of product type?

- What is the breakup of the UAE online grocery market on the basis of business model?

- What is the breakup of the UAE online grocery market on the basis of platform?

- What is the breakup of the UAE online grocery market on the basis of purchase type?

- What are the various stages in the value chain of the UAE online grocery market?

- What are the key driving factors and challenges in the UAE online grocery?

- What is the structure of the UAE online grocery market and who are the key players?

- What is the degree of competition in the UAE online grocery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE online grocery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE online grocery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE online grocery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)