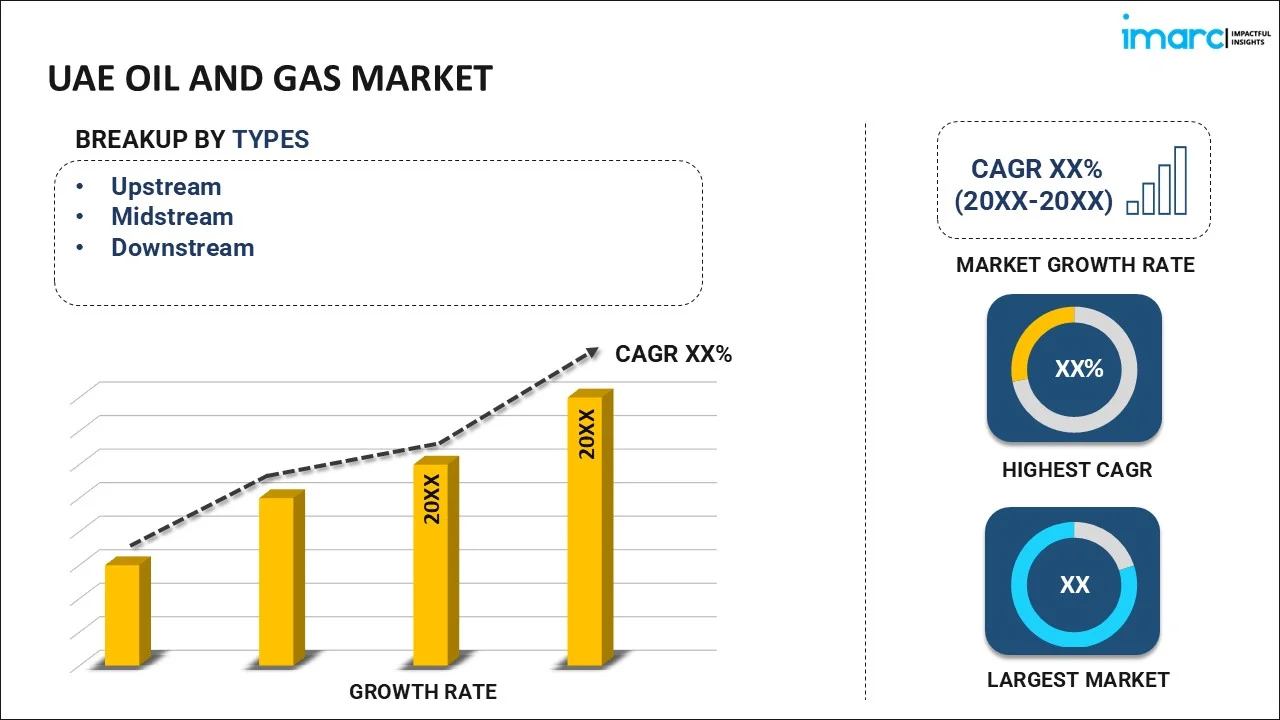

UAE Oil and Gas Market Report by Type (Upstream, Midstream, Downstream), Application (Offshore, Onshore), and Region 2025-2033

UAE Oil and Gas Market Overview:

The UAE oil and gas market size reached 3.4 BPD in 2024. Looking forward, IMARC Group expects the market to reach 4.9 BPD by 2033, exhibiting a growth rate (CAGR) of 3.7% during 2025-2033. The rising substantial reserves, significant technological advancements, growing strategic government policies, strong international partnerships, the enhancing recovery techniques and diversification into downstream activities, and the rising focus on sustainability and energy efficiency, along with high investments in the oil and gas industry are some of the major propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

3.4 BPD |

|

Market Forecast in 2033

|

4.9 BPD |

| Market Growth Rate 2025-2033 | 3.7% |

UAE Oil and Gas Market Trends:

Rising Substantial Reserves and Production Capacity

The UAE has some of the largest proven oil and gas reserves in the world, enabling extensive production and export activities which is acting as a major growth-inducing factor in the market. For instance, in May 2024, Sharjah discovered new gas reserves in the onshore Al Hadiba field. The emirate, however, did not reveal the volumes of gas discovered as it is yet to test the field located north of the Al Sajaa Industrial Area in Sharjah, which has “promising quantities” of gas reserves, according to the Sharjah Government Media Bureau. According to the organization’s global gas outlook report in March, the global demand for natural gas will rise to 5.36 trillion cubic metres in 2050 from 4.02 trillion cm in 2022. This abundance ensures the country remains a key player in the global energy market, contributing significantly to its economy.

Significant Investments in Advanced Technologies

The UAE continually invests in cutting-edge technologies for enhanced oil recovery and efficient gas extraction which is influencing the growth of the market. For instance, in July 2024, Abu Dhabi’s national oil company ADNOC raised the production capacity at one of its offshore oilfields by 25% using AI technology as the United Arab Emirates looks to boost its total crude oil production capacity to 5 million barrels per day (bpd) by 2027. ADNOC’s offshore Satah Al Razboot (SARB) field has also seen a 25% jump in production capacity to 140,000 bpd, through the implementation of advanced digital technologies, the state company of the UAE, as per one of OPEC’s largest producers. ADNOC implemented remote monitoring, smart well operations, and production management technologies at the SARB field, and these technologies are being operated remotely from Zirku island, 20 km (12.4 miles) away. These technological advancements not only improve production efficiency but also extend the life of existing oil fields, ensuring sustained output and profitability.

UAE Oil and Gas Market News:

- In July 2024, ADNOC Gas announced a strategic move to optimize capital efficiency. They awarded EPC contracts valued at $550 million for the next phase of the UAE's gas pipeline expansion project, ESTIDAMA. While ADNOC Gas will manage the project, ownership is being transferred to ADNOC, allowing ADNOC Gas to focus its resources. This project will extend the pipeline network by over 300 kilometers, enabling them to deliver natural gas to more customers in the Northern Emirates.

- In July 2024, TotalEnergies joined, with a 10% interest, the Ruwais LNG project alongside national company ADNOC (60%), Shell (10%), bp (10%) and Mitsui (10%). Launched by ADNOC in June 2024, Ruwais LNG is a liquefied natural gas (LNG) project located in Al Ruwais Industrial city, in Abu Dhabi. The project includes two liquefaction trains with a total capacity of 9.6 million tons per year. Start-up is expected in the second half of 2028.

UAE Oil and Gas Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Upstream

- Midstream

- Downstream

The report has provided a detailed breakup and analysis of the market based on the type. This includes upstream, midstream, and downstream.

Application Insights:

- Offshore

- Onshore

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes offshore and onshore.

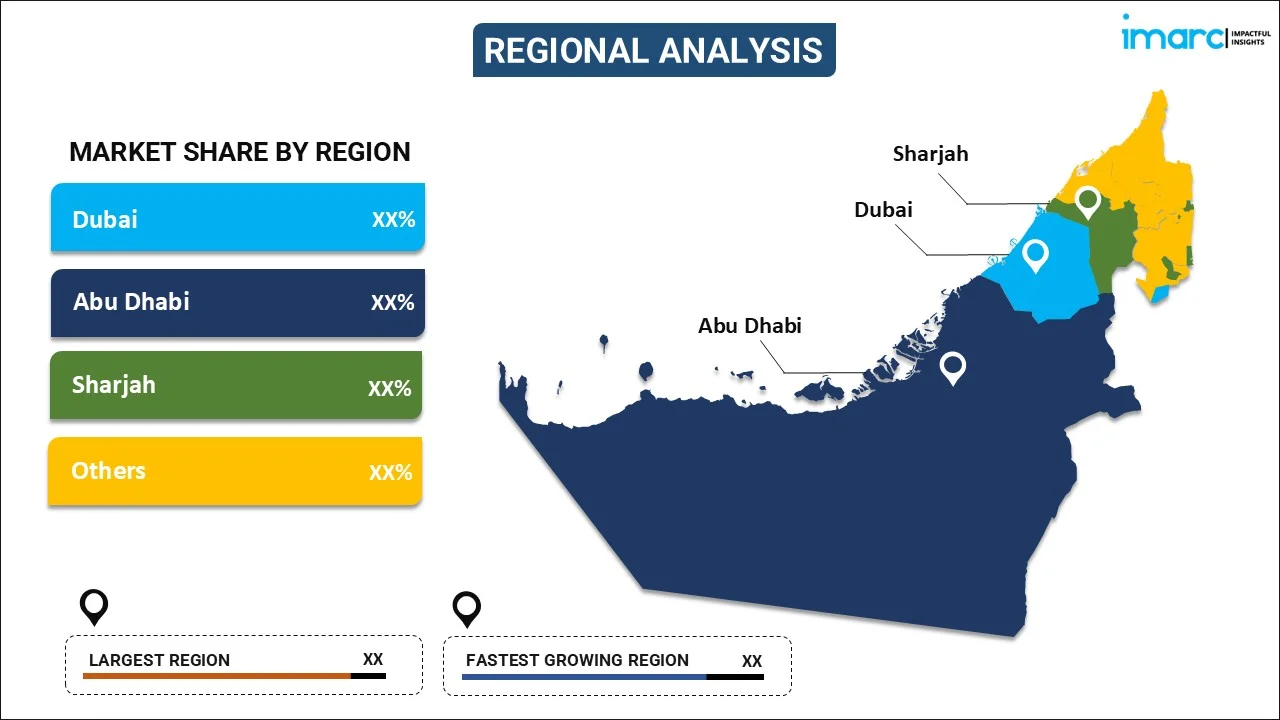

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Oil and Gas Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | BPD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Upstream, Midstream, Downstream |

| Applications Covered | Offshore, Onshore |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE oil and gas market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the UAE oil and gas market?

- What is the breakup of the UAE oil and gas market on the basis of type?

- What is the breakup of the UAE oil and gas market on the basis of application?

- What are the various stages in the value chain of the UAE oil and gas market?

- What are the key driving factors and challenges in the UAE oil and gas?

- What is the structure of the UAE oil and gas market and who are the key players?

- What is the degree of competition in the UAE oil and gas market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE oil and gas market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE oil and gas market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE oil and gas industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)