UAE mHealth Market Size, Share, Trends and Forecast by Components, Service Type, Stakeholders, and Application, 2025-2033

UAE mHealth Market Size and Share:

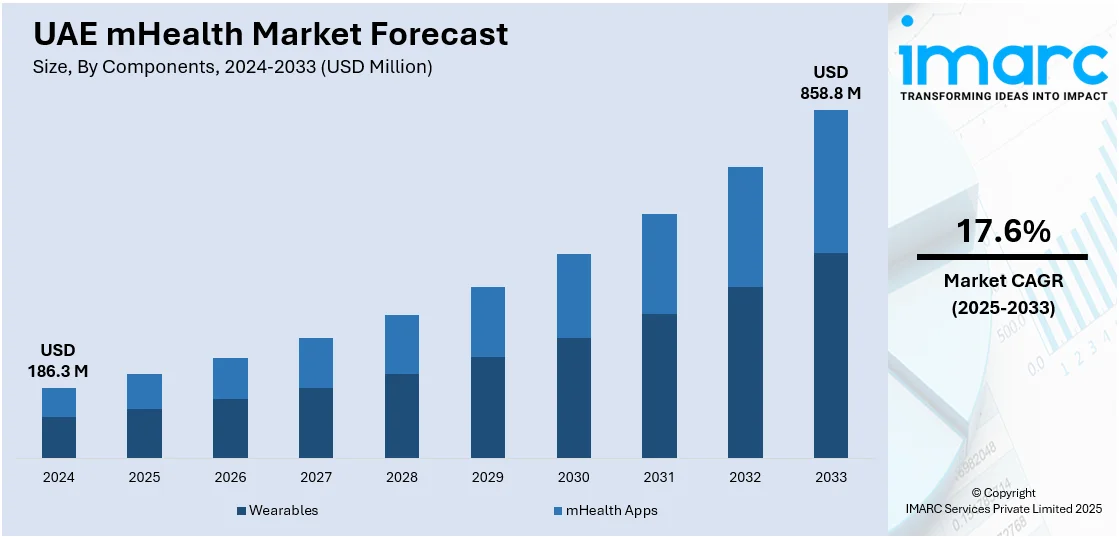

The UAE mHealth market size was valued at USD 186.3 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 858.8 Million by 2033, exhibiting a CAGR of 17.6% from 2025-2033. The UAE market is experiencing robust growth, driven by widespread smartphone adoption, government initiatives supporting digital healthcare, increasing awareness of preventive care, rising chronic disease prevalence, and the integration of advanced technologies like AI and blockchain.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 186.3 Million |

|

Market Forecast in 2033

|

USD 858.8 Million |

| Market Growth Rate (2025-2033) | 17.6% |

The UAE market is primarily driven by the increasing focus on the demand for personalized healthcare and precision medicine. Moreover, continuous monitoring and tailored health insights are being provided to the mHealth market by changing wearable health technology. This advanced AI-enabled device integrates seamlessly into the ecosystem and allows users to be proactive with their health, increasing accessibility and convenience and enhancing overall engagement with digital healthcare solutions. For example, On October 21, 2024, Samsung Gulf Electronics launched the Galaxy Ring in the UAE, enhancing its wearables lineup. This smart ring offers 24/7 health monitoring, focusing on sleep analysis, and integrates seamlessly with the Galaxy ecosystem. Leveraging advanced AI algorithms, it provides personalized health insights, exemplifying Samsung's commitment to mHealth innovations.

Furthermore, the rapid development of the mHealth ecosystem is highly dependent on the robust collaboration between the private and public sectors. Adoption of blockchain technology in the healthcare sector is further expanding the mHealth market with increased data security, interoperability, and patient-centric care. Blockchain ensures secure seamless data exchange across platforms, leading to trust and efficiency in digital health solutions and an even more integrated and accessible healthcare system. On January 29, 2024, the Department of Health –Abu Dhabi (DoH) signed a Memorandum of Understanding with Abu Dhabi health data services (ADHDS) and MSD GCC to explore blockchain technology in healthcare. This initiative aims to enhance data security and interoperability, aligning with DoH's commitment to advancing patient-centric care and integrating mHealth solutions within the Emirate.

UAE mHealth Market Trends:

Continual Technological Advancements in Mobile Applications

The growing focus on mHealth services is driving forward digital healthcare progress, significantly through integrated mobile applications that offer streamlined access to teleconsultations, medical records, and wellness tracking tools, bringing in more patient engagement and convenience. Features like AI-based symptom checkers and the integration of wearable devices aid in proactive health monitoring as well as personalized care toward better outcomes. This trend aligns with the increasing demand for accessible, tech-driven healthcare solutions that can address issues of efficiency and continuity of care. With increased digital adoption, such innovations further strengthen healthcare ecosystems by filling gaps between patients and providers and enhancing overall service delivery and satisfaction. On October 15, 2024, the department of health – Abu Dhabi (DoH) launched 'Sahatna,' an integrated mobile app designed to enhance mHealth services. The app offers features such as appointment scheduling, teleconsultations, access to medical records, and personalized genomic reports.

Growing Demand for Senior-Centric Healthcare Solutions

The increased attention being paid to senior-specific health care is fueling the expansion of healthcare and insurance markets. There are now personalized health care plans, encompassing treatment for chronic disease management, home visits by a medical professional, and specialty care, designed for an aging population's unique requirements. Service integration into mHealth platforms allows better accessibility and convenience, increasing engagement in services by senior residents. With an expansion of healthcare networks to meet these demands, the uptake of senior-focused insurance plans is likely to increase. On November 26, 2024, Dubai Insurance and Aster DM healthcare introduced "vibrance senior," a health insurance plan tailored for senior UAE residents. This plan offers comprehensive medical services, including specialized chronic disease care and home-based consultations, accessible through Aster's extensive network and mHealth platforms like the My Aster app.

Increasing Prevalence of Chronic Diseases

The increase in chronic diseases, including diabetes, heart issues, and obesity in the UAE is driving a higher demand for mHealth solutions, contributing to the UAE mHealth market growth. These platforms enable continuous monitoring, remote consultations, and medication reminders, offering efficient management options for chronic conditions. Features such as AI-driven analytics and tailored care plans enhance treatment adherence and results. With many individuals affected by these illnesses, healthcare providers and insurers are integrating mHealth technologies into their offerings. This trend meets the growing need for affordable, scalable solutions while enhancing chronic disease management quality.

UAE mHealth Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the UAE mHealth market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on components, service type, stakeholders, and application.

Analysis by Components:

- Wearables

- BP Monitors

- Glucose Meters

- Pulse Oximeters

- Sleep Apnea Monitors (PSG)

- Neurological Monitors

- Activity Trackers/ Actigraphs

- Cardiac Monitors

- mHealth Apps

- Medical Apps

- Women’s Health

- Personal Health Record Apps

- Medication Management Apps

- Chronic Disease Management Apps

- Diagnostic Apps

- Remote Monitoring Apps

- Others

- Fitness Apps

- Exercise and Weight Loss

- Diet and Nutrition

- Activity Tracking

- Medical Apps

mHealth apps are the largest segment in the UAE mHealth market. They are accessible, diverse in functionalities, and have widespread smartphone penetration. The applications provide a variety of features, such as teleconsultations, medication reminders, wellness tracking, and chronic disease management. Their user-friendly interfaces and integration with wearable devices make them highly appealing to a tech-savvy population. In addition, advances in AI and data analytics enabled these applications to deliver the health insights in personalized format, thus further improving its utility. With the efforts of governments to increase adoption of digital healthcare and increasing acceptance of the need for handy, on-the-go solutions for health, mHealth applications continue to attract customers. This ability to cover a multitude of health-related needs within one platform places mHealth at the leading end, creating tremendous growth potential within the UAE's mHealth ecosystem.

Analysis by Service Type:

- Monitoring Services

- Independent Aging Solutions

- Chronic Disease Management

- Post-Acute Care Services

- Diagnostic Services

- Self-Diagnosis Services

- Telemedicine Solutions

- Medical Call centers manned by Healthcare Professionals

- Treatment Services

- Remote Patient Monitoring Services

- Teleconsultation

- Wellness and Fitness Solutions

- Other Services

Monitoring services are leading the UAE mHealth market as the prevalence of chronic diseases like cardiovascular conditions and diabetes is rising. These services ensure continuous tracking of vital signs, timely interventions, and better management of diseases. Integration with wearable devices and mHealth platforms increases convenience and accessibility, empowering patients to actively monitor their health. The use of advanced features, including AI-driven analytics, brings actionable insights and encourages a better adherence to treatment plans. Preventive healthcare initiatives in the UAE and measures against hospital readmissions have pushed the adoption of monitoring services further. Further, growing needs for the real-time tracking of health among older populations have increased the demand for these solutions, establishing the monitoring services as the biggest segment in the UAE mHealth market.

Analysis by Stakeholders:

- Mobile Operators

- Device Vendors

- Content Players

- Healthcare Providers

The UAE mHealth market share is largely dominated by the mobile operators that provide essential infrastructure that allows for unbroken connectivity and data transfer. Such infrastructure allows the seamless access of mHealth applications, teleconsultations, and monitoring services. High smartphone penetration in the UAE further underlines the reliance on mobile operators to expand and strengthen the reliability of digital healthcare solutions. This creates opportunities for novel, packaged mHealth services through their active partnerships with healthcare providers. Mobile operators' initiatives in bringing in 5G into the healthcare service are accelerating and improving by real-time data transmission, AI-powered insight, and advanced remote monitoring systems.

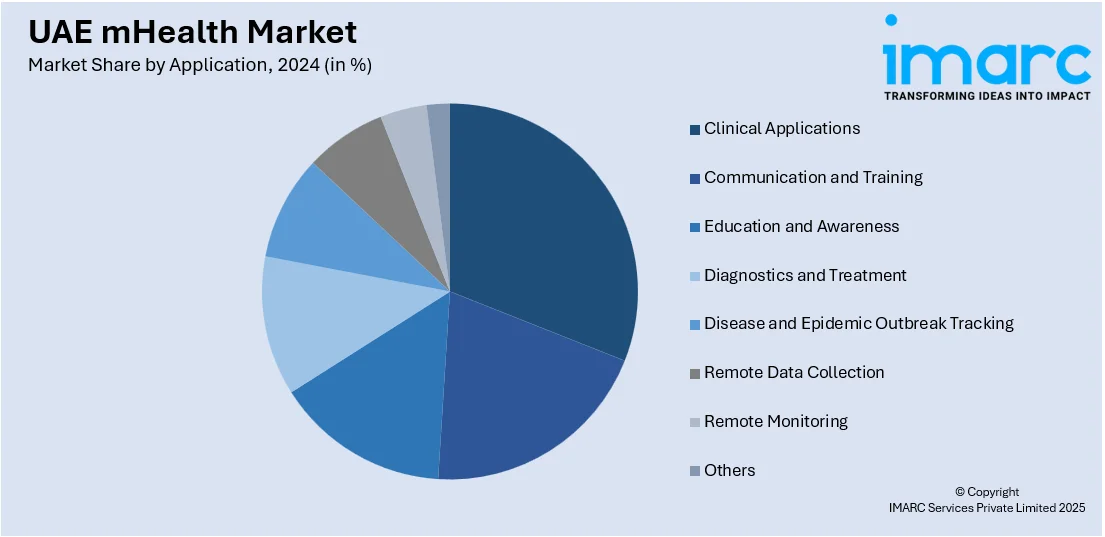

Analysis by Application:

- Clinical Applications

- Cardiovascular Diseases

- Diabetes

- Respiratory Diseases

- Neurological Diseases

- Others

- Communication and Training

- Education and Awareness

- Diagnostics and Treatment

- Disease and Epidemic Outbreak Tracking

- Remote Data Collection

- Remote Monitoring

- Others

Remote data collection stands as the largest application segment in the UAE mHealth market due to its essential function in enabling efficient and prompt healthcare services. It allows healthcare providers to access patient data in real-time, enhancing diagnostics, treatment planning, and chronic illness management. With the rise of wearables and IoT devices, remote data collection has evolved to become more sophisticated, providing detailed health metrics such as heart rate, glucose levels, and sleep patterns. This function aligns with the UAE’s commitment to smart healthcare and personalized medicine. Additionally, remote data collection bolsters research initiatives and improves healthcare accessibility, especially in underserved regions. Its capability to deliver ongoing and precise health insights makes this application crucial, enhancing its importance in the UAE mHealth market.

Competitive Landscape:

Major players in the UAE mHealth market are enhancing their tech infrastructure for better connectivity and data transfer. They are improving mobile health platforms with features like AI diagnostics, real-time monitoring, and personalized health insights. Collaborations with healthcare providers are essential for delivering innovative solutions that address various medical needs. There is a focus on harnessing 5G technology to speed up and strengthen data transmission, ensuring immediate access to vital health information. Furthermore, companies are looking to broaden mHealth applications, including chronic disease management and remote consultations, to improve patient outcomes. There is also a strong emphasis on user-friendly designs and security measures to increase user trust and acceptance.

The report provides a comprehensive analysis of the competitive landscape in the UAE mHealth market with detailed profiles of all major companies, including:

- Apple Inc.

- Bayer AG

- Cerner Corporation

- Cisco Systems Inc.

- Dexcom, Inc.

- Koninklijke Philips N.V.

- Masimo Corporation

- Medtronic Inc.

- Nike Inc.

- Samsung

Latest News and Developments:

On April 8, 2024, AXA Global healthcare and Daman, the UAE's largest health insurer, announced a partnership to offer a new international private medical insurance (IPMI) plan. Launched in March 2024, this Global healthcare plan is administered by daman and supported internationally by AXA. Members benefit from enhanced coverage options and can access services via the Daman Mobile app, reflecting a commitment to mHealth solutions.

UAE mHealth Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Service Types Covered |

|

| Stakeholders Covered | Mobile Operators, Device Vendors, Content Players, Healthcare Providers |

| Applications Covered |

|

| Companies Covered | Apple Inc., Bayer AG, Cerner Corporation, Cisco Systems Inc., Dexcom, Inc., Koninklijke Philips N.V., Masimo Corporation, Medtronic Inc., Nike Inc. and Samsung |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE mHealth market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the UAE mHealth market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE mHealth industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

mHealth encompasses mobile health solutions using devices, apps, and wearables to provide healthcare services. It includes teleconsultations, remote monitoring, chronic disease management, and personalized insights, enhancing accessibility and convenience. By integrating advanced technologies, mHealth empowers users to proactively manage health, bridging gaps in care and promoting efficiency in the UAE’s digital healthcare ecosystem.

The UAE mHealth market was valued at USD 186.3 Million in 2024.

IMARC estimates the UAE mHealth market to exhibit a CAGR of 17.6% during 2025-2033.

The market is driven by high smartphone penetration, government support for digital healthcare, rising chronic disease cases, and integration of advanced technologies like AI and blockchain.

In 2024, mHealth apps represented the largest segment by components, driven by their accessibility, diverse functionalities, and integration with wearable devices.

Monitoring services lead the market by service type, due to rising chronic disease prevalence and demand for continuous health tracking.

The remote data collection segment is the leading application, driven by its role in real-time data sharing and enhanced healthcare accessibility.

On a regional level, the market has been classified into Abu Dhabi, Dubai, Sharjah, Ajman, Ras Al Khaimah, Fujairah, wherein Abu Dhabi currently dominates the market.

Some of the major players in the UAE mHealth market include Apple Inc., Bayer AG, Cerner Corporation, Cisco Systems Inc., Dexcom, Inc., Koninklijke Philips N.V., Masimo Corporation, Medtronic Inc., Nike Inc., and Samsung, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)