UAE Home Furniture Market Size, Share, Trends and Forecast by Product Type, Raw Material, Room Type, Price Range, Distribution Channel, and Region, 2026-2034

UAE Home Furniture Market Summary:

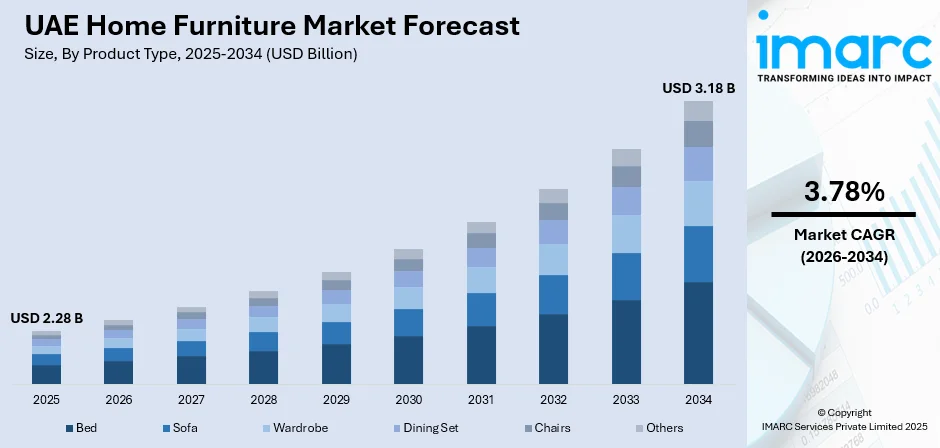

The UAE home furniture market size was valued at USD 2.28 Billion in 2025 and is projected to reach USD 3.18 Billion by 2026-2034, growing at a compound annual growth rate of 3.78% from 2026-2034.

The home furniture market in UAE is growing steadily, aided by the economic developments in the region, growing purchasing powers of people, and a growing population of foreigners with ever-changing lifestyles. The growing real estate business in UAE, assisted by the growing urbanization in the cities of Dubai and Abu Dhabi, has further accelerated the demand for trendy and good quality home furniture. There is a growing demand from people for environment-friendly as well as tech-integrated furniture.

Key Takeaways and Insights:

- By Product Type: Sofa dominates the market with a share of 32% in 2025, driven by the emphasis on living room aesthetics and the growing preference for versatile seating solutions that accommodate modern lifestyles.

- By Raw Material: Wooden leads the market with a share of 51% in 2025, owing to its timeless appeal, durability, and alignment with both traditional and contemporary design preferences.

- By Room Type: Living room represents the largest segment with a market share of 39% in 2025, attributed to the cultural importance of hospitality spaces and increasing investments in home entertainment areas.

- By Price Range: Mass dominates with a share of 65% in 2025, reflecting the large middle-income expatriate population seeking affordable yet stylish home furnishing solutions.

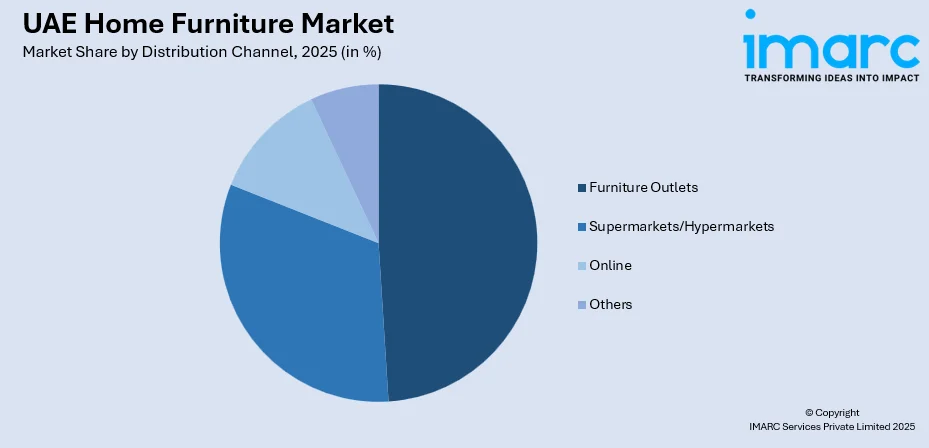

- By Distribution Channel: Furniture outlets lead with a market share of 49% in 2025, driven by consumer preference for experiencing products firsthand and accessing professional interior design consultation services.

- Key Players: The UAE home furniture market features a competitive landscape with established international retailers, regional furniture chains, and specialty boutiques. Major players focus on product innovation, omnichannel retail strategies, and sustainable product offerings to capture market share across diverse consumer segments.

To get more information on this market Request Sample

The UAE has witnessed strong economic growth driven by diversification into tourism, finance, and real estate sectors, resulting in increased consumer spending on home furnishings. In 2025, India’s organized furniture retailer Royaloak Furniture entered the UAE market with three new stores across Dubai, Ras Al Khaimah, and Fujairah, capitalizing on rising demand for quality home and office furniture. The nation's population continues to grow, with expatriates accounting for a significant majority of residents who regularly refresh their living spaces. Rising real estate activity, including a notable increase in property sales and residential development projects across Dubai and Abu Dhabi, translates directly into furniture demand. The growing emphasis on home office setups and multifunctional living spaces, influenced by evolving work patterns, has expanded average purchase values across bedroom and living room categories.

UAE Home Furniture Market Trends:

Sustainability and Eco-Friendly Furniture Preferences

Environmental consciousness is increasingly influencing furniture purchasing decisions in the UAE. Consumers are actively seeking products manufactured from sustainable materials, including FSC-certified timber and recycled components. As per the sources, Dubai-based Environmental Solutions arm of Dulsco launched “The New Old & Reloved,” an upcycled furniture brand at Wafi Mall that transforms recycled materials into stylish, repurposed furniture pieces, reinforcing eco-friendly consumption in the home furnishings sector. Retailers are responding by expanding their eco-friendly product lines and highlighting environmental certifications. This shift aligns with broader government initiatives promoting sustainable development and green building standards, creating opportunities for manufacturers offering environmentally responsible furniture solutions.

Smart and Technology-Integrated Furniture Solutions

The integration of technology into home furniture represents a significant trend shaping market evolution. Smart furniture featuring built-in charging stations, IoT connectivity, and home automation compatibility appeals to tech-savvy consumers seeking enhanced convenience and modern functionality. In the UAE, furniture brand Ebarza introduced a new smart collection that maximizes space with intelligent, multifunctional pieces such as transformable beds and desks designed for compact living environments, reflecting growing consumer interest in tech-enabled home solutions. Adjustable workstations, smart beds with sleep tracking capabilities, and furniture with integrated lighting systems are gaining popularity.

E-Commerce Growth and Digital Visualization Tools

Online furniture retail is experiencing accelerated growth as platforms enhance delivery logistics and customer experience capabilities. Augmented reality showrooms and virtual visualization tools enable customers to preview furniture arrangements within their actual living spaces before purchasing. For instance, UAE retailers are increasingly adopting AR and 3D visualization features, such as those used by Al Huzaifa Furniture to let customers virtually place products in their homes, boosting engagement and confidence in online purchases. This digital transformation extends brand presence beyond physical stores, reaching tech-oriented consumers and international buyers. The convenience of online shopping, combined with improved customization options and swift delivery services, continues reshaping consumer purchasing behaviors.

Market Outlook 2026-2034:

The UAE home furniture market outlook remains positive, supported by continued economic growth, population expansion, and sustained real estate development across all emirates. The luxury and custom furniture segments are witnessing increased demand from affluent residents and high-net-worth individuals seeking bespoke pieces reflecting personal style. Government initiatives supporting local manufacturing and the Make it in the Emirates program are expected to enhance domestic production capabilities. The ongoing development of mega-projects, smart city initiatives, and hospitality infrastructure will generate substantial demand throughout the forecast period. The market generated a revenue of USD 2.28 Billion in 2025 and is projected to reach a revenue of USD 3.18 Billion by 2034, growing at a compound annual growth rate of 3.78% from 2026-2034.

UAE Home Furniture Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Sofa |

32% |

|

Raw Material |

Wooden |

51% |

|

Room Type |

Living Room |

39% |

|

Price Range |

Mass |

65% |

|

Distribution Channel |

Furniture Outlets |

49% |

Product Type Insights:

- Bed

- Sofa

- Wardrobe

- Dining Set

- Chairs

- Others

The sofa dominates with a market share of 32% of the total UAE home furniture market in 2025.

The sofa is among most integral elements of living room furniture in UAE households and carry notable social and cultural importance rooted in long-standing traditions of hospitality and guest entertainment. Living spaces often serve as gathering areas, driving consistent demand for seating solutions that balance comfort and aesthetics. Consequently, the market accommodates a broad spectrum of sofa designs, including modular configurations, sectional formats, and traditional Arabic Majlis styles that reflect cultural preferences and social norms.

Demand from the consumers for high-quality upholstery materials, including leather and other high-quality fabrics, propels the overall value growth in this category. Various innovations from companies, such as the presence of recline functions, storage options, and convertible furniture, are engaging consumers to make maximum use, whether it is in a villa or a smaller apartment setting. Customization trends are also increasing to adapt to a particular setting or design requirement.

Raw Material Insights:

- Wooden

- Metal

- Plastic

- Others

The wooden leads with a share of 51% of the total UAE home furniture market in 2025.

Wooden maintains market leadership due to its enduring aesthetic appeal, durability, and versatility across traditional and contemporary design styles. For example, UAE-focused brand Wooden Twist celebrated reaching over 150,000 orders globally and expanded its presence in the UAE with a new Dubai showroom in 2024, highlighting strong consumer demand for handcrafted wooden pieces. The material's natural warmth and elegance resonate with consumers seeking timeless pieces that complement diverse interior themes prevalent in the UAE's multicultural environment.

Hybrid constructions that combine wood veneers with complementary materials are gaining increasing traction, as they appeal to consumers who value a blend of traditional craftsmanship and modern minimalist aesthetics. Demand for FSC-certified timber is rising, driven by environmentally conscious consumers and government buyers prioritizing sustainability and compliance with green building standards. This segment is supported by strong mass-market demand for cost-effective engineered wood products, alongside sustained luxury segment preference for premium solid wood furniture craftsmanship.

Room Type Insights:

- Living Room

- Bedroom

- Dining Room

- Others

The living room dominates with a market share of 39% of the total UAE home furniture market in 2025.

Living room accounts for the largest share of furniture demand in UAE homes, underscoring the cultural significance of hospitality-oriented spaces. These areas function as focal points for entertaining guests and hosting family gatherings, driving consistent demand for sofas, coffee tables, entertainment units, and decorative accessories. Homeowners increasingly invest in furniture that blends comfort with visual appeal, aiming to create welcoming environments that reflect social traditions while aligning with modern interior design preferences.

The expanding role of living room as a multifunctional space for work-from-home (WFH) activities and home entertainment continues to influence furniture purchasing decisions. Consumers show a growing preference for modular, adaptable, and space-efficient designs that support changing daily requirements. This segment witnesses’ frequent upgrades, as residents update furniture and décor to match evolving trends and personal tastes, sustaining a steady demand for versatile, contemporary, and aesthetically refined living room furnishings.

Price Range Insights:

- Luxury

- Mass

The mass leads with a share of 65% of the total UAE home furniture market in 2025.

The mass accounts for the largest share, driven by the substantial middle-income expatriate population seeking affordable yet stylish home furnishing solutions. Competitive price-to-quality ratios offered by major retailers attract cost-conscious consumers who prioritize both aesthetics and everyday functionality. Flexible payment options, instalment schemes, and frequent seasonal promotions further stimulate purchasing activity. These factors ensure steady sales volumes and rapid product turnover, while expanding access to contemporary home furniture across a broad and diverse consumer base.

Budget-oriented retailers have established strong market positions by offering trendy, functional furniture at accessible price points. High residential mobility among the expatriate population supports recurring demand for complete, ready-to-use home furnishing solutions. Consumers increasingly expect better durability, comfort, and design features that were traditionally associated with premium segments. This shift encourages manufacturers and retailers to enhance product quality, materials, and visual appeal while maintaining competitive pricing structures to attract value-conscious buyers.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Furniture Outlets

- Supermarkets/Hypermarkets

- Online

- Others

The furniture outlets dominate with a market share of 49% of the total UAE home furniture market in 2025.

Furniture outlets continue to hold market leadership as consumers value physically experiencing products before purchase. These stores provide curated room displays, professional design consultations, and immediate product availability, enhancing overall buying confidence. Leading retailers operate flagship outlets in prime shopping malls and major retail districts across Dubai, Abu Dhabi, and other emirates. Physical presence supports brand visibility, allows comparison across collections, and reassures buyers about quality, comfort, proportions, and finishes before making higher-value furniture investments within the domestic market.

These furniture outlets differentiate through in-store services including custom orders, delivery, assembly, and interior design support, justifying premium positioning. Experiential store formats allow customers to assess comfort, build quality, and scale in realistic settings, reducing purchase uncertainty. To compete with expanding online channels, retailers are investing in store expansions, omnichannel integration, and innovative formats that elevate engagement, strengthen brand identity, and reinforce long-term customer trust across competitive urban markets while improving service consistency and post-purchase support standards for modern furniture buyers.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Dubai home furniture market is driven by luxury living, modern interiors, and high disposable incomes. Demand remains strong for premium, customized, and smart furniture, supported by rapid real estate development, steady expatriate inflows, and hospitality-led residential projects that favor contemporary, space-efficient, and designer home furnishing solutions across upscale urban communities and districts.

Abu Dhabi home furniture market reflects stable residential growth and preference for high-quality, durable furnishings. Government housing initiatives and long-term family residences sustain demand for classic, functional, and premium furniture, alongside rising interest in sustainable materials, refined craftsmanship, and locally sourced interior solutions supporting planned communities, villas, and owner-occupied housing developments nationwide.

Sharjah home furniture market is shaped by affordability and family-oriented housing preferences. Demand centers on cost-effective, functional, and space-saving furniture, driven by middle-income households and expanding apartment developments. Traditional designs coexist with modern styles, appealing strongly to practical, value-conscious consumers seeking durability, efficient layouts, reasonable pricing, and everyday comfort within urban neighborhoods.

Others in UAE, including Ajman, Ras Al Khaimah, Fujairah, and Umm Al Quwain, exhibit steady furniture demand linked to emerging residential projects. The market emphasizes affordable, durable furniture for villas and apartments, with gradual adoption of modern designs as urbanization and tourism activity expands across smaller cities, coastal towns, and developing economic zones.

Market Dynamics:

Growth Drivers:

Why is the UAE Home Furniture Market Growing?

Robust Real Estate Development and Property Market Activity

The UAE's dynamic real estate sector serves as a primary catalyst for home furniture market expansion. Significant increases in property sales and residential development projects generate substantial demand for furnishing newly acquired homes. In 2025, Dubai saw strong demand for ready-to-move-in furnished homes, with Bayut reporting nearly 59,000 Q3 property transactions worth over AED 169 billion, many including essential furniture, boosting furniture sales. High-end residential developments, beachfront villas, and premium commercial projects across Dubai, Abu Dhabi, and other emirates require quality furniture solutions. Rising property values and rental rates encourage residents toward homeownership, triggering complete refurnishing cycles for new acquisitions. The continuous pipeline of luxury developments, branded residences, and smart city projects ensures sustained demand for premium and mass-market furniture alike.

Growing Population and Expatriate Community Expansion

Population growth continues driving incremental household formation and furniture demand across the UAE. The large expatriate community, representing the majority of residents, regularly purchases furniture when relocating, upgrading accommodations, or refreshing living spaces. Reflecting this trend, Dubai recently inaugurated Art of Living, the first dedicated home design and furniture mall in the MENA region, which spans 50,000 sqm with global and regional brands to cater to rising demand from new residents and established households alike. Average household spending on furniture and home goods has increased substantially as disposable incomes rise and lifestyle expectations evolve. New residents typically purchase complete home furnishing suites rather than individual pieces, generating higher transaction values. The multicultural population creates diverse demand spanning traditional, contemporary, and fusion design preferences.

Rising Consumer Preference for Premium and Customized Products

Increasing affluence and evolving consumer preferences drive demand for premium and bespoke furniture solutions. High-net-worth individuals and luxury property owners seek customized pieces reflecting personal style and complementing exclusive interior designs. The trend toward personalization extends across price segments as consumers expect furniture tailored to specific dimensions, materials, and aesthetic preferences. International and local designers collaborate to deliver solutions combining aesthetic appeal with functional excellence. Brand heritage, craftsmanship quality, and exclusive designs command premium positioning as consumers prioritize differentiation and status expression through home furnishings.

Market Restraints:

What Challenges the UAE Home Furniture Market is Facing?

High Retail Operating Costs and Commercial Real Estate Expenses

Rising retail and operational costs in prime Dubai and Abu Dhabi locations challenge furniture businesses, increasing product prices and affecting affordability. These higher expenses may slow market growth and create hurdles for smaller or new players trying to enter or expand within the competitive UAE furniture sector, limiting opportunities despite growing consumer demand.

Import Dependency and Supply Chain Vulnerabilities

The UAE’s heavy dependence on imported furniture makes the market vulnerable to currency swings, shipping costs, and global supply chain disruptions. Import duties and logistics expenses impact pricing and profit margins. To reduce these risks, manufacturers and retailers need to adopt hedging measures and diversify their sourcing strategies, ensuring greater stability and competitiveness in the market.

Intense Competition and Market Fragmentation

The UAE’s furniture retail market is highly competitive, with international brands, regional chains, and local players driving pricing pressures and margin compression. Market fragmentation across diverse consumer segments necessitates tailored strategies and significant marketing investment. Rapidly changing consumer preferences and fast-moving trends require constant product innovation and agile inventory management to stay competitive.

Competitive Landscape:

The UAE home furniture market features a competitive landscape characterized by established international retailers, regional furniture chains, luxury boutiques, and emerging online platforms. Major players compete through extensive product portfolios, strategic retail locations, omnichannel capabilities, and differentiated customer experiences. International brands leverage global design expertise and supply chain efficiencies, while regional players capitalize on local market understanding and cultural relevance. Competition intensifies as retailers expand physical presence through new store formats and enhance digital capabilities to capture evolving consumer preferences. Strategic partnerships with interior designers, real estate developers, and hospitality operators provide access to project-based demand. Sustainability commitments and eco-friendly product offerings increasingly differentiate market positioning as environmental consciousness grows among consumers and commercial buyers.

Recent Developments:

- In November 2025, Sobha Furniture, a new venture of Sobha Group, launched its made-in-UAE furniture operations at Downtown Design 2025. The company showcased large-scale manufacturing capabilities with integrated facilities in Dubai and Abu Dhabi, aiming to strengthen local production and streamline the regional furniture supply chain.

UAE Home Furniture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Bed, Sofa, Wardrobe, Dining Set, Chairs, Others |

| Raw Materials Covered | Wooden, Metal, Plastic, Others |

| Room Types Covered | Living Room, Bedroom, Dining Room, Others |

| Price Ranges Covered | Luxury, Mass |

| Distribution Channels Covered | Furniture Outlets, Supermarkets/Hypermarkets, Online, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The UAE home furniture market size was valued at USD 2.28 Billion in 2025.

The UAE home furniture market is expected to grow at a compound annual growth rate of 3.78% from 2026-2034 to reach USD 3.18 Billion by 2034.

Sofa dominates the product type segment with a 32% share, driven by the cultural importance of living room spaces for hospitality and the growing preference for versatile, stylish seating solutions across residential settings.

Key factors driving the UAE home furniture market include robust real estate development and property market activity, growing population and expatriate community expansion, rising consumer preference for premium and customized products, and increasing adoption of e-commerce and digital retail channels.

Major challenges include high retail operating costs and commercial real estate expenses, import dependency and supply chain vulnerabilities, intense competition and market fragmentation, and rapidly changing consumer preferences requiring continuous product innovation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)