UAE Home Decor Market Report by Product Type (Home Furniture, Home Textiles, Flooring, Wall Decor, Lighting, and Others), Distribution Channel (Home Decor Stores, Supermarkets and Hypermarkets, Online Store, Gift Shops, and Others), and Region 2025-2033

UAE Home Decor Market Overview:

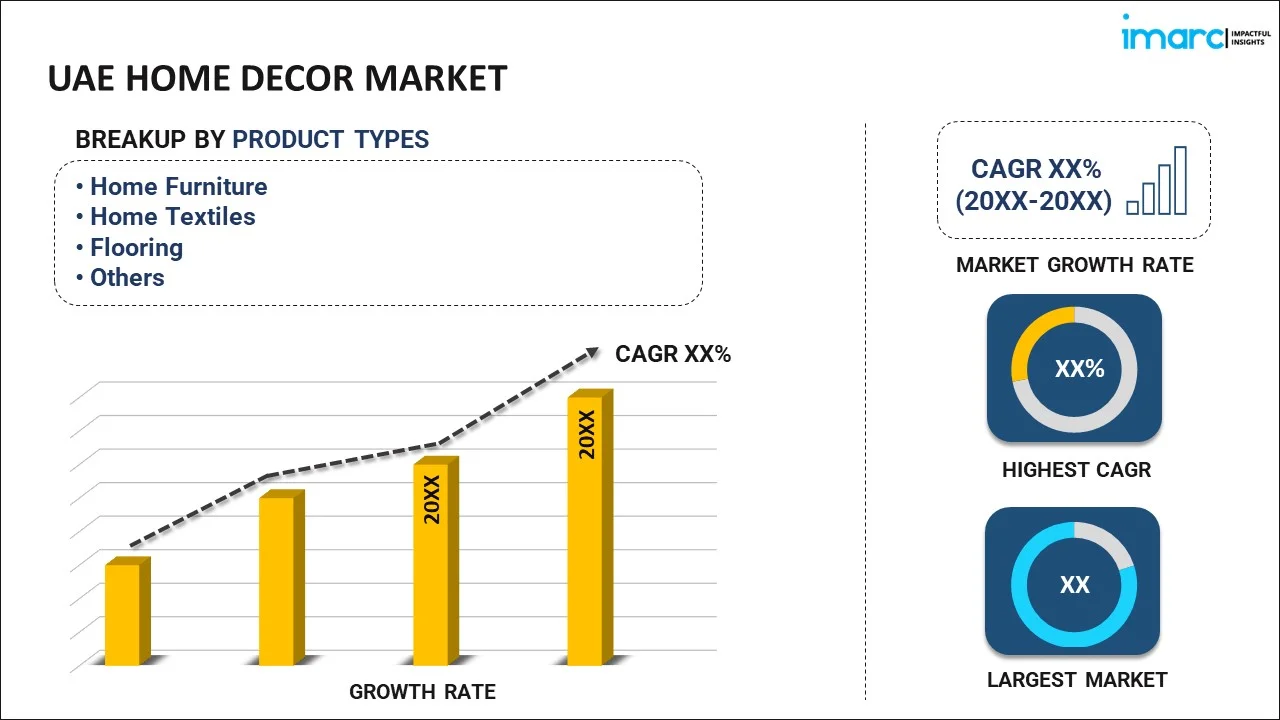

The UAE home decor market size reached USD 3,762.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 5,785.3 Million by 2033, exhibiting a growth rate (CAGR) of 4.9% during 2025-2033. The market is thriving, driven by increasing disposable incomes and a booming real estate sector. Luxury and modern aesthetics dominate, with a high demand for eco-friendly and smart home products. Retail expansions and e-commerce growth significantly boost market accessibility and variety.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3,762.7 Million |

| Market Forecast in 2033 | USD 5,785.3 Million |

| Market Growth Rate 2025-2033 | 4.9% |

UAE Home Decor Market Trends:

E-commerce Growth

The growth of the e-commerce sector in the UAE home decor market is prominently driven by the rising convenience and variety that online shopping platforms offer. This trend is not just a regional phenomenon but a global shift in consumer purchasing behaviors with more consumers opting to shop online for home decor products. According to a report published by the International Trade Administration, the UAE leads in e-commerce among all GCC states with a 53% market jump in the year 2020 and recorded sales of $3.9 billion, constituting 10% of total retail sales. The COVID-19 digital shift largely drove this growth. The Dubai Chamber of Commerce and Industry predicts e-commerce to reach $8 billion in sales by 2025, fueled by almost 100 % internet and mobile phone access among UAE population. Online platforms have responded by expanding their offerings and improving their user experiences, making it easier for customers to find and purchase a wide range of home decor items from the comfort of their homes. This move towards retail commerce is transforming the home decor market, making it more accessible and providing consumers with enhanced choices.

Luxury and High-End Collaborations

The UAE home decor market is increasingly characterized by collaboration between local companies and renowned international luxury brands. This trend is mainly driven by a rising demand for upscale and exclusive home decor products among the affluent segments of UAE population. For instance, THE FITOUT has partnered with Gurian, an Italian furniture company, to bring luxury furniture to the UAE. This collaboration aims to cater to increasing demand for high quality interior solutions in the region. THE FITOUT will exclusively distribute Gurian's authentic Italian upholstered furniture in UAE. Both companies are looking forward to providing consumers with exceptional products. The demand for furniture, fixtures, and equipment (FF&E) is growing, and this partnership will help meet that demand. These collaborations not only enrich the local market offerings with high end quality products but also enable international branch type into lucrative Middle Eastern market. By merging global luxury aesthetics with local tastes these partnerships are transforming UAE’s home decor landscape setting a new standard in luxury living.

UAE Home Decor Market News:

- In 2023, Homes r Us unveiled it's a special Ramadan collection, aiming to help customers create unforgettable memories during the holy month. The collection features diverse themes such as white canvas, forest forage and industrial sleek catering to various home styles.

- In 2023, UAE's well-known furniture store, Pan Home, recently opened its first flagship store in Riyadh, Saudi Arabia. Spanning 100,000 square feet, the store offers a wide range of home decor items, including furniture, accessories, and drapes. From minimalistic to contemporary designs, the store caters to every space in your home, including kids' furniture rooms, home offices, and outdoor areas. The store boasts an eclectic collection of furniture, kitchenware, office chairs, and more.

UAE Home Decor Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Home Furniture

- Home Textiles

- Flooring

- Wall Decor

- Lighting

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes home furniture, home textiles, flooring, wall decor, lighting, and others.

Distribution Channel Insights:

- Home Decor Stores

- Supermarkets and Hypermarkets

- Online Store

- Gift Shops

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes home decor stores, supermarkets and hypermarkets, online store, gift shops, and others.

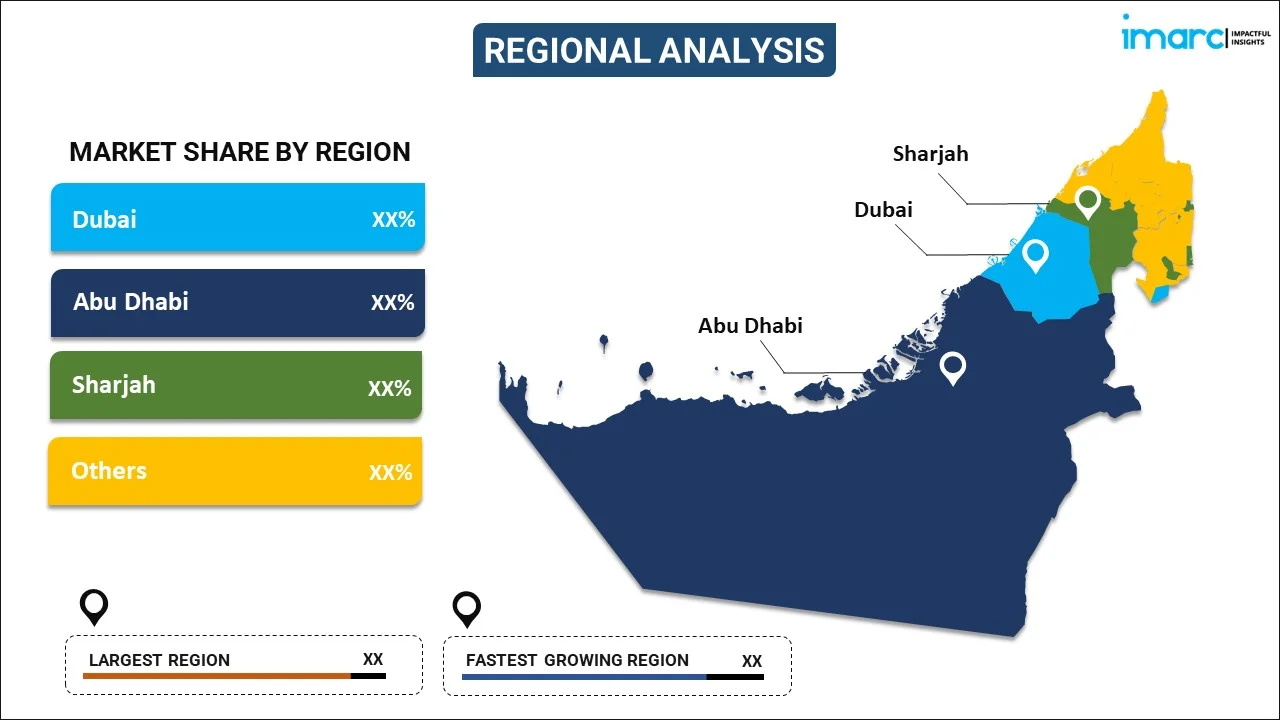

Region Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Home Decor Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Home Furniture, Home Textiles, Flooring, Wall Decor, Lighting, Others |

| Distribution Channels Covered | Home Decor Stores, Supermarkets and Hypermarkets, Online Store, Gift Shops, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE home decor market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the UAE home decor market?

- What is the breakup of the UAE home decor market on the basis of product type?

- What is the breakup of the UAE home decor market on the basis of distribution channel?

- What are the various stages in the value chain of the UAE home decor market?

- What are the key driving factors and challenges in the UAE home decor?

- What is the structure of the UAE home decor market and who are the key players?

- What is the degree of competition in the UAE home decor market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE home decor market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE home decor market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE home decor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)