UAE Health Insurance Market Size, Share, Trends and Forecast by Type, and Service Provider, 2025-2033

UAE Health Insurance Market Size and Share:

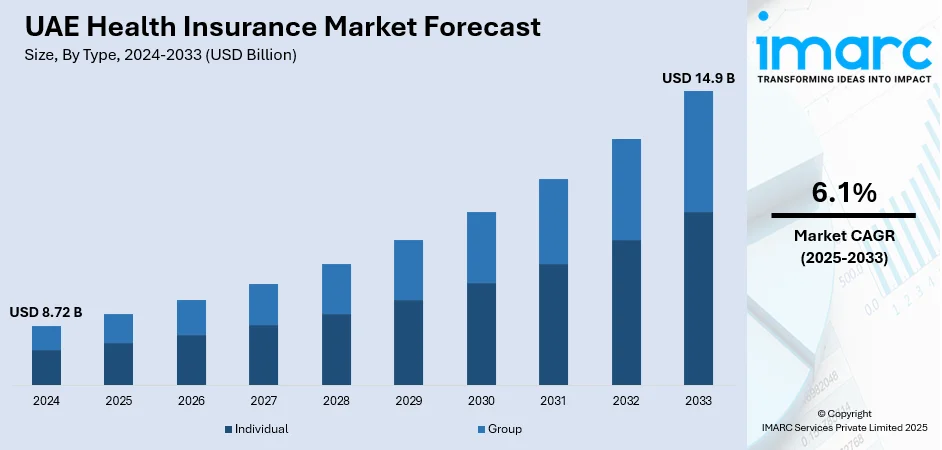

The UAE health insurance market size was valued at USD 8.72 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 14.9 Billion by 2033, exhibiting a CAGR of 6.1% during 2025-2033. The mandatory insurance regulations across Emirates like Abu Dhabi and Dubai, increasing demand for private healthcare services, and rising awareness about health risk protection are propelling market growth. In addition to this, the rising population, a growing influx of expatriates seeking comprehensive medical coverage, increased government investment in healthcare infrastructure, digitalization of insurance services, and higher consumer awareness are some of the major factors augmenting UAE health insurance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 8.72 Billion |

|

Market Forecast in 2033

|

USD 14.9 Billion |

| Market Growth Rate (2025-2033) | 6.1% |

The market is driven by the increasing prevalence of chronic diseases such as diabetes and cardiovascular conditions, which is prompting individuals and employers to seek comprehensive health plans. Besides this, strategic collaborations between insurance providers and healthcare institutions are enhancing service efficiency and patient experience. Moreover, continual advancements in digital health technologies and telemedicine services are also encouraging insurers to develop innovative product offerings. Apart from this, the growing awareness of mental health and its integration into insurance coverage is becoming a key factor shaping consumer preferences in the UAE health insurance sector. This shift is especially relevant as mental health challenges gain increased visibility across different population segments. For instance, an industry survey revealed that women attending well-childcare clinics in the Emirate of Abu Dhabi during the study period faced a 35% likelihood, approximately one in three of experiencing postpartum depression. Among these, 18% were at modest risk, 7% at moderate risk, and 10% at severe risk. These findings highlight the urgent need for accessible mental health support within insurance frameworks.

In addition to this, rising healthcare costs and the expansion of private medical infrastructure are compelling individuals to opt for insurance as a financial safeguard. According to industry reports, there were 11.06 million expatriate population living in the UAE. The country’s rapidly expanding expatriate population continues to boost insurance enrollment, particularly among private-sector employees. Additionally, government-led initiatives to promote preventive healthcare and wellness are intensifying the focus on long-term cost management through insurance. Also, strategic investments by global insurers and local firms alike are improving product diversity and accessibility, reinforcing market development.

UAE Health Insurance Market Trends:

Rising Need for Enhanced Healthcare Services Among Patients

The growing adoption of health insurance due to the increasing need for enhanced healthcare services among patients is positively influencing the market growth. People are increasingly adopting healthcare insurance as they are suffering from various chronic diseases, such as heart disease, diabetes, asthma, arthritis, and obesity. According to a 2022 study by the National Institutes of Health (NIH) in the UAE, the prevalence of chronic diseases among the respondents was found to be between 16.5% and 30.0%. People are facing these issues due to their changing lifestyles and poor dietary patterns. Health insurance coverage supports ongoing management and treatment of these conditions, including medications, regular check-ups, and specialist consultations that assist in improving health outcomes and reducing healthcare costs in the long run, which is offering a positive UAE health insurance market outlook.

Apart from this, major players are providing a range of ideas to satisfy the needs of individuals while meeting their specific preferences. For instance, e& Enterprise and the National Health Insurance Company–Daman, a division of PureHealth, which is the biggest integrated healthcare platform in the Middle East, launched the Hyakum Digital Booth on March 27, 2024, in Dubai. This innovative idea aims to facilitate accessibility and enhance user service. Unmatched 24/7 insurance service accessibility is made possible by the Hayakom Digital Booth. After a Proof of Concept (POC) in two strategic locations, this innovative project plans to expand to more than 20 venues in three years aggressively. Modern self-service health insurance kiosks will be connected to a central command center, utilizing the integration of artificial intelligence (AI) and the Internet of Things (IoT) to provide optimal operating efficiency and a high-quality customer experience. High-security video monitoring, interactive touchscreens, Emirates biometric and identity verification, and sophisticated document scanning will all be included in the kiosks. Further, a strong data infrastructure driven by the fifth generation (5G) will support these features.

Growing Population Increasing Demand

The rising focus on preventive healthcare services is contributing to the UAE health insurance market growth. Health insurance plans include coverage for preventive care services such as screenings, vaccinations, and wellness programs. This focus on preventive healthcare encourages individuals to prioritize their health and well-being, leading to earlier detection and management of health issues, ultimately reducing the need for more extensive and costly treatments. In line with this, the rising population, along with the prevalence of chronic diseases in the region, increases the need for health coverage. As per industry reports, the population of the UAE accounts for 0.14% of the global population in 2025 and is estimated to be growing at an annual rate of 2.89%. Health insurance mitigates the financial burden on any one individual or insurer when it comes to covering healthcare expenses.

Favorable Government Initiatives and Regulatory Framework

Governing agencies in the UAE are implementing initiatives and regulatory frameworks which are bolstering market expansion. They are focusing on mandating health insurance for all residents, which increases the demand for health insurance products. Regulations continue to evolve, impacting the market dynamics and driving innovation, thereby increasing UAE health insurance market demand. For instance, the Department of Health–Abu Dhabi (DoH), which oversees the healthcare industry in the Emirate, launched a flexible health insurance plan in Abu Dhabi in February 2023 in collaboration with the Abu Dhabi Department of Economic Development (ADDED). The recently introduced option aims to improve the Emirate's standing as a desirable location for investors and entrepreneurs who want to live and work there, as well as increase access to top-notch healthcare services for all members of the community that meet the strictest quality and efficiency requirements. The flexible health insurance policy aims to meet the growing demand for insurance plans among the public in the United Arab Emirates by attracting additional investments to the Emirate of Abu Dhabi and targeting present and prospective business owners and investors. In addition to offering an inexpensive and competitive insurance option to investors, entrepreneurs, and others, the new flexible health insurance policy also allows flexible insurance holders to improve their coverage in accordance with the insurance provider's terms.

Various Collaborations and Partnerships Among Companies

One of the significant UAE health insurance market trends is the rising focus on collaborations, partnerships, and mergers and acquisitions (M&As), which are supporting market growth. These initiatives benefit in introducing new insurance plans that cater to the unique needs of a diverse population, while increasing UAE health insurance market revenue. For example, one of the top insurance companies in the United Arab Emirates, Sukoon (formerly Oman Insurance Company), has extended its collaboration with Aster DM Healthcare (one of the biggest integrated healthcare service providers in the GCC and India) by introducing two new health insurance plans that cater to the needs of both individuals and large to mid-sized corporates. Accessibility and affordability are frequently obstacles that prevent both individuals and business workers from making healthy physical health improvements. To provide access to a larger network, Sukoon and Aster DM Healthcare have introduced two cutting-edge healthcare plans. "Shield Saver" and "Shield Saver Plus," the two new health insurance plans, are intended to provide people with more accessibility and convenience. Both plans make use of Aster DM Healthcare's robust geographic footprint by providing access to a larger network. Additionally, through the myAster mobile app, members will have access to round-the-clock virtual care with no co-pay for consultations, lab tests, radiography, and prescription medications.

UAE Health Insurance Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the UAE health insurance market, along with forecasts at the country level from 2025-2033. The market has been categorized based on type and service provider.

Analysis by Type:

- Individual

- Group

Group leads the market with around 81.7% of market share in 2024. Employers often provide group health insurance plans as part of their employee benefits package. They operate on the principle of risk pooling, which means that the premiums paid by all members of the group are pooled together to cover the healthcare expenses of the entire group. This spreads the risk across a larger number of people, which can help lower costs for individual members. Additionally, group health insurance plans often have lower premiums as compared to individual health insurance plans. This is because the risk is spread across a larger group of people, which can result in cost savings for both the insurer and the insured members. Furthermore, they help promote a healthy workforce and reduce absenteeism, provide financial protection for unexpected medical expenses, and offer a variety of coverage options to fit the needs of the group.

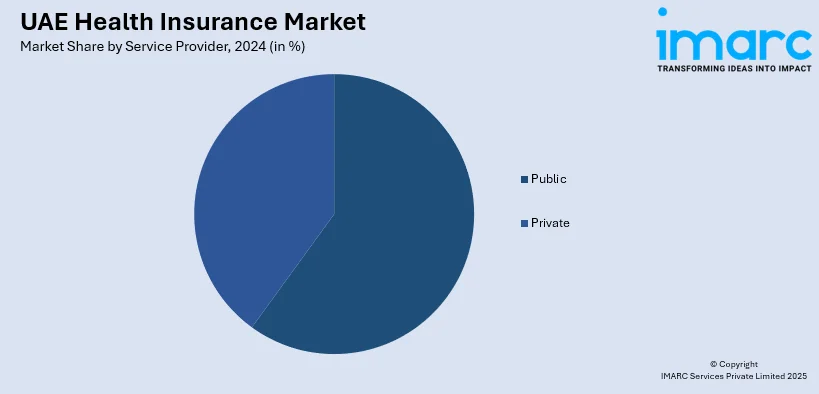

Analysis by Service Provider:

- Public

- Private

Private leads the market with around 64.9% of market share in 2024. Private health insurance service providers create and offer a diverse range of health insurance plans to cater to different requirements and budgets. These plans cover a range of medical expenses, including hospitalization, diagnostic tests, doctor visits, prescription medications, and other healthcare services. On 19 March 2024, The UAE enacted a national law mandating that companies in the private sector offer health insurance to domestic workers and employees who do not currently have such coverage. Beginning on January 1, 2025, the ruling will be subject to mandatory enforcement. There are several benefits to this choice for everyone concerned. For workers, it guarantees coverage; for insurance firms, it means more profits and larger risk pools; and for the healthcare industry, it provides a motivator to improve healthcare infrastructure across the country.

Competitive Landscape:

The key players in the market are providing customizable plans that allow individuals to tailor their coverage based on their specific healthcare needs and financial capabilities. This includes options for deductibles, coverage limits, co-payments, and additional benefits such as dental, vision, maternity, or wellness programs. According to the UAE health insurance market forecast, strategic alliances and partnerships are expected to play a key role in shaping the market growth trajectory. These partnerships aim to enhance user experience, improve care outcomes, and reduce administrative costs. For instance, AXA-Global Healthcare partnered with The National Health Insurance Company-Daman, the biggest health insurer in the United Arab Emirates, on April 30, 2024, to provide a brand-new, industry-leading International Private Medical Insurance (IPMI). Businesses with a global workforce can benefit from the premium healthcare plans, which enable workers to get the best care available anywhere in the globe while on assignment. Daman runs the new global healthcare plan and is compliant and licensed locally. AXA-Global Healthcare provides international support. An important milestone in AXA-worldwide Healthcare's worldwide growth strategy has been reached with this agreement.

The report provides a comprehensive analysis of the competitive landscape in the UAE health insurance market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: The National Health Insurance Company, Daman, a division of UAE’s PureHealth, started a nationwide campaign in order to improve health insurance knowledge and enable the general population to make better decisions regarding their healthcare insurance. The educational campaign began during the Abu Dhabi Global Health Week 2025.

- March 2025: Dubai National Insurance introduced a new Group Protection Insurance program for blue-collar employees in the UAE in partnership with Nexus Insurance Brokers LLC. The plan provides comprehensive coverage, which includes benefits for repatriation costs, permanent disablement, and natural and accidental fatalities.

- January 2025: HAYAH Insurance launched Care Protect, a health insurance program created to improve and streamline access to complete health coverage for families and individuals throughout the UAE.

- January 2025: Policybazaar.ae launched PB Advantage, a health insurance initiative offering 30-minute claims assistance, Auto Recharge (restores full coverage post-claim), and No Claim Bonus (10% annual sum increase for claim-free years, up to 50%). Features include policy portability to India, cashless claims, and complimentary health check-ups.

- December 2024: As part of the UAE Cabinet-approved Health Insurance Scheme, the Ministry of Human Resources and Emiratization (MoHRE) introduced a basic health insurance plan for domestic workers and employees in the private sector in the UAE who are currently without insurance.

- November 2024: Dubai Insurance partnered with Aster DM Healthcare to launch ‘Vibrance Senior’, a health insurance package designed to address the healthcare requirements of older citizens in the United Arab Emirates. This approach aims to ensure that senior citizens can access a wide range of medical services, from expert treatments to preventive services, through Aster’s hospitals and pharmacies.

- November 2024: Reinsurance Group of America launched Aspire, a licensed third-party operator, in the UAE. Aspire was designed in collaboration with the tech company CarePay and aids in health insurance portfolio management for insurance firms.

UAE Health Insurance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Individual, Group |

| Service Providers Covered | Public, Private |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE health insurance market from 2019-2033.

- The UAE health insurance market research report provides the latest information on the market drivers, challenges, and opportunities in the regional market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE health insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The health insurance market in UAE was valued at USD 8.72 Billion in 2024.

The growth of the UAE health insurance market is driven by the increasing expatriate population, and rising awareness of preventive healthcare. The implementation of government initiatives to enhance healthcare infrastructure, growing medical tourism, and adoption of digital health services also support growth. Additionally, employer-provided coverage and increasing private sector participation are reinforcing market penetration.

The health insurance market in UAE is projected to exhibit a CAGR of 6.1% during 2025-2033, reaching a value of USD 14.9 Billion by 2033.

Group holds the largest share in UAE health insurance due to mandatory employer coverage policies, especially in Dubai and Abu Dhabi. Large expatriate workforce, cost-efficiency of bulk premiums, and comprehensive corporate health benefits drive uptake. Employers prefer group plans to ensure compliance and employee satisfaction, making this segment the most widely adopted.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)