UAE Furniture Market Size, Share, Trends and Forecast by Product, Material, End Use, and Region, 2025-2033

UAE Furniture Market Size and Share:

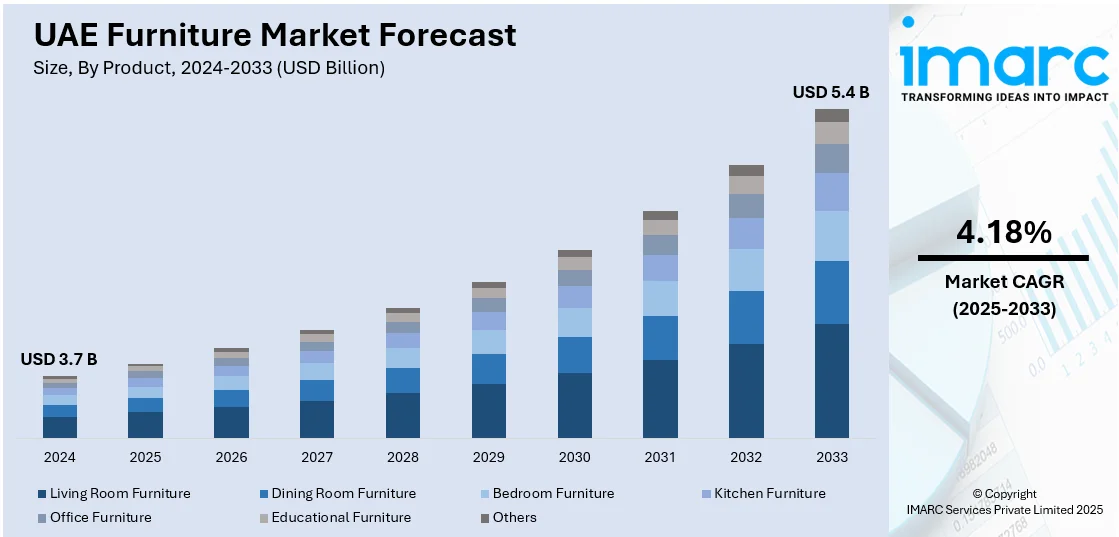

The UAE furniture market size was valued at USD 3.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.4 Billion by 2033, exhibiting a CAGR of 4.18% from 2025-2033. The rising disposable incomes, rapid urbanization, strong tourism and hospitality industry, favorable initiatives taken by the government, developments in the real estate sector, increasing emphasis on sustainability, and technological advancements are primary factors driving the market across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.7 Billion |

| Market Forecast in 2033 | USD 5.4 Billion |

| Market Growth Rate (2025-2033) | 4.18% |

The UAE furniture market is witnessing robust growth, driven by a combination of urbanization, demographic shifts, evolving consumer preferences, and technological advancements. According to the Central Intelligence Agency, by 2025, urbanization is expected to surge to an annual rate of 1.5% in UAE. Other cities, such as Abu Dhabi and Dubai, continuously grow in size, enhancing demand for residential and also commercial furniture. There is an increased need for more up-to-date and functional furniture for modern houses due to increased people relocation towards urban areas and increasing the number of newly developed properties. The population of the UAE constitutes a significant number of expatriates, which have different tastes and preferences, thus influencing the demand for customized, contemporary, and luxury furniture. Among these, young professionals and millennials are interested in furniture items that represent their lifestyle in the form of multifunctional, space-saving, and smart furniture pieces. Consumers' ability to save is also bound to the increasing levels of disposable income, through which consumers are more and more eager to spend their money on high-end designer and bespoke furniture items designed around their personalities and needs. Smart furniture, automated systems, energy-efficient solutions, and furniture items containing built-in technology features, including USB ports and wireless charging stations, are also taking off.

With the prevalence of online shopping and e-commerce websites, furniture is available for the consumer. It offers more options, as well as the comfort of being shopped for at any given time. Easy online furniture shopping enabled competitive pricing both to the business side and consumers' pockets. There is a growing concern about sustainability on the part of UAE consumers. There is an increasing awareness about the environment, and this translates to a demand for more eco-friendly and sustainable furniture. Manufacturers are responding to these demands by using renewable and recyclable materials in designs, such as sustainably sourced wood and more environmentally friendly upholstery options. Another indicator of sustainability is the trend of minimalist, functional furniture designs that allow for greater energy efficiency and waste reduction. Global interior design trends also impact the UAE furniture market. This is because of the region's penchant for a luxurious lifestyle, where premium furniture brands are constantly in demand. International furniture designers and high-end global brands continue to increase their penetration in the UAE, bringing sophisticated, luxury furniture collections that meet the taste of the elite consumer base. The rise of professional interior designers and stylists in the country has resulted in a growing demand for uniquely curated, personalized furniture that reflects contemporary and global aesthetics.

UAE Furniture Market Trends:

Rise in demand for luxury and custom furniture

Luxury and custom furniture demand is witnessing a significant increase in UAE owing to the increasing affluent populations in the region and increased land sales in real estate industries. HNWIs opt more for bespoke pieces that indicate and reflect their personality and wealth. This trend is further supported by Dubai’s solid residential market performance in Q3 2024, where average prices registered a nearly 20% increase compared to the previous year, driven by a 19% rise in average apartment prices and a 23% increase in average villa prices, as per the CRBE. There is an increased demand for luxury furniture due to the growth in high-end residential developments, hotels, and commercial properties across cities such as Dubai and Abu Dhabi. Brands are responding by providing customized solutions and bespoke designs. International and local designers are collaborating to cater to this premium segment, which has both aesthetic and functional appeal. For starters, as with the increasing popularity of social media in interior design, there has been an interest in lavish home decor products. Here below is a description of just those.

Sustainability and eco-friendly furniture solutions

Rising sustainability is one of the biggest trends in the UAE furniture market as it is increasingly focused on sustainable and ethically sourced products. With the Abu Dhabi Climate Change Strategy aiming to reduce 22% of carbon emissions by 2027, furniture production's alignment with such objectives becomes more pronounced. Manufacturers now adopt eco-friendly practices, use recycled materials, do not leave carbon footprints, and emphasize green production. Consumers are targeting environmentally conscious furniture brands such as furniture from responsibly sourced woods and the use of organic and biodegradable products. Furthermore, a new trend of circular economy models is increasing the pressure on furniture brands to emphasize longer use, repairability, and recyclability. An ecologically conscious younger generation dictates their preferences for purchases within the furniture market, promoting the sustainability movement in this market. The momentum should pick up even faster given the fact that more urban residents are adopting the global agendas toward sustainability.

Technological integration in furniture

Another trend increasing the UAE furniture market share is the use of advanced technology in furniture products. Smart furniture is on the rise, especially with the ever-growing smart home and IoT markets. Consumers are now demanding more innovative furniture than usual, such as adjustable smart beds, wireless charging tables, and voice-activated lighting. With the increased growth of urban living and compact spaces, multifunctional furniture that can fold, be modular, or save space is increasingly becoming a standard piece in both homes and offices. Technology integrated into furniture is providing an added layer of convenience and personalization for tech-savvy and convenience-driven consumers in the UAE. This trend is in line with the vision of the UAE: becoming a global leader in technologically driven solutions, helping fast-track the adoption of smart furniture across residential and commercial spaces.

UAE Furniture Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the UAE furniture market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product, material, and end use.

Analysis by Product:

- Living Room Furniture

- Dining Room Furniture

- Bedroom Furniture

- Kitchen Furniture

- Office Furniture

- Educational Furniture

- Others

The living room furniture market share is primarily driven by the requirement of diverse, stylish furniture elements, such as modular sofas, and entertainment units, answering to the needs of current space-conscious living. Dining room furniture benefits from a growing preference for formal dining setups and premium materials, such as marble or solid wood, among urban households. Bedroom furniture, including beds, wardrobes, and dressers, is driven by the demand for ergonomic and storage-efficient designs. Kitchen furniture is driven by the increasing adoption of modular kitchens and smart cabinetry solutions. Office furniture is driven by hybrid work models and an increased need for ergonomic furniture in terms of productivity. Popular office furniture types in Dubai include ergonomic chairs (35%), collaborative workstations (20%), height-adjustable desks (25%), storage solutions (10%), and lounge furniture (10%). These items are aimed at creating flexible and efficient work environments that prioritize employee comfort and well-being. Educational furniture, on the other hand, is driven by investments in schools and training centers and demands durable and functional designs fit for the learning environment.

Analysis by Material:

- Metal

- Wood

- Plastic

- Glass

- Others

Metal furniture is prized for its durability and sleek, industrial designs. Its high value makes it popular both in residential and commercial settings. Its ability to not wear off easily and minimal maintenance is a driving factor for consumers seeking long-lasting solutions. Wood furniture is in demand due to its timeless appeal, versatility, and the growing availability of sustainable and responsibly sourced options. Its natural look and workmanship make it suitable for all ranges of styles, from old to modern. Plastic furniture is preferred due to its low cost, lightness, and resistance to environmental effects, making it a very suitable furniture for outdoor or casual settings. Glass furniture is used in the forms of dining tables, shelves, and decorative items. People who want a very smooth, modern look are the ones who opt for glass furniture. It's reflective quality and elegant designs enhance spaces, adding a sense of sophistication and lightness to interiors.

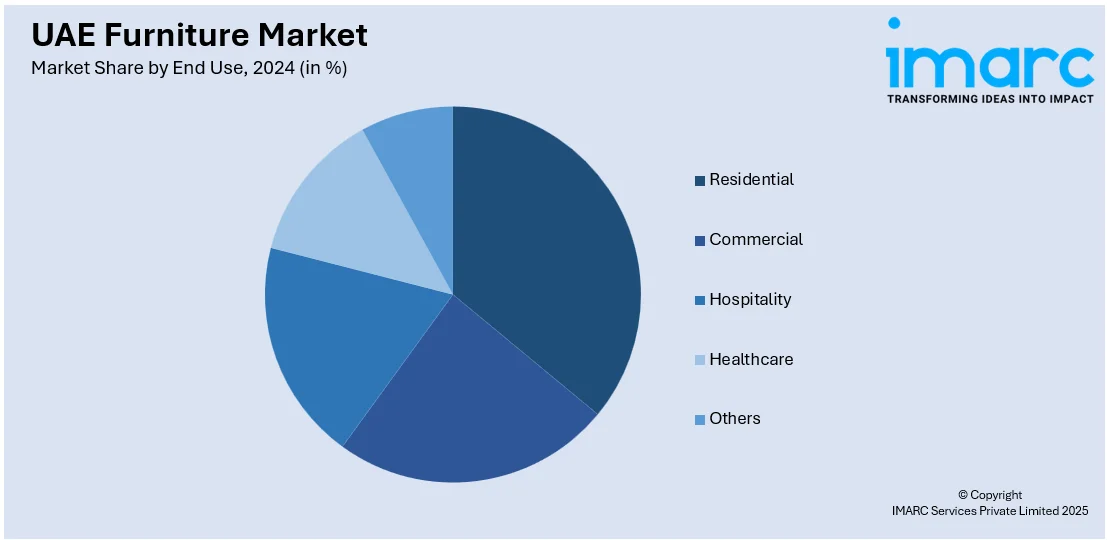

Analysis by End Use:

- Residential

- Commercial

- Hospitality

- Healthcare

- Others

Residential furniture leads the market, driven by increasing urbanization, higher disposable incomes, and a growing preference for personalized and multifunctional furniture to suit modern apartments and villas. The rise in corporate office expansions, co-working spaces, and growing demand for ergonomically designed furniture to enhance employees' productivity drives the market for commercial furniture, encompassing office desks, chairs, and storage units. This growth in commercial leasing is indicative of the rising demand for furniture to accommodate the expanding urban population. Hospitality furniture, such as hotel room furniture, lobby, and outdoor furniture, benefits from significant demand as tourism flourishes in the country, while the number of luxury and mid-tier hotels is also on the increase. Healthcare furniture, such as hospital beds, seating, and cabinets, is driven by investments in advanced medical facilities and the need for durable, easy-to-clean, and functional designs tailored to healthcare environments. Each category reflects a unique set of drivers aligned with its respective end-user demands and sector growth.

Regional Analysis:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The city of Dubai, being a global business and tourism hub, is a major driver for furniture demand, thanks to the real estate sector, luxury hotel developments, and high consumer spending power. Modern, high-end interiors, as well as the growing expatriate communities, increase demand for stylish and functional furniture according to varied tastes. The infrastructure development through the government and grand schemes for urbanization in Abu Dhabi will largely impact the furniture market. The Abu Dhabi Projects and Infrastructure Centre (ADPIC) announced that the Abu Dhabi Executive Council has approved the launch of 144 projects across the emirate, with a total budget of approximately AED66 Billion. This development will create a surge in demand for residential, commercial, and public space furniture, driven by new housing, office spaces, and commercial developments. Sustainability development by the region along with meeting its environmental goals is enhanced, and with that, an eco-friendly approach in the furniture sector also is witnessed. Sharjah has an increasing middle-class population. Its demand is also seen for more budget-friendly and heritage traditional furniture. The emirate's growing residential schemes, schools, and SMEs increase demand in the market.

Competitive Landscape:

Key players in the sector are offering a range of affordable and luxurious furniture options to cater to various consumer tastes. Many of these players are extending their market presence through both online and offline retail channels that provide a seamless shopping experience to consumers. There is a greater need for eco-friendly materials, sustainable production methods, and customization in order to satisfy the consumer's demand for something unique and customized. Moreover, smart home furniture, which brings technology and convenience together, is an emerging factor that influences product development. Home automation, with the increasing interest of consumers in convenience, energy efficiency, and enhanced living experience, is increasingly driving demand for smart home furniture. Nine in 10 residents are willing to pay a premium of over 2.3%, for a home comprising smart technology features, according to Construction Week, further fueling the trend. Players are also introducing innovative solutions that blend functionality with aesthetic appeal, further driving UAE furniture market growth. The focus on delivering quality products, responsive customer service, and competitive pricing is crucial for maintaining a strong market position.

Latest News and Developments:

- On 19 November 2024, Bentley Home launched its first store in the UAE, commemorating its 11th year in business. The store located in Dubai Mall Zabeel displayed iconic collections and new pieces like the Wilton desk and Bollington armchair. The store was created with the support of The Mattress Store and marked Bentley's entry into the UAE market.

- On 29 August 2024, Al-Futtaim IKEA, opened its new small store at the Dalma Mall in Abu Dhabi, marking the opening of the second new store in the last month. The 50,000 sq ft store offered 5,000 products of which 32% was sustainable, thereby further expanding the reach and commitment of IKEA in the UAE market.

UAE Furniture Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Living Room Furniture, Dining Room Furniture, Bedroom Furniture, Kitchen Furniture, Office Furniture, Educational Furniture, Others |

| Materials Covered | Metal, Wood, Plastic, Glass, Others |

| End Uses Covered | Residential, Commercial, Hospitality, Healthcare, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE furniture market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the UAE furniture market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE furniture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Furniture relates to a broad range of stylish and functional furniture designs and manufacturing, which ranges from residential and commercial purposes such as sofas, beds, chairs, tables, and office furniture, to modern aesthetics, luxury, and high-quality craftsmanship of different interior designs.

The UAE furniture market was valued at USD 3.7 Billion in 2024.

IMARC estimates the UAE furniture market to exhibit a CAGR of 4.18% during 2025-2033.

Rising levels of disposable income, urbanization across the region, strong tourism and hospitality industry, favorable initiatives taken by the government, developments in the real estate sector, increasing emphasis on sustainability, and rapid technological advancements are driving the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)