UAE Facility Management Market Report by Type (Inhouse, Outsourced), Offering (Hard FM, Soft FM), End User (Commercial, Institutional, Public/Infrastructure, Industrial, and Others), and Region 2025-2033

UAE Facility Management Market Overview:

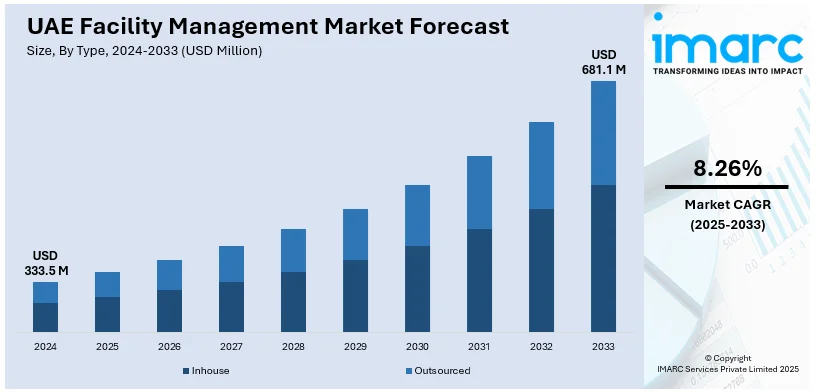

The UAE facility management market size reached USD 333.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 681.1 Million by 2033, exhibiting a growth rate (CAGR) of 8.26% during 2025-2033. The market is primarily driven by the incorporation of smart technologies and IoT for enhanced operational efficiency, a strong focus on viability and green building practices, considerable rise in Integrated Facility Management (IFM) services streamlining operations, and the advent of eco-friendly and technologically advanced management solutions to meet changing client needs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 333.5 Million |

| Market Forecast in 2033 | USD 681.1 Million |

| Market Growth Rate (2025-2033) | 8.26% |

UAE Facility Management Market Analysis:

- Major Market Drivers: The UAE facility management market is driven by rapid urbanization, increasing commercial activity, and a focus on maintaining high-quality standards in buildings and infrastructure.

- Key Market Trends: Key trends include outsourcing of facility management services, adoption of technology-driven solutions, and a growing emphasis on sustainability and energy efficiency.

- Competitive Landscape: The competitive landscape is characterized by a mix of local and international players, with strong competition among providers.

- Challenges and Opportunities: Challenges include fluctuating energy costs, labor shortages, and regulatory compliance. However, the UAE's growing economy and focus on infrastructure development present significant opportunities for the facility management market.

To get more information on this market, Request Sample

UAE Facility Management Market Trends:

Integration of Smart Technologies

The UAE facility management market size is driven by the increasing adoption of the Internet of Things (IoT) as well as integrated smart technologies to enhance operational efficiency and service delivery. This trend involves the adoption of smart sensors, automation systems, and connected devices that enable real-time monitoring and predictive maintenance. The use of IoT in facility management allows for more effective energy management and improved building performance. The increasing need for cost-effective solutions and a growing emphasis on sustainability, is encouraging the facility management providers to invest in advanced technological solutions. Moreover, this rapid integration is leading to intelligent, responsive services that optimize resource utilization, reduce operational costs, and enhance the user experience in managed facilities.

Focus on Sustainability and Green Building Practices

The market is increasingly focusing on sustainability and green building practices, driven by regulatory mandates and growing client demand for environmentally responsible solutions. This trend emphasizes the implementation of energy-efficient systems, waste management protocols, and water conservation measures to minimize the environmental impact of buildings. In addition to this, facility management companies are seeking green building certifications, such as Leadership in Energy and Environmental Design (LEED), to enhance the marketability of properties and attract eco-conscious tenants and investors. By adopting sustainable practices, these companies comply with local regulations as well as contribute to long-term cost savings and improved building performance. This focus on sustainability is reshaping the facility management landscape, thus prioritizing eco-friendly solutions.

Growth of Integrated Facility Management (IFM) Services

A prominent trend in the market is the widespread adoption of Integrated Facility Management (IFM) services, which are significantly enhancing operational efficiency and service quality. The consolidating multiple facility management functions, such as maintenance, cleaning, security, and energy management, under a single contract is revolutionizing the industry by streamlining operations and reducing costs. IFM services also offer a unified approach that delivers greater efficiency and accountability, meeting the rising demand for comprehensive solutions. Furthermore, clients are benefitting from simplified management processes and improved performance outcomes. Additionally, rapid expansion of service portfolios by facility management companies is facilitating the provision of integrated, holistic solutions. This trend is driving the UAE facility management market growth, enabling providers to meet the changing needs of clients.

UAE Facility Management Market News:

- 2nd April 2024: Leading UAE-based smart and green facilities management company Farnek expanded its business operations throughout the emirate of Abu Dhabi following a raft of new and retained FM contract across various industry sectors. Some of the more notable contract wins, include a total facilities management deployment for Mina Zayed, which is an emerging innovation-focused neighbourhood for diverse entrepreneurial communities. Other contracts include Etihad Airways Engineering, and the Barakah Nuclear Power Plant, where Farnek provides cleaning and maintenance services, as well as managing the facilities for the F1 Grand Prix at the Yas Marina Circuit.

- 4th July 2023: Aldar Properties, International Holding Company (IHC), and ADNEC Group are merging their property and facilities management businesses within the Aldar Estates platform, making it the region's largest such entity. This merger significantly enhances Aldar Estates' portfolio, increasing its managed residential units to approximately 135,000 and adding prime retail and commercial spaces, thereby solidifying its leading position in the UAE property and facilities management market. The expanded platform will offer integrated services across its enlarged client base, driving innovation and sustainability in the industry.

UAE Facility Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, offering, and end user.

Type Insights:

- Inhouse

- Outsourced

- Single FM

- Bundled FM

- Integrated FM

The report has provided a detailed breakup and analysis of the market based on the type. This includes inhouse and outsourced (single FM, bundled FM, and integrated FM).

Offering Insights:

- Hard FM

- Soft FM

A detailed breakup and analysis of the market based on the offering have also been provided in the report. This includes hard FM and soft FM.

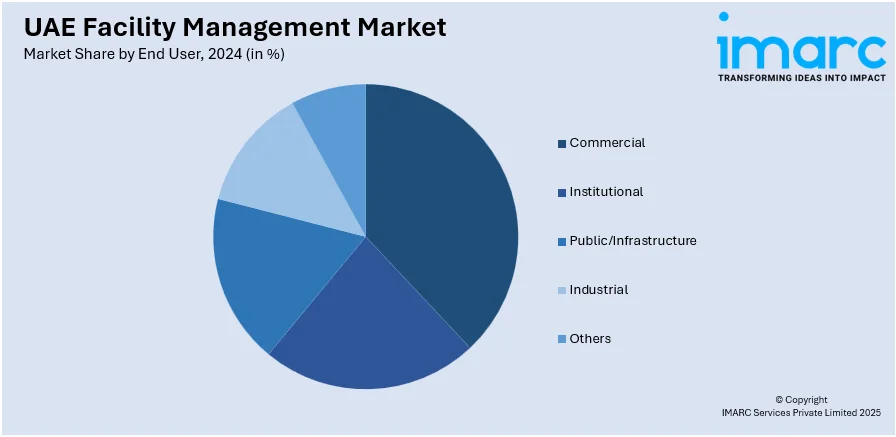

End User Insights:

- Commercial

- Institutional

- Public/Infrastructure

- Industrial

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes commercial, institutional, public/infrastructure, industrial, and others.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive UAE facility management market analysis of all the major regions, which include Dubai, Abu Dhabi, Sharjah, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. The companies in the market are adopting various strategic initiatives including new services and business alliances to gain a significant UAE facility management market share.

UAE Facility Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered |

|

| Offerings Covered | Hard FM, Soft FM |

| End Users Covered | Commercial, Institutional, Public/Infrastructure, Industrial, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE facility management market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the UAE facility management market?

- What is the breakup of the UAE facility management market on the basis of type?

- What is the breakup of the UAE facility management market on the basis of offering?

- What is the breakup of the UAE facility management market on the basis of end user?

- What are the various stages in the value chain of the UAE facility management market?

- What are the key driving factors and challenges in the UAE facility management?

- What is the structure of the UAE facility management market and who are the key players?

- What is the degree of competition in the UAE facility management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE facility management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE facility management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE facility management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)