UAE Electric Vehicle Market Report by Component (Battery Cells and Packs, Fuel Stack, On-Board Charger, Electric Motor, Brake, Wheel and Suspension, Body and Chassis, and Others), Propulsion Type (Battery Electric Vehicle (BEV), Fuel Cell Electric Vehicle (FCEV), Plug-In Hybrid Electric Vehicle (PHEV)), Vehicle Type (Passenger Vehicles, Commercial Vehicles, and Others), and Region 2025-2033

UAE Electric Vehicle Market Overview:

The UAE electric vehicle market size reached USD 2.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.0 Billion by 2033, exhibiting a growth rate (CAGR) of 18.5% during 2025-2033. The market in UAE is primarily driven by rising government initiatives and policies, ongoing infrastructure development, continual technological advancements, economic diversification and sustainability goals, and increasing consumer awareness and environmental concerns.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.4 Billion |

| Market Forecast in 2033 | USD 11.0 Billion |

| Market Growth Rate (2025-2033) | 18.5% |

UAE Electric Vehicle Market Trends:

Rising Consumer Awareness and Environmental Concerns

Growing awareness on effects of climate change and the negative impacts associated with use of fossil fuels, consumers are increasingly adopting electric vehicles. Public education campaigns and media coverage highlighting the benefits of EVs, such as reduced greenhouse gas emissions and lower operating costs, are influencing consumer preferences. Moreover, individuals of the millennial and younger generation prefer environmentally friendly transportation means, due to the high sensitivity to the environment. This new consumer attitude can be explained with reference to the changing culture of sustainability that is becoming more and more popular in different areas including property market and shops. Consequently, the uptake of electric vehicles has increased throughout the country and automakers are bringing out new models while spending on marketing campaigns aimed at environmentally conscious buyers in the UAE.

Ongoing Infrastructure Development

The creation of an expansive charging infrastructure is another pivotal driver of the electric vehicle market in the UAE. With the recognizing necessity of readily available charging stations, both the government and private sector are investing significantly in establishing a comprehensive network of charging facilities. The Dubai electricity and water authority (DEWA) is spearheading this effort with its "Green Charger" initiative, which aims to install charging stations across Dubai, including at public parking areas, shopping malls, and gas stations. This burgeoning infrastructure is tackling one of the main hurdles to EV adoption, range anxiety by ensuring that drivers have easy and reliable access to charging points. Moreover, continual technological advancements in charging, such as fast-charging stations, are further increasing the allure of electric vehicles by cutting down charging times and propelling the practicality of EV ownership.

Continual Technological Advancements

Constant advancements in battery technology including lithium-ion and solid-state batteries are improving the range, charging time and overall efficiency of electric cars. These developments contribute to the fact that EVs are now far more convenient and efficient than traditional internal combustion engine vehicles. Furthermore, the synergy of smart technologies including connected and autonomous driving technologies is enhancing the use of electric vehicles among car enthusiasts with regard to innovative technology. Advanced features, such as regenerative braking, ADAS, and infotainment concepts are making the consumers more interested in electric vehicles. Also, the growing trends in research and development by manufacturers will lead to the availability of more efficient and cheaper technologies that increases the adoption rate of electric vehicles in the UAE.

UAE Electric Vehicle Market News:

- On 12th December 2023, Hedin Mobility Group AB (PUBL) and Ford Motor Company signed a non-binding memorandum of understanding (MoU) regarding the acquisition of Ford’s national sales company in Finland.

- On 4th January 2024, Samsung partnered with Hyundai motor group to present a future lifestyle connecting the smart home with connected cars. The companies work together for the next-generation smart home to connect Samsung’s smart things with Hyundai and Kia’s connected cars, including EVs, to develop the “Home-to-Car” and “Car-to-Home” services as well as an integrated home energy management service.

UAE Electric Vehicle Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, propulsion type, and vehicle type.

Component Insights:

- Battery Cells and Packs

- Fuel Stack

- On-Board Charger

- Electric Motor

- Brake, Wheel and Suspension

- Body and Chassis

- Others

The report has provided a detailed breakup and analysis of the market based on the component. This includes battery cells and packs, fuel stack, onboard chargers, electric motor, brake, wheel and suspension, body and chassis, and others.

Propulsion Type Insights:

- Battery Electric Vehicle (BEV)

- Fuel Cell Electric Vehicle (FCEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

A detailed breakup and analysis of the market based on the propulsion type have also been provided in the report. This includes battery electric vehicle (BEV), fuel cell electric vehicle (FCEV) and plug-in hybrid electric vehicle (PHEV).

Vehicle Type Insights:

- Passenger Vehicles

- Commercial Vehicles

- Others

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger vehicles, commercial vehicles, and others.

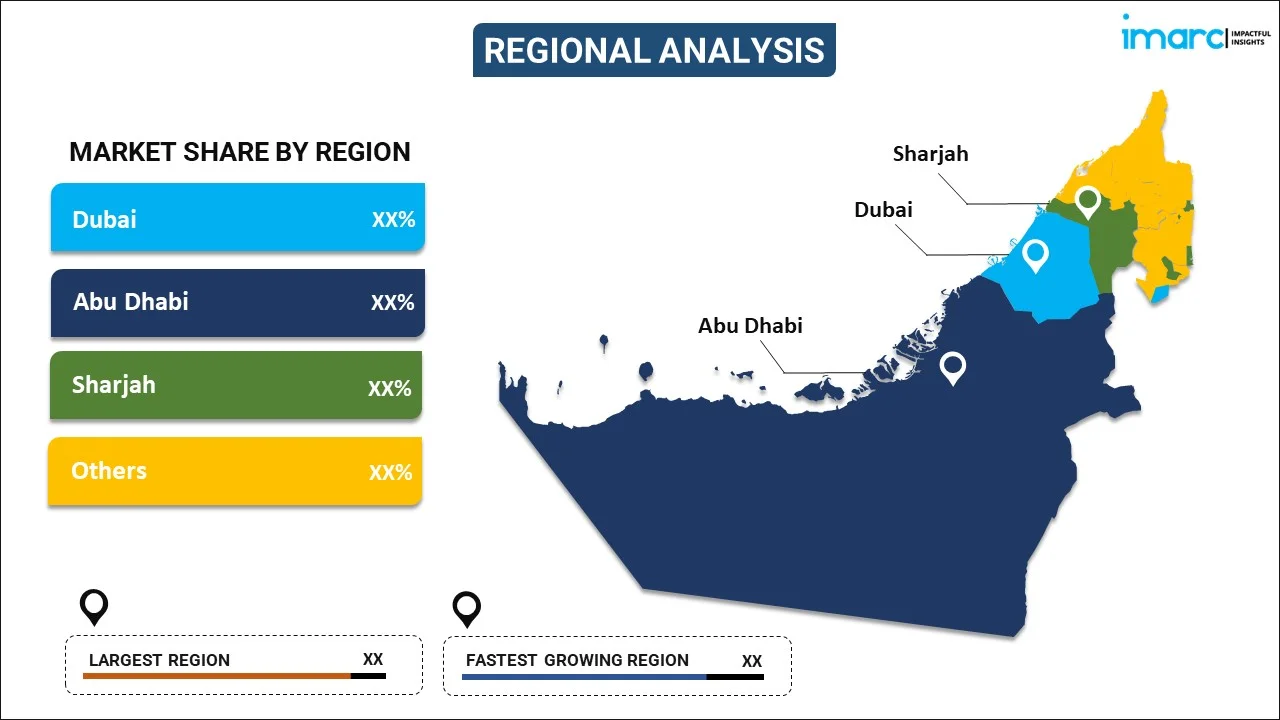

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Electric Vehicle Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered | Battery Cells and Packs, Fuel Stack, On-Board Charger, Electric Motor, Brake, Wheel and Suspension, Body and Chassis, Others |

| Propulsion Types Covered | Battery Electric Vehicle (BEV), Fuel Cell Electric Vehicle (FCEV), Plug-In Hybrid Electric Vehicle (PHEV) |

| Vehicle Types Covered | Passenger Vehicles, Commercial Vehicles, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE electric vehicle market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the UAE electric vehicle market?

- What is the breakup of the UAE electric vehicle market on the basis of component?

- What is the breakup of the UAE electric vehicle market on the basis of propulsion type?

- What is the breakup of the UAE electric vehicle market on the basis of vehicle type?

- What are the various stages in the value chain of the UAE electric vehicle market?

- What are the key driving factors and challenges in the UAE electric vehicle?

- What is the structure of the UAE electric vehicle market and who are the key players?

- What is the degree of competition in the UAE electric vehicle market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE electric vehicle market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE electric vehicle market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE Electric vehicle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)