UAE Dairy Market Size, Share, Trends and Forecast by Product Type, and Region, 2025-2033

UAE Dairy Market Size and Share:

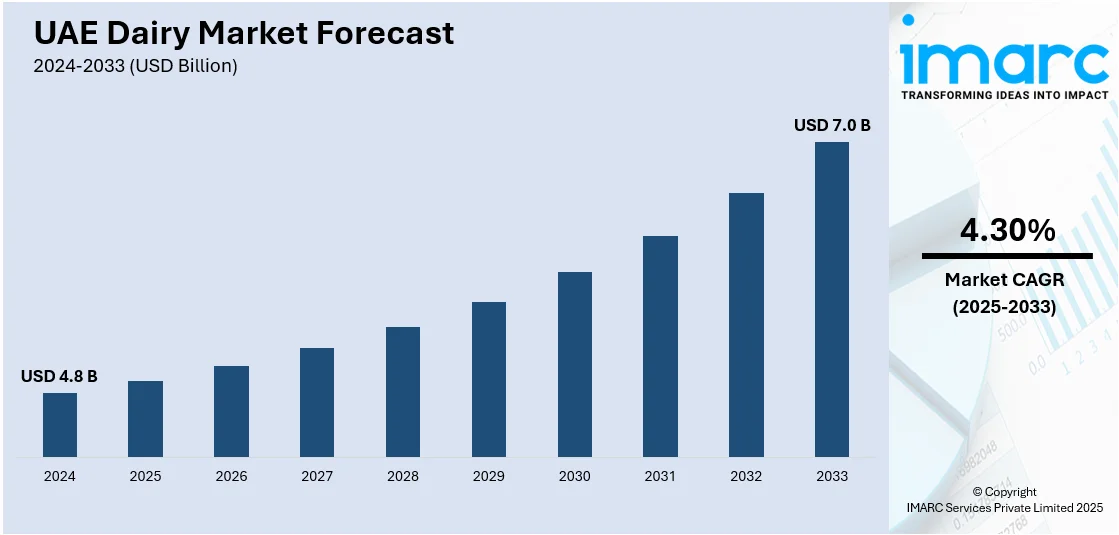

The UAE dairy market size was valued at USD 4.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 7.0 Billion by 2033, exhibiting a CAGR of 4.30% from 2025-2033. The rising population and urbanization in the country, evolving consumer dietary habits, increasing health consciousness among people, ongoing product innovation in the dairy sector, and the implementation of supportive government policies are some of the factors pushing the market forward.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.0 Billion |

| Market Growth Rate (2025-2033) | 4.30% |

The UAE has experienced rapid population growth in recent years, which is a significant driver for increased demand in various sectors, including dairy. As of 2023, the country’s population is 10.17 million, with a notable percentage of expatriates (88.5%). Urbanization trends have led to more families and individuals in urban centers, such as Dubai and Abu Dhabi, where dairy consumption is more frequent due to lifestyle habits. The growing number of households, combined with a rising preference for convenience foods, is boosting milk production in UAE. As cities become more densely populated, there’s a rising need for diversified dairy products, including packaged milk, cheeses, and yogurt, all of which cater to different dietary preferences. Moreover, urban consumers often lean toward convenience and health-consciousness, making dairy products that offer nutritional benefits, such as fortified milk, more popular. This demographic shift not only impacts local consumption but also fosters a growing export market for dairy goods, with the UAE positioned as a regional hub.

To get more information on this market, Request Sample

In recent years, the UAE has witnessed a shift in consumer behavior towards healthier eating habits, with a greater focus on nutrition. Dairy, being a primary source of protein, calcium, and vitamins, is increasingly incorporated into daily diets. The government’s emphasis on public health through initiatives such as the UAE Food Security Strategy (launched in 2020) also plays a pivotal role in promoting nutritional awareness. The popularity of health and wellness trends has led to the introduction of low-fat, lactose-free, and plant-based dairy products. These products cater to the growing demand from consumers with dietary restrictions, such as lactose intolerance or vegan preferences. Additionally, the rising awareness around obesity, particularly among the youth population, is prompting consumers to adopt healthier dairy alternatives. According to a latest report, more than 39% of the adult population in UAE is obese, highlighting the importance of functional and low-calorie dairy options in curbing health issues. Products like probiotic yogurt, fortified milk with vitamin D, and other value-added dairy items are gaining significant traction, reflecting this shift in dietary habits.

UAE Dairy Market Trends:

Increasing Demand for Organic Dairy Products

With rising health consciousness and environmental awareness among consumers, there is a increase in the preference for dairy products devoid of artificial additives, hormones, and pesticides. This trend is particularly noticeable among younger, wealthy consumers who are ready to spend more on organic choices that reflect their principles of sustainability and natural lifestyles. Moreover, the growing recognition of the health advantages linked to organic dairy, including improved nutritional value and reduced chemical residues, is contributing to the increasing demand. As a result, dairy companies are focusing on organic product ranges to meet this changing consumer demand. In 2025, Meliha, a dairy brand owned by Sharjah's Department of Agriculture and Livestock, launched a new organic laban product in response to rising demand for organic dairy in the UAE. The laban, produced at Meliha Dairy Farm, is available in multiple sizes and is part of the company's expansion to meet local and regional market needs. The initiative aligns with Sharjah's 2025 "Golden Year" for organic food sustainability.

Technological Advancements in Dairy Production

Innovations in dairy production technology are bolstering the market growth by improving efficiency and boosting product quality. Contemporary dairy farming practices, including automated milking and enhanced feed management systems, are greatly improving production capacity while lowering operational expenses. Furthermore, improvements in dairy processing, including ultrafiltration and advanced fermentation techniques, are facilitating the creation of innovative and targeted products that attract health-oriented consumers. These advancements aid in guaranteeing that dairy items adhere to elevated safety and nutritional benchmarks, essential for preserving consumer confidence. The implementation of advanced packaging technologies are also helping in extending shelf life and enhancing product preservation, enabling dairy items to reach a wider user group throughout the UAE. These technological advancements are influencing the market by enhancing production productivity, broadening product ranges, and sustaining competitive costs.

Government Support and Strategic Initiatives

Support from the government and strategic initiatives are impelling the market growth as they foster innovation, enhance local production capabilities, and ensure sustainability, which boosts both domestic supply and consumer confidence in the industry. The government's emphasis on bolstering local production abilities and decreasing dependence on imports is creating a favorable atmosphere for growth in the dairy sector. Measures designed to guarantee food security, like grants for local dairy producers and funding for sustainable farming methods, are further strengthening local production. In addition, several efforts aimed at enhancing the overall supply chain framework, ranging from agricultural methods to logistics systems, are resulting in a more effective dairy market. These governmental actions are allowing local manufacturers to provide competitive rates while preserving superior quality standards. Ongoing investments in technology and innovation are enhancing the dairy sector, fostering long-term sustainability and growth in the UAE market.

UAE Dairy Market Growth Drivers:

Changing Consumer Preferences and Lifestyle Shifts

Consumers in the UAE are increasingly selective, showing a clear shift towards products that match their dynamic and rapid lifestyles. This change reflects a preference for convenience, like ready-to-drink (RTE) dairy products and single-serve containers, simplifying the incorporation of dairy into consumers' everyday lives. Furthermore, the growing inclination towards specialized dairy items, such as probiotic-enriched yogurts and functional milk drinks, showcases the rising demand for products that address particular health requirements. This evolving environment suggests that consumer preferences are moving beyond conventional dairy products, encouraging producers to create and introduce novel product categories that address this varied demand. In 2025, Sour Sally, Indonesia's leading frozen yogurt brand, announced its entry into the UAE market with the opening of its first outlet at Al Ghurair Centre, Dubai. Known for its innovative products like Black Sakura and White Zero, Sour Sally offers probiotic-rich, low-calorie, and plant-based options.

Expansion of Retail and Distribution Channels

As urbanization rises and modern retail spaces expand, dairy products are now more available to consumers in different areas of the UAE. Supermarkets, hypermarkets, and convenience stores are emerging as the main sales venues, enabling dairy brands to connect with a wider audience. The rise of e-commerce and online shopping platforms is further supporting market growth by providing consumers the ease of buying dairy products from their homes. Retailers are also putting money into designated dairy areas, where a broader selection of products, such as organic, high-end, and global choices, can be easily found. These extended channels are simplifying the process for consumers to discover a wider variety of dairy products, leading to higher consumption and fostering the overall development of the market. In 2024, Lifeway Foods announced an expanded distribution agreement for its probiotic kefir and farmer cheese in the UAE market. The products, including 32oz Lifeway Kefir and Lactose-Free flavors, began shipping in the fourth quarter of 2024 and was available across supermarkets in Dubai and the Emirates.

Growing Focus on Sustainability and Eco-Friendly Practices

As consumers and producers alike prioritize minimizing the ecological footprint of dairy production, sustainability and environment-friendly methods are progressively influencing the UAE dairy market. Rising worries about climate change and environmental concerns are resulting in a preference for dairy brands that highlight sustainable sourcing and production practices. Shoppers are becoming more aware about the ecological impact of the goods they buy, insisting on dairy products made with little application of pesticides, hormones, and other detrimental substances. In reply, dairy farmers are implementing sustainable methods like energy-efficient agriculture, minimizing waste, and conserving water. Additionally, the need for eco-friendly packaging solutions, including recyclable substances and minimized plastic usage, is increasing. With the UAE government actively supporting sustainability initiatives, dairy producers are adapting to these efforts to attract eco-friendly consumers, thus strengthening the market growth.

UAE Dairy Industry Segmentation:

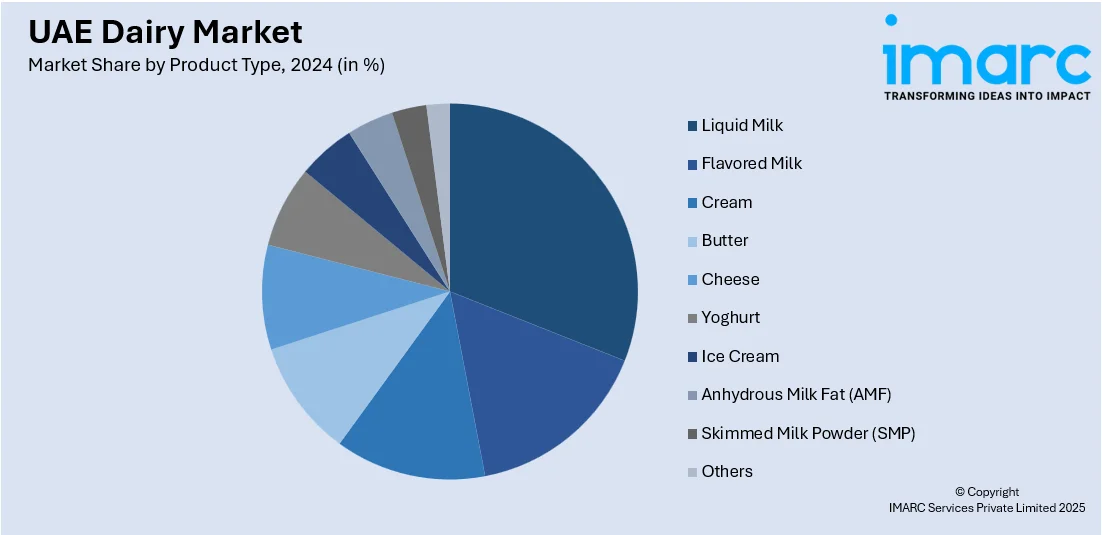

IMARC Group provides an analysis of the key trends in each segment of the UAE dairy market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type.

Analysis by Product Type:

- Liquid Milk

- Flavored Milk

- Cream

- Butter

- Cheese

- Yoghurt

- Ice Cream

- Anhydrous Milk Fat (AMF)

- Skimmed Milk Powder (SMP)

- Whole Milk Powder (WMP)

- Whey Protein

- Lactose Powder

- Curd

- Others

Liquid milk is one of the largest segments in the UAE dairy market. It is highly consumed because of its convenience, nutritional value, and versatility. Regular cow's milk, as well as fortified options, are in high demand. Consumers often prefer fresh, pasteurized milk and long-life milk for its extended shelf life. The segment also benefits from the rise in health-consciousness, as there is growing interest in milk enriched with vitamins and minerals, such as Vitamin D and calcium.

Flavored milk has gained popularity in the UAE for its taste and appeal among children and adults. Popular flavors include chocolate, strawberry, and vanilla. Demand for flavored milk arises from its perception as a fun and tasty way to consume milk while providing added nutritional benefits, such as protein, calcium, and vitamins. Product innovations like low-fat and fortified variants have also expanded its consumer base.

Cream is an important ingredient in most culinary uses, whether cooking and baking or dessert preparation. The demand for cream in the UAE is on the rise as the country's food and beverage industry is thriving. Both fresh and long-life cream are used in restaurants and homes. With a high demand for premium dairy products, there is an increasing demand for rich, premium cream, such as whipping cream, in premium food establishments.

The consumption of butter in the UAE has been steady, primarily driven by its use in cooking, baking, and as a spread. While the interest in plant-based alternatives is growing, butter continues to be a staple in many homes. High-quality butter from fresh cream is in high demand, particularly in the premium segment. The increasing influence of Western cuisines and a thriving foodservice sector are also boosting butter usage in different culinary applications.

Cheese is one of the fastest-growing segments within the UAE dairy market. Growing international influence on domestic food is attributed to diversifying preferences for various varieties of cheese, including mozzarella, cheddar, and feta. More and more local and foreign brands are doing well due to the increasing demand in sandwiches, salads, and snacks. The growth of the foodservice sector, restaurants and fast food chains, raises cheese consumption.

Yoghurt is a highly versatile and popular dairy product in the UAE, particularly consumed for breakfast, snacks, and desserts. The demand for Greek yoghurt, probiotic, and low-fat options is increasing as consumers seek functional foods that contribute to digestive health and overall wellness. Local and international brands continue to innovate in the yoghurt category, with flavored, low-sugar, and fortified variants gaining popularity. The increasing health-conscious population further accelerates yoghurt consumption.

Hot weather is consistent throughout the year, creating a steady demand for ice cream in the UAE. The market ranges from simple dairy-based to advanced plant-based options, but it is also seen with a high premium, artisanal ice cream brands. It is characterized by a number of exotic flavors, which are also seen to have healthier alternatives, like sugar-free and low-fat options. With the increasing trend towards indulgence and comfort foods, the segment is expected to continuously expand, particularly within the hospitality and retail sectors.

Anhydrous milk fat is a concentration form of butterfat with the demand of this application because of the versatility required for food processing, most notably in the baking area, confectionery production, and other dairy processing applications. Rising trends and increases in the demand to high-quality and fat rich ingredient for premium food have pushed the AMF segment forward as the long shelf life combined with easy storage has influenced many manufacturers.

Skimmed milk powder is widely used in the production of dairy products, including beverages, confectionery, and bakery items. The demand for low-fat and calorie-conscious products has been fueling the popularity of SMP, as it offers the benefits of milk without the fat content. In the UAE, it is also commonly used in infant formulas, further driving the growth of the segment. The growth in demand for powdered milk in the food processing industry increases the growth rate of the market.

Whole milk powder is widely used in all food and beverages, from dairy products, to baked goods and desserts. It is highly valued for its convenience, extended shelf life, and ability to be reconstituted into liquid milk. In the UAE, WMP is widely used in the production of dairy beverages and processed foods. This product's demand is promoted by the ever-increasing food processing industry and expanding foodservice sectors, and various local and international brands that depend on its flexibility.

Whey protein has recently found immense popularity in the UAE for its high content, primarily among the masses associated with fitness and other bodily and health-related workouts by individuals. It has numerous applications in protein supplement shakes, nutritional drinks, as well as energy bars. This awareness about muscle development and recovery as well as managing weight through intake has catapulted the demand for whey protein. Fitness activities booming within the UAE combined with higher disposable incomes boosted growth for the segment.

Lactose powder is applied across food processing, infant formula, and pharmaceutical products, and it is primarily absorbed by people who are free from lactose intolerance; hence, the demand can be attributed to the developing functional food sector. Moreover, the increasing availability of lactose-free products across the UAE dairy market contributes to the dual demand: for lactose powder and its counterparts.

Curd, a staple in many Middle Eastern and South Asian diets, is gaining popularity in the UAE due to its versatile use in cooking, as a snack, and in desserts. The demand for curd is driven by its cultural significance, health benefits, and ability to serve as a base for various dairy products, such as yogurt and cheese. In addition, the increasing demand for probiotic-rich foods which are considered to be gut-friendly is driving curd consumption in the UAE. The segment is likely to grow further as more and more consumers are opting for traditional and functional dairy products.

Regional Analysis:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Dubai, as the economic and cultural hub of the UAE, is a prominent dairy market with one of the highest demands across various segments. The city's diverse population, including a large expatriate community, fuels the demand for a wide variety of dairy products. Dubai's thriving retail sector, along with a booming hospitality industry, drives substantial consumption of dairy products such as flavored milk, cheese, yogurt, and ice cream. The city's strong focus on health and wellness also influences dairy preferences.

Abu Dhabi, the capital of the UAE, holds a significant share of the dairy market, driven by its wealth, government initiatives, and large population. With a high standard of living and growing health consciousness, consumers in Abu Dhabi are increasingly opting for premium dairy products like organic milk, yogurt, and cheese. The region's robust infrastructure and emphasis on food security further contribute to the market's expansion, with local production and sustainable practices gaining traction.

Sharjah's dairy market has been growing steadily, supported by its expanding population and economic diversification. As the third-largest emirate, Sharjah has seen increased consumption of dairy products, especially in household and retail segments. The demand for affordable dairy products such as milk, butter, and yogurt is strong, alongside growing interest in health-oriented dairy items. The emirate's proximity to Dubai and its competitive pricing also make it an attractive market for dairy producers

Competitive Landscape:

Leading players in the UAE dairy market are actively engaging in strategies aimed at enhancing their market share and meeting the growing demand for diverse dairy products. These companies are focusing on product innovation, such as introducing lactose-free, low-fat, and plant-based dairy alternatives, to cater to the health-conscious consumer base. Many are also expanding their portfolios to include fortified and functional products, such as probiotic yogurts, protein-enriched milk, and organic dairy options, responding to the increased focus on nutrition and wellness. In addition, premium dairy offerings are gaining traction, with brands introducing specialty cheeses, artisanal ice creams, and high-quality butter. Furthermore, established players are investing in state-of-the-art production facilities and adopting sustainable practices to increase production efficiency and reduce their environmental footprint.

The report provides a comprehensive analysis of the competitive landscape in the UAE dairy market with detailed profiles of all major companies, including:

- Almarai

- AI RAWABI

- Arla Foods Group

- Gulf Safa Dairies (ADH) Company L.L.C.

- Unikai Foods PJSC

Latest News and Developments:

- In June 2025, Ausnutria launched GOOT Dairy, the region's first full-range goat dairy brand, offering products like goat butter, cheese, and milk powder. GOOT Dairy is packed with A2 protein, which is easier to digest, and is now available in the UAE, KSA, and soon in Kuwait and Oman. The brand aims to serve health-conscious consumers with premium, nutritious, and preservative-free goat dairy products.

- In May 2025, Pure Ice Cream broke ground on an AED 80 million production facility at Dubai Industrial City. The plant, set to launch in 2026, will significantly increase production capacity to 50 million liters annually. The facility will incorporate AI, automation, biodegradable packaging, and solar power, contributing to sustainable growth and export expansion across 20 countries.

- In January 2025, Anchor Food Professionals launched 100% recyclable mini butter portions in the Middle East, crafted from grass-fed New Zealand butter. These single-serve portions cater to the hospitality and F&B industries, combining premium taste with eco-friendly packaging. The initiative aligns with the region's growing demand for sustainable solutions, offering both quality and operational efficiency.

-

April 2024, the ruler of Sharjah, UAE, inaugurated the first phase of Mleiha Dairy farm, which will provide unadulterated milk straight from the source. The dairy will import 1000 cows from Denmark, which will carry A2A2 genes and boast approximately 18 unique characteristics.

-

In September 2024, Puck launched a limited-time flavor jar of its Zaatar cream cheese. These new jars will be available at selected retailers across Oman, Kuwait, Lebanon, UAE, Bahrain, and KSA.

-

In September 2024, New Zealand and UAE signed a trade agreement, which will eliminate all dairy tariffs. This will provide the necessary certainty for the continued growth of dairy trade between the two countries.

-

In June 2024, Department of Agriculture and Livestock (DAL) of the Government of Sharjah announced that it will deploy latest advancements in sustainable packaging at its Meliha Dairy Factory, which is the first farm in UAE to integrate authentic organic production methods.

UAE Dairy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Liquid Milk, Flavored Milk, Cream, Butter, Cheese, Yoghurt, Ice Cream, Anhydrous Milk Fat (AMF), Skimmed Milk Powder (SMP), Whole Milk Powder, (WMP), Whey Protein, Lactose Powder, Curd, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE dairy market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the UAE dairy market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE dairy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A dairy refers to both the products derived from the milk of mammals (primarily cows, goats, sheep, and camels) and the facilities or farms where these products are produced, processed, and sometimes distributed. Dairy products are quite a broad variety of foods ranging from milk, cheese, butter, yogurt, cream, ice cream, and whey to mention a few. These foods are high in essential nutrients, such as calcium, protein, vitamins, and fats, for bone health and muscle growth as well as nutritional purposes.

The dairy market in UAE was valued at USD 4.8 Billion in 2024.

The UAE dairy market is projected to exhibit a CAGR of 4.30% during 2025-2033, reaching a value of USD 7.0 Billion by 2033.

The UAE dairy market is influenced by increasing consumer preference for high-quality, nutritious products, supported by a growing health-conscious population. Advancements in dairy farming technology, coupled with a strong retail infrastructure, ensure consistent product availability. Additionally, government support for local agriculture and a rising preference for sustainable practices are offering a favorable market outlook.

Some of the major players in the UAE dairy market include Almarai, AI RAWABI, Arla Foods Group, Gulf Safa Dairies (ADH) Company L.L.C., Unikai Foods PJSC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)