UAE Cold Chain Logistics Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

UAE Cold Chain Logistics Market Size and Share:

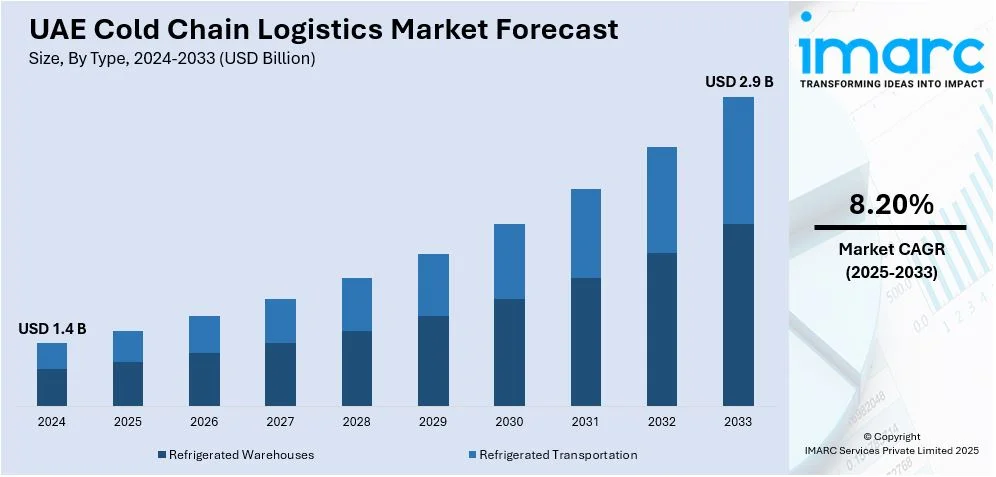

The UAE cold chain logistics market size was valued at USD 1.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.9 Billion by 2033, exhibiting a CAGR of 8.20% from 2025-2033. The market is driven by the growing demand for perishable goods, including fresh produce, dairy, and pharmaceuticals, supported by advanced infrastructure and technological innovation. The rising e-commerce activities and increasing focus on vaccine distribution are further impelling the market growth. Strategic location and government initiatives to boost trade and logistics make the UAE a regional hub for temperature-sensitive supply chains.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.4 Billion |

| Market Forecast in 2033 | USD 2.9 Billion |

| Market Growth Rate (2025-2033) | 8.20% |

The increasing consumption of fresh produce, seafood, dairy products, and frozen food items is driving the need for cold chain solutions. As consumer preferences lean towards quality and freshness, efficient temperature-controlled logistics become essential to maintain product integrity during storage and transportation. Additionally, the rising popularity of specialty and gourmet food items, which are often highly perishable, is leading to greater demand for sophisticated cold chain logistics to maintain their quality and appeal. Besides this, the growing popularity of online grocery platforms and food delivery services in the UAE is catalyzing the demand for reliable cold chain infrastructure. Individuals are opting for the convenience of home delivery, which requires effective refrigeration systems to guarantee that perishable items can be delivered in an ideal condition.

In addition, the adoption of advanced technologies like internet of things (IoT), radio frequency identification (RFID) tracking, and artificial intelligence (AI)-driven monitoring systems is enhancing the efficiency and reliability of cold chain operations. These technologies facilitate real-time tracking of conditions and templaturep, minimizing risks and ensuring consistent quality. Apart from this, the proliferation of hypermarkets, supermarkets, and convenience stores across the UAE is driving the need for cold storage and transportation systems to cater to these retail outlets. Furthermore, partnerships between local and international logistics companies are bringing advanced expertise and technology into the UAE’s cold chain sector, improving service quality and expanding capacity. Moreover, companies are adopting environment-friendly practices, such as sustainable packaging and fuel-efficient refrigerated vehicles, which are supporting innovation and investment in the sector.

UAE Cold Chain Logistics Market Trends:

Technological Advancements in Cold Storage Efficiency

Sophisticated systems, like IoT-connected monitoring devices, enable real-time observation of temperature, humidity, and storage conditions, guaranteeing ideal product preservation along the supply chain. AI and machine learning (ML) are utilized to forecast storage requirements, enhance energy consumption, and lower operational expenses. Automation in cold storage warehouses, featuring robotic handling systems, accelerates inventory management and reduces human error. These advancements enhance the overall efficiency of cold chain logistics while allowing companies to satisfy the increasing demand for high-quality perishable items with improved accuracy. By adopting these technologies, the cold chain industry in the UAE is set for improved productivity and sustainability. In 2024, the collaboration between SSI Schaefer and Noatum Logistics Middle East has created the largest mobile racking system for deep-freeze storage in the UAE, located in the AD Ports Group's KLP21 warehouse hub in Khalifa Economic Zone Abu Dhabi (KEZAD). The system enhances storage capacity by over 90%, improves cooling efficiency, and facilitates logistics for industries such as healthcare and FMCG. This effort strengthens Abu Dhabi's role as a key center for cold chain logistics in the area.

Adoption of Green Logistics Solutions

With increasing awareness about environmental sustainability and pressure to reduce carbon emissions, companies are integrating eco-friendly practices into their operations. This encompasses the utilization of energy-saving refrigeration systems, solar-powered cold storage units, and substitute fuels for refrigerated transport vehicles. Logistics providers are also optimizing routes and leveraging advanced technologies like IoT and AI to minimize energy usage and waste. Government initiatives and policies promoting sustainability further encourage businesses to cater to the international environmental policies. Additionally, certifications and green logistics benchmarks are gaining traction, enhancing the reputation of companies adopting such practices. By prioritizing green solutions, the UAE’s cold chain sector not only addresses environmental concerns but also achieves cost efficiencies and fosters long-term growth while meeting the rising expectations of environmentally conscious individuals and businesses. In 2024, HummingbirdEV revealed intentions to set up a microfactory in the UAE to manufacture zero-emission commercial vehicles, such as refrigerated trucks, for mid-mile and last-mile uses. This initiative is in line with sustainability objectives and speeds up the acceptance of eco-friendly transportation.

Strategic Development of Cold Storage Infrastructure

Strategically located storage hubs equipped with multi-temperature capabilities are addressing the increasing demand for efficient handling of perishable goods. These facilities support seamless storage and distribution across the UAE, ensuring the preservation of temperature-sensitive items like food, chemicals and pharmaceuticals products. Investments in cutting-edge technologies for real-time monitoring, energy efficiency, and scalability further enhance operational effectiveness. Additionally, collaborations between logistics providers and port operators create integrated solutions that streamline supply chains and reduce transit times. By establishing infrastructure in free zones and key trade hubs, the UAE fortifies its position as a regional leader for temperature-controlled logistics. In December 2023, Americold revealed its intentions to build a $35 million cold storage center featuring 40,000 pallet slots in the Jebel Ali Free Zone, Dubai, in collaboration with RSA Cold Chain and DP World. The facility was designed to provide multi-temperature functionalities and to improve the flow of temperature-sensitive food items. The construction will start in early 2024, and it is anticipated to be finished by the first quarter of 2025.

UAE Cold Chain Logistics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the UAE cold chain logistics market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- Refrigerated Warehouses

- Refrigerated Transportation

- Railways

- Airways

- Roadways

- Waterways

Refrigerated warehouses are critical components of the market as per the UAE cold chain logistics market analysis. This can be accredited to nature of offering long-term storage solutions for temperature-sensitive goods. These facilities guarantee the best preservation of items like perishable food, medications, and specialized chemicals. Fitted with cutting-edge temperature and humidity management systems, they facilitate bulk storage and serve industries that need uniform conditions to uphold product quality and regulatory compliance.

Refrigerated transportation (railways, airways, roadways, and waterways) facilitates safe as well as efficient movement of temperature-sensitive items across the supply chain. This segment includes different types of vehicles, including refrigerated trucks, ships, and air freight systems, outfitted with real-time tracking and cooling mechanisms to sustain optimal conditions. It is essential for transporting perishable items swiftly and dependably, both within the country and abroad.

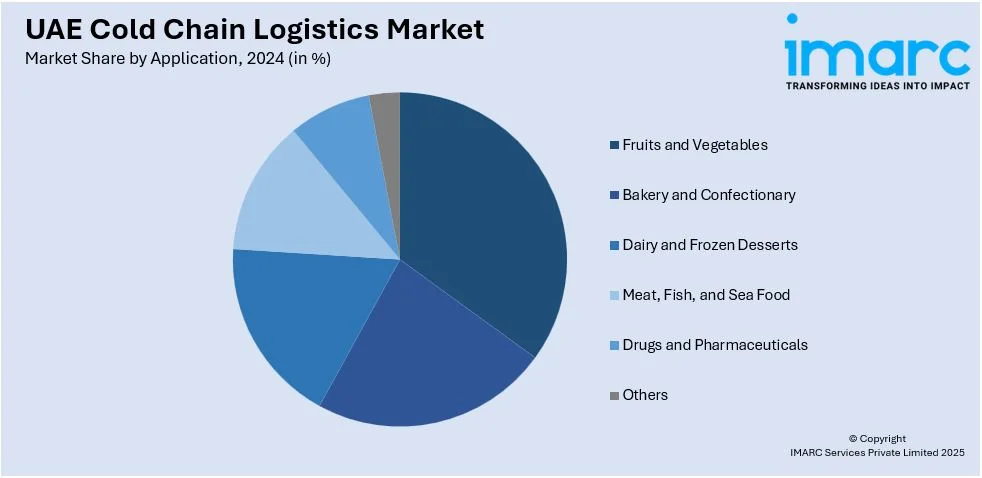

Analysis by Application:

- Fruits and Vegetables

- Bakery and Confectionary

- Dairy and Frozen Desserts

- Meat, Fish, and Sea Food

- Drugs and Pharmaceuticals

- Others

The segment of cold chain logistics for fruits and vegetables maintains their freshness and longevity from farms to marketplaces. Advanced refrigerated storage and transport systems are crucial for handling tropical and imported fruits and vegetables, minimizing spoilage, and maintaining nutritional quality. This part requires precise control of temperature and humidity to satisfy consumer demands for fresh and premium products.

Bakery and confectionery require cold chain logistics to maintain specific conditions to preserve taste, texture, and shelf stability. These goods are sensitive to temperature fluctuations, especially items containing chocolate or cream, necessitating specialized storage and transport solutions that prevent melting or spoilage.

Dairy products and frozen desserts need closely regulated temperature conditions to avoid spoilage and guarantee safety. This section depends on effective cold storage and transport systems to manage products such as milk, yogurt, ice cream, and cheese.

The meat, fish, and seafood segment is highly dependent on cold chain logistics to maintain freshness and prevent contamination. Such products are sensitive to temperature changes and need quick processing, freezing, and delivery through refrigerated systems. This segment often involves international imports and exports, further intensifying the requirement for effective logistics.

Cold chain logistics for drugs and pharmaceuticals ensures the stability and efficiency of temperature-sensitive biologics, medicines, and vaccines. This segment demands stringent monitoring and regulatory compliance to maintain the required conditions throughout storage and transportation, particularly for critical products like vaccines and biotechnology-based drugs. The UAE cold chain logistics market analysis share highlights the growing importance of this segment as the pharmaceutical industry expands and prioritizes cold chain solutions.

Others encompass specialized uses such as cosmetics, unique chemicals, and premium electronics that necessitate regulated environments. Cold chain logistics guarantees the secure management of temperature-sensitive goods, aiding sectors that depend on stable temperatures to preserve product quality and avoid deterioration.

Regional Analysis:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Dubai serves as a key center for cold chain logistics, propelled by its optimal location and robust infrastructure, featuring ports such as Jebel Ali and top-tier air cargo services. The city's emphasis on trade and tourism generates a strong need for temperature-controlled services, especially in food, pharmaceuticals, and valuable perishable items. Its environment, conducive to innovation, promotes the implementation of advanced cold chain technologies and sustainability efforts.

Abu Dhabi plays a vital role in the market, supported by being the UAE’s capital and its investments in various sectors like healthcare and agriculture. The ports and logistics areas of the city improve its capacity to handle extensive cold chain operations, particularly for pharmaceuticals and perishable goods, as sustainability efforts promote energy-saving cold storage methods.

Sharjah plays a significant role in the market due to its strategic connections to other emirates and its growing logistics infrastructure. With key industrial zones and ports, the region supports food processing and distribution activities. Sharjah’s focus on inter-emirate connectivity enables efficient cold chain networks to cater to local and regional demand for perishables and sensitive goods.

Others including Ras Al Khaimah, Fujairah, and Ajman also enhance the market by aiding niche industries and local distribution. Ports such as Fujairah offer extra access points for imports and exports, while investments in logistics centers and storage facilities cater to the increasing demand for temperature-sensitive solutions in specialized sectors like seafood, agriculture, and pharmaceuticals.

Competitive Landscape:

Major participants in the market are concentrating on broadening their infrastructure and implementing cutting-edge technologies to improve efficiency and dependability. They are putting money into cutting-edge temperature-controlled storage units and fleets that have real-time monitoring systems to maintain product quality. Focus is directed towards automation, including robotics and IoT, to optimize processes and lower expenses. Businesses are also adopting sustainable practices, such as energy-efficient cooling solutions and environmentally friendly packaging, to meet their ecological objectives. Collaborations and alliances are being established to enhance networks and expand service options. In 2024, FedEx launched a state-of-the-art logistics center valued at USD 350 million at Dubai World Central in Dubai South. The 57,000 sq. m building incorporates modern technologies, a cold storage section, and eco-friendly elements, improving logistics effectiveness and fostering global commerce. This investment bolsters Dubai's status as a prominent logistics and aviation center.

The report provides a comprehensive analysis of the competitive landscape in the UAE cold chain logistics market with detailed profiles of all major companies.

Latest News and Developments:

- October 2024: Spinneys revealed intentions to construct a 500,000 sq. ft processing plant in Food Tech Valley under a 27-year contract. Food Tech Valley is also establishing various facilities, including production areas, logistics and cold-storage options, a research and development center, a business park, and housing areas to build a complete ecosystem.

- October 2024: Dubai Customs and the Dubai Land Department have entered into a memorandum of understanding to launch the "Warehouse Platform" at GITEX Global 2024. This centralized system simplifies the registration and rental process of warehouses, including both refrigerated and dry spaces, to enhance efficiency in logistics and commercial sectors. The initiative reinforces Dubai's status as an international logistics center.

- July 2024: SINGAUTO launched its autonomous cold chain logistics vehicle at Yas Marina Circuit in Abu Dhabi. The vehicle features AI-driven technology, multi-temperature control, and an advanced digital platform to enhance logistics efficiency. This innovation underscores SINGAUTO’s focus on sustainable and intelligent solutions.

- January 2024: GreenDome Holdings, via its subsidiary Elite Co., has purchased LogX, the foremost last-mile cold chain logistics firm in the UAE. This purchase enhances GDH's standing in the logistics industry, broadening its ability to provide complete temperature-controlled solutions. This action coincides with GDH's plan to create a regional logistics leader and seize growth opportunities.

UAE Cold Chain Logistics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Applications Covered | Fruits and Vegetables, Bakery and Confectionary, Dairy and Frozen Desserts, Meat, Fish, and Sea Food, Drugs and Pharmaceuticals, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE cold chain logistics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the UAE cold chain logistics market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE cold chain logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Cold chain logistics refers to the process of storing as well as transporting temperature-sensitive products within a restricted environment for retaining their quality and safety. It includes refrigerated transport like trucks, ships, planes, temperature-controlled storage facilities, and monitoring systems to ensure consistent conditions. It is critical for items like perishable foods, pharmaceuticals, vaccines, and certain chemicals that require specific temperature ranges to remain effective or consumable.

The UAE cold chain logistics market was valued at USD 1.4 Billion in 2024.

IMARC estimates the UAE cold chain logistics market to exhibit a CAGR of 8.20% during 2025-2033.

The UAE cold chain logistics market is influenced by magnifying demand for perishable goods, expansion of e-commerce, pharmaceutical industry growth, and government investments in infrastructure. Technological advancements, food security goals, a strategic trade location, and increasing health awareness further boost the sector.

Some of the major players in the UAE cold chain logistics market include Al-Futtaim Logistics, Agility Logistics, Emirates SkyCargo, Aramex, Global Shipping and Logistics LLC, Mohebi Logistics, Hellman Worldwide Logistics, DHL Supply Chain, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)