UAE Cleaning Services Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2026-2034

UAE Cleaning Services Market Summary:

The UAE cleaning services market size was valued at USD 2.10 Billion in 2025 and is projected to reach USD 3.23 Billion by 2034, growing at a compound annual growth rate of 4.90% from 2026-2034.

The UAE cleaning services market is witnessing robust expansion, driven by rapid urbanization, increasing construction activities, and growing emphasis on hygiene standards across residential and commercial sectors. The tourism and hospitality industries continue to fuel demand for professional cleaning services, while stringent government regulations promote cleanliness in public spaces. Additionally, rising adoption of outsourced and technology-enabled cleaning solutions by businesses seeking operational efficiency and compliance with sustainability standards is further strengthening market growth across the UAE.

Key Takeaways and Insights:

-

By Type: Maid services dominate the market with a share of 22% in 2025, owing to the growing demand from dual-income households, expanding expatriate population seeking domestic assistance, and the increasing preference for outsourcing household tasks amid fast-paced urban lifestyles in the UAE.

-

By End Use: Residential leads the market with a share of 32% in 2025, driven by the expanding real estate sector, rising disposable incomes among urban households, heightened hygiene awareness, and the growing preferences for professional cleaning services among busy working professionals and families.

-

By Region: Dubai represents the largest region with 40% share in 2025, reflecting its position as the commercial and tourism hub of the UAE with extensive hospitality infrastructure, high concentration of residential properties, and continuous influx of tourists requiring premium cleaning services.

-

Key Players: Key players drive the UAE cleaning services market by expanding service portfolios, investing in smart cleaning technologies, strengthening distribution networks, and adopting eco-friendly practices. Their focus on quality assurance, staff training, and digital booking platforms enhances market penetration across diverse consumer segments.

The UAE cleaning services market is experiencing significant growth, propelled by multiple interconnected factors reshaping the industry landscape. Rapid urbanization and continuous population growth have substantially increased demand for professional cleaning solutions across residential and commercial properties. As per macrotrends, the total population of the UAE in 2025 reached 9,665,319, reflecting a 0.77% rise compared to 2024. The nation's thriving tourism sector, which welcomes millions of visitors annually, necessitates maintaining impeccable cleanliness standards in hotels, restaurants, and entertainment venues. Government initiatives aimed at promoting hygiene and sanitation in public spaces have created regulatory frameworks that mandate professional cleaning services across various sectors, including healthcare, hospitality, and food services. The rising number of dual-income households and busy urban lifestyles have shifted consumer preferences towards outsourcing domestic tasks to professional service providers.

UAE Cleaning Services Market Trends:

Adoption of Smart Cleaning Technologies

The UAE cleaning services market is witnessing rapid integration of smart cleaning technologies, driven by advancements in Internet of Things (IoT), artificial intelligence (AI), and robotics. As per IMARC Group, the UAE AI market size reached USD 578.10 Million in 2024. These innovations are revolutionizing traditional cleaning practices by enhancing operational efficiency, precision, and sustainability. Smart cleaning solutions, including automated floor scrubbers, robotic vacuums, and sensor-based systems, optimize resource utilization while improving outcomes.

Rising Demand for Eco-Friendly Cleaning Solutions

Sustainability has emerged as a central theme in the UAE cleaning services sector, with growing emphasis on environmentally responsible practices and green cleaning products. Consumers increasingly prioritize eco-friendly solutions that reduce environmental impact while maintaining cleaning effectiveness. YouGov surveys indicated that over 60% of UAE residents preferred brands that offer sustainability, as of November 2025. Dubai Municipality's green building regulations mandate sustainable practices for government buildings, accelerating adoption of eco-conscious cleaning services aligned with the UAE's broader sustainability vision. Cleaning service providers are responding by investing in biodegradable chemicals, water-efficient equipment, and staff training programs to meet regulatory requirements and evolving client expectations.

Digital Transformation and Mobile Booking Platforms

In the UAE, the cleaning services sector is experiencing substantial digital transformation through user-friendly mobile applications connecting consumers with verified professional cleaners. These platforms streamline booking processes, enable real-time service tracking, and facilitate seamless payment transactions. The proliferation of on-demand cleaning services through digital channels has significantly enhanced consumer convenience and accessibility. Service providers also leverage data analytics and customer feedback tools to optimize scheduling, pricing, and service quality. This shift towards platform-based models is intensifying competition while expanding market reach among tech-savvy urban consumers.

Market Outlook 2026-2034:

The UAE cleaning services market demonstrates promising growth potential throughout the forecast period, supported by sustained infrastructure development, expanding tourism sector, and evolving consumer preferences toward professional cleaning solutions. Continued urbanization across emirates will drive residential cleaning demand, while commercial real estate expansion creates opportunities in the corporate and retail sectors. The market generated a revenue of USD 2.10 Billion in 2025 and is projected to reach a revenue of USD 3.23 Billion by 2034, growing at a compound annual growth rate of 4.90% from 2026-2034. Government initiatives promoting cleanliness standards coupled with mega infrastructure projects, including airport expansions and smart city developments, will sustain market momentum. The integration of advanced technologies, such as AI-powered cleaning robots and IoT-enabled monitoring systems, will enhance service delivery efficiency while meeting evolving client expectations for quality and sustainability.

UAE Cleaning Services Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Maid Services | 22% |

| End Use | Residential | 32% |

| Region | Dubai | 40% |

Type Insights:

To get detailed segment analysis of this market, Request Sample

- Window Cleaning

- Vacuuming

- Floor Care

- Maid Services

- Carpet and Upholstery

- Others

Maid services dominate with a market share of 22% of the total UAE cleaning services market in 2025.

The maid services segment maintains market leadership, driven by the substantial expatriate population requiring domestic assistance for household management. The UAE's fast-paced lifestyle, particularly in urban centers, has created strong demand for professional housekeeping services as dual-income families increasingly outsource domestic tasks. The sector employed over 180,000 domestic workers across Dubai alone in 2024, reflecting the scale of this market segment. Government-regulated Tadbeer centers have streamlined recruitment processes, enhancing service accessibility and quality standards across the emirate.

Rising disposable incomes and changing lifestyle preferences continue strengthening demand for maid services across residential segments. The introduction of standardized service quality regulations and improved worker protection measures have elevated industry professionalism. Mobile applications and digital platforms have modernized service delivery, enabling convenient booking and transparent pricing while connecting consumers with verified professional domestic workers. Additionally, growing acceptance of part-time and flexible maid service models is broadening the customer base, supporting sustained expansion of the segment across the UAE.

End Use Insights:

- Residential

- Commercial Spaces

- Institutional

- Government

- Healthcare Facilities

- Hospitality

- Aviation

- Others

Residential leads with a share of 32% of the total UAE cleaning services market in 2025.

The residential segment commands the largest market share, supported by expanding real estate development and growing population across emirates. The UAE's steadily growing population, exceeding 11.3 Million people, as of 2024, has substantially increased demand for residential cleaning services. Busy urban professionals increasingly rely on professional cleaning services to maintain household hygiene while balancing demanding work schedules. The preference for premium cleaning solutions among high-income households further strengthens segment growth.

The UAE real estate is creating substantial opportunities for residential cleaning service providers. Rising health consciousness, following global health concerns, has elevated hygiene standards in homes, driving demand for regular deep cleaning and sanitization services. Digital booking platforms have enhanced accessibility, allowing residents to schedule cleaning services conveniently. The segment benefits from diverse service offerings, including regular housekeeping, deep cleaning, move-in/move-out cleaning, and specialized sanitation services, tailored to residential requirements.

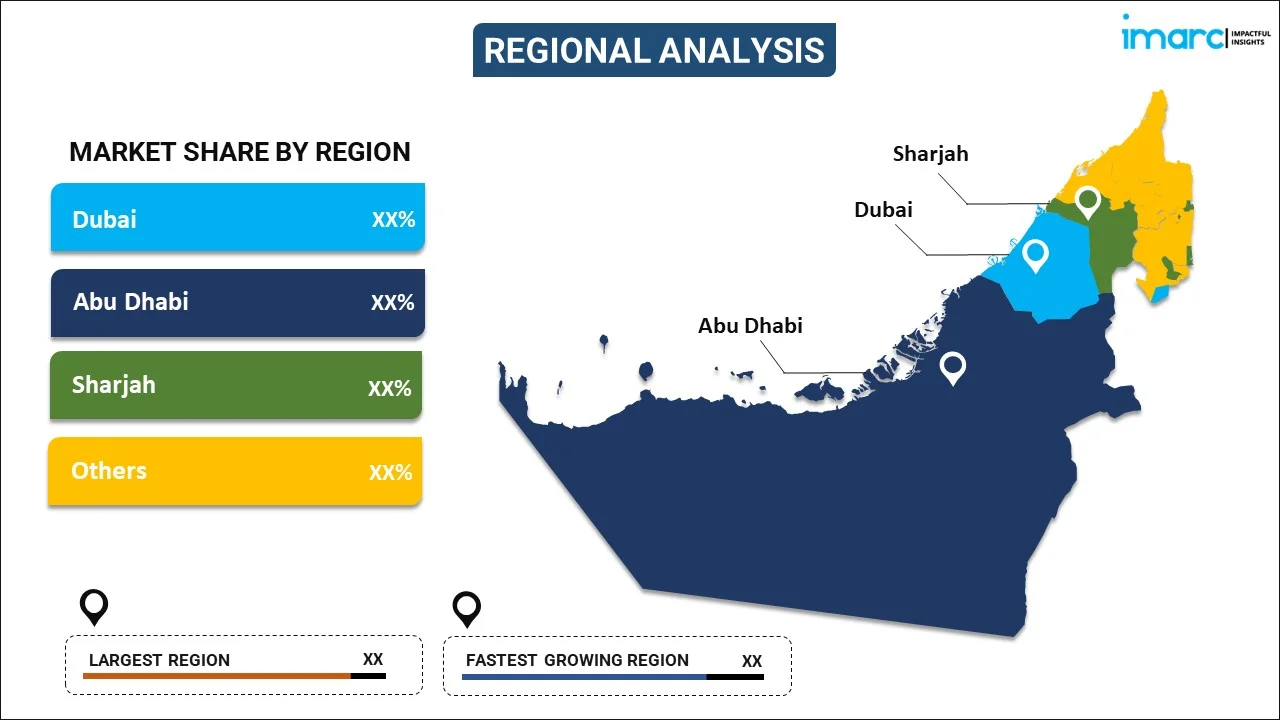

Regional Insights:

To get detailed regional analysis of this market, Request Sample

- Dubai

- Abu Dhabi

- Sharjah

- Others

Dubai exhibits a clear dominance with a 40% share of the total UAE cleaning services market in 2025.

Dubai maintains its position as the leading regional market, driven by its status as the commercial, tourism, and hospitality hub of the UAE. In January to November 2025, Dubai hosted 17.55 Million overnight tourists, showing a 5% rise from January to November 2024. The emirate accounts for the majority of development projects within the UAE's commercial sector, creating sustained demand for professional cleaning services. The extensive infrastructure, including shopping malls, airports, and luxury residential complexes, generates continuous cleaning service requirements.

Dubai’s robust economy and rapid urbanization further fuel the demand for cleaning services, as businesses and residential developments seek high standards of hygiene and maintenance. The influx of international events, exhibitions, and conferences necessitates specialized cleaning solutions for large venues and temporary setups. Moreover, increasing awareness about health and sanitation among residents and corporations has driven the adoption of advanced cleaning technologies and eco-friendly practices. The presence of global hotel chains and premium commercial spaces also encourages service providers to maintain consistent quality, ensuring Dubai remains a benchmark for professional cleaning standards in the UAE.

Market Dynamics:

Growth Drivers:

Why is the UAE Cleaning Services Market Growing?

Rapid Urbanization and Infrastructure Development

The UAE is experiencing unprecedented urbanization and infrastructure expansion, creating substantial demand for professional cleaning services across the residential, commercial, and public sectors. As cities expand with new buildings and facilities, the requirement for regular and specialized cleaning services increases proportionally. The construction sector's growth introduces numerous new properties requiring ongoing maintenance and hygiene management. Mega infrastructure projects, including airport expansions, smart city developments, and mixed-use complexes, generate long-term cleaning service contracts. In 2024, the urban population, as a percentage of the total population, in the UAE was recorded at 88.01%, based on the World Bank collection of development indicators. Government investments in sustainable infrastructure, inculcating Expo City Dubai and Abu Dhabi's Yas Bay waterfront developments, are expanding the addressable market for cleaning services.

Thriving Tourism and Hospitality Sectors

The UAE's position as a premier global tourist destination significantly contributes to cleaning services market expansion. The hospitality sector requires maintaining impeccable cleanliness standards to attract and retain international visitors while upholding the nation's premium destination image. Hotels, restaurants, entertainment venues, and tourist attractions demand consistent professional cleaning to meet guest expectations and regulatory requirements. The UAE Tourism Strategy 2031 intends to elevate the tourism industry's contribution to GDP to AED 450 Billion, with a yearly growth of AED 27 Billion. The sector's commitment to enhanced hygiene protocols has elevated cleaning standards across all hospitality establishments. Additionally, the rise of luxury resorts and themed attractions has created opportunities for specialized cleaning services, including deep cleaning and sanitation of high-traffic areas. This focus on hygiene and operational excellence ensures that the UAE continues to set global benchmarks for cleanliness in the tourism and hospitality sectors.

Stringent Hygiene Regulations and Standards

The enforcement of a comprehensive regulatory framework by the UAE government to have all sectors maintain standards of cleanliness and hygiene encourages the use of cleaning services. Hospitals, food sectors, and public areas are compelled to maintain high standards of hygiene and cleanliness in order to function properly and provide a secure environment. Dubai Municipality’s green building regulations advocate for the adoption and implementation of green sustainable construction and operation methods. This increases the need for cleaning service providers who are conscious and committed to adopting a green culture. The UAE government's efforts to create a healthy and green lifestyle have encouraged the adoption and implementation of sustainable methods by the cleaning services industry. The application and implementation of regulations regarding cleaning and hygiene in healthcare facilities, educational institutions, and food processing companies pose an opportunity.

Market Restraints:

What Challenges the UAE Cleaning Services Market is Facing?

Intense Market Competition and Price Sensitivity

The UAE cleaning services market faces significant competitive pressure from numerous service providers, ranging from small local businesses to multinational corporations. This intense competition creates price sensitivity among customers seeking cost-effective solutions without compromising service quality. Companies struggle to balance competitive pricing while maintaining profitability, as customers increasingly compare rates across providers. Price-based competition can erode profit margins, limiting investment capacity for service quality improvements and technological upgrades.

Rising Operational Costs and Labor Expenses

Escalating operational expenses, including labor costs, equipment investments, and specialized cleaning agent procurement, create significant challenges for market participants. Wage inflation and enhanced regulatory compliance requirements for worker welfare increase personnel expenses substantially. The introduction of value-added tax and other regulatory obligations further strain company finances. Service providers must balance cost management while attracting and retaining skilled workers, creating operational complexities that impact overall market growth.

Skilled Labor Shortage and Workforce Challenges

In the UAE, the cleaning services sector experiences workforce challenges related to skilled labor availability and retention. Physically demanding working conditions and competition from other service sectors affect recruitment efforts. Lack of comprehensive training programs and limited career advancement opportunities contribute to workforce instability. The aging workforce, combined with changing employment preferences among the young demographic, impacts the sector's ability to maintain adequate staffing levels for service delivery excellence.

Competitive Landscape:

The UAE cleaning services market presents a moderately fragmented competitive landscape, featuring established multinational corporations alongside emerging local service providers. Market participants differentiate through service quality, technological capabilities, sustainability practices, and customer relationship management (CRM). Leading players invest in smart cleaning technologies, staff training programs, and eco-friendly solutions to enhance competitive positioning. Strategic partnerships with property developers, hospitality groups, and government entities create sustained business relationships. Digital transformation initiatives, including mobile booking platforms, strengthen market presence among tech-savvy consumers. Price competitiveness, combined with service reliability and brand reputation, determines market positioning across residential and commercial segments.

UAE Cleaning Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Window Cleaning, Vacuuming, Floor Care, Maid Services, Carpet and Upholstery, Others |

| End Uses Covered | Residential, Commercial Spaces, Institutional, Government, Healthcare Facilities, Hospitality, Aviation, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The UAE cleaning services market size was valued at USD 2.10 Billion in 2025.

The UAE cleaning services market is expected to grow at a compound annual growth rate of 4.90% from 2026-2034 to reach USD 3.23 Billion by 2034.

Maid services dominated the market with a share of 22%, driven by growing expatriate demand for domestic assistance and busy urban lifestyles, prompting the outsourcing of household tasks.

Key factors driving the UAE cleaning services market include rapid urbanization, expanding tourism and hospitality sectors, stringent hygiene regulations, and rising consumer preferences for professional cleaning services.

Major challenges include intense market competition across the country, price sensitivity among customers, rising operational and labor costs, skilled workforce shortages, and balancing service quality with competitive pricing strategies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)