UAE Bottled Water Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

UAE Bottled Water Market Size and Share:

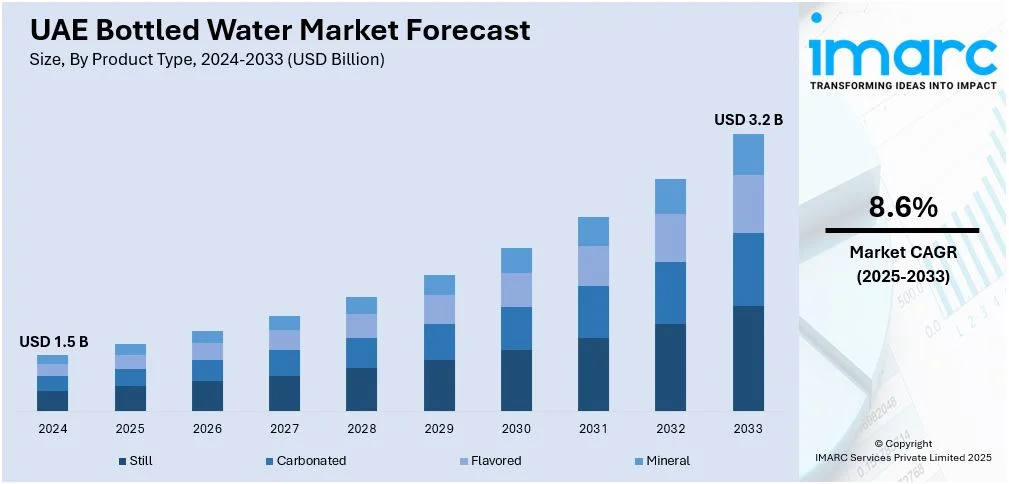

The UAE bottled water market size was valued at USD 1.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.2 Billion by 2033, exhibiting a CAGR of 8.6% from 2025-2033. The market is driven by the growing demand for green packaging made of recyclable and biodegradable materials, increasing concern over tap water quality, and rising preference for online shopping, as it offers a better facility to compare prices and reviews.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 3.2 Billion |

| Market Growth Rate (2025-2033) | 8.6% |

The UAE bottled water market is driven by a growing awareness among consumers toward health and hydration, in addition to the region's hot climate, and increasing demand for convenient and safe drinking water. Increasing concern regarding water quality and scarcity of clean tap water has added fuel to this shift. The market also benefits due to the increasing preference for premium bottled water brands that offer advanced products such as mineral-enriched or alkaline water. This is further driven by expanded urbanization and tourist inflows, which continue to grow demand, especially in hospitality, where bottled water has become a staple. Marketing strategies that emphasize purity, health benefits, and innovation in sustainable packaging are attracting conscious consumers, thus impacting UAE bottled water market growth.

Improved production and distribution technologies have enabled efficient supply throughout the UAE, while an increasing e-commerce platform is providing access to a wide variety of bottled water brands, hence increasing sales. Ministry of Energy and Infrastructure states that the United Nations report marked the UAE's achievement with 100% access to safe drinking water and sanitation services, as well as a 79% rating in integrated water resources management. These successes reinforce consumer confidence in the safety of water in the UAE and underscore the country's commitment to sustainability. Government initiatives promoting recyclable and eco-friendly packaging materials are shaping market trends, in line with the global shift toward sustainability. In addition, the growing demand for flavored and functional water products catering to specific consumer preferences, such as hydration for fitness enthusiasts, is diversifying the product portfolio and expanding the market base.

UAE Bottled Water Market Trends:

Sustainability and eco-friendly packaging

The UAE bottled water market is changing considerably with the growing focus on sustainability. Consumers are becoming more environmentally conscious, choosing brands that use recyclable, biodegradable, or reusable materials to reduce their impact on the environment. Companies are investing in advanced technologies to produce lighter bottles with less plastic to save on production costs and still meet environmental objectives. The adoption of plant-based or recycled PET materials is slowly gathering pace, supported by the government's policies that emphasize sustainability. These trends demonstrate the larger shift in consumers' preferences, where customers seek options that are more environment-friendly without compromising quality. With sustainability programs from large corporations, which may be seen through carbon-neutral production, also in their approach to handling waste, these aspects add to the growth prospects for eco-friendly branded bottled water brands.

Increasing demand for premium and functional water

Demand for premium and functional bottled water is on the rise in the UAE, driven by the rising health consciousness and disposable income among consumers. The water products that are enhanced, mineral-rich, alkaline, or electrolyte-infused serve the needs of consumers looking for hydration with health benefits. Premium packaging and exclusive branding appeal to high-end consumers who focus on quality and luxury. Functional water that targets fitness enthusiasts and wellness-focused individuals, providing hydration solutions tailored to specific needs, such as energy boosts or detoxification, is gaining popularity. The influx of expatriates and tourists has further diversified demand, and brands are innovating to meet global tastes and preferences. These high-value products, often marketed through lifestyle campaigns, are strengthening their presence in both retail and hospitality sectors.

Growth of e-Commerce and digital marketing

E-commerce has been playing transformative roles within the UAE's bottled water market, catering to customer convenience in the form of doorstep delivery and offering as wide a product range as feasible. Online forums offer comprehensive reports on quality, benefits, and packaging-related information that leads to informed choices while buying it. Digital marketing initiatives like social campaigns and influencer-led endorsements are upping brand visibility and raising customer engagement. Subscription-based services for regular water delivery are gaining popularity, appealing to busy professionals and families. The integration of mobile apps and websites by leading brands enhances the customer experience, allowing for easy customization of orders. This digital shift is particularly relevant as tech-savvy younger generations dominate consumer demographics, driving the evolution of the bottled water market toward online channels. Azad News Agency states that according to Mitch Bittermann, senior vice president of commercials at Dubai CommerCity, UAE e-commerce is predicted to cross $7 Billion by the end of 2024 and grow further to $11.5 Billion by 2029 as it grows by an increase of 50%. As e-commerce continues to scale, it will further define the future bottled water market in terms of new growth avenues and greater consumer interaction.

UAE Bottled Water Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the UAE bottled water market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type and distribution channel.

Analysis by Product Type:

- Still

- Carbonated

- Flavored

- Mineral

Still water remains a widely consumed segment, particularly because of its simplicity, and value for money, and it is easily applicable for house and office hydration. There is an increasing demand for Carbonated water due to the preference for sugary sodas as a healthy alternative for fizzy soda lovers. Flavored water is gaining momentum with its appeal among the younger demographics and health-conscious consumers seeking low-calorie yet flavorful hydration options. Mineral water, rich in essential nutrients, is a premium product, appealing to health-conscious and affluent consumers who value its health benefits and purity. These categories ensure sustained growth across the bottled water market.

Analysis by Distribution Channel:

.webp)

- Supermarkets/Hypermarkets

- Convenience Stores

- Direct Sales

- On-Trade

- Others

Supermarkets/hypermarkets holds a significant UAE bottled water market share as they offer a maximum variety of products, are promoted frequently, and are most accessible for buying in bulk. On-the-go consumption is best served by a convenience store that is ideal for urban working professionals as well. Direct sales, including subscription-based delivery services, serve households and businesses looking for regular and convenient access to bottled water. On-trade channels, including hotels, restaurants, and cafes, drive demand for premium and mineral water as the hospitality industry grows.

Regional Analysis:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Regional growth in the UAE bottled water market is observed across its regions, particularly contributed by Dubai, Abu Dhabi, and Sharjah each for their respective causes. In Dubai, the city's high consumption rate is ascribed to the mixed demographics of the city with thriving tourism, a highly developed hospitality industry demanding a premium, and specialized water product, health-conscious living becomes part of the emphasis from which the city is being sustained. According to the Dubai Economy and Tourism, Dubai attracted 10.62 Million overnight visitors in the first half of 2024, thereby sustaining an 8% growth rate, which drives demand for bottled water. The market in Abu Dhabi is supported by a wealthier population and heavy urbanization, with stable demand driven by the corporate and residential sectors. Abu Dhabi will remain a key player in the market as demand shifts towards higher-quality and sustainable products. Sharjah's balanced mix of affordability-driven demand, as well as mid-tier products catering to locals and expatriates, offers a ready-made platform for an expanding retail network and awareness about bottled safe drinking water. Consequently, Sharjah's growth is steady in its bottled water market, giving it a place in the overall development of the UAE's bottled water sector.

Competitive Landscape:

The key players in the UAE bottled water market, through innovation, strategic partnerships, and sustainability initiatives aligning with the country's environmental goals, are fostering growth. Companies are adopting advanced technologies to produce lightweight, recyclable, and biodegradable packaging as they cater to eco-friendly consumers and reduce their carbon footprint. It includes various initiatives, such as that undertaken by DEWA. They have recycled 656,315 plastic bottles and aluminum cans in the first six months of 2024 and diverted 9.180 Tonnes of waste away from landfills, according to Dubai Electricity and Water Authority. The activities show how this field is gaining more emphasis on waste management and responsible environments in industries. Additionally, bottled water brands are diversifying their portfolios with premium, flavored, and functional products while using digital platforms to offer subscription-based delivery services. Partnerships with retail and hospitality sectors ensure product availability and targeted marketing campaigns increase consumer loyalty by emphasizing health benefits, purity, and sustainability. All these factors contribute to the dynamic growth of the market.

The report provides a comprehensive analysis of the competitive landscape in the UAE bottled water market with detailed profiles of all major companies.

Latest News and Developments:

- On 09 February 2024, Bisleri extended its network across the UAE by partnering with major sporting events such as the Dubai Marathon and International League T20, Bisleri hydrates for players and spectators with effective on-ground brand branding, along with quality digital content.

- On 04 September 2024, A1RWATER, an innovative water firm in the UAE, unveiled plans to build an air-to-water bottling facility at Dubai Industrial City. This plant will make more than 100,000 liters per day through atmospheric water generation technology. A1RWATER would minimize plastic waste as water would be bottled in reusable glass bottles and support the sustainability objectives.

UAE Bottled Water Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Still, Carbonated, Flavored, Mineral |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Direct Sales, On-Trade, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE bottled water market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the UAE bottled water market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE bottled water industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Bottled water is pre-packaged drinking water that assists with hydration, supports lifestyle and health-conscious living, as well as being used in numerous domestic, office, restaurants, hotels, and events venues, for easy and safe provision of water.

The UAE bottled water market was valued at USD 1.5 Billion in 2024.

IMARC estimates the UAE bottled water market to exhibit a CAGR of 8.6% during 2025-2033.

The growing demand for green packaging made of recyclable and biodegradable materials, growing concern over tap water quality, and rising preference for online shopping, as it offers a better facility to compare prices and reviews, are some factors driving the market forward.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)