UAE Alcoholic Drinks Market Report by Category (Beer, Wine, Spirits, and Others), Alcoholic Content (High, Medium, Low), Flavour (Unflavoured, Flavoured), Packaging Type (Glass Bottles, Tins, Plastic Bottles, and Others), Distribution Channel (Supermarkets and Hypermarkets, On-Trade, Specialist Retailers, Online, Convenience Stores, and Others), and Region 2025-2033

UAE Alcoholic Drinks Market Overview:

The UAE alcoholic drinks market size reached USD 7.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 10.3 Billion by 2033, exhibiting a growth rate (CAGR) of 3.17% during 2025-2033. The growing tourism and hospitality industries, international events and exhibitions, liberalization of regulations, and changing norms represent some of the key factors driving the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.8 Billion |

|

Market Forecast in 2033

|

USD 10.3 Billion |

| Market Growth Rate 2025-2033 | 3.17% |

UAE Alcoholic Drinks Market Trends:

Expanding Tourism and Hospitality Industries

Market trends that are observed in the tourism and hospitality segment are more prominent in the UAE, which highly influences the sales of alcoholic drinks. There was an approximate 19.43% increase in international visitors to Dubai in 2023 compared to 2022 (14.36 million). Due to the UAE's promotion of itself as a top global tourist destination, the number of foreign visitors is substantial, leading to increased consumption of alcoholic beverages. Hotels like the Holiday Inn, as well as cafes, fine dining establishments, and exclusive bars aimed at tourists, have proven to be effective channels for distributing alcoholic products. Additionally, hosting international events and exhibitions in the UAE boosts the demand for premium alcoholic products, thereby expanding the market size. The key focus of the tourism industry to provide a differentiated and premium experience to niche consumers directly translates into a need for premium, high-quality alcoholic beverages, thus driving the market growth.

Liberalization of Regulations

Drinking culture rules in the UAE have relaxed over the years for the purchase and consumption of alcoholic beverages, and societal attitude towards drinking have also evolved. Dubai Duty Free, based at the emirate’s airports, stated that its retail revenues to leisure and business travellers had also surged. It is forecasting $2 billion of revenues in 2023, beating its 2019 record. New legal measures have also been laid down that has provided more flexibility to the residents and tourists to buy and consume the alcoholic products. Increased availability of markets has been because of easing of licensing laws as well as introduction of new outlets that specialize in sales of alcoholic products. Additionally, the changing perception towards alcoholic products is gradually leading to increased acceptance and consumption among young individuals and expatriates. These preparatory and social changes ensure the market has the right environment for market expansion in a way that increases the uptake of the products beyond common market trends.

UAE Alcoholic Drinks Market News:

- In May 2024, Pernod Ricard and ecoSPIRITS announced a new stage in their partnership with a five-year global licensing agreement. This deal will enable the distribution of Pernod Ricard’s spirits brands in ecoSPIRITS’ circular packaging technology to on-trade venues around the world.

- In May 2024, Diageo announced plans to invest over €100 million to decarbonise its historic St. James’s Gate site in Dublin 8, where Guinness has been brewed for 264 years. The investment underpins the goal to accelerate to net zero carbon emissions for the site and will transform energy and water consumption with the aim to make it one of the most efficient breweries in the world by 2030.

UAE Alcoholic Drinks Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on category, alcoholic content, flavour, packaging type, and distribution channel.

Category Insights:

- Beer

- Wine

- Still Light Wine

- Sparkling Wine

- Spirits

- Baijiu

- Vodka

- Whiskey

- Rum

- Liqueurs

- Gin

- Tequila

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the category. This includes beer, wine (still light wine and sparkling wine), spirits (baijiu, vodka, whiskey, rum, liqueurs, gin, tequila, and others), and others.

Alcoholic Content Insights:

- High

- Medium

- Low

A detailed breakup and analysis of the market based on the alcoholic content have also been provided in the report. This includes high, medium, and low.

Flavour Insights:

- Unflavoured

- Flavoured

The report has provided a detailed breakup and analysis of the market based on the flavour. This includes unflavoured and flavoured.

Packaging Type Insights:

- Glass Bottles

- Tins

- Plastic Bottles

- Others

A detailed breakup and analysis of the market based on the packaging type have also been provided in the report. This includes glass bottles, tins, plastic bottles, and others.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- On-Trade

- Specialist Retailers

- Online

- Convenience Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, on-trade, specialist retailers, online, convenience stores, and others.

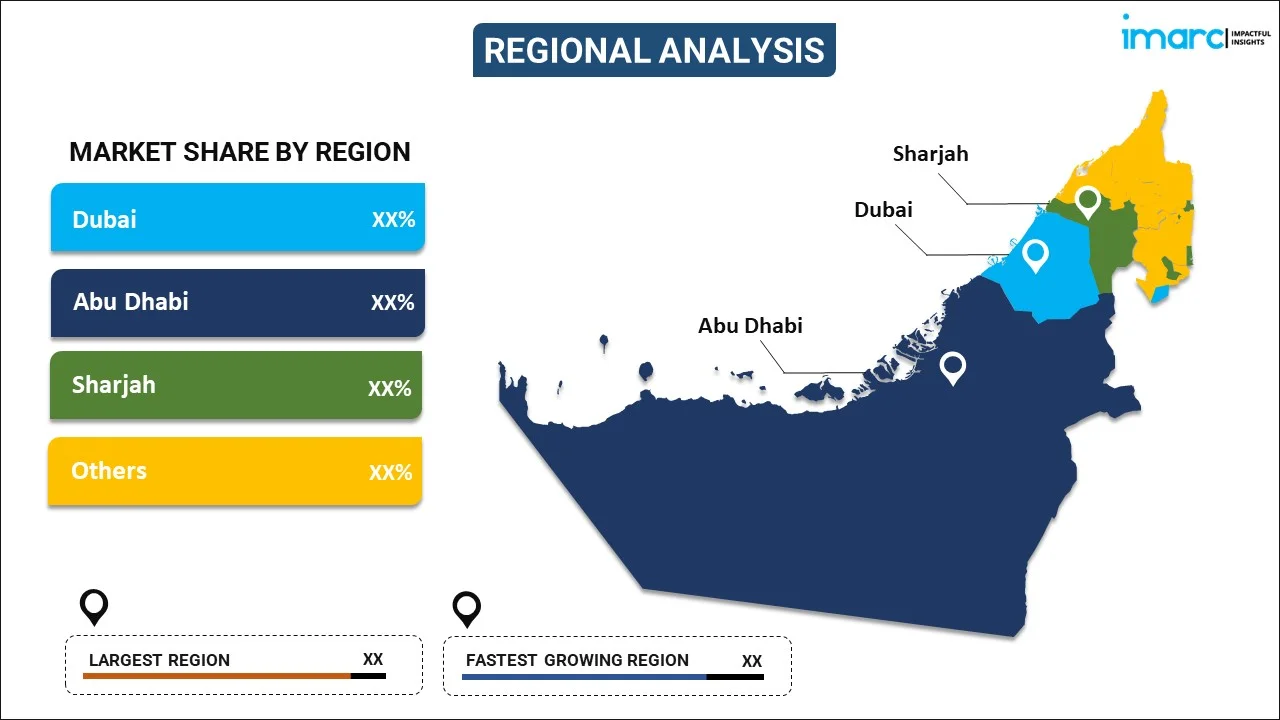

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Alcoholic Drinks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Categories Covered |

|

| Alcoholic Contents Covered | High, Medium, Low |

| Flavours Covered | Unflavoured, Flavoured |

| Packaging Types Covered | Glass Bottles, Tins, Plastic Bottles, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, On-Trade, Specialist Retailers, Online, Convenience Stores, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE alcoholic drinks market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the UAE alcoholic drinks market?

- What is the breakup of the UAE alcoholic drinks market on the basis of category?

- What is the breakup of the UAE alcoholic drinks market on the basis of alcoholic content?

- What is the breakup of the UAE alcoholic drinks market on the basis of flavour?

- What is the breakup of the UAE alcoholic drinks market on the basis of packaging type?

- What is the breakup of the UAE alcoholic drinks market on the basis of distribution channel?

- What are the various stages in the value chain of the UAE alcoholic drinks market?

- What are the key driving factors and challenges in the UAE alcoholic drinks?

- What is the structure of the UAE alcoholic drinks market and who are the key players?

- What is the degree of competition in the UAE alcoholic drinks market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE alcoholic drinks market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE alcoholic drinks market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE alcoholic drinks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)