UAE Agriculture Market Size, Share, Trends and Forecast by Type, and Region, 2025-2033

UAE Agriculture Market Size and Share:

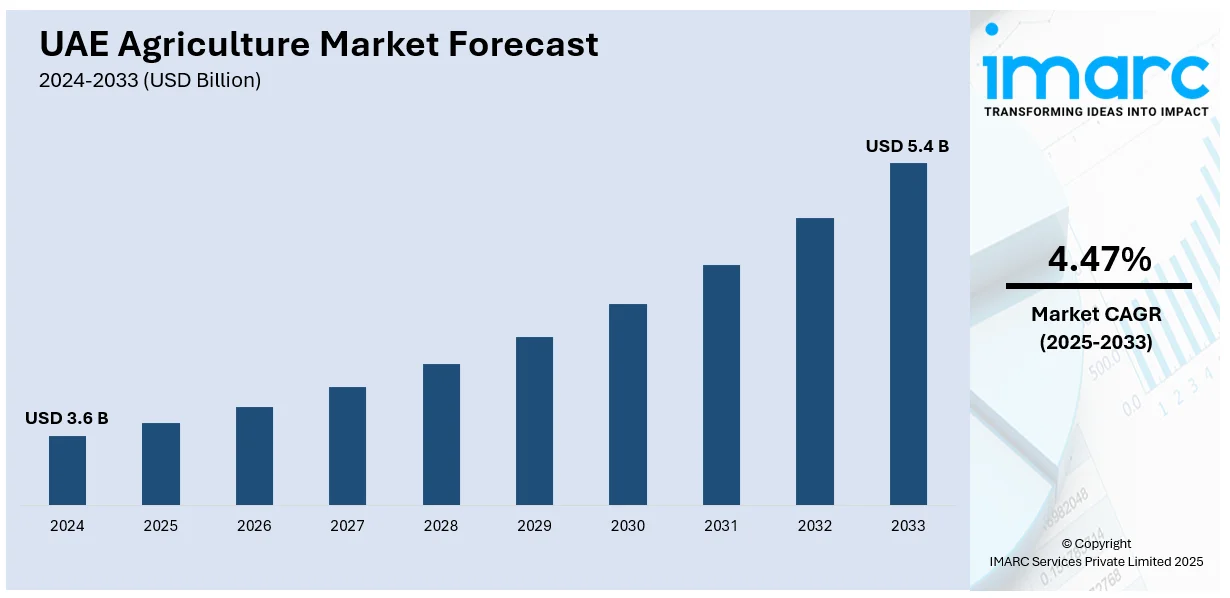

The UAE agriculture market size was valued at USD 3.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.4 Billion by 2033, exhibiting a CAGR of 4.47% from 2025-2033. The UAE agriculture market is driven by government support, technological advancements, rising demand for organic and locally grown food, water management innovations, and climate resilience initiatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.6 Billion |

| Market Forecast in 2033 | USD 5.4 Billion |

| Market Growth Rate (2025-2033) | 4.47% |

The agricultural sector of the UAE is strongly supported by the policies and initiatives of the government that facilitate ensuring food security. The government continues investing in modern agricultural technologies and subsidies for local farmers along with partnering with international agribusiness firms. The National Food Security Strategy 2051, for instance emphasizes on increasing domestic production of food, reducing dependency on imports, and practicing sustainable agriculture. Programs such as Ag-Tech Parks further push the frontiers of innovation in hydroponics, vertical farming, and aquaponics in addressing challenges from arid conditions and water scarcity.

Besides this, the integration of technology into agriculture is one of the basic cornerstones of UAE agricultural development. Artificial intelligence, drones, and IoT are thus used in enhancing productivity as well as efficiency. With precision farming, resource utilization is optimized, while vertical farming and hydroponics, help crops to grow throughout the year in controlled environments, therefore reducing the ecological footprint and amount of water usage. Furthermore, the Internet of Things (IoT) transformed the farming infrastructure in the UAE. IoT sensors monitor critical factors such as temperature, humidity, and light intensity in controlled environments. These include greenhouses, vertical farms, and some other controlled environments. Using automated systems, these conditions may be adjusted to create optimized growing environments, thus allowing uniform and high-quality production throughout.

UAE Agriculture Market Trends:

Increasing demand for organically grown food

The UAE agriculture market analysis indicates a growing preference for organic and locally grown food due to rising health awareness and environmental concerns. Therefore, the agriculture market within the UAE is responding with organic farming expansion and better marketing of produce that is regionally grown. The supermarkets retail chain now provides prominent places for locally farmed produces to help expand the business along this line while also reducing imported products' carbon footprint. In line with this, the focus to reduce the carbon footprint of food imports is increasing exponentially. Locally sourced food minimizes the need for long haul transportation and extensive packaging, which greatly reduces greenhouse emissions. The promotion of local produce creates consumer confidence and a social bond, as individuals connect to the source of their food.

Increasing population and rapid urbanization

A major driver catalyzing the UAE agricultural market growth is its rapidly growing population, along with increased urbanization. As per the Data Reportal, the population of the UAE reached 9.55 million in January 2024. As the population grows, so does the demand for food, compelling the country to increase its local agricultural production to attain food security. Urbanization brings more issues related to food production, including limited arable land and increased pressure on resources, which have made the country adopt modern agricultural technologies such as vertical farming, hydroponics, and aquaponics. This demographic change has led to changes in the dietary preferences with rising demand for fresh produce, organic food and high quality of meat and dairy products, thereby leading the UAE government to engage itself in initiatives such as the National Food Security Strategy 2051 through emphasizing sustainable practices and locating food production. By innovating ways of addressing the challenges caused by population growth, the UAE is addressing its domestic food requirements while reducing its dependence on imports.

Investment in agribusiness and research development

Investment in agribusiness and agricultural research is a significant factor driving the UAE agriculture market. According to the UAE agriculture market statistics, public and private sectors are driving innovation in areas such as vertical farming and precision agriculture. Moreover, the government and private sectors are increasingly channeling resources into agricultural innovation, funding research institutions, and creating partnerships with global agritech companies. These investments focus on developing sustainable farming methods, improving crop yield, and addressing environmental challenges unique to the region, such as water scarcity and soil salinity. For instance, the UAE has become a leader in agritech startups and ventures, such as vertical farming, precision agriculture, and biotechnology research aimed at creating drought-resistant crops. The establishment of research hubs such as the International Center for Biosaline Agriculture and various agricultural incubators is fostering innovation.

UAE Agriculture Industry Segmentation:

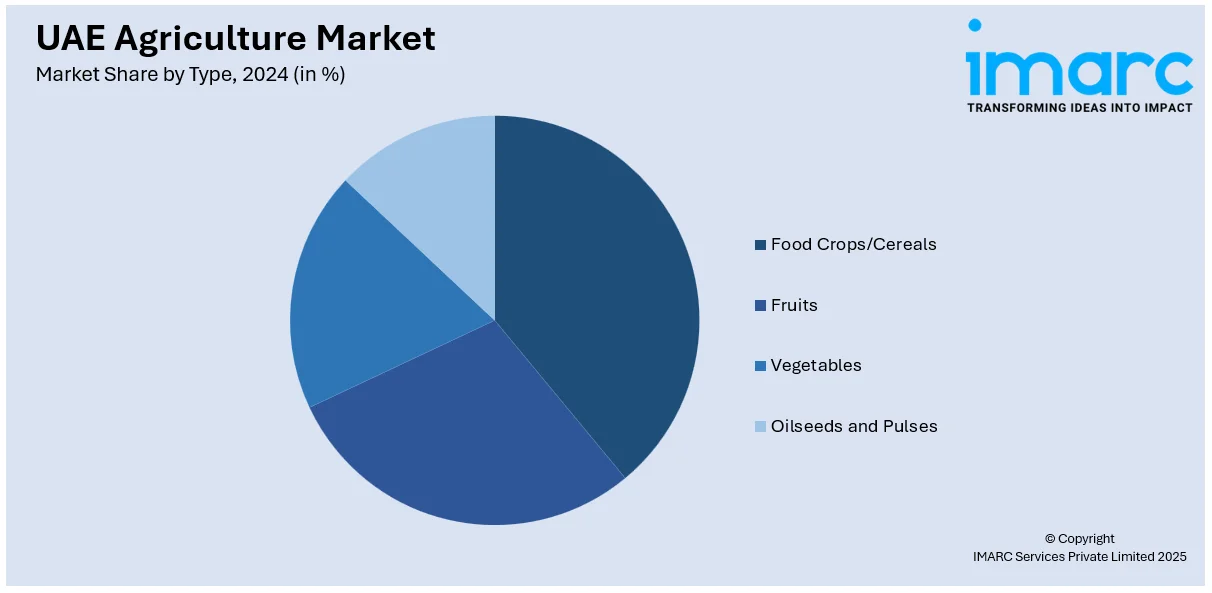

IMARC Group provides an analysis of the key trends in each segment of the UAE agriculture market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type.

Analysis by Type:

- Food Crops/Cereals

- Fruits

- Vegetables

- Oilseeds and Pulses

Food crops/cereals is one of the major categories holding a significant UAE agriculture market share, majorly including wheat, barley, and rice. Although arid climates are challenging for the development of traditional cereal farming, the development of high technology such as hydroponics and vertical farming, grains can be cultivated in controlled environments. The government is placing more emphasis on food security.

Fruit production, primarily dates, is deeply rooted in the agriculture sector of UAE. Melons, figs, and citrus fruits are equally produced with growing modern forms of farming, hence adopting better yields. Focus of the UAE toward sustainable ways of farming through organic methods and water-conserving means of irrigation make fruit cultivation more viable within the UAE.

Vegetables is an area of quick growth within the UAE agriculture market that is addressing rising demand for fresh and nutrient-rich produce. Tomatoes, cucumbers, and leafy greens represent a big portion of these crops that are benefited with hydroponics, greenhouse farming, and aquaponics, allowing year-round production without much water, hence the sustainability and scalability of vegetable farming.

Regional Analysis:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The agricultural market of Dubai reflects its stature as a global trade and innovation hub. Advanced techniques in farming, such as vertical farming and hydroponics, are preferred to overcome its limited arable land while catering to the needs of fresh produce among its varied population. Dubai has many high-tech farms and agritech startups that have an emphasis on sustainability, such as the Bustanica farm, one of the largest vertical farms in the world.

Abu Dhabi, the UAE's capital, spearheads extensive agricultural investments and research projects in the nation. Due to extensive desert areas and scarce water supplies, the emirate has prioritized desalination and water recycling methods to support its farming operations. The government of Abu Dhabi has initiated various programs to assist local farmers, including subsidies and education in sustainable methods. Important elements of the market include extensive greenhouses, aquaculture operations, and the use of salt-tolerant plants.

Sharjah has been known for its balance in old farming traditions and gradual induction of modern practices. With the UAE having an agricultural history, a number of family-owned farms are found here that have a massive contribution to food production in local regions. Sharjah supports innovations in small to medium-scale farm modernization to benefit the modernization of facilities such as drip irrigation and soil enhancers. Its product portfolio majorly involves vegetables, fruits, and dates.

Competitive Landscape:

Major stakeholders in the UAE agriculture sector are boosting growth via strategic investments and innovative approaches designed to address the specific challenges of the nation. Firms such as Pure Harvest Smart Farms and Badia Farms are leading the way in controlled-environment agriculture (CEA) through innovative greenhouse and vertical farming methods, allowing for year-round cultivation of premium fruits and vegetables while saving water and land resources. Al Dahra Group, a prominent player in agribusiness, emphasizes extensive farming and water-saving methods, including drip irrigation and the growing of salt-resistant plants. Emirates Bio Farm, a key participant in organic farming, advocates for sustainable methods and provides high-quality organic products to both local and global markets.

The report provides a comprehensive analysis of the competitive landscape in the UAE agriculture market with detailed profiles of all major companies.

Latest News and Developments:

- January 9, 2025: The Abu Dhabi Agriculture and Food Safety Authority (ADAFSA) is promoting sustainable agricultural practices by encouraging farm owners to adopt modern technologies to improve production quality and achieve global food security leadership. Their initiatives have reduced water consumption in the agricultural sector from 2 billion cubic meters in 2019 to 1.89 billion cubic meters.

- November 17, 2024: UAE announced the development of "CHAG" (Chat + Ag), the world's first ChatGPT tool for the agricultural community at COP29. Leveraging over 50 years of research data, CHAG aims to assist farmers globally, especially in challenging climates, by providing actionable insights for planting and harvesting decisions. This initiative underscores the UAE's commitment to technological innovation in agriculture.

- November 14, 2024: UAE's Vice President, Prime Minister, HH Sheikh Mohammed bin Rashid Al Maktoum launched the "Plant the Emirates" program to promote sustainable agricultural development and food security. The initiative honors the vision of Sheikh Zayed by enhancing domestic agriculture, expanding green spaces, and improving local produce. It includes the establishment of the National Agriculture Centre to foster sector growth and aligns with environmental and economic goals through initiatives on biodiversity, circular economy, and global partnerships.

- June 2024: Sheikh Khaled bin Mohamed, the Crown Prince of Abu Dhabi, has given approval for the establishment of the AgriFood Growth and Water Abundance Cluster (Agwa), a new economic cluster aimed at promoting agricultural and food sector growth as well as ensuring water abundance in line with the UAE food security strategy 2051. It will be led by the Abu Dhabi Department of Economic Development in partnership with the Abu Dhabi Investment Office. It is anticipated that Agwa will contribute Dh90 Billion in incremental GDP to the Abu Dhabi economy, creating upwards of 60,000 jobs and attracting a projected investment of Dh128 Billion.

UAE Agriculture Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Food Crops/Cereals, Fruits, Vegetables, Oilseeds and Pulses |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE agriculture market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the UAE agriculture market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE agriculture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Agriculture is the way of cultivating soil, farming crops, and raising domestic animals for food, fibres, medicinal plants, as well as other products being used to sustain and also enhance human life.

The UAE agriculture market was valued at USD 3.6 Billion in 2024.

IMARC estimates the UAE agriculture market to exhibit a CAGR of 4.47% during 2025-2033.

The UAE agriculture market is driven by government support, technological advancements, water management innovations, rising demand for organic and locally grown food, and a growing population across the region.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)