Turkey Textile Market Report by Raw Material (Cotton, Chemical, Wool, Silk, and Others), Product (Natural Fibers, Polyesters, Nylon, and Others), Application (Household, Technical, Fashion and Clothing, and Others), and Region 2026-2034

Turkey Textile Market Overview:

The Turkey textile market size reached USD 14.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 22.3 Billion by 2034, exhibiting a growth rate (CAGR) of 4.75% during 2026-2034. The market thrives on a rich heritage of craftsmanship, competitive manufacturing costs and a skilled workforce, which, in turn, is contributing to the market growth. Strategic geographical location facilitates trade, while innovative product development and increasing export opportunities bolster growth. Steady government support and a growing global demand for sustainable textiles contribute to its dynamic expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 14.5 Billion |

| Market Forecast in 2034 | USD 22.3 Billion |

| Market Growth Rate (2026-2034) | 4.75% |

Access the full market insights report Request Sample

Turkey Textile Market Trends:

Rising Demand for Organic Fabric

The Turkish textile industry is increasingly prioritizing sustainability and the use of organic fabrics to meet the rising consumer demand for environmentally friendly products. Manufacturers are adopting eco-friendly production methods, including the utilization of organic cotton, recycled fibers, and low-impact dyes. For instance, OEKO-TEX introduced new ORGANIC COTTON in April 2023. Hohenstein has certified Indian textile supplier Milan Group and Turkish cotton producer Akasya as the initial pilot customers for the organic label. The certification guarantees compliance with organic cotton standards, including limits on genetically modified material and pesticides. Textile companies with OEKO-TEX STANDARD 100 certification can extend their certificates to include ORGANIC COTTON promoting ecological production. These practices not only reduce the environmental footprint but also comply with international environmental regulations and standards. Additionally, companies are incorporating energy-efficient technologies and water-saving techniques in their manufacturing processes. Investments in certifications such as the Global Organic Textile Standard (GOTS) and OEKO-TEX are becoming common to validate their sustainable claims and enhance credibility in global markets.

Technological Advancements

The Turkish textile industry is increasingly integrating advanced technologies to enhance production efficiency and product quality. Digital printing has revolutionized the sector by offering greater flexibility, enabling shorter production runs, and reducing waste through precise color application. For instance, in May 2024, ColorJet expanded its presence in Turkey by showcasing sustainable digital textile printing solutions at the ITM exhibition in Istanbul. The company highlights its Earth 32i printer which integrates eco-friendly technology with high precision. ColorJet aims to support Turkey's textile industry by offering dedicated local support and services. Visitors can explore the company's innovative solutions at stand D 403C in Hall 4 and learn about its commitment to sustainability and innovation. This technology allows for customized designs, faster turnaround times, and improved sustainability by minimizing the use of water and chemicals. Automation in textile manufacturing is another significant innovation, with robotic systems and automated machinery streamlining various processes such as weaving, cutting, and sewing. This shift towards automation not only reduces labor costs but also increases precision and consistency in product quality, thereby boosting overall productivity. Automated inspection systems are also being employed to detect defects early in the production line, ensuring higher quality standards are met consistently. Furthermore, smart textiles represent a cutting-edge advancement in the industry.

Turkey Textile Market News:

- In March 2024, the Istanbul Apparel Exporters' Association (IHKIB) announced a partnership with the Worldwide Responsible Accredited Production (WRAP) as a part of the government initiative to boost exports to the US through collaborations and partnerships. The partnership aims to promote ethical and sustainable production standards, with a focus on enhancing Turkish companies' presence in the US market through WRAP certification training. This strategic move is expected to strengthen Turkish apparel exports and foster commercial ties between the two countries.

- In October 2023, Kenya's textile industry received a boost through a new partnership with a Turkish firm Raff Military Textile. The collaboration aims to generate employment opportunities, stimulate economic growth and bolster the country's defense and security capabilities. Raff Military Textile further expressed enthusiasm about leveraging their expertise to support Kenya's evolving textile sector and contribute to its growth.

Turkey Textile Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on raw material, product, and application.

Raw Material Insights:

To get detailed segment analysis of this market Request Sample

- Cotton

- Chemical

- Wool

- Silk

- Others

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes cotton, chemical, wool, silk, and others.

Product Insights:

- Natural Fibers

- Polyesters

- Nylon

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes natural fibers, polyesters, nylon, and others.

Application Insights:

- Household

- Technical

- Fashion and Clothing

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes household, technical, fashion and clothing, and others.

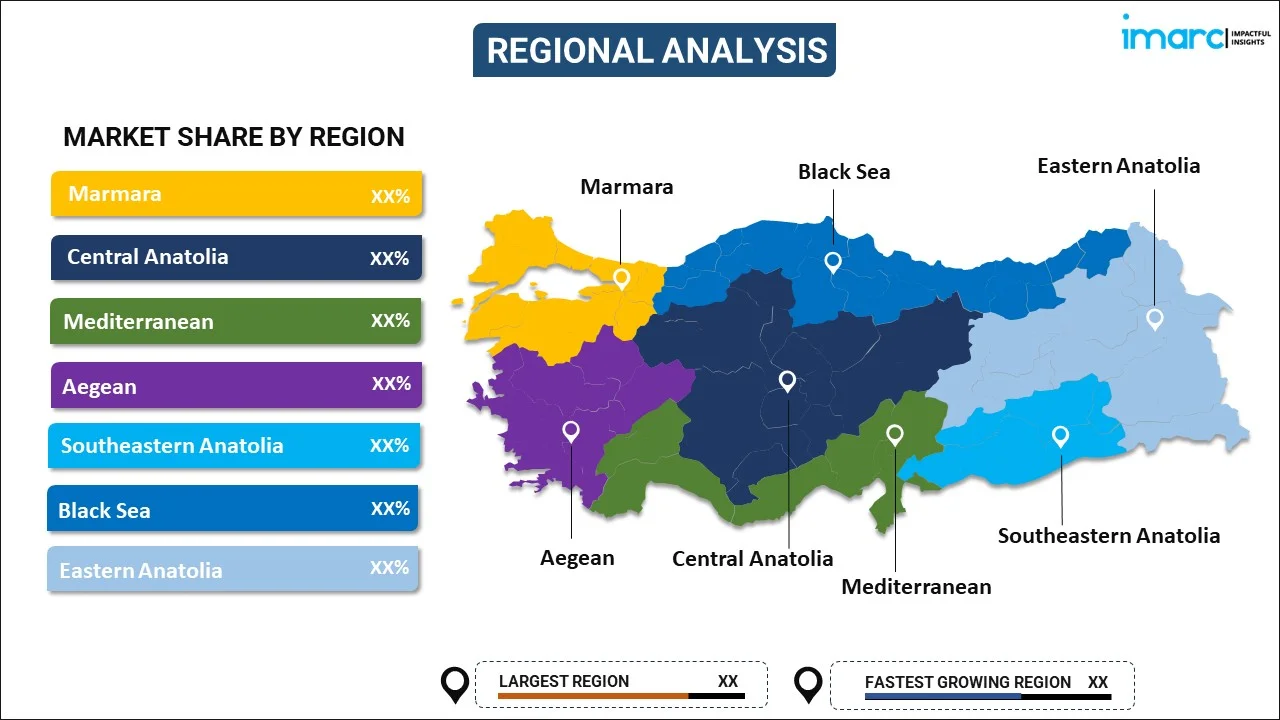

Region Insights:

To get detailed regional analysis of this market Request Sample

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Blacksea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Textile Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Raw Materials Covered | Cotton, Chemical, Wool, Silk, Others |

| Products Covered | Natural Fibers, Polyesters, Nylon, Others |

| Applications Covered | Household, Technical, Fashion and Clothing, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey textile market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey textile market on the basis of raw material?

- What is the breakup of the Turkey textile market on the basis of product?

- What is the breakup of the Turkey textile market on the basis of application?

- What are the various stages in the value chain of the Turkey textile market?

- What are the key driving factors and challenges in the Turkey textile?

- What is the structure of the Turkey textile market and who are the key players?

- What is the degree of competition in the Turkey textile market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey textile market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey textile market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey textile industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)