Turkey Solar Energy Market Report by Technology (Solar Photovoltaic (PV), Concentrated Solar Power (CSP)), Application (On-grid, Off-grid), End User (Residential, Commercial, Industrial), and Region 2026-2034

Turkey Solar Energy Market Overview:

The Turkey solar energy market size reached 20.0 GW in 2025. Looking forward, IMARC Group expects the market to reach 30.4 GW by 2034, exhibiting a growth rate (CAGR) of 4.60% during 2026-2034. The market is majorly driven by the implementation of favorable government policies, continual technological advancements, decreasing costs of solar panels, increasing energy security concerns and the push for energy self-sufficiency, growing environmental awareness, and education campaigns promoting public acceptance and adoption of solar energy solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 20.0 GW |

| Market Forecast in 2034 | 30.4 GW |

| Market Growth Rate 2026-2034 | 4.60% |

Access the full market insights report Request Sample

Turkey Solar Energy Market Trends:

Growing public and private sector collaborations

Increased partnerships between the public and private sectors are having a major impact on the growth of Turkey's solar energy market. These collaborations help to speed up the development and implementation of solar projects by allowing for the sharing of resources, expertise, and technology. Furthermore, partnerships with global organizations and companies result in the transfer of cutting-edge technologies and industry standards to Turkey, enhancing the overall quality and effectiveness of solar projects. Public-private partnerships are also beneficial for tackling infrastructure challenges, as well as improving grid integration and energy storage solutions. Additionally, government incentives and regulatory support are encouraging private investments in solar energy. Enhanced research and development efforts are driving innovation in solar technologies, making them more efficient and cost-effective. Increased awareness and education campaigns are raising public acceptance and adoption of solar energy solutions. Financial institutions are offering more favorable financing options for solar projects, making them more accessible to a broader range of investors.

Increasing energy security concerns

Growing concerns regarding energy security is one of the main factors fueling Turkey's solar energy market. Fluctuations in global energy prices and geopolitical tensions, coupled with Turkey's heavy reliance on imported fossil fuels, pose significant risks to the country's energy stability. Solar power offers a viable solution to these challenges by providing a local, sustainable, and inexhaustible energy source. This reduces the country's dependence on foreign energy imports, thereby enhancing energy security. Recognizing the strategic importance of energy security, the Turkish government is actively promoting solar energy through supportive policies, incentives, and investments in solar infrastructure. These measures are aimed at mitigating the risks associated with external supply disruptions and price volatility by diversifying energy sources and boosting local energy production.

Improving energy security through solar power not only strengthens Turkey's economic resilience but also reduces the country's energy trade deficit. A more reliable and predictable energy supply is essential for economic stability and growth. By advancing towards energy self-sufficiency, Turkey is driving significant investment and growth in its solar energy sector, making it a vital component of the national energy strategy.

Turkey Solar Energy Market News:

- August 17, 2023: Zorlu Energy, generating 100% of its electricity in Turkey from renewable sources, secured preliminary licenses for its first energy storage-integrated wind power plants in Tekirdağ and Kırklareli, totaling 375 MWe. These plants will enhance energy efficiency by storing excess energy and reducing 532,000 tons of CO2 emissions annually, equivalent to the absorption of 24 million trees.

- January 22, 2024: Yingli Solar announced the supply of 405MW of high efficiency solar modules for the well-known Solar EPC iSOLAR SA, including 120MW N-type modules and 285MW P-type modules. Currently, 180MW products have been put into use. These high-efficiency modules will be used in multiple local solar projects. After all projects are completed and put into operation, it is expected that the annual power generation will reach 486 million KWH, equivalent to reducing carbon dioxide emissions by 500000 tons.

Turkey Solar Energy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on technology, application, and end user.

Technology Insights:

To get detailed segment analysis of this market Request Sample

- Solar Photovoltaic (PV)

- Concentrated Solar Power (CSP)

The report has provided a detailed breakup and analysis of the market based on the technology. This includes solar photovoltaic (PV) and concentrated solar power (CSP).

Application Insights:

- On-grid

- Off-grid

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes on-grid and off-grid.

End User Insights:

- Residential

- Commercial

- Industrial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential, commercial, and industrial.

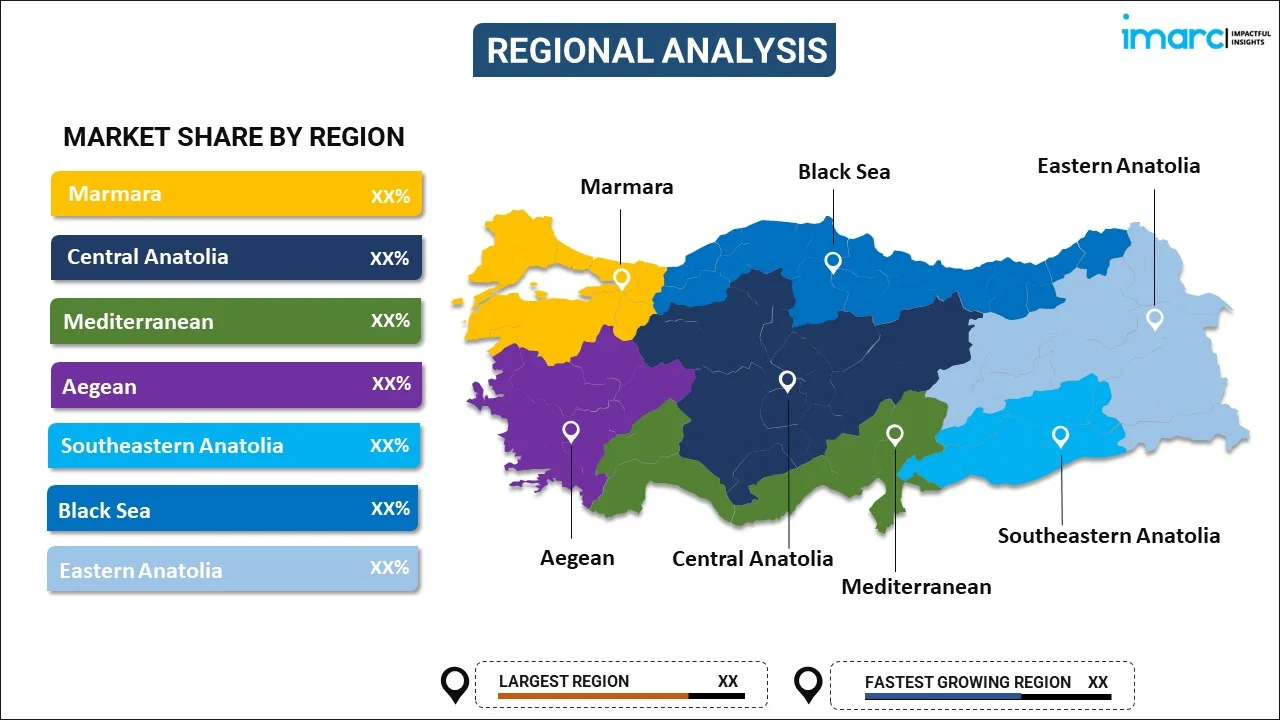

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Blacksea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Solar Energy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | GW |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Technologies Covered | Solar Photovoltaic (PV), Concentrated Solar Power (CSP) |

| Applications Covered | On-grid, Off-grid |

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey solar energy market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Turkey solar energy market?

- What is the breakup of the Turkey solar energy market on the basis of technology?

- What is the breakup of the Turkey solar energy market on the basis of application?

- What is the breakup of the Turkey solar energy market on the basis of end user?

- What are the various stages in the value chain of the Turkey solar energy market?

- What are the key driving factors and challenges in the Turkey solar energy?

- What is the structure of the Turkey solar energy market and who are the key players?

- What is the degree of competition in the Turkey solar energy market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey solar energy market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey solar energy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey solar energy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)