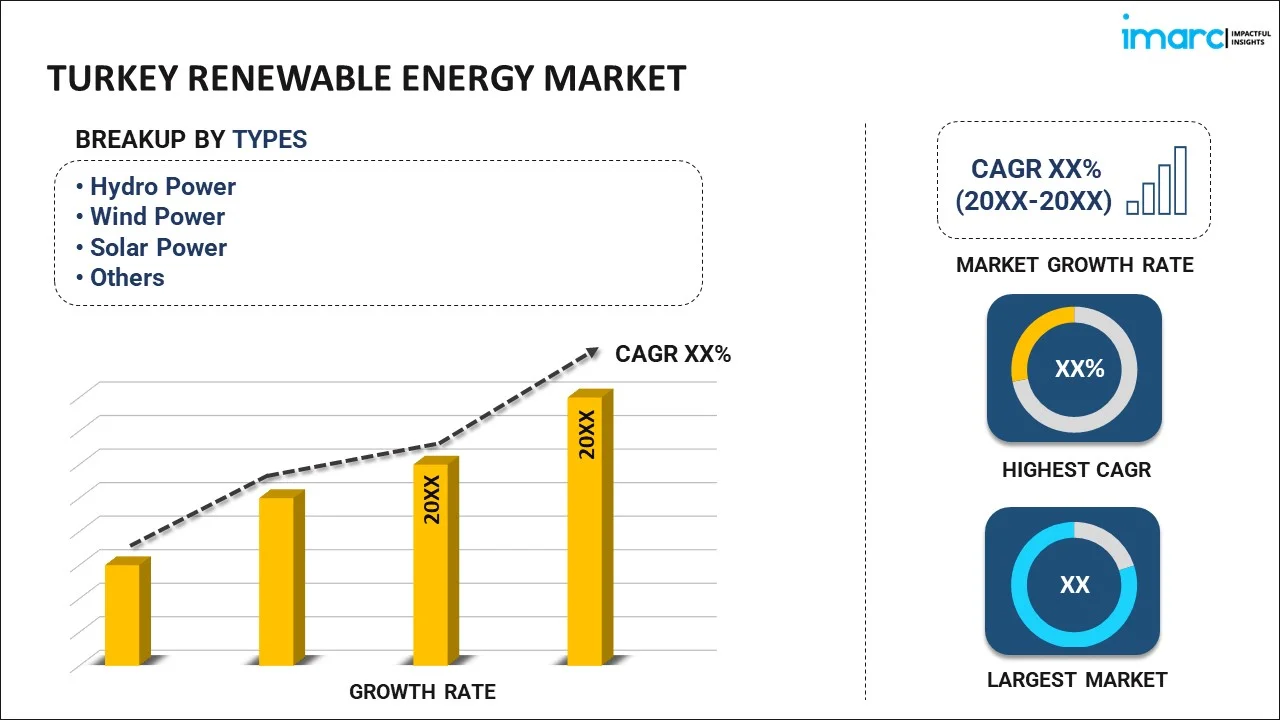

Turkey Renewable Energy Market Report by Type (Hydro Power, Wind Power, Solar Power, Bioenergy, and Others), End User (Industrial, Residential, Commercial), and Region 2026-2034

Turkey Renewable Energy Market Overview:

The Turkey renewable energy market size reached 61.8 GW in 2025. Looking forward, IMARC Group expects the market to reach 96.1 GW by 2034, exhibiting a growth rate (CAGR) of 4.88% during 2026-2034. The growing energy demand and energy security concerns, increasing focus on reducing reliance on fossil fuels, and rising advancements in solar and wind energy storage solutions, supported by government and private partnerships, are some of the factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 61.8 GW |

| Market Forecast in 2034 | 96.1 GW |

| Market Growth Rate (2026-2034) | 4.88% |

Access the full market insights report Request Sample

Turkey Renewable Energy Market Trends:

Private Sector Investment and International Partnerships

Private corporations, both domestic and international, are progressively investing into renewable energy initiatives due to the appealing regulatory conditions and profitable incentives. Prominent international renewable energy companies are venturing into the Turkish market, bringing knowledge, innovations, and funds. These investments play a crucial role in increasing the capacity of renewable energy and encouraging technological advancements. Furthermore, international collaborations help to share knowledge and develop skills, improving the overall success of renewable energy initiatives. Joint work with international financial institutions like the World Bank is crucial for securing funding and assistance for major renewable energy projects. In 2024, Turkey and the World Bank agreed to a $1 billion deal to enhance renewable energy by concentrating on growing the distributed solar energy sector and testing battery storage projects. The implementation of the program was scheduled to be carried out by the Development and Investment Bank of Turkey (TKYB) and the Industrial Development Bank of Turkey (TSKB). These collaborations not only enhance the financial and technical abilities of the sector but also demonstrate Turkey's dedication to worldwide renewable energy objectives and sustainable development.

Technological Advancements and Innovation

Advancements in solar and wind technologies are resulting in higher efficiency and lower expenses, enhancing the competitiveness of these sources against traditional fossil fuels. The advancement of energy storage options, like batteries, improves the dependability and consistency of renewable energy sources, tackling the problem of inconsistency linked with solar and wind power. In addition, incorporating smart grid technologies is facilitating improved assimilation of renewable energy into the national grid, enhancing energy distribution and usage. Local manufacturing capacity is also improving, resulting in less reliance on imports and decreased total project expenses. The support of government and private sector partnerships in research and development (R&D) is leading to innovation and the implementation of advanced technologies, establishing Turkey as a frontrunner in the renewable energy sector. GE Vernova signed a major deal with Kalyon PV in May 2024 to provide its FLEXINVERTER™ solar power station for a project in Viranşehir, Turkey. This alliance was established to help Turkey achieve its renewable energy objectives by incorporating cutting-edge solar technology to strengthen the country's clean energy facilities.

Rising Energy Demand and Energy Security Concerns

The rapidly growing population and economy are leading to an increase in energy usage, necessitating the diversification of energy sources to meet this demand sustainably. Dependence on foreign fossil fuels presents dangers associated with interruptions in supply and fluctuating prices. Turkey aims to decrease reliance on foreign energy sources and improve energy security through investing in renewable energy. Renewable energy offers a reliable and steady energy source, reducing the potential dangers linked to political tensions and unpredictable fossil fuel prices. Additionally, the rise of domestic renewable energy sources helps to maintain long-lasting energy security, guaranteeing a steady flow of sustainable energy to meet the demands of the economy and population.

Turkey Renewable Energy Market News:

- June 2024: Enspire Enerji, a Turkish company under Entek Elektrik, bought a 214 MW solar project in Romania from Econergy for EUR 32.9 million. The transaction was scheduled to be completed once the project was ready to start construction and received approval from regulators.

- November 2023: PV Hardware (PVH) reached an important goal by finishing the installation of solar panels for Turkey's YEKA-4 130MWp project. This represents a crucial step forward in Turkey's renewable energy objectives, with the target of incorporating 10GW of solar energy into the country's grid by 2027.

Turkey Renewable Energy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and end user.

Type Insights:

To get detailed segment analysis of this market Request Sample

- Hydro Power

- Wind Power

- Solar Power

- Bioenergy

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes hydro power, wind power, solar power, bioenergy, and others.

End User Insights:

- Industrial

- Residential

- Commercial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes industrial, residential, and commercial.

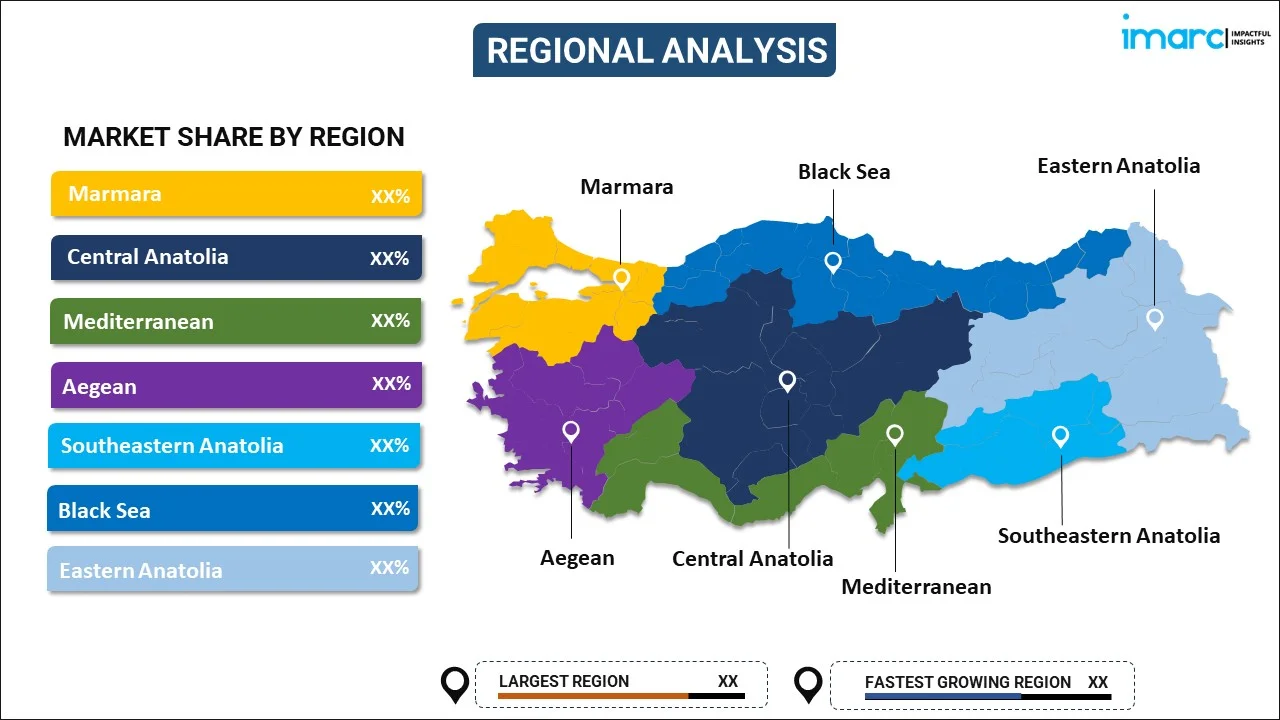

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Blacksea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Renewable Energy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | GW |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Hydro Power, Wind Power, Solar Power, Bioenergy, Others |

| End Users Covered | Industrial, Residential, Commercial |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey renewable energy market performed so far and how will it perform in the coming years ?

- What has been the impact of COVID-19 on the Turkey Renewable Energy market ?

- What is the breakup of the Turkey renewable energy market on the basis of type ?

- What is the breakup of the Turkey renewable energy market on the basis of end user ?

- What are the various stages in the value chain of the Turkey renewable energy market ?

- What are the key driving factors and challenges in the Turkey renewable energy market ?

- What is the structure of the Turkey renewable energy market and who are the key players ?

- What is the degree of competition in the Turkey renewable energy market ?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey renewable energy market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey renewable energy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey renewable energy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)