Turkey Real Estate Market Report by Property (Residential, Commercial, Industrial, Land), Business (Sales, Rental), Mode (Online, Offline), and Region 2026-2034

Turkey Real Estate Market Overview:

The Turkey real estate market size reached USD 68,283.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,10,267.3 Million by 2034, exhibiting a growth rate (CAGR) of 5.31% during 2026-2034. Urbanization, increasing population, favorable government policies, foreign investments, tourism, infrastructure development, affordable housing projects, economic growth, low interest rates, and robust demand for residential, commercial, and industrial properties are some of the factors contributing to the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 68,283.8 Million |

|

Market Forecast in 2034

|

USD 1,10,267.3 Million |

| Market Growth Rate 2026-2034 | 5.31% |

Access the full market insights report Request Sample

Turkey Real Estate Market Trends:

Rising Urbanization

The migration of individuals from rural areas to cities in search of enhanced employment aspects, education, and living standards has led to an increased demand for residential properties. Major cities like Istanbul, Ankara, and Izmir are expanding rapidly, necessitating the development of new housing projects to accommodate the growing urban population. This urban migration drives the construction of residential units and commercial and retail spaces, as well as infrastructure projects such as transportation networks, schools, and hospitals. According to TurkStat's "Urban-Rural Population Statistics 2022," 67.9% of Turkey's population resides in urban areas, totaling over 57 million people. Rural settlements account for 17.3% of the population but cover 93.5% of Turkey's land area, while medium-density cities house 14.8%. Additionally, urbanization encourages the growth of mixed-use developments that combine residential, commercial, and leisure facilities, offering a comprehensive living experience supporting the market growth.

Government Incentives

The Turkish government has implemented several policies aimed at attracting both domestic and international investments in real estate. These measures include tax breaks, reduced value-added tax (VAT) rates for property purchases, and citizenship programs for foreign investors. For instance, the Turkish Citizenship by Investment Program allows foreign nationals to obtain citizenship by purchasing real estate worth at least $400,000. This initiative has significantly boosted the demand for high-end residential properties, especially among Middle Eastern and Asian (MEA) investors. Additionally, the government’s urban renewal initiatives, which focus on replacing older, unsafe buildings with modern, earthquake-resistant structures, have spurred construction activities across the country. Collectively, these incentives enhance the attractiveness and accessibility of real estate investments, thereby fostering market growth.

Foreign Investment

Turkey’s strategic location, bridging Europe and Asia, coupled with its relatively affordable property prices compared to other European countries, makes it an attractive destination for international buyers. Foreign investors are finding property investments in Turkey increasingly alluring due to the depreciation of the Turkish lira in recent years, which has allowed them to obtain greater value for their money. Foreign investment is not limited to residential properties; there is also substantial interest in commercial real estate, including office spaces, retail centers, and hotels. The influx of foreign capital has led to increased competition in the real estate market, driving up property prices and encouraging the development of high-quality projects to meet international standards providing an impetus to the market growth.

Turkey Real Estate Market News:

- In April 2024, Tor Holding and ELIE SAAB partnered to launch dual real estate projects in Turkey, marking a significant milestone in the country's evolving luxury market. The partnership blends the renowned design legacy of ELIE SAAB with the property development expertise of Tor Holding. The two ELIE SAAB-branded residences are ideally situated, one near the famous Bosphorus in Istanbul, providing breathtaking views and city access, and the other in a tranquil, verdant environment outside the city limits. These residences offer distinctive, opulent living experiences that combine cutting-edge regional ideas with global expertise.

Turkey Real Estate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on property, business, and mode.

Property Insights:

To get detailed segment analysis of this market Request Sample

- Residential

- Commercial

- Industrial

- Land

The report has provided a detailed breakup and analysis of the market based on the property. This includes residential, commercial, industrial, and land.

Business Insights:

- Sales

- Rental

A detailed breakup and analysis of the market based on the business have also been provided in the report. This includes sales and rental.

Mode Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the mode. This includes online and offline.

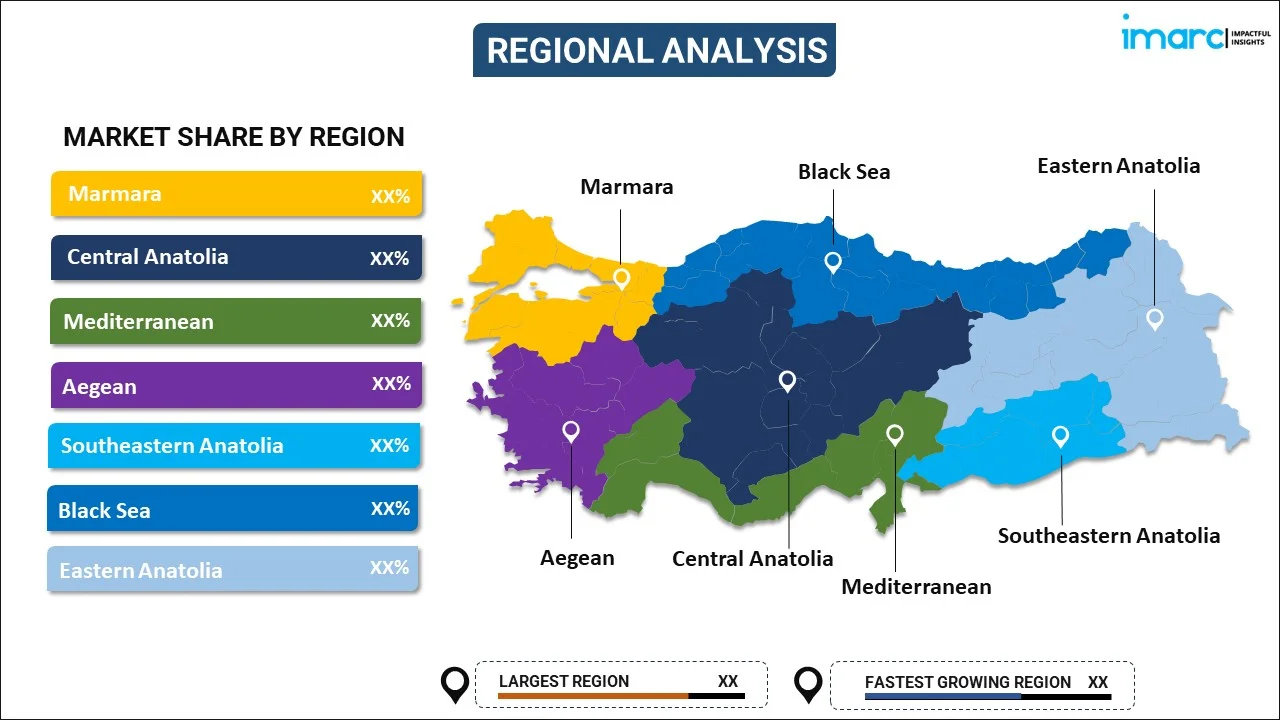

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Blacksea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Real Estate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Properties Covered | Residential, Commercial, Industrial, Land |

| Businesses Covered | Sales, Rental |

| Modes Covered | Online, Offline |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the turkey real estate market performed so far and how will it perform in the coming years?

- What is the breakup of the turkey real estate market on the basis of property?

- What is the breakup of the turkey real estate market on the basis of business?

- What is the breakup of the turkey real estate market on the basis of mode?

- What are the various stages in the value chain of the turkey real estate market?

- What are the key driving factors and challenges in the turkey real estate?

- What is the structure of the turkey real estate market and who are the key players?

- What is the degree of competition in the turkey real estate market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the turkey real estate market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the turkey real estate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the turkey real estate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)