Turkey Home Appliances Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2026-2034

Turkey Home Appliances Market Summary:

The Turkey home appliances market size was valued at USD 18,085.45 Million in 2025 and is projected to reach USD 28,268.81 Million by 2034, growing at a compound annual growth rate of 5.09% from 2026-2034.

The market is propelled by rising disposable incomes across urban centers, rapid household formation driven by sustained urbanization, and expanding real estate development nationwide. Government initiatives promoting energy-efficient appliances and smart home technologies have accelerated consumer preference shifts toward premium products. The growing middle class, especially in urban regions, increasingly prioritizes convenience and energy savings, driving sustained Turkey home appliances market share expansion.

Key Takeaways and Insights:

-

By Product: Major appliances dominate the market with a share of 74% in 2025, serving essential household functions while benefiting from strong domestic manufacturing capabilities.

-

By Distribution Channel: Multi-brand stores lead the market with a share of 38.5% in 2025, offering comprehensive product ranges alongside expert sales assistance and after-sales services.

-

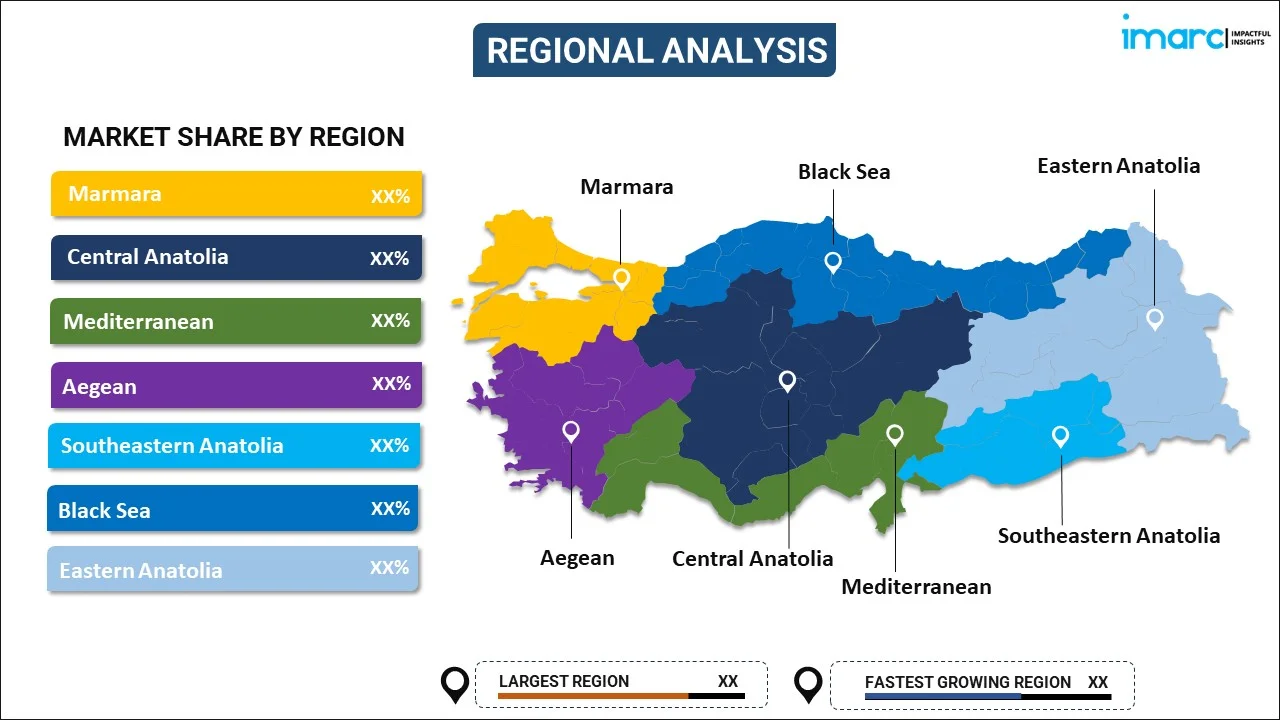

By Region: Marmara represents the largest segment with a market share of 32% in 2025, driven by high disposable incomes and dense urban populations in metropolitan areas.

-

Key Players: Key players in Turkey's home appliances market are focusing on energy-efficient and smart products, expanding exports, optimizing production, enhancing online retail platforms, and adopting sustainable practices. These strategies aim to meet growing consumer demand and stay competitive globally.

Turkey has turned out to be an important production base when it comes to consumer appliances and a continuous trade surplus within the country. The location of Turkey geographically positioned between Europe and Asia makes it easy to ship goods to European, Middle Eastern, African, and Central Asian markets, with the UK and Germany being major export markets. Homegrown production ensured by the production units of Arçelik Manisa and Arçelik-Ankara, as well as units from Bosch and Haier, help reduce costs. Turkey had a population of 85.66 million as of 2024, indicating an annual growth rate of 292,567 citizens, while Istanbul alone had increased by 45,678 citizens, thereby contributing to an increased demand within the country for new home appliances of all types.

Turkey Home Appliances Market Trends:

Digital Integration Through IoT and Smart Home Technologies

Turkey's smart home market demonstrates strong momentum as people are looking for technologically advanced solutions. The adoption of internet-connected appliances is accelerating rapidly, with household penetration rising. Turkish consumers increasingly prioritize convenience, remote monitoring, and automated household management systems, driving manufacturers to integrate advanced IoT sensors, artificial intelligence capabilities, and cloud-based platforms into refrigerators, washing machines, ovens, and small appliances. Major Turkish manufacturers and other global brands to establish standardized cloud-to-cloud interoperability protocols, enabling seamless device communication and whole-home energy management solutions that resonate with tech-savvy urban consumers. In 2024, MOVA, an emerging leader in the smart living technology sector, officially launched in Turkey. Known for its innovative products designed to enhance everyday life, MOVA is committed to transforming how people live, offering a glimpse into a future filled with limitless possibilities. MOVA, although a newcomer to the Turkish market, is a sub-brand of the well-known tech firm DREAME, merging advanced innovation with a history of quality.

Accelerated Shift Toward Sustainability and Energy Efficiency

Turkey's comprehensive energy efficiency strategy encompassing a USD 20 billion investment program spanning 2024 through 2030 is fundamentally reshaping consumer appliance preferences and manufacturer product development priorities. Government grants up to 21.6 million lira are available for business centers, offices, shopping malls, hospitals, and large campuses willing to achieve energy efficiency. The Energy Efficiency 2030 Strategy targets cumulative savings across residential, commercial, and industrial sectors, incentivizing households to replace outdated appliances with modern energy-saving alternatives that deliver long-term utility cost reductions while supporting Turkey's broader commitment to reducing carbon emissions and achieving net-zero targets by 2050.

E-commerce Channel Expansion and Digital Retail Transformation

Online sales channels are contributing to total household appliances revenue in Turkey, reflecting profound shifts in consumer purchasing behavior and retail infrastructure. E-commerce platforms have driven double-digit growth rates in small kitchen appliances by enabling price transparency, product comparison tools, customer reviews, and convenient home delivery services. Turkish SMEs, wholesale, and retail businesses enhanced their e-commerce participation while making investments in research and development (R&D) for digital platforms and smart appliance integration. Traditional electronic stores are evolving into experiential showrooms with omnichannel capabilities that integrate physical browsing with online ordering, while quick commerce platforms have revolutionized ultra-fast delivery models for smaller appliances and accessories, expanding market reach into underserved suburban and peri-urban areas where physical retail penetration remains limited. IMARC Group anticipates that the Turkey e-commerce market is projected to attain USD 1,774.5 Billion by 2033.

Market Outlook 2026-2034:

Turkey's home appliances market is positioned for robust expansion throughout the forecast period as urbanization continues driving household formation, government incentives bolster energy-efficient product adoption, and domestic manufacturing capabilities strengthen the nation's competitive position in regional export markets. The market generated a revenue of USD 18,085.45 Million in 2025 and is projected to reach a revenue of USD 28,268.81 Million by 2034, growing at a compound annual growth rate of 5.09% from 2026-2034. Build-to-rent housing developments and tourism infrastructure investments in Mediterranean and Aegean regions will create additional commercial procurement opportunities, while improved electricity infrastructure in Southeastern and Eastern Anatolia will gradually expand market penetration in traditionally underserved areas.

Turkey Home Appliances Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Major Appliances | 74% |

| Distribution Channel | Multi-brand Stores | 38.5% |

| Region | Marmara | 32% |

Product Insights:

To get more information on this market, Request Sample

- Major Appliances

- Refrigerators

- Freezers

- Dishwashing Machines

- Washing Machines

- Ovens

- Air Conditioners

- Others

- Small Appliances

- Coffee/Tea Makers

- Food Processors

- Grills and Roasters

- Vacuum Cleaners

- Others

Major appliances dominate with a market share of 74% of the total Turkey home appliances market in 2025.

Major appliances command the dominant position in Turkey's household appliances sector due to their essential role in modern households and sustained demand driven by new household formation alongside upgrade cycles in existing residences. Rising disposable incomes across urban centers enable consumers to invest in premium-segment refrigerators, washing machines, dishwashers, and ovens featuring smart connectivity, energy-efficient inverter compressors, and advanced automation capabilities. The booming real estate sector, with a major portion of Turkey's 86 million population residing in urban settlements, continuously generates first-time purchase opportunities as young professionals and nuclear families establish independent households.

Government incentives supporting energy-efficient appliances and Turkey's robust domestic manufacturing base, ensure competitive pricing and reliable supply chains. Arçelik's manufacturing facilities in Manisa and Ankara, alongside Bosch's Turkish production operations, provide locally manufactured products that minimize import dependencies while delivering quality standards comparable to European competitors, strengthening major appliances' market leadership through accessible financing, widespread after-sales service networks, and omnichannel retail distribution infrastructure spanning electronic stores, hypermarkets, and rapidly expanding e-commerce platforms.

Distribution Channel Insights:

- Multi-brand Stores

- Exclusive Stores

- Online

- Others

Multi-brand stores lead with a share of 38.5% of the total Turkey home appliances market in 2025.

Multi-brand stores maintain market leadership by fostering consumer trust through hands-on product interaction, comprehensive product range presentation, and expert sales assistance that guide purchasing decisions for high-consideration durable goods. Electronic stores commanded an impressive revenue share by providing experiential showrooms where customers physically examine appliance build quality, test smart features, compare energy efficiency labels, and receive personalized recommendations from trained staff knowledgeable about technical specifications, warranty coverage, and maintenance requirements. After-sales service capabilities including installation coordination, repair services, and warranty claim processing strengthen customer relationships and encourage repeat purchases over appliance lifecycles spanning eight to fifteen years.

Omnichannel integration connecting physical stores with e-commerce platforms enables seamless shopping experiences where consumers research products online, visit showrooms for demonstrations, and complete transactions through preferred channels while maintaining unified customer profiles and purchase histories. Turkey's established retail infrastructure spanning Media Markt, Teknosa, Bimeks, and regional chains provides nationwide coverage concentrated in urban centers but extending into secondary cities and suburban developments through strategically located outlets in shopping malls and standalone retail parks.

Regional Insights:

To get detailed regional analysis of this market, Request Sample

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Blacksea

- Eastern Anatolia

Marmara exhibits a clear dominance with a 32% share of the total Turkey home appliances market in 2025.

Marmara region commands the largest market share by virtue of hosting Turkey's most populous and economically prosperous metropolitan areas including Istanbul, Bursa, and Kocaeli, which concentrate high-income households, corporate headquarters, and manufacturing centers. Istanbul alone reached 15.7 million residents, gaining 45,600 inhabitants in 2024 while maintaining the one of the highest per capita disposable income levels and most mature retail infrastructure. The region's export-oriented industries generated rising real wages in 2024 despite tight monetary policy, supporting premium appliance upgrades among dual-income professional households seeking energy-efficient, smart-connected products.

Dense urban development with limited residential space incentivizes adoption of compact, multifunctional appliances and built-in kitchen systems that maximize efficiency in apartments and condominiums. The concentration of organized retail chains, specialty appliance stores, and e-commerce fulfillment centers in Marmara provides unparalleled product selection, competitive pricing, and convenient access to latest model introductions. Industrial clusters in Bursa and surrounding provinces support substantial B2B demand from manufacturing facilities, commercial kitchens, and hospitality establishments requiring professional-grade equipment and bulk procurement arrangements. Infrastructure maturity including reliable electricity supply, developed logistics networks, and comprehensive after-sales service coverage reduces operational barriers while facilitating rapid adoption of emerging technologies and premium product segments.

Market Dynamics:

Growth Drivers:

Why is the Turkey Home Appliances Market Growing?

Rising Disposable Income and Accelerating Urbanization

Turkey's sustained economic development has elevated household purchasing power across urban centers, enabling increased investment in essential and premium-segment appliances. In the first half of 2025, Turkey's population reached 85.82 million people, with new inhabitants who require complete appliance outfitting for newly established households. According to the Turkish Statistical Institute’s (TÜİK) Income Distribution 2025 survey released on December 26th, the top income quintile represented 48 percent of the overall equivalized household disposable income in Turkey, representing an increase of points year-over-year and concentrating significant purchasing power among affluent consumers prioritizing quality, energy efficiency, and smart features.

Expanding Real Estate Development and Household Formation

Turkey's robust construction sector drives sustained appliance demand through continuous new residential project completions in metropolitan regions and secondary cities experiencing rapid population growth and economic development. The real estate boom particularly benefits major appliance categories as developers increasingly bundle refrigerators, washing machines, dishwashers, and ovens into turnkey residential units targeting middle-income buyers and renters seeking move-in-ready accommodation. Government housing initiatives and mortgage incentive programs facilitate homeownership among middle-class families, translating into predictable appliance demand cycles as construction activity sustains momentum throughout the forecast period. The largest social housing initiative in the history of the Turkish republic, dubbed the “Housing Project of the Century,” started taking applications in 2025. Under this program, 500,000 residential homes are intended to be created across 81 provinces of Turkey.

Government Energy Efficiency Initiatives and Sustainability Programs

Turkey's comprehensive energy efficiency investment program spanning 2024 through 2030 fundamentally reshapes consumer purchasing decisions and manufacturer product development priorities by establishing robust incentive frameworks promoting adoption of A+++ rated appliances and green building standards. Financial grants for commercial property energy retrofits encourage office buildings, shopping malls, hospitals, and educational campuses to replace outdated equipment with energy-efficient refrigeration, HVAC, and lighting systems. The mandate requiring all new public buildings to obtain green building certification beginning in 2026 sets precedent for private sector residential construction and generates anticipated annual savings while driving specification of premium appliances meeting stringent energy and water consumption criteria. By 2030, the government’s aim is to achieve a 50% share of renewable energy, and 80% by 2053. Government programs subsidizing residential energy audits and equipment upgrades help households identify opportunities to replace aging refrigerators, washing machines, and water heaters with modern alternatives delivering 30-50% efficiency improvements and substantial long-term utility cost reductions. Turkey's commitment to achieving net-zero emissions by 2050 positions energy-efficient appliances as critical infrastructure components supporting broader climate objectives, creating sustained policy support for consumer incentives, manufacturer research and development funding, and public awareness campaigns highlighting environmental and economic benefits of modern household appliances throughout the decade-long forecast period.

Market Restraints:

What Challenges the Turkey Home Appliances Market is Facing?

Currency Volatility and Rising Import Cost Pressures

Turkish Lira depreciation against major currencies including the US Dollar and Euro has significantly elevated import costs for components, raw materials, and finished appliances, compressing manufacturer margins and necessitating retail price increases that dampen demand among price-sensitive consumers. Global supply chain disruptions beginning in 2022 have exacerbated cost pressures by extending lead times, increasing freight rates, and limiting availability of critical components including semiconductors, compressors, and advanced electronic controls. The resulting upward trend in average import prices forces manufacturers to balance profit protection against competitive pricing requirements, while retailers face inventory carrying cost increases and promotional margin pressure as they absorb inflation to maintain market share in highly competitive segments.

Monetary Policy Tightening and Consumer Financing Constraints

The Central Bank of Turkey's decision to raise the policy rate to 50% in October 2024 has substantially tightened consumer credit conditions, making installment financing significantly more expensive and reducing affordability for middle-income households relying on payment plans to acquire major appliances. Commercial banks have responded to higher benchmark rates by increasing consumer loan interest rates and implementing stricter credit approval standards, limiting access to financing particularly for borrowers with limited credit histories or marginal debt service coverage. The combination of elevated borrowing costs and constrained credit availability forces consumers to delay discretionary purchases, extend replacement cycles for existing appliances, and trade down to entry-level models lacking smart features and premium finishes, thereby suppressing total market value growth despite sustained unit volume demand.

Income Inequality and Regional Market Disparities

Turkey's pronounced income distribution inequality limits mass market penetration of premium appliances and concentrates demand within affluent urban segments. Rural and less developed regions including Southeastern Anatolia and Eastern Anatolia face persistent infrastructure challenges including unreliable electricity supply, limited retail presence, and constrained service networks that impede market expansion despite gradual improvements in connectivity and electrification. The geographic concentration of purchasing power in Marmara, Aegean, and Mediterranean regions creates natural ceiling effects as these mature markets approach saturation for essential appliances while emerging regions lack the income levels, retail infrastructure, and consumer awareness necessary to generate substantial near-term volume growth.

Competitive Landscape:

Key players in the Turkish home appliances market are focusing on several strategies to boost their businesses. One of the primary efforts is investing in new product development, especially in energy-efficient and smart appliances. With growing consumer interest in sustainability and smart home technology, these companies are prioritizing appliances that offer connectivity, convenience, and lower energy consumption. To expand their reach, many companies are increasing their export activities, particularly targeting European, Middle Eastern, and African markets. They are enhancing production capabilities and optimizing their logistics to support growing demand internationally. Alongside this, there is a significant effort to boost manufacturing efficiency by expanding local production capacities and streamlining supply chains. In terms of retail strategy, businesses are shifting towards digital channels. They are improving online shopping platforms, introducing virtual showrooms, and offering flexible payment methods. This helps them cater to an increasingly tech-savvy consumer base while also capitalizing on e-commerce growth. Sustainability remains a key focus, with many companies incorporating eco-friendly materials and sustainable production methods into their processes. This not only aligns with global environmental standards but also appeals to consumers who are becoming more environmentally conscious in their purchasing decisions.

Recent Developments:

-

In May 2025, Sahterm Elektrikli Isiticilar San. ve Tic., a Turkish manufacturer of heating elements for home appliances. A.S. commenced construction on a new plant in North Macedonia, with the initial phase estimated at 25 million euro ($28.2 million).

Turkey Home Appliances Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered |

|

| Distribution Channels Covered | Multi-brand Stores, Exclusive Stores, Online, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Turkey home appliances market size was valued at USD 18,085.45 Million in 2025.

The Turkey home appliances market is expected to grow at a compound annual growth rate of 5.09% from 2026-2034 to reach USD 28,268.81 Million by 2034.

Major appliances dominated the Turkey home appliances market with a 74% share, driven by their essential household role, sustained demand from new household formation and upgrade cycles, rising disposable incomes enabling premium purchases, and strong domestic manufacturing capabilities. Government incentives supporting energy-efficient models and expanding e-commerce accessibility further strengthen this segment's market leadership position.

Key factors driving the Turkey home appliances market include rising disposable incomes concentrated among urban middle-class and affluent households, accelerating urbanization with population reaching 85.66 million, robust real estate development creating continuous new household formation, and Turkey's comprehensive government energy efficiency program incentivizing adoption of modern appliances with superior environmental performance and operating cost savings.

Major challenges include currency volatility and rising import costs pressuring manufacturer margins and retail pricing, monetary policy tightening with Central Bank raising rates constraining consumer financing availability, and pronounced income inequality with bottom quintile holding a nominal percentage of disposable income limiting mass market penetration while regional disparities create infrastructure and distribution challenges in less developed Southeastern and Eastern Anatolia regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)