Turkey Health and Medical Insurance Market Report by Product Type (Private Health Insurance (PMI), Public/Social Security Schemes), Term of Coverage (Short-term, Long-term), Distribution Channel (Brokers/Agents, Banks, Direct Sales, Companies, and Others), and Region 2026-2034

Turkey Health and Medical Insurance Market Overview:

The Turkey health and medical insurance market size reached USD 16,242.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 27,405.7 Million by 2034, exhibiting a growth rate (CAGR) of 5.81% during 2026-2034. The rising healthcare costs, increasing awareness of health insurance benefits, government healthcare reforms, growing geriatric population, improved healthcare infrastructure, expanding private healthcare sector, economic growth, and higher disposable incomes are impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 16,242.1 Million |

| Market Forecast in 2034 | USD 27,405.7 Million |

| Market Growth Rate (2026-2034) | 5.81% |

Access the full market insights report Request Sample

Turkey Health and Medical Insurance Market Trends:

Rising healthcare costs

The escalating cost of medical treatments and procedures has paralleled advancements in medical technology and improvements in the quality of healthcare services. This rise in healthcare expenses has led to a heightened awareness among individuals and families about the financial risks associated with serious illnesses and medical emergencies. As a result, in 2019, around 662,000 international patients visited Turkey, injecting nearly $1 billion into the economy. According to the Turkish Statistics Institute's Health Expenditure report for 2020, healthcare spending in Turkey surged by 24.3% during that year. Furthermore, people are turning to health insurance as a means to mitigate these costs and ensure access to necessary healthcare services without the burden of high out-of-pocket expenses, strengthening the demand for health insurance products.

Government healthcare reforms

The Turkish government has implemented various policies and initiatives aimed at improving the accessibility and quality of healthcare services. One notable reform is the expansion of the Social Security Institution (SGK) coverage; thus, by expanding the coverage to encompass all citizens. This expansion seeks to achieve universal health insurance, ensuring that every individual has access to essential healthcare services without financial barriers. This initiative reduces disparities in healthcare access among numerous socioeconomic groups and enhances health outcomes. In addition to this, the government has introduced regulatory changes to encourage the growth of the private health insurance sector, such as tax incentives for individuals purchasing private health insurance policies. Health insurance has become more widely available in the nation as a result of these reforms, which have also encouraged private insurers to create more competitive and all-inclusive insurance products, thus bolstering the market growth.

Growing demand for comprehensive coverage

As the population becomes more health-conscious and aware of the benefits of health insurance, there is an increasing demand for policies that offer extensive coverage, including outpatient services, dental care, and chronic disease management. This shift is driven by a combination of factors, including an aging population, rising incidences of chronic diseases, and a greater emphasis on preventive care. Insurers are responding to this demand by offering more diversified and customized insurance plans that cater to the specific needs of different demographic groups. The expanding private healthcare sector provides high-quality healthcare services and drives the need for insurance products that can cover the associated costs, creating a positive outlook for market expansion.

Turkey Health and Medical Insurance Market News:

- In September 2023, Cigna Healthcare, the global health benefits provider of The Cigna Group with operations in Turkey, introduced the 'Cigna Global Plan for Seniors,' a health benefits plan for the globally mobile over-60s. Responding to increasing demand, this plan aligns with Cigna's research, predicting the market to expand to 450,000 people by 2025.

Turkey Health and Medical Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product type, term of coverage, and distribution channel.

Product Type Insights:

To get detailed segment analysis of this market Request Sample

- Private Health Insurance (PMI)

- Public/Social Security Schemes

The report has provided a detailed breakup and analysis of the market based on the product type. This includes private health insurance (PMI) and public/social security schemes.

Term of Coverage Insights:

- Short-term

- Long-term

A detailed breakup and analysis of the market based on the term of coverage have also been provided in the report. This includes short-term and long-term.

Distribution Channel Insights:

- Brokers/Agents

- Banks

- Direct Sales

- Companies

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes brokers/agents, banks, direct sales, companies, and others.

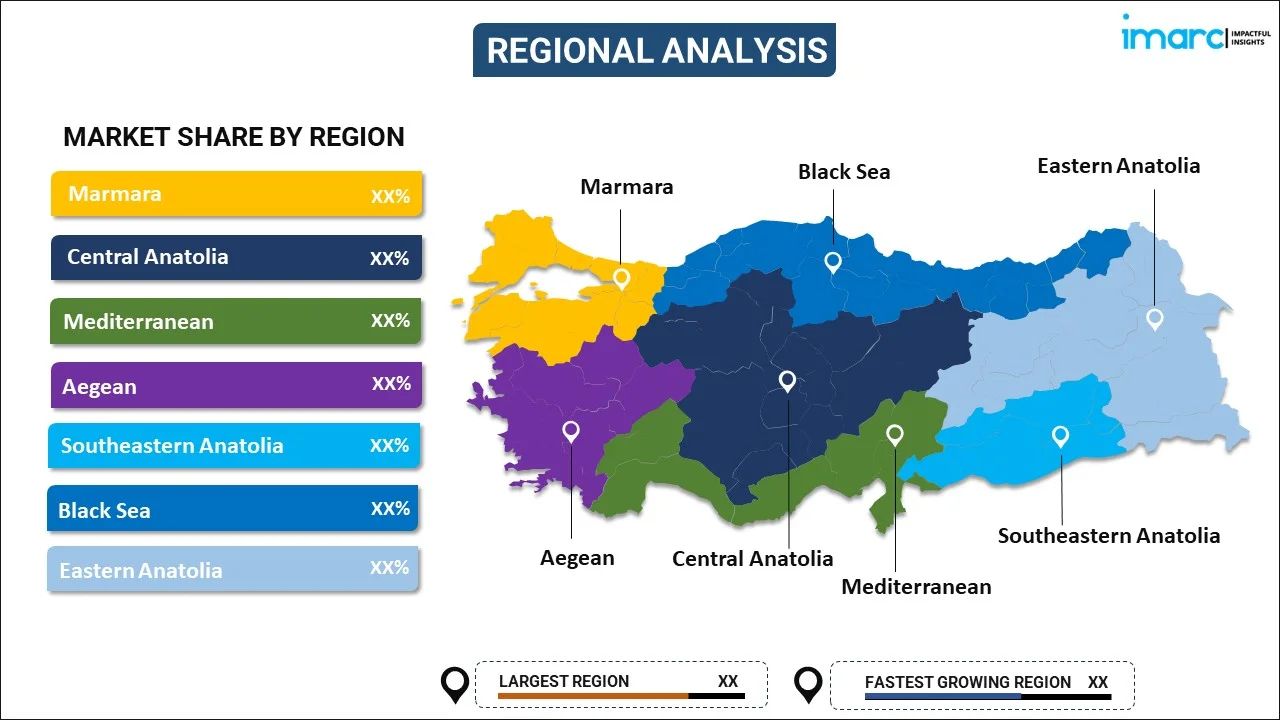

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Blacksea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Health and Medical Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Private Health Insurance (PMI), Public/Social Security Schemes |

| Term of Coverages Covered | Short-term, Long-term |

| Distribution Channels Covered | Brokers/Agents, Banks, Direct Sales, Companies, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey health and medical insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey health and medical insurance market on the basis of product type?

- What is the breakup of the Turkey health and medical insurance market on the basis of term of coverage?

- What is the breakup of the Turkey health and medical insurance market on the basis of distribution channel?

- What are the various stages in the value chain of the Turkey health and medical insurance market?

- What are the key driving factors and challenges in the Turkey health and medical insurance?

- What is the structure of the Turkey health and medical insurance market and who are the key players?

- What is the degree of competition in the Turkey health and medical insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey health and medical insurance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey health and medical insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey health and medical insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)