Turkey Data Center Market Report by Component (Solution, Services), Type (Colocation, Hyperscale, Edge, and Others), Enterprise Size (Large Enterprises, Small and Medium Enterprises), End User (BFSI, IT and Telecom, Government, Energy and Utilities, and Others), and Region 2026-2034

Turkey Data Center Market Overview:

The Turkey data center market size reached USD 534.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,003.1 Million by 2034, exhibiting a growth rate (CAGR) of 7.24% during 2026-2034. Rapid digital transformation, rising internet penetration, increasing cloud services adoption, expanding e-commerce, governmental information technology (IT) investments, robust telecom infrastructure, and growing demand for data storage and processing capabilities are some of the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 534.6 Million |

| Market Forecast in 2034 | USD 1,003.1 Million |

| Market Growth Rate (2026-2034) | 7.24% |

Access the full market insights report Request Sample

Turkey Data Center Market Trends:

Increasing Digital Transformation Initiatives

One of the major trends propelling the Turkey data center market is the widespread push towards digital transformation across various industries. With 74.41 million internet users (86.5% penetration) and 57.50 million social media users (66.8% of the population) as of January 2024, businesses in Turkey are increasingly adopting digital technologies to enhance operational efficiency, customer engagement, and competitiveness. This change is particularly noticeable in industries like manufacturing, healthcare, retail, and finance, where the integration of digital tools and platforms is fostering innovation, process optimization, and better service delivery. The Turkish government's support for digital transformation through policies and incentives is further contributing to the market growth. As companies digitize their operations, the demand for data storage, management, and processing capabilities rises, driving the need for advanced data center infrastructure to support these activities.

Rising Adoption of Cloud Services

Increasing cloud service adoption in Turkey, where the benefits of scalability, flexibility, and cost-efficiency drive businesses to optimize IT resources and reduce capital expenditure on physical infrastructure, is impelling the market growth. Moreover, with 74.41 million internet users (86.5% penetration) and 80.69 million active cellular connections (93.8% of the population), demand for cloud services is surging. To serve 3,500 cloud customers, Turkcell invested in four high-performance data centers, enhancing its Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS) offerings. As Turkey's largest cloud services and data center provider, Turkcell aims to elevate data protection and provide enterprises nationwide with greater peace of mind. Moreover, global providers like AWS, Microsoft Azure, and Google Cloud are increasingly focusing on the Turkish market, establishing local data centers, and expanding services, which fuels the demand for robust data center infrastructure and investments.

Substantial Investments in IT Infrastructure

Substantial investments in information technology (IT) infrastructure, driven by both private and public sectors, are key to fueling the growth of the Turkey data center market. The Turkish government's initiatives, including technology park development and smart city projects, aim to bolster the nation's digital infrastructure. Private sector investments in data centers align with this, meeting the escalating demand for data services. The telecom industry, notably, invests heavily in data center infrastructure to accommodate increasing data traffic and ensure reliable connectivity. Furthermore, the IT sector's significant growth and its integral role in Türkiye's digital transformation is acting as another significant growth-inducing factor.

Turkey Data Center Market News:

- In February 2024, Damac's Edgnex and Vodafone Turkey reached an agreement on a $100 million data center project. Both organizations are committed to regional development and technological advancements, and by collaborating they hope to improve Turkey's digital infrastructure and data services.

- In November 2023, Equinix announced significant investments in data centers in Turkey in response to the burgeoning need for digital infrastructure. This calculated action highlights Equinix's dedication to meeting local market needs while also enhancing connectivity and bolstering the region's expanding digital economy.

Turkey Data Center Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on component, type, enterprise size, and end user.

Component Insights:

To get detailed segment analysis of this market Request Sample

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and service.

Type Insights:

- Colocation

- Hyperscale

- Edge

- Others

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes colocation, hyperscale, edge, and others.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium enterprises.

End User Insights:

- BFSI

- IT and Telecom

- Government

- Energy and Utilities

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes BFSI, IT and telecom, government, energy and utilities, and others.

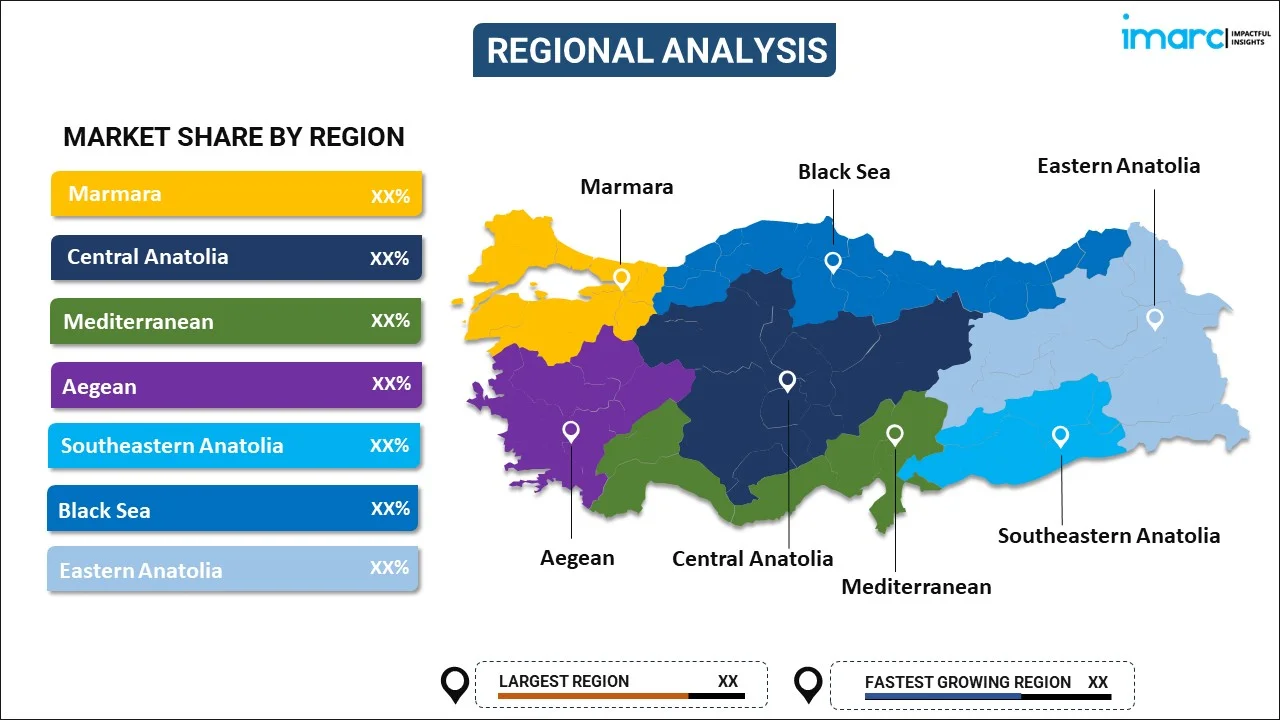

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Blacksea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Data Center Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered | Solution, Services |

| Types Covered | Colocation, Hyperscale, Edge, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| End Users Covered | BFSI, IT and Telecom, Government, Energy and Utilities, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey data center market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey data center market on the basis of component?

- What is the breakup of the Turkey data center market on the basis of type?

- What is the breakup of the Turkey data center market on the basis of enterprise size?

- What is the breakup of the Turkey data center market on the basis of end user?

- What are the various stages in the value chain of the Turkey data center market?

- What are the key driving factors and challenges in the Turkey data center?

- What is the structure of the Turkey data center market and who are the key players?

- What is the degree of competition in the Turkey data center market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey data center market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey data center market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey data center industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)