Turkey Cold Chain Logistics Market Report by Type (Refrigerated Warehouses, Refrigerated Transportation), Application (Fruits and Vegetables, Bakery and Confectionary, Dairy and Frozen Desserts, Meat, Fish, and Sea Food, Drugs and Pharmaceuticals, and Others), and Region 2026-2034

Turkey Cold Chain Logistics Market Overview:

The Turkey cold chain logistics market size reached USD 4.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 12.6 Billion by 2034, exhibiting a growth rate (CAGR) of 12.73% during 2026-2034. The increasing advancements in refrigeration technology to improve performance, rising expansion of cold storage infrastructure in the country, and heightened demand for sustainable solutions to lower the carbon footprint of cold chain logistics operations are propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 4.3 Billion |

|

Market Forecast in 2034

|

USD 12.6 Billion |

| Market Growth Rate 2026-2034 | 12.73% |

Access the full market insights report Request Sample

Turkey Cold Chain Logistics Market Trends:

Technological Advancements in Cold Chain Logistics

The cold chain logistics market in Turkey is witnessing huge technological advances that are driving efficiency and reliability across the sector. One of the pivotal developments is the integration of Internet of Things (IoT) devices and blockchain technology. IoT sensors are increasingly being used for real-time monitoring of temperature-sensitive goods, ensuring that perishable items, such as pharmaceuticals, dairy products, and fresh produce, maintain optimal conditions throughout the supply chain. The sensors transmit data on temperature, humidity, and other crucial factors at every moment to allow immediate corrective measures in the case of deviations. In addition, the technology makes sure that transparency and traceability across the cold chain are improved. An unchangeable record of transactions and movements across the supply chain assures all stakeholders information that is verifiable with regard to the handling and condition of the products.

Expansion of Cold Storage Infrastructure

There is a heightened need for advanced and reliable cold storage facilities due to the rising consumption of fresh produce, dairy products, and pharmaceuticals, which require stringent temperature-controlled environments to maintain their quality and. As a result, there are increasing investments in advanced, reliable cold storages to match the requirements. Apart from this, advanced refrigeration systems, energy-efficient technologies, and automated storage and retrieval systems (AS/RS) are becoming the critical installations within state-of-the-art cold storage warehouses. In addition to maximizing storage density, AS/RS enhances operational efficiency, eliminates human error, and reduces labor cost. The Turkish government, in association with the private sector, is working on cold chain infrastructure by building various initiatives and providing incentives to defray the cost of the construction of new cold storages, apart from the existing plan to modernize the existing facilities. It has also been possible through the public-private partnership in different forms, so that necessary expertise and resources could be tapped to complete the increasing market demand. According to the information presented by the Trans.eu Group S.A. in 2023, the Turkish government stated that the transport and logistics sector would bring $20 billion in revenue at the end of that year.

Growing Demand for Sustainable Cold Chain Solutions

Sustainability is becoming a crucial factor in cold chain logistics, driven by increasing environmental awareness and regulatory pressures. There is a heightened demand for eco-friendly and energy-efficient cold chain solutions as companies seek to reduce their carbon footprint and adhere to stricter environmental regulations. One significant trend is the adoption of green refrigeration technologies. These include the use of natural refrigerants, such as ammonia and carbon dioxide, which have a lower environmental impact compared to traditional synthetic refrigerants. Additionally, energy-efficient refrigeration systems, including those utilizing solar power and advanced insulation materials, are being increasingly implemented to reduce energy consumption and greenhouse gas emissions. Moreover, the National Energy Efficiency Action Plan 2017-2023 implemented by the government in Turkey resulted in a 25% reduction in energy consumption in the country.

Turkey Cold Chain Logistics Market News:

- In April 2023: PSA-BDP Turkey Supply Chain Solutions Pte Ltd, signed an agreement to acquire 75% of the shares of ALISAN Logistics A.S. (ALISAN).

- In April 2023: The European Bank for Reconstruction and Development (EBRD) and Citi announced that they are supporting the rollout of a sustainable supply chain finance programme for Finnish tech and services company Metso Outotec and its suppliers in Turkey. €25 million was invested to support Metso Outotec suppliers.

Turkey Cold Chain Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

To get detailed segment analysis of this market Request Sample

- Refrigerated Warehouses

- Refrigerated Transportation

- Railways

- Airways

- Roadways

- Waterways

The report has provided a detailed breakup and analysis of the market based on the type. This includes refrigerated warehouses and refrigerated transportation (railways, airways, roadways, and waterways).

Application Insights:

- Fruits and Vegetables

- Bakery and Confectionary

- Dairy and Frozen Desserts

- Meat, Fish, and Sea Food

- Drugs and Pharmaceuticals

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes fruits and vegetables, bakery and confectionary, dairy and frozen desserts, meat, fish, and sea food, drugs and pharmaceuticals, and others.

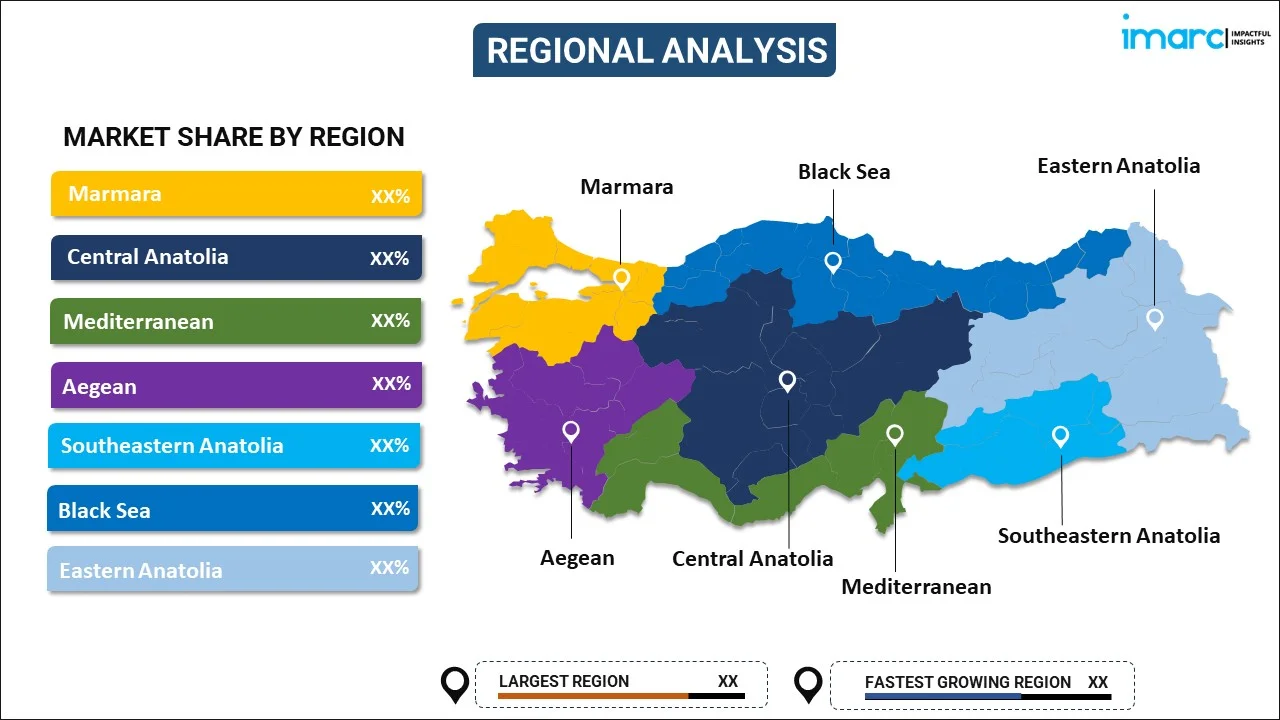

Region Insights:

To get detailed regional analysis of this market Request Sample

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Blacksea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Cold Chain Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered |

|

| Applications Covered | Fruits and Vegetables, Bakery and Confectionary, Dairy and Frozen Desserts, Meat, Fish, and Sea Food, Drugs and Pharmaceuticals, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Blacksea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey cold chain logistics market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey cold chain logistics market on the basis of type?

- What is the breakup of the Turkey cold chain logistics market on the basis of application?

- What are the various stages in the value chain of the Turkey cold chain logistics market?

- What are the key driving factors and challenges in the Turkey cold chain logistics?

- What is the structure of the Turkey cold chain logistics market and who are the key players?

- What is the degree of competition in the Turkey cold chain logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey cold chain logistics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey cold chain logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey cold chain logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)