Turbocompressors Market Size, Share, Trends and Forecast by Type, Stage, End User, and Region, 2025-2033

Turbocompressors Market Size and Share:

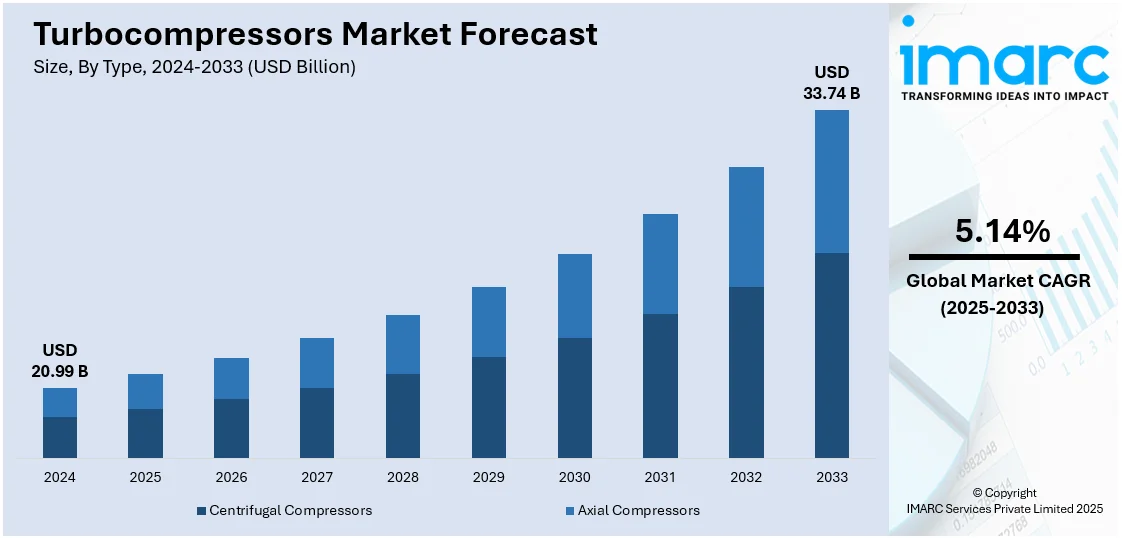

The global turbocompressors market size was valued at USD 20.99 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 33.74 Billion by 2033, exhibiting a CAGR of 5.14% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 37.5% in 2024. The market is driven by the increasing need for low-emission and energy-efficient systems, industrial growth, and higher adoption in industries such as oil & gas, power generation, and manufacturing. Improvements in technology and tighter environmental laws are also encouraging industries to shift towards more dependable and cleaner turbocompressor solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 20.99 Billion |

|

Market Forecast in 2033

|

USD 33.74 Billion |

| Market Growth Rate 2025-2033 | 5.14% |

The rising demand for energy-efficient systems across various sectors is one of the major factors propelling the turbocompressors market share. Industries like manufacturing, electricity generation, and oil and gas are concentrating on solutions that reduce energy consumption and carbon emissions due to rising global energy prices and more stringent environmental requirements. Because of their great efficiency and dependability, turbocompressors are being utilized more and more to meet these demands. They are ideal for continuous operations in essential processes because of their efficiency in high-speed operations with minimal energy loss. This push for cost reduction and sustainability is driving the turbocompressors market demand.

The U.S. turbocompressor market is gradually increasing, led by robust industrial growth and a focus on energy efficiency, with a market share of 85.40%. Major industries such as oil and gas, power generation, and manufacturing are embracing turbocompressors due to their high reliability and performance. Specifically, they are used by the oil and gas sector to process and transport natural gas and by the energy sector to enhance the efficiency of power plants. Additional technological innovation such as smart control systems and variable speed drives adds to their versatility. This is being facilitated by the U.S. Department of Energy (DOE) as seen through the provision of a $1.8 million grant for a turbo-compression cooling system that would be used to recover waste heat at ultra-low temperatures. This emphasizes the DOE's dedication to advancing energy-efficient turbocompressor technologies, affirming the U.S.'s position as a leader in the international market.

Turbocompressors Market Trends:

Integration of Digital Technologies and Smart Monitoring

The Indian government's investment of ₹10,300 crore (around USD 1.3 billion) in the IndiaAI Mission is in line with the prevailing digital evolution in industrial processes, including turbocompressor systems. With industries adopting smart manufacturing, technologies such as AI, IoT, and cloud connectivity are being incorporated into turbocompressor operations for real-time monitoring and control. These changes support predictive maintenance, detecting potential faults before they create downtime, and promoting greater operating efficiency. Smart sensors to gather performance data further augment decision-making and prolong equipment life. With AI-based monitoring systems, businesses are able to maximize performance, lower costs, and enhance reliability. The government emphasis on AI infrastructure is driving the implementation of these technologies, and turbocompressors are becoming smarter, more efficient, and responsive to new industrial requirements.

Emphasis on Energy Efficiency and Sustainability

One of the dominant trends in the turbocompressors market outlook is the increasing demand for energy-saving and eco-friendly solutions. Manufacturers are focusing on energy reduction and emission reduction in order to conform to global sustainability standards. Efficient turbocompressors are in greater demand as industries seek to reduce costs while complying with tough regulations. Progress in turbocompressor technology has driven reductions in energy consumption and more than 30% reductions in greenhouse gas emissions in wastewater treatment applications. Companies are increasingly concentrating on new materials and geometries to provide higher airflow efficiency and reduced waste. There is also a huge impetus to upgrade from inefficient older systems to newer, more efficient ones. This trend will persist as businesses move towards sustainability, and energy efficiency becomes an important consideration in equipment choice and investment decisions globally.

Expansion in Emerging Markets and Industrial Growth

Growth markets in Asia-Pacific, the Middle East, and Latin America are emerging as the new growth drivers for the turbocompressor market owing to the growing industrialization, urbanization, and infrastructure growth. Governments are investing significantly in industries such as energy, oil and gas, manufacturing, and infrastructure, fueling demand for high-performance, efficient equipment such as turbocompressors. For example, India's goal of achieving 500 GW non-fossil fuel-based power capacity by 2030 is likely to expedite the demand for energy-efficient solutions. Governments at the local level are also advocating modernization for both environmental and operational objectives, providing a massive opportunity for producers. This expansion is rewriting the global turbocompressor market, with developing markets holding strong potential as they build their industrial foundations, driving the acceptance of state-of-the-art technologies to meet growing energy and manufacturing infrastructure.

Turbocompressors Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global turbocompressors market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, stage, and end user.

Analysis by Type:

- Centrifugal Compressors

- Axial Compressors

Centrifugal compressors dominate turbocompressors market share of 76.5% because they deliver better performance under high-volume and high-pressure demands in numerous industrial applications. Large flows of air or gas that they can treat with high efficiency make them preferred in industries such as oil and gas, electricity generation, and chemical processing. The ease with which the rotary energy is harnessed to compress gases offers continuous and reliable operation with very low maintenance. Centrifugal compressors are also smaller and scalable in size, unlike other compressor forms, thus highly adaptable across many applications. As the need for energy efficiency and operational dependability gains more attention from industries, centrifugal compressors remain the choice, cementing their leading market status. Their large capacity, accompanied by energy efficiency, powers their high rate of adoption.

Analysis by Stage:

- Single Stage

- Multi-stage

According to the turbocompressors market forecast, the single-stage turbocompressors dominate the market share because they are simple, efficient, and economical for most industrial uses. Single-stage turbocompressors work best for moderate pressure levels and can be found extensively in industries like oil and gas, manufacturing, and HVAC systems. The simplicity of the design helps them be simpler to operate and maintain, which is attractive to industries seeking dependable and low-maintenance options. Moreover, single-stage compressors tend to be smaller and more energy-efficient, which makes them ideal for small-scale or less complicated operations. With industries striving to maximize performance while reducing operating expenses, single-stage turbocompressors are still a widely used option for applications that demand moderate compression without the complexity and cost of multi-stage systems.

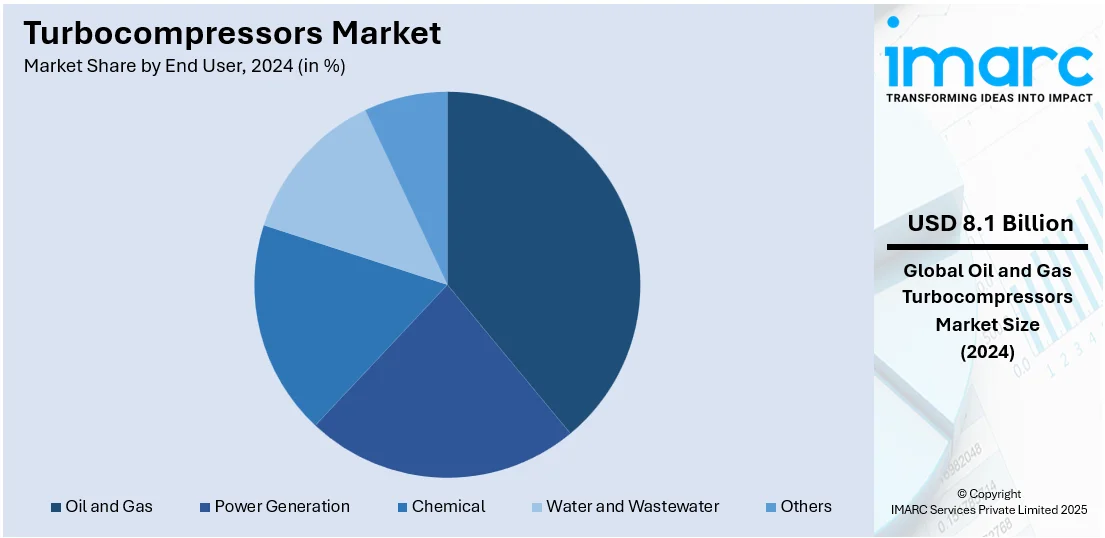

Analysis by End User:

- Oil and Gas

- Power Generation

- Chemical

- Water and Wastewater

- Others

The oil and gas dominate turbocompressor market demand at 38.5% market share due to its critical need for high-performing, reliable compression systems in production, exploration, processing, and transport. Turbocompressors are crucial to gas lift operations, natural gas processing, refining, and pipeline transportation, where they facilitate efficient pressure control and energy conservation. The increase in complexity of the techniques of oil extraction and the increase in offshore and shale projects also create demand for more complex turbocompressors. As energy companies prioritize operational efficiency and regulatory considerations, they seek equipment that provides lower emissions and energy consumption. In addition, growing worldwide energy demand and investment in liquefied natural gas (LNG) facilities have boosted the role of turbocompressors in this sector, and oil and gas is now the most prominent market segment.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific leads the turbocompressor market with a robust share of 37.5% due to the high rate of industrialization, infrastructure development, and increasing energy needs in the region. China, India, and Southeast Asian nations are investing heavily in power generation, oil and gas, manufacturing, and transportation sectors, all of which require efficient turbocompression technologies. Huge projects on an industrial scale, government incentives for clean energy and technology, also bolstering the turbocompressors market growth. Additionally, the population growth and urbanization of the region are driving increased energy and industrial goods consumption. Indigenous manufacturing bases, cheap human resources, and a surge in foreign investment also bolster the region's dominance, turning Asia-Pacific into a turbocompressor production and consumption hub.

Key Regional Takeaways:

North America Turbocompressors Market Analysis

The market for turbocompressors in North America is growing strongly, led by high demand from major industries including oil and gas, power generation, manufacturing, and chemicals. The U.S. leads the market with a huge market share because of its strong industrial base and emphasis on energy efficiency. Turbocompressors are common in natural gas processing, power plants, and other mission-critical operations where their efficiency and reliability at high levels are needed. The driver of the market is one, which is pressure to provide energy-efficient solutions amid strict environmental legislation. With rising energy prices and growing pressure on industries to reduce carbon emissions, turbocompressors present the perfect solution due to their ability to work at high speeds while suffering minimal loss of energy. Moreover, advancements in technology, particularly variable speed drives, smart control technologies, and digitalization, are improving turbocompressor performance and versatility. The North American market is further bolstered by government programs involving funding for energy-saving technologies as well as eco-friendly industrial processes. Ongoing industrial growth and the move towards more sustainable solutions mean that North America is still a strong contender in the global market for turbocompressors.

United States Turbocompressors Market Analysis

The United States turbocompressors market is witnessing steady expansion, driven by increased demand across industries such as oil & gas, manufacturing, and energy. The country's emphasis on industrial efficiency and technological modernization has contributed significantly to the integration of turbocompressors in various high-performance systems. Advancements in process automation and a growing inclination toward energy-efficient machinery are further fueling market momentum. The presence of advanced infrastructure, coupled with rising investments in clean energy and sustainable industrial practices, has amplified the adoption of turbocompressors. Additionally, regulatory support for reducing carbon emissions and enhancing system efficiency aligns well with the increased deployment of turbocompressors in industrial applications. Looking ahead, the U.S. Energy Information Administration (EIA) projects the global liquid fuel consumption to increase by 1.3 million barrels per day (b/d) in 2025 and a further 1.2 million b/d in 2026, underscoring the ongoing need for efficient energy systems. This growing preference for robust and high-speed compression systems is anticipated to sustain demand over the forecast period. Innovations in compressor design and material science are also enhancing the performance and lifecycle of turbocompressors.

Europe Turbocompressors Market Analysis

The Europe turbocompressors market is characterized by a strong focus on energy efficiency and sustainable industrial practices. Industrial sectors are increasingly adopting turbocompressors for their ability to optimize performance and reduce operational costs. The integration of smart technologies and digital monitoring systems into turbocompressor operations is further strengthening market adoption across diverse industries. Growing industrial automation and process optimization needs are encouraging upgrades from traditional systems to advanced turbocompressors. Additionally, environmental standards and regulatory frameworks promoting lower emissions are indirectly propelling demand. One such regulatory development is the EU Green Bond Standard (Regulation (EU) 2023/2631), which began applying at the end of 2024. As reported by Bruegel, this regulation mandates that at least 85 percent of proceeds from green bonds be directed toward taxonomy-aligned activities for issuers to qualify for the EU Green Bond label. Turbocompressors, a reliable, efficient, and cost-effective industrial technology, are gaining popularity due to their continuous R&D efforts, enhancing performance and reducing energy consumption.

Asia Pacific Turbocompressors Market Analysis

The Asia Pacific turbocompressors market is expanding rapidly, fueled by growing industrialization and infrastructure development. A surge in demand for efficient mechanical systems across sectors such as manufacturing and energy is boosting the adoption of turbocompressors. The region’s increasing focus on productivity enhancement and energy-saving technologies supports the integration of advanced compression solutions. Rising investments in industrial expansion and upgrades are further driving market penetration. Additionally, evolving industrial standards and heightened awareness about energy management are contributing to the increased use of turbocompressors. India, a key market in the region, is actively working to enhance its infrastructure to meet its ambitious economic growth target of USD 5 Trillion by 2025, according to the India Brand Equity Foundation (IBEF). This push for infrastructural development is accelerating the deployment of energy-efficient technologies such as turbocompressors. Technological advancements are also improving system performance and cost efficiency, making turbocompressors an attractive choice for industries aiming to streamline operations.

Latin America Turbocompressors Market Analysis

The Latin America turbocompressors market is witnessing a gradual uptick, influenced by an increased focus on industrial optimization and energy efficiency. Expanding industrial operations and modernization initiatives are promoting the adoption of turbocompressors across various sectors. Industries are recognizing the value of turbocompressors in enhancing operational performance and reducing long-term energy costs. A notable development supporting this trend is Brazil’s National Energy Efficiency Plan, under which the Ministry of Mines and Energy and the Energy Research Company aim to reduce the country’s energy consumption by 7% by 2034 through efficiency improvements. This initiative is fostering the adoption of advanced mechanical systems such as turbocompressors, which contribute to reduced energy use and higher process efficiency. The market expansion is driven by the region's upgrading of existing systems, investments in industrial infrastructure, and rising demand for reliable compression technologies.

Middle East and Africa Turbocompressors Market Analysis

The Middle East and Africa turbocompressors market is gaining momentum due to increased industrial activities and infrastructure development, driven by the need for high-efficiency machinery in process-intensive environments. Rising investments in key industrial sectors are further promoting the integration of advanced compression systems. According to the International Energy Agency, the construction market in Saudi Arabia, one of the region's major growth engines, has emerged as a leader in the Middle East and North Africa, with an estimated size of USD 70.33 Billion in 2024 and is projected to reach USD 91.36 Billion by 2029. This robust infrastructure expansion is enhancing demand for efficient mechanical systems such as turbocompressors. The market is experiencing a surge in energy management and process optimization, with the demand for turbocompressors expected to continue rising due to ongoing modernization efforts.

Competitive Landscape:

The competitive environment is marked by innovation, technological development, and emphasis on efficiency. Players in the market are always coming up with high-performance, energy-saving products to address changing industrial needs. The competition is fueled by the desire to provide dependable, cost-saving, and environmentally friendly solutions. Firms are spending on research and development to incorporate smart technologies, including automation and remote monitoring, into their products. Strategic alliances, acquisitions, and worldwide expansion strategies are typical since companies try to advance their presence in the marketplace. Furthermore, customer service following a sale, personalization capacities, and sustainable performance are significant differentiation factors. The market is fluid, and companies compete on quality of product in addition to innovativeness, service, and responsiveness to consumers' requirements.

The report provides a comprehensive analysis of the competitive landscape in the turbocompressors market with detailed profiles of all major companies, including:

- Atlas Copco AB

- BorgWarner Inc.

- Continental AG

- Cummins Inc.

- Eaton Corporation plc

- Howden Group Holdings Ltd

- Ingersoll Rand Inc.

- Kawasaki Heavy Industries Ltd.

- MAN Energy Solutions SE (Volkswagen AG)

- Mitsubishi Heavy Industries Ltd

- Siemens AG

- Sulzer Ltd

Latest News and Developments:

- February 2025: Tecumseh revealed its AL Series, the world’s most efficient fixed-speed compressor, at ACREX India 2025. The compressor offered 25% higher energy efficiency, ultra-low noise, and broad application versatility.

- December 2024: ebm papst inaugurated its EUR 60 million HighSpeed Technical Center in Mulfingen to advance energy-efficient turbo compressor development. The facility created 60 new jobs and focused on sustainable, oil-free compressors for heat pumps and air conditioners.

- May 2024: Sulzer launched the HST 10 turbocompressor to support smaller sewage plants processing under 10,000 m³/day. It is designed for municipal and manufacturing wastewater treatment, the HST 10 reduced operational costs and noise while enhancing consistency.

- May 2024: Aggreko initiated a new line of 100% oil-free air compressors and dryers featuring low-emission Stage 3 engines. Targeting manufacturing such as petrochemicals and healthcare, the compressors offered improved fuel efficiency, reduced maintenance, and remote monitoring.

- February 2024: In Wuxi, China, Cummins introduced its e-compressor for fuel cell engines. For 150–260 kW fuel cell applications, the e-compressor's 45kW motor, low noise level, and high efficiency improved safety, fuel economy, and acceleration.

Turbocompressors Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Centrifugal Compressors, Axial Compressors |

| Stages Covered | Single Stage, Multi-stage |

| End Users Covered | Oil and Gas, Power Generation, Chemical, Water and Wastewater, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Atlas Copco AB, BorgWarner Inc., Continental AG, Cummins Inc., Eaton Corporation plc, Howden Group Holdings Ltd, Ingersoll Rand Inc., Kawasaki Heavy Industries Ltd., MAN Energy Solutions SE (Volkswagen AG), Mitsubishi Heavy Industries Ltd, Siemens AG and Sulzer Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the turbocompressors market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global turbocompressors market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the turbocompressors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The turbocompressors market was valued at USD 20.99 Billion in 2024.

The turbocompressors market was valued at USD 33.74 Billion in 2033, exhibiting a CAGR of 5.14% during 2025-2033.

Key factors driving the turbocompressors market include rising industrialization, demand for energy-efficient systems, growth in oil & gas and power generation sectors, advancements in compressor technology, and increasing applications in HVAC, chemical, and manufacturing industries. Environmental regulations also boost adoption of efficient, low-emission turbo compressors.

Asia Pacific currently dominates the turbocompressor market due to rapid industrialization, urbanization, and infrastructure growth. High demand from sectors like oil and gas, manufacturing, and energy, combined with government support for modernization and sustainability, drives adoption. The region’s expanding economies make it a key hub for turbocompressor deployment.

Some of the major players in the Turbocompressors market include Atlas Copco AB, BorgWarner Inc., Continental AG, Cummins Inc., Eaton Corporation plc, Howden Group Holdings Ltd, Ingersoll Rand Inc., Kawasaki Heavy Industries Ltd., MAN Energy Solutions SE (Volkswagen AG), Mitsubishi Heavy Industries Ltd, Siemens AG and Sulzer Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)