Tuna Market Size, Share, Trends and Forecast by Species, Type, and Region, 2026-2034

Tuna Market Size and Share:

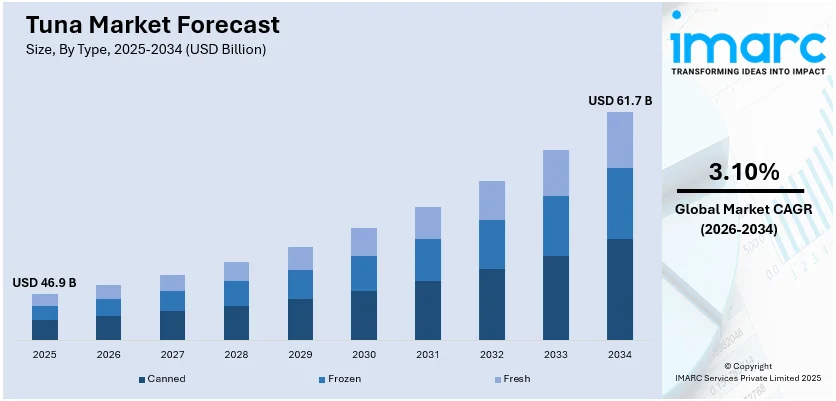

The global tuna market size was valued at USD 46.9 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 61.7 Billion by 2034, exhibiting a CAGR of 3.10% during 2026-2034. Indonesia currently dominates the market by production holding a significant market share of over 9.4%, while European Union dominates the market by consumption, holding 26.8% of market share in 2025. The increasing demand for healthy and protein-rich diets, with consumers gravitating toward seafood options, is one of the key growth-inducing factors in the market. At present, Indonesia holds the largest region by production due to abundant marine resources and export demand, while Japan holds strong domestic consumption propelled by the cultural significance of tuna and its popularity in traditional dishes such as sushi and sashimi.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 46.9 Billion |

|

Market Forecast in 2034

|

USD 61.7 Billion |

| Market Growth Rate 2026-2034 | 3.10% |

The tuna market is primarily driven by increasing global seafood consumption and the rising demand for high-quality protein among consumers. According to the IMARC Group, the global seafood market size reached USD 370.2 Billion in 2024 and is projected to reach USD 493.3 Billion by 2033, exhibiting a CAGR of 3.08% during 2025-2033. The rising popularity of ready-to-eat and canned tuna products is also contributing to market growth, offering convenience for busy lifestyles. Expanding seafood trade, particularly in Asia-Pacific and Europe, is boosting global tuna consumption, supported by advancements in cold storage and logistics. Additionally, sustainable fishing practices and certifications are attracting environmentally aware consumers. Innovations in packaging and processing technologies further enhance product quality and shelf life, encouraging greater adoption of tuna in diverse culinary applications.

To get more information on this market Request Sample

The United States tuna market is driven by the growing consumer preference for high-protein, low-fat food options among health-conscious consumers. The affordability and versatility of tuna in recipes such as salads, sandwiches, and sushi make it a staple in American households. The increasing demand for convenience food has also boosted sales of canned and pouch-packaged tuna. As per a report published by the IMARC Group, the United States convenience food market is forecasted to reach USD 165.58 Billion by 2032, exhibiting a CAGR of 3.50% during 2024-2032. In addition to this, the rising popularity of premium and fresh tuna products in restaurants and retail channels is expanding the market, supported by robust seafood trade and distribution networks.

Tuna Market Trends:

Rising expansion of ready-to-eat tuna meals

Ready-to-eat tuna meals cater to busy consumers who are seeking nutritious, quick, and healthy meal options that require minimal preparation, driving the overall tuna market. According to tuna market insights, these products are popular among individuals with on-the-go lifestyles, particularly in urban areas where time-pressed consumers seek convenient food solutions. For instance, in June 2024, Frime S.A.U., a leading company in tuna sales and production, introduced its new ‘ready-to-eat’ segment. This new segment is the first and only marinated tuna that is not smoked and is suitable for raw consumption. Furthermore, according to USFDA, canned light tuna is in the "Best Choices" category, and its consumption is advised at 2 to 3 servings per week. Other affordable fish options in the same category that consumers can explore include canned salmon, sardines, frozen fish, or fresh fish offered at a reduced price.

Expansion of value-added tuna products

Growing consumer demand for convenience is propelling innovation in value-added tuna products such as pre-cooked, marinated, and ready-to-eat variants contributing substantially to the tuna market growth. The needs of busy lifestyles can be easily met by quick, nutritious meal solutions with these variants without losing on the flavors or quality. The market is now able to reach a wider population segment among the youth and food lovers through the flavored variants available, such as spicy, lemon pepper, and herb-infused varieties. Packaging innovations such as single-serve pouches and vacuum-sealed cans are improving shelf life and ease of use, thereby making tuna more accessible for on-the-go consumption. This trend is supported by a rise in e-commerce platforms and retail availability, thereby ensuring that consumers worldwide can enjoy tuna in convenient formats.

Increasing focus on eco-friendly packaging

There is a growing trend toward eco-friendly packaging solutions as environmental concerns become more prominent in the tuna industry. A research article reports that 61% of US consumers consider sustainability to be a valuable purchase criterion. Consumers and manufacturers are seeking products that offer sustainable sourcing and are available in packaging that minimizes environmental impact. For instance, in June 2024, John West, a division of the seafood company Thai Union Group, launched its new ECOTWIST packaging for its tuna products. As per the tuna market highlights, this new packaging format is fully recyclable and designed to minimize waste.

Tuna Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the global tuna market forecast at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on the species and type.

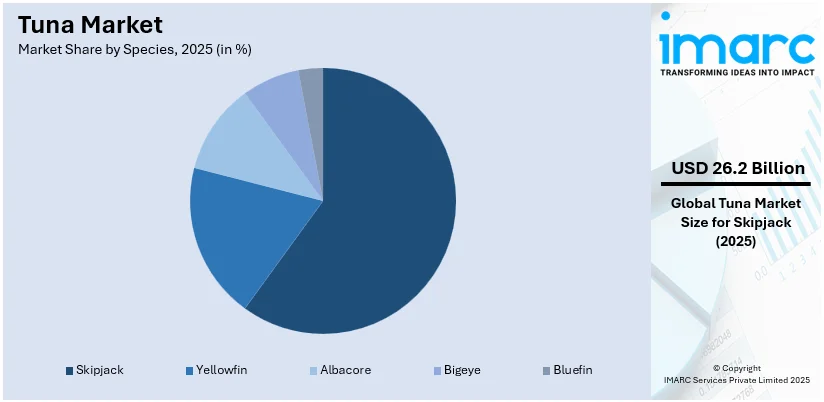

Analysis by Species:

Access the comprehensive market breakdown Request Sample

- Skipjack

- Yellowfin

- Albacore

- Bigeye

- Bluefin

Skipjack leads the market, holding a significant share of 57.8% in 2025. This dominance is largely due to its abundant population and high-volume output at low prices. Since skipjack tuna is generally distributed all over tropical and subtropical waters, there is adequate supply throughout the world. Its relatively short maturity cycle allows for sustainable fishing practices, aligning with eco-conscious consumer preferences. Skipjack is also flexible in its usage in terms of food preparation and finds wide usage in canned, frozen, and ready-to-eat products, which appeals to a wide range of consumers. Moreover, it has less mercury content than any other tuna species, which provides a safer option for continuous consumption, thereby increasing the demand and sustaining its position in the global tuna market.

Analysis by Type:

- Canned

- Frozen

- Fresh

Canned represents the leading market segment, holding 70.9% of market shares in 2025. The convenience of canned tuna, particularly due to its cost, shelf life, and versatility in terms of preparation of many recipes in salads, sandwiches, or casseroles, makes it a consistent bestseller within households on an international basis. Another appealing aspect that makes it convenient for busy clients is its ability to be easily stored or transported, as well as the availability of various flavors and preparation methods. It is also a source of cost-effective nutrition, which caters to the increasing demand for affordable yet healthy food items. Moreover, as canned tuna is readily available in most retail stores and e-commerce platforms, accessibility is also a significant contributing factor to its market leader position.

Production Analysis by Region:

.webp)

To get more information on the regional analysis of this market Request Sample

- Japan

- Indonesia

- Philippines

- Taiwan P.C.

- Republic of Korea

- Spain

- Others

In 2025, Indonesia accounted for the largest region, possessing 9.4% of the market share. Indonesia dominates the global tuna market dynamics in terms of production region due to its vast maritime territory and favorable fishing conditions. The extensive fishing fleet of the country and its improvements in fishing practices contribute significantly to its dominance. As the largest archipelago in the world, Indonesia benefits from rich marine biodiversity, making it a key player in the industry. In line with this, governmental support to promote sustainable fishing and enhance the value chain is strengthening the position of Indonesia as a leading producer. This rising government support is acting as one of the major tuna industry trends in Indonesia. The Indonesian government has also launched a new initiative to provide financial incentives and technical support to local fishing communities for adopting sustainable fishing practices. This program aims to reduce overfishing and improve the quality of tuna exports, further solidifying the leadership of Indonesia in the global tuna market.

Consumption Analysis by Region:

- Japan

- USA

- Republic of Korea

- China

- Taiwan P.C.

- European Union

- Others

In 2025, European Union accounted for the largest market share, holding 26.8% of the shares, due to several key factors. The region's high demand for seafood, driven by cultural preferences and a strong focus on healthy eating, makes tuna a staple in diets across member states. The EU's robust processing and canning industries further bolster its consumption, as canned tuna is a convenient and affordable protein source for consumers. Additionally, the region's well-established trade networks and regulatory framework ensure a steady supply of high-quality tuna products. Countries like Spain and Italy, with significant tuna processing industries, play a pivotal role in meeting domestic and international demand.

Key Regional Takeaways:

Japan Tuna Market Analysis

According to the Food and Agriculture Organization, the tuna market in Japan witnessed a rise of 20% in total tuna imports, amounting to 46,775 metric tons during the first quarter of 2023. Demand for sashimi-grade tuna increased slightly during the Spring festivals in April and May but still remained low. Restaurant operators expressed lower-than-expected sales from poor foreign tourist inflow, particularly from China. Imports of high-value fresh/chilled tuna and ultra-frozen tuna fillets are lower than the previous year, showing weaker consumer demand for sashimi tuna. Imports of frozen tuna fillets declined as this was the unsold stock bought in 2022. Though Japan is one of the major markets for tuna, the shift in consumer behavior, along with external factors such as tourism, continues to have an impact on the demand for tuna products in the country.

Indonesia Tuna Market Analysis

Indonesia is one of the biggest producers of tuna worldwide, contributing to almost 16% of the global tuna supply and catching around one million metric tons annually. According to Indonesia Tuna, the species most caught in the country include eastern little tuna and skipjack tuna. Indonesia is also recognized for pole-and-line fishing, where more than 100,000 metric tons of pole-and-line caught tuna are produced annually. The country is also a key player in the global supply chain, ranking as a major contributor to the tuna market. The pole-and-line method of the country is being recognized more and more for its environmental benefits, thus positioning Indonesia as a key player in the tuna industry.

Philippines Tuna Market Analysis

Tuna is one of the most important commodities in the Philippines regarding exports and imports. According to the Bureau of Fisheries and Aquatic Resources (BFAR), in 2021, the country shipped out 91,754 metric tons of tuna in various forms, including fresh, chilled, frozen, smoked, and prepared/preserved, valued at USD 378.71 Million. Prepared/preserved/preserved tuna accounted for 89.09% of the total export volume, but the volume and value of exports decreased by 31.74% and 21.25%, respectively, during the year. Tuna made up 38.53% of the total import in the fishery commodity from the Philippines, amounting to 533,235 metric tons imported in 2021 and contributing an import value of USD 412.73 Million for fishery commodities. This sector of the Philippines tuna industry remains a significant component of the national economy and world seafood trade.

Taiwan P.C. Tuna Market Analysis

Production and consumption trends significantly impact the Taiwanese tuna industry. According to the APEDA Agri Exchange, home-based seafood production stagnated at 910,358 metric tons in 2021. That is approximately 24% below its past decade output levels as overfishing and climate change take a toll on fish production. Skipjack tuna represents one of the key species that have a majority of total fish production in Taiwan at 19%. In addition, Taiwan's per capita seafood consumption was 27 kg in 2021, 26% higher than the global average, with tuna being one of the most popular seafood products, along with shrimp and salmon. Frozen seafood, driven by convenience in storage, also experienced growth in frozen seafood products, with a 9% increase in value in 2022. Seafood consumption in Taiwan remains strong, with over 80% of consumers eating seafood at least once a week.

Republic of Korea Tuna Market Analysis

The Republic of Korea recorded notable growth in the imports of tuna, mainly sourced from Vietnam. According to the Vietnam Association of Seafood Exporters and Producers (VASEP), Korea's imports of tuna from Vietnam in January 2023 were 457% up compared to the corresponding period in 2022. This made it one of the eight top import markets of Vietnam. Though it has one of the largest fishing fleets worldwide, South Korea's tuna catch has declined in recent years mainly due to the depletion of tuna resources and the restriction placed on fish aggregating devices. Accordingly, imports of canned processed tuna, as well as frozen tuna, have risen in Korea. In 2022, Vietnam's tuna export to Korea reached nearly USD 7 Million, which is an 84% increase from 2021. Frozen steamed tuna loin accounted for 69% of total exports to Korea, averaging an export price of about USD 5,142 per ton in 2022. The top exporters to Korea include Nha Trang Bay, Phat Trien Seafood, and Tuna Vietnam, which account for 66% of the total export value.

Spain Tuna Market Analysis

Spain is at the forefront of tuna fish production and exportation as an industry that focuses on being green and collaborative with all. ANFACO-CECOPESCA reports that the canned tuna industry in Spain generates EUR 1.1 Billion (USD 1.4 Billion) annually while providing 62,000 jobs directly and indirectly, wherein 97% of that total is found in Galicia and the Basque Country. Spain is also the second-largest producer of canned tuna globally, after Thailand, and holds 15% of the global production and 70% of the EU's quota. In 2023, Spain's canned tuna exports reached 95,000 tons, valued at EUR 400 Million (USD 512 Million), with Italy, France, Portugal, the UK, and Germany as key markets. Canned tuna is also highly consumed by Spaniards, with an average consumption of 2.25 kg per inhabitant. This nation supports the EU taking leadership in sustainable tuna fishing activities while advocating for transparency in and cooperation over international tuna trading.

United States Tuna Market Analysis

The United States tuna market is witnessing great developments both in terms of catch volume and economic value. NOAA Fisheries indicates that in 2022, U.S. commercial fishers caught 368 metric tons (over 800,000 pounds) of Pacific bluefin tuna, earning over USD 2.2 Million. This is a positive development since the 2-year catch limit for 2025–2026 is expected to increase by nearly 80%, from 1,017 metric tons in 2023–2024 to 1,822 metric tons. This shift will enable the U.S. fleet to land more Pacific bluefin tuna into markets, helping captains, crews, and distributors who have been restricted by tighter regulations for a decade. The rise in allowable catch volume is a significant shift in the U.S. tuna industry, one that seafood markets and participants in the Pacific bluefin tuna trade have been clamoring for.

China Tuna Market Analysis

The China tuna market is rapidly expanding, driven by increased imports and exports. Industry reports reveal that the tuna imported in China has increased tenfold in volume and 193% in value in the first seven months of 2023 compared to the same period in 2022. Frozen skipjack, bluefin, and yellowfin are the primary types of tuna imported into China, which is reflective of the increasing demand for premium tuna products. Exports also recorded an upward trend, with tuna exports valued at 30.21% higher in 2022. The increasing middle class and demand for quality seafood are the reasons behind the growth. Government policies promoting sustainable fishing and distant-water operations further support China's position in the global tuna trade. Better traceability and logistics infrastructure assure the quality and sustainability performance of China in meeting global standards, which makes this country an important importer as well as exporter in the global fish product industry.

European Union Tuna Market Analysis

The European Union is a key player in the global tuna market, with an increasing share of imports. According to industrial reports, in 2022, tuna covered 10% of the volumes and values of fish that were imported into the EU. The volume was up by 1%, and its value increased by 29% compared to 2021. Skipjack tuna is the most imported type since it covers 53% of the volume and 49% of the value. Yellowfin tuna has a share of 32% in both volume and value. Spain, Italy, and France are among the biggest consumers and processors in the EU. A strong demand for quality tuna, particularly canned tuna, in this region drives these figures. Sustainability efforts, in consonance with EU regulations within the Common Fisheries Policy, promote environmentally friendly fishing methods. As consumer preferences turn toward premium and responsible sourcing products, the EU remains an important market globally for tuna and focuses much on traceability, innovation, and sustainability in their supply chains.

Competitive Landscape:

The key players operating in the tuna market continue to stimulate growth through strategies that center on sustainability, innovation, and wider consumer appeal. Pole-and-line or purse-seine fishing, among others, has been embraced in order to respond to environment-conscious consumer demand and support certifications such as MSC (Marine Stewardship Council). In addition, value-added options such as ready-to-eat meals and flavored varieties of tuna, as well as premium-grade products, help attract an even wider cross-section of customers to the products. Collaboration with retailers and e-commerce platforms is improving product availability, while strategic marketing is focusing on health benefits as well as ethical sourcing. Besides this, improvements in packaging technology to enhance shelf life and convenience are helping to foster consumer trust and brand loyalty that is driving market momentum forward.

The report provides a comprehensive analysis of the competitive landscape in the tuna market with detailed profiles of all major companies, including:

- Thai Union

- Tri Marine

- Starkist

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- October 2025: Dutch company Schouten Europe unveiled a new plant-based tuna product at the 2025 Anuga trade fair, offering improved texture and taste compared to their previous version. The ready-to-eat product aims to address overfishing concerns, especially of endangered tuna species like bluefin.

- May 2025: Tamil Nadu CM M.K. Stalin inaugurated India’s first exclusive tuna fishing harbor in Chennai, benefiting around 6,250 people from 12 fishing villages. The harbor, costing Rs 272.70 crore, can handle 70,000 tons of fish annually and helps fishermen sell their catch quickly without quality loss.

- April 2025: Fujitsu, Sonofai, Ishida Tec, and Tokai University launched the SONOFAI T-01, an AI-powered device that non-destructively measures fat content in frozen tuna, improving inspection speed and accuracy. The device automates tuna quality assessment, reducing labor by up to 80%, and aims to enhance efficiency and sustainability in the seafood industry.

- April 2025: BlueNalu, a US cultivated seafood startup, announced plans to launch its cultured bluefin tuna toro in California, targeting premium sushi markets with aims for global expansion. The company is seeking FDA approval and has partnerships in the UK, Asia-Pacific, and the Middle East. Consumer research shows strong interest, with many willing to pay price parity for sustainable, lab-grown tuna.

- February 2025: EROSKI launched Spain's first own-brand MSC-certified canned light tuna, reinforcing its leadership with 35 sustainable fishing products. The tuna, caught using eco-friendly line and hook methods, is sold in recyclable packaging and enriched with olive oil.

- January 2025: Chicken of the Sea and McCormick launched two new flavors in their Wild Caught Light Tuna Packet lineup, including Old Bay Seasoning and McCormick Chili Lime. These convenient, on-the-go tuna packets aim to offer innovative, flavorful seafood options. The products are available online and in major retailers across the US.

- August 2024: Tuna Australia member Walker Seafoods Australia has partnered with renowned chef Neil Perry to launch a new product line of preserved local tuna for sale in Australian supermarkets. Walker’s Tuna features sustainable Marine Stewardship Council (MSC) certified preserved Albacore tuna caught in the pristine waters off Mooloolaba.

- July 2024: Major European retailer Carrefour joined forces with the Global Tuna Alliance (GTA) to spearhead significant transformations within tuna supply chains. This partnership aims to implement a dual approach, focusing on improving tuna fishing regulations and management while also ensuring best practices on all vessels supplying Carrefour.

- July 2024: Frime S.A.U., a leading company in tuna sales and production, introduced its new ‘ready-to-eat’ segment that is smoked and suitable for raw consumption.

- June 2024: John West, a division of the seafood company Thai Union Group, launched its new ECOTWIST packaging for its tuna products. This new packaging format is fully recyclable and designed to minimize waste.

- May 2024: Wanda Fish, a cell-based seafood maker, unveiled its bluefin tuna toro sashimi. The company stated that this new cell-cultivated 3D tuna is high in omega-3 levels with a buttery sensation, making it the most tender and desired fish meat.

Tuna Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD, Million Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Species Covered | Skipjack, Yellowfin, Albacore, Bigeye, Bluefin |

| Types Covered | Canned, Frozen, Fresh |

| Production Regions Covered | Japan, Indonesia, Philippines, Taiwan P.C., Republic of Korea, Spain, Others |

| Consumption Regions Covered | Japan, USA, Republic of Korea, China, Taiwan P.C., European Union, Others |

| Companies Covered | Thai Union, Tri Marine, Starkist, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the tuna market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global tuna market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the tuna industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The tuna market was valued at USD 46.9 Billion in 2025.

IMARC estimates the tuna market to exhibit a CAGR of 3.10% during 2026-2034, reaching USD 61.7 Billion by 2034.

The tuna market is driven by increasing global seafood consumption, rising demand for high-protein diets, growing popularity of ready-to-eat and canned tuna products, advancements in cold storage and logistics, and the adoption of sustainable fishing practices. Additionally, innovative packaging and processing technologies are enhancing product quality and accessibility.

Indonesia currently dominates the tuna market in terms of production, holding a share exceeding 9.4%, driven by its vast marine resources and export demand. For consumption, the European Union leads, accounting for 26.8% of the market share in 2025, supported by its strong demand for seafood and robust processing industries.

Some of the major players in the tuna market include Thai Union, Tri Marine, and Starkist, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)