Trout Market Size, Share, Trends and Forecast by Trout Type, Trout Size, Distribution, Packaging Form, and Region, 2026-2034

Trout Market Size and Share:

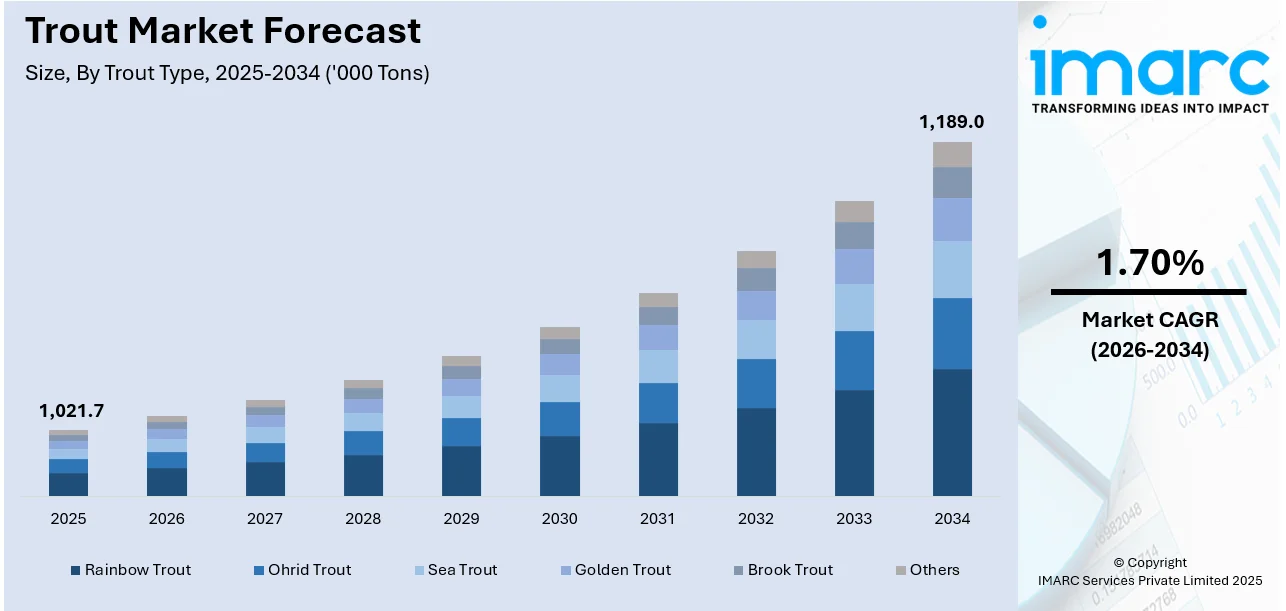

The global trout market size reached 1,021.7 Thousand Metric Tons in 2025. Looking forward, IMARC Group estimates the market to reach 1,189.0 Thousand Metric Tons by 2034, exhibiting a CAGR of 1.70% during 2026-2034. Europe currently dominates the market in 2025. The trout market is thriving driven by health-conscious consumer's demand for its nutritional benefits, its alignment with sustainability goals, and its versatile use in diverse culinary creations, making it a top choice in the seafood industry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

1,021.7 Thousand Metric Tons |

|

Market Forecast in 2034

|

1,189.0 Thousand Metric Tons |

| Market Growth Rate 2026-2034 | 1.70% |

The global trout market is driven by increasing demand for healthy and sustainable seafood options. As consumers become more health-conscious, trout is increasingly favored for its high protein content, omega-3 fatty acids, and low-fat levels, resulting in a higher product uptake. Along with this, expanding aquaculture practices are enhancing trout production, ensuring year-round availability and consistent supply, which is fueling the market. The rising popularity of trout in culinary applications, ranging from fine dining to home cooking, further bolsters market growth. Additionally, governmental support for sustainable fishing practices and advancements in aquaculture technology are aiding the market. On 27th August 2024, Constellar and MY Exhibition Co., announced a strategic partnership to accelerate advancements in aquaculture technology across Singapore and Taiwan. By combining Singapore’s leadership in agrifood tech innovation with Taiwan’s expertise in high-tech and biotech solutions, the collaboration aims to foster sustainable practices and technological breakthroughs in aquaculture. This partnership will drive transnational innovation and strengthen Asia’s aquaculture ecosystem. Moreover, considerable growth in the hospitality and tourism sectors, particularly in regions known for trout-based cuisines, also contributes to the increasing product demand on a global scale.

To get more information on this market Request Sample

The United States stands out as a key regional market, primarily driven by growing consumer interest in locally sourced and sustainably farmed fish. The increasing emphasis on environmental sustainability is leading to greater adoption of eco-friendly aquaculture practices, supporting the production of high-quality trout. Regional preferences for fresh, farmed seafood are positively influencing market growth. Along with this, the rising popularity of recreational fishing, which stimulates both trout farming and stocking activities, is creating lucrative opportunities in the market. The expanding food service industry, including restaurants and retail outlets offering specialty seafood, plays a crucial role in promoting trout consumption. Furthermore, the integration of trout into wellness-focused diets and the rise of gourmet home cooking trends are driving demand, while government regulations ensure quality standards that bolster consumer confidence in domestic trout products.

Trout Market Trends:

Health-Conscious Consumers

In an era marked by growing awareness of dietary choices and their impact on well-being, trout stands out as a nutritional powerhouse. With abundant omega-3 fatty acids, high-quality protein, and essential vitamins and minerals, it is increasingly sought after by individuals dedicated to maintaining a healthy lifestyle. Trout's reputation as a heart-healthy option further propels its demand, as it contributes to lower cholesterol levels and reduced risk of cardiovascular diseases. This alignment with consumer health priorities positions trout as a staple in balanced diets. Health-conscious people are concerned about omega-3-rich fish intake. The U.S. FDA recommends that most adults be eating two servings of omega-3-rich fish a week with a serving size about the size of a deck of cards, or 4 ounces. As a result, the trout market has experienced consistent growth, with consumers making informed choices to support their overall health.

Sustainability and Responsible Sourcing

The commitment to responsible sourcing and eco-friendly production methods has become a driving force behind the trout market's success. Trout farming has a lower environmental footprint, making it an attractive option for eco-conscious consumers. Companies that prioritize sustainability, such as adhering to stringent aquaculture practices, reducing environmental impacts, and supporting conservation efforts, are gaining a competitive edge in the market. For instance, the sustainability report from Cermaq provides data on its efforts to reduce 10% per ton of emission since 2022; on the other hand, its commitment to lowering global impacts from temperature rise by 35% of 2019 levels is another way forward. Again, a focus on fish health and welfare through vaccination, screening, and monitoring in such countries as Norway, Chile, and Canada reflects practice-oriented sustainability. Trout's reputation as a seafood choice that aligns with these principles positions it favorably among environmentally conscious consumers. As sustainability initiatives continue to gain momentum globally, trout's reputation as an eco-friendly protein source ensures its continued growth in market share.

Diverse Culinary Applications

Chefs and home cooks appreciate trout for its mild, delicate flavor and flaky texture, making it an ideal ingredient for a wide range of dishes. Whether grilled, baked, smoked, or pan-seared, trout's adaptability allows it to shine in various cooking methods. Trout's flexibility in the kitchen has expanded its consumer base beyond traditional seafood enthusiasts. It appeals to a broader audience seeking flavorful and easy-to-cook options. For instance, a survey conducted in the Kashmir valley in the past reported trout as the most preferred fish purchased by 33.33 percent of consumers once a week and 28.33 percent of consumers once a month. Consumers preferred trout for the taste (91.67%), freshness (78.33%), and less bone content (58.33%). Another aspect was that 65% of consumers were willing to pay a premium for locally available trout, which again revealed its acceptability. As culinary creativity continues to flourish, trout's adaptability ensures its continued prominence in the market. From gourmet restaurant menus to home kitchens, trout has solidified its position as a preferred choice for those seeking culinary excellence and a delightful dining experience.

Trout Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global trout market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on trout type, trout size, distribution, and packaging form.

Analysis by Trout Type:

- Rainbow Trout

- Ohrid Trout

- Sea Trout

- Golden Trout

- Brook Trout

- Others

Rainbow trout leads the market in 2025 due to its wide availability, mild flavor, and adaptability to various farming conditions. It is favored by consumers and foodservice establishments alike for its consistent quality and taste. The market for rainbow trout continues to expand as it remains a popular choice for both home cooks and chefs, driving consistent demand in the seafood industry. Its efficient farming practices and availability throughout the year further enhance its market share, making it a staple in aquaculture and a key driver of overall trout market growth.

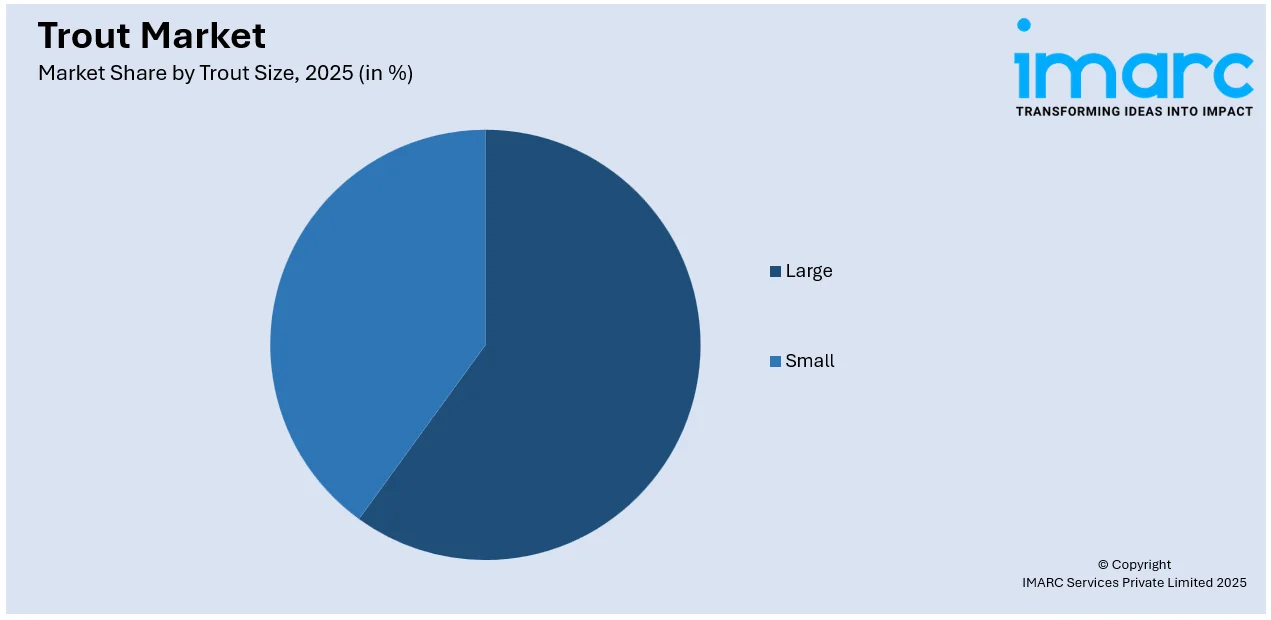

Analysis by Trout Size:

Access the comprehensive market breakdown Request Sample

- Large

- Small

The large trout segment encompasses trout that have reached a substantial size, often preferred for their meaty fillets and extended shelf life. This segment is highly favored by the foodservice industry, as larger trout can yield generous portions for restaurants and catering. Consumers seeking larger cuts for special occasions or family gatherings also contribute to the demand in this segment. Large trout's versatility in various culinary applications, such as grilling or roasting whole fish, makes it an attractive choice for those looking to create impressive and delicious meals.

The small trout segment caters to a different set of preferences. These smaller-sized trout are often preferred by consumers who appreciate their delicate, tender meat and quicker cooking times. Small trout are well-suited for pan-frying, baking, or smoking, providing a convenient option for individuals and households.

Analysis by Distribution:

- Foodservice

- Retail

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Outlets

- Online Channels

- Others

Foodservice leads the market in 2025. Restaurants, hotels, and catering businesses are the primary customers in this category, relying on trout for their menus. The foodservice industry values trout for its versatility, quality, and ability to be incorporated into a variety of dishes, catering to diverse culinary preferences. This segment demands consistent supply and often involves long-term contracts with trout suppliers to meet the needs of establishments serving meals to a broad range of consumers.

Analysis by Packaging Form:

- Fresh

- Frozen

- Canned

- Others

Fresh leads the market in 2025. Fresh trout is sought after by consumers who prioritize the quality and taste of their seafood. It is typically available at seafood markets, supermarkets, and specialty stores, where customers can select whole fish or fillets. Fresh trout's appeal lies in its natural flavor, texture, and the opportunity for consumers to inspect and choose their preferred cuts. Restaurants and culinary enthusiasts often prefer fresh trout for its versatility in various cooking methods, from grilling to pan-searing, allowing for the creation of exquisite dishes with a focus on the trout's inherent qualities.

Regional Analysis

- Europe

- Armenia

- Norway

- Italy

- France

- Denmark

- Spain

- Poland

- Others

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- Australia

- Indonesia

- Vietnam

- Others

- Latin America

- Chile

- Peru

- Mexico

- Brazil

- Others

- Middle East and Africa

- Turkey

- Iran

- Egypt

- Others

In 2025, Europe accounted for the largest market share as it has a rich history of trout consumption and production, with countries, such as Norway, France, and Germany leading the way in trout farming and processing. The European market benefits from a strong tradition of seafood consumption, where trout is valued for its culinary versatility and nutritional benefits. Furthermore, European consumers often prioritize sustainability and quality, which align well with trout's attributes. The region's diverse culinary traditions and well-established distribution networks contribute to the prominence of the trout market in Europe.

Key Regional Takeaways:

United States Trout Market Analysis

The U.S. trout market is doing well due to the strong demand for fish-based protein by consumers and recreational fishing activities. A market expansion is shown by the 26% rise in overall sales of U.S. aquaculture goods from 2018 to 2023, according to the USDA 2023 Census of Aquaculture. High consumption of trout products, driven by health-conscious consumers, fuels growth. Recreational fishing, with 46 million anglers in the United States, is another source of steady demand for live and frozen trout. Improved land-based recirculating systems enhance production efficiency for sustainable aquaculture. Diversified product lines have led to market leadership for major players such as Clear Springs Foods and Riverence. Federal initiatives related to sustainable fisheries and consumer awareness campaigns regarding the nutritional benefits of trout enhance market dynamics. U.S. trout exporters increasingly seek international markets, using high production standards to exploit quality fish products in international markets.

Europe Trout Market Analysis

European trout continues gaining its grounds as robust aquaculture production drives market growth in addition to increased demand by consumers for higher-quality fish. According to Eurostat, EU aquaculture accounted for 1.1 million tonnes of aquatic organisms worth Euro 4.8 Billion (USD 5.23 Billion) in 2022. The four largest contributing members included Spain, France, Greece, and Italy with an aggregate that formed over two-thirds of the output, further highlighting Europe's dependency on its significant producers. The focus on finfish species, such as trout, is in accordance with the EU's Common Fisheries Policy (CFP) to promote sustainable growth and environmental stewardship. The highest aquaculture output value was recorded in Greece in 2022 at Euro 844 Million (USD 920 Billion), proving that it plays a key role in trout farming. Furthermore, innovative, closed-loop systems and R&D initiatives supported by the government are furthering sustainability. Norway, even though outside the EU, is the benchmark. It produces 1.6 million tonnes of aquatic organisms worth Euro 10.7 Billion (USD 11.77 Billion), which again highlights growth potential in the European market.

Asia Pacific Trout Market Analysis

Asia Pacific's trout market is growing rapidly, driven by a rise in seafood consumption and advancements in aquaculture. Agro Spectrum India reports that India reached an all-time high fish production of 175.45 lakh tonnes (17.55 million tonnes) in the fiscal year 2022-23, establishing itself as the third-largest fish producer globally. Supported by the "Blue Revolution" initiative, trout farming in India is gaining momentum towards both domestic and export markets. China is the regional leader in aquaculture. Its production of over 50 million tonnes of aquatic products in 2023 focused on advanced production systems. The increase in demand for sushi-grade trout in Japan and South Korea indicates a higher preference for premium fish products in the region. Innovations in water quality management systems and collaborations between local and global seafood brands are accelerating growth. Asia Pacific's growing middle class and desire for high-protein diets continue to drive demand, ensuring the region is a key player in global fisheries.

Latin America Trout Market Analysis

Aquaculture export leadership by Chile fuels Latin America's trout industry. Chilean Salmon Council stated that the aggregate exported volume of farmed salmon and trout increased year on year by 3.1% to reach 774,531 metric tons in 2023. For the period between January and October 2023, exported volume of salmon and trout in Chile reached 625,220 metric tons and fetched USD 5.38 Billion. This portrays how active the seafood business of this region is. Chile's strategic focus on sustainable aquaculture practices and advanced farming technologies makes it a global leader. The increased demand for high-quality trout in North America and Asia drives exports, while partnerships with international markets enhance growth. Government-backed initiatives to improve traceability and environmental standards further enhance Chile's competitiveness in the global aquaculture sector, driving Latin America's prominence in the trout industry.

Middle East and Africa Trout Market Analysis

The trout market is going forward in the Middle East and Africa. Strong initiatives that seek to enhance fish farm production have supported the move forward. Fish farm production has rocketed in Saudi Arabia at a rate of 56.4% since 2021, to record highs of 140,000 tons in 2023 according to the Ministry of Environment, Water, and Agriculture report. This growth, supplemented by marine fisheries from the Red Sea and Arabian Gulf that amounted to 74,700 tons, puts the total fish production in 2023 at 214,000 tons. The Saudi government's strategic plans to diversify species, improve fish quality, and encourage investment have further supported the domestic aquaculture sector, which now has the possibility of trout farming. A new feature is the growing national focus to enhance per capita consumption to 13 kilograms every year, which signifies greater consumption of fish products in that nation. As this industry improves and expands, so are Middle Eastern countries such as Saudi Arabia.

Competitive Landscape:

The key players in the trout market are actively engaged in several strategic initiatives to maintain and expand their market presence. These initiatives include investing in sustainable aquaculture practices to address environmental concerns and meet the growing demand for eco-friendly seafood. Additionally, they are focused on product innovation, introducing new trout varieties, value-added products, and convenient packaging formats to cater to changing consumer preferences. Key players are also expanding their distribution networks and leveraging e-commerce platforms to reach a broader consumer base. Furthermore, they are engaging in marketing campaigns to promote the nutritional benefits of trout, targeting health-conscious consumers.

The report provides a comprehensive analysis of the competitive landscape in the trout market with detailed profiles of all major companies, including:

- Albury Estate Fisheries

- Aquabest Seafood LLC

- JM Clayton Seafood Company

- Cermaq Group AS

- Clear Springs Foods LLC

- Grieg Seafood ASA

- Lerøy Seafood Group ASA

- Mowi ASA

- Rushing Waters Fisheries LLC

- Sunburst Trout Farms

- Torre Trout Farms Ltd

Latest News and Developments:

- October 2024: Finnish trout farmer Finnforel is planning to globally expand after having received investment by Mitsubishi Corporation, which owns the company. Founded in 2015, Finnforel produces 3,000 tonnes of trout each year from its Varkhaus plant. The group aims to scale up its operations with significant vertical integration and global growth before 2032.

- October 2024: In accordance with Cermaq's new sustainability report, it will use a new format to report under the regulations of the EU CSRD. The report is spread across 15 months and talks about fish health priorities and preventive measures in Norway, Chile, and Canada; moreover, the global emission was reduced by 35% since 2019.

- April 2023: Albury Estate Fisheries introduced a new species of trout called the King Trout or Oncorhynchus myking aprilfoolia. This new species is expected to revolutionize the fly-fishing industry and become the most sought-after fish.

- October 2022: Mowi ASA completed the acquisition of 51.28% of the shares in Arctic Fish.

- February 2020: Clear Springs Foods LLC was acquired by Riverence Holdings, making it the largest land-based producer of trout in the Americas. The deal enhances the company's position as a vertically-integrated producer, encompassing Riverence Brood in Washington State and Riverence Farms, with a combined annual production capacity exceeding 15,000 metric tons.

Trout Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD, ‘000 Metric Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Trout Types Covered | Rainbow Trout, Ohrid Trout, Sea Trout, Golden Trout, Brook Trout, Others |

| Trout Sizes Covered | Large, Small |

| Distributions Covered |

|

| Packaging Forms Covered | Fresh, Frozen, Canned, Others |

| Regions Covered | Europe, North America, Asia Pacific, Latin America, Middle East and Africa |

| Countries Covered | Armenia, Norway, Italy, France, Denmark, Spain, Poland, United States, Canada, China, Japan, Australia, Indonesia, Vietnam, Chile, Peru, Mexico, Brazil, Turkey, Iran, Egypt |

| Companies Covered | Albury Estate Fisheries Ltd., Aquabest Seafood LLC, JM Clayton Seafood Company, Cermaq Group AS, Clear Springs Foods LLC, Grieg Seafood ASA, Lerøy Seafood Group ASA, Mowi ASA, Rushing Waters Fisheries LLC, Sunburst Trout Farms, Torre Trout Farms Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the trout market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global trout market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the trout industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Trout is a type of freshwater fish belonging to the Salmonidae family, known for its delicate flavor, nutritional richness, and versatility in culinary applications. Popular trout species include rainbow trout, sea trout, and brook trout, prized for their omega-3 fatty acids and high-quality protein.

The global trout market size reached 1,021.7 Thousand Metric Tons in 2025.

IMARC estimates the global trout market to exhibit a CAGR of 1.70% during 2026-2034.

The trout market is driven by rising demand for health-conscious seafood options, high nutritional value, sustainable aquaculture practices, and its versatile use in diverse cuisines globally.

Rainbow trout represented the largest segment by trout type, driven by its wide availability, mild flavor, and adaptability to various farming conditions.

The foodservice industry is the leading segment by distribution, driven by consistent demand from restaurants and catering services for high-quality trout.

Fresh trout represented the largest segment by packaging form, driven by consumer preference for natural flavor, texture, and versatility in cooking.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Europe currently dominates the market.

Some of the major players in the global trout market include Albury Estate Fisheries Ltd., Aquabest Seafood LLC, JM Clayton Seafood Company, Cermaq Group AS, Clear Springs Foods LLC, Grieg Seafood ASA, Lerøy Seafood Group ASA, Mowi ASA, Rushing Waters Fisheries LLC, Sunburst Trout Farms, and Torre Trout Farms Ltd., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)