Tree Nuts Market Size, Share, Trends and Forecast by Product Type, Form, Distribution Channel, Application, and Region, 2026-2034

Tree Nuts Market Size and Share:

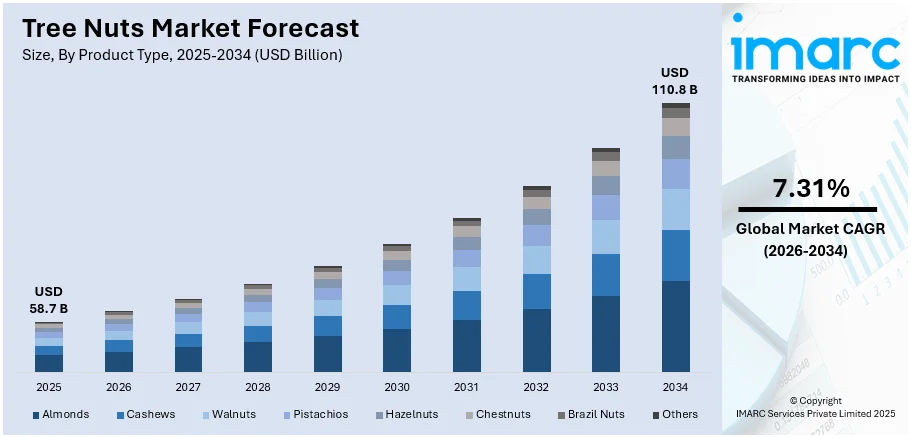

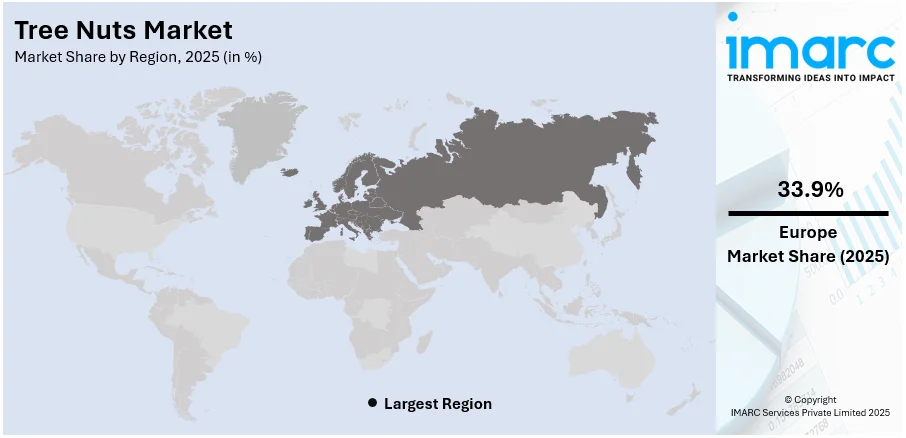

The global tree nuts market size was valued at USD 58.7 Billion in 2025. The market is projected to reach USD 110.8 Billion by 2034, exhibiting a CAGR of 7.31% from 2026-2034. Europe dominates the market share, accounting for 33.9% of the share in 2025. The market is propelled by the growing interest in health-conscious eating, the popularity of plant-based diets, and the incorporation of tree nuts into diverse food items. At the same time, concerns around nut allergies and the shift toward organic alternatives could influence future market growth. Also, the shift towards sustainable farming and increasing disposable incomes are some of the factors positively impacting the tree nuts market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 58.7 Billion |

|

Market Forecast in 2034

|

USD 110.8 Billion |

| Market Growth Rate (2026-2034) | 7.31% |

The growth of the global market is primarily driven by increasing consumer demand for nutritious snacks, as tree nuts are rich in healthy fats, protein, and antioxidants. Rising awareness of their health benefits, such as improved heart health, weight management, and cognitive function, enhanced their popularity in the market. A notable development occurred on December 20, 2024, when the FDA's new "healthy" food definition included walnuts, recognizing their nutritional value in promoting heart health and cognitive function. This follows decades of research supporting walnuts’ role in healthy diets. Additionally, the rise of vegan and plant-based food trends fueled tree nuts market demand, with tree nuts being a key ingredient. Packaging innovations and expanding culinary applications further support market growth.

To get more information on this market Request Sample

The United States is a key regional market and is majorly driven by several key factors, including the growing preference for plant-based protein sources, positioning tree nuts as vital ingredients in plant-forward diets. A rising demand for clean label products, where consumers favor natural, minimally processed foods, has augmented tree nuts' appeal. According to Packaged Facts’ report Organic and Clean Label Food Shoppers, 51% of U.S. respondents seek clean label packaged foods, while 40% prefer organic options. The expanding use of tree nuts in sectors like confectionery, baking, and dairy alternatives further broadens their market presence. Additionally, increased export opportunities, particularly to Asia and Europe, support U.S. growth. Rising disposable incomes and health-conscious lifestyles drive consumer spending on premium, nutrient-dense snacks like tree nuts.

Tree Nuts Industry Trends:

Health Benefits and Nutritional Value

These nuts, including almonds, walnuts, cashews, and others, are rich in essential nutrients, such as omega-3 fatty acids, fiber, protein, and antioxidants. The increasing consumer inclination towards healthier diets and the incorporation of nuts as a source of plant-based protein have amplified their demand. The USDA reports that 28g of almonds contain 6 grams of protein, 3.5 grams of fiber, and 14 grams of healthy fats. Scientific research has established tree nuts to be associated with a 28% reduction in the risk of heart disease and 22% in diabetes. These facts have elevated tree nuts as the number one favorite among health-conscious consumers, including those on diets that are vegan, paleo, and ketogenic. Additionally, scientific research linking tree nuts to various health benefits such as reduced risk of heart disease, diabetes, and certain types of cancer has further bolstered their popularity. This trend is particularly noticeable among health-conscious consumers and those following specific diet plans, such as vegan, paleo, and ketogenic diets, where tree nuts are a key component.

Versatility in Food Applications

Tree nuts are highly versatile and find extensive use in a myriad of food products, which propels their market growth. They are integral ingredients in confectionery, bakery products, snacks, dairy alternatives, and as toppings in various cuisines. The flexibility of tree nuts in terms of flavor, texture, and form makes them desirable in culinary applications, from gourmet dishes to everyday snacks. Food manufacturers are continually innovating with tree nuts, introducing them in various forms, such as nut butters, milk, flours, and oils, catering to the shifting consumer tastes and preferences. The INC (International Nut and Dried Fruit Council) estimates world tree nut production at around twice the level from the past ten years, where in the crop season 2014/15 the global production level was 3.62 million metric tons but for 2023/24 reached 5.69 million metric tons as there has been a lot of demand for tree nuts for use in applications such as above, thereby leading to increased usage and consumption in household cooking as well as in the food processing industries, which drive up growth in this market.

Globalization and Cultural Influence

The globalization of food cultures has played a crucial role in expanding the tree nuts market. According to an industrial report, the global export of almonds alone grew by 13% in 2023. As individuals travel more and become exposed to different cuisines, there's a growing appreciation and incorporation of tree nuts in various cultural dishes. This exposure has led to an increased demand for tree nuts in regions where they were not traditionally consumed. Furthermore, the influence of ethnic cuisines, particularly Mediterranean and Middle Eastern, where tree nuts are a staple, has led to their increased popularity in Western diets. This cultural exchange, fueled by globalization, has not only diversified the consumer base for tree nuts but also encouraged the introduction of new nut-based products in the market.

Tree Nuts Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global tree nuts market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on product type, form, distribution channel, and application.

Analysis by Product Type:

- Almonds

- Cashews

- Walnuts

- Pistachios

- Hazelnuts

- Chestnuts

- Brazil Nuts

- Others

Almonds stand out as the largest and most influential segment in the market. The dominance of almond can be attributed to their widespread utilization across various food products. They are preferred for their versatility and nutritional value, making them a popular choice for culinary enthusiasts as well as health-conscious consumers. Additionally, their popularity in vegan and gluten-free diets further boosts their demand across global markets. Moreover, their long shelf life and diverse culinary applications solidify their market dominance.

Analysis by Form:

- Whole

- Split

- Others

Whole nuts are the dominant choice in the market, prized for their natural, intact state, which preserves freshness and flavor. Their versatility makes them ideal for snacking, baking, and various culinary applications, ranging from savory dishes to desserts. Rich in healthy fats, protein, fiber, and essential vitamins, whole nuts are highly sought after by health-conscious consumers. They also align with the growing demand for minimally processed and clean-label products. Their long shelf life and ability to serve as a premium ingredient in gourmet offerings further enhance their widespread appeal across global markets.

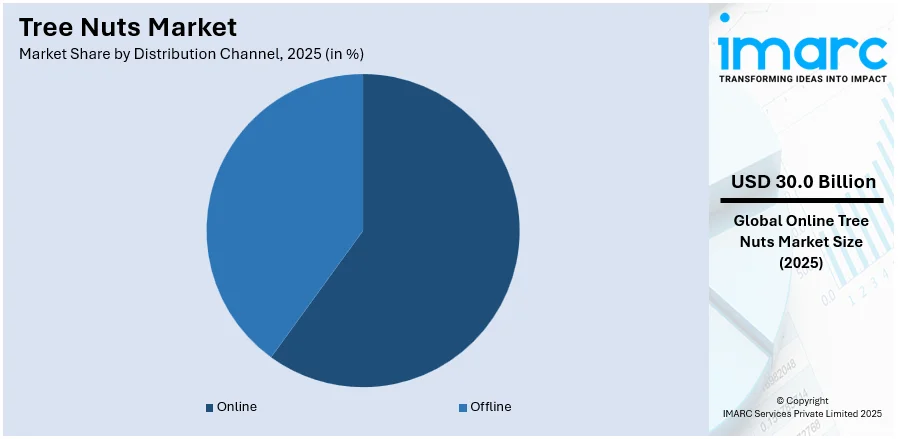

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

Online leads the market share in 2025. The online channel has witnessed substantial growth due to its convenience and accessibility, especially in the wake of digital advancements and changing consumer shopping behaviors. Nut companies are heavily investing in e-commerce platforms, optimizing websites, and leveraging digital marketing to reach a wider and more diverse customer base. Online retailing offers a vast selection of nut products, from traditional favorites to niche and specialty items, providing consumers with a wide array of choices.

Analysis by Application:

- Direct Consumption/Culinary Purpose

- Bakery and Confectionery

- Breakfast Cereals

- Snacks

- Flavored Drinks

- Butter and Spreads

- Dairy Products

- Others

Bakery and confectionery represent the largest and most influential segment. Nuts play a pivotal role in enhancing the flavor and texture of baked goods and confectionery products. Their versatility and ability to add crunch and richness have made them essential ingredients in this category. Additionally, their perceived health benefits and premium quality contribute to their growing popularity in artisanal and gourmet baked goods and confectionery. With increasing demand for innovative products, nuts are also used in gluten-free and plant-based bakery items, further solidifying their position as essential ingredients in the industry.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe represents a major market for tree nuts, primarily driven by a strong health and wellness trend among consumers. The increasing incorporation of tree nuts in diverse dietary regimes, including vegan and gluten-free diets, is significantly strengthening market demand. European consumers are showing a growing preference for organic and sustainably sourced tree nuts, influencing market dynamics. The presence of a robust distribution network, including supermarkets and online retail channels, facilitates easy accessibility to a variety of tree nuts. Additionally, the region's stringent quality and safety standards ensure high-quality products, thereby attracting health-conscious consumers. Moreover, the growing culinary and confectionery industries in Europe are continuously experimenting with tree nuts, creating new consumption avenues in the market.

Key Regional Takeaways:

United States Tree Nuts Market Analysis

Tree nuts market growth drivers in the U.S. include the rising popularity of healthy snacking and the increasing demand for plant-based diets. For 2023, exports by the U.S. in tree nuts stood at 1.76 million metric tons, and an overall export value of USD 8.82 Billion, reports the USDA. Apart from this, strong production has been observed in domestic fields, and the chief is the almonds. The top varieties are almonds, walnuts, and pistachios, with California accounting for 80% of U.S. tree nut production. The growth is fueled by the rise of health-conscious consumers and the increasing popularity of nuts in plant-based food alternatives. In addition, strong investments in research and development (R&D) for sustainable farming practices and better product quality support the market. The domestic and international markets are dominated by U.S. manufacturers, such as Blue Diamond Growers and Wonderful Pistachios.

Europe Tree Nuts Market Analysis

The tree nuts market revenue in Europe is primarily driven by the increasing demand for nutritionally enhanced snacks and ingredients. The consumption rate of almonds in Europe as given by the European Commission was 5% per annum since previous years, and the top leading consumer countries include Germany, Spain, as well as the UK. Even on the same lines, The EU has emphasized on sustainable farming in tree nuts production, but that is more on their environmentally friendly side. In this market, the region of the Mediterranean plays an essential role. More specifically, there have been tremendous developments in pistachios and hazelnut cultivations in that area, besides continued rises in imports of tree nuts from countries like the United States and Turkey. It further adds to market growth as organic and premium product availability increases. The continuous increase in consumer choices due to health trends, European manufacturers are innovating with new snack products capitalizing on the growing popularity of plant-based and allergy-friendly options.

Asia Pacific Tree Nuts Market Analysis

The tree nuts market forecast in the Asia Pacific region indicates strong growth, driven by increasing disposable income and a preference for healthy snacks. According to the Food and Agriculture Organization, China's tree nut imports for 2023 have stood at around USD 1.2 Billion. The country was also seen to be the largest importer of food globally for the year 2023 with its overall food imports valued at around USD 140 Billion. Almonds and walnuts are the most widely accepted in this region. In India, due to consumer awareness of the benefits that these nuts bring toward better health, there has been more demand for this healthier substitute. The number of the middle class in this region has increasingly taken on more of Western diets, causing higher intakes of tree nuts. Australia, where most macadamia nuts are sourced from, has recorded increases in their exports by 15 percent annually, as per an industry report. Local production is also on the rise, with countries like India investing in tree nut farming to meet domestic demand. The growing use of tree nuts in confectionery, bakery, and snack foods is further propelling market expansion in the region.

Latin America Tree Nuts Market Analysis

According to tree nuts industry news, the market in Latin America is growing due to the increased demand for premium and organic nuts, as well as the region's position as a key producer. According to an industrial report, Brazil and Chile are among the top cashew and walnut exporting countries, with export values of over USD 2 Billion in 2023. Brazil's nut production for the year 2022/23 was around 22,000 metric tons, accounting for 5% of global production, with Bolivia and Peru taking the lead in production. Rising demand for tree nuts as a snack food, especially in Brazil, where the consumption of tree nuts has grown at 7% per annum, is a major driver of this market. Furthermore, the region's middle class is growing, thereby driving demand for healthier and protein-rich foods. Sustainability, including organic farming practices, is also picking up pace in the region, especially in Brazil. The tree nuts market research report highlights that Latin America is well-positioned to capture both domestic and international market share, as sustainable farming practices, particularly organic farming, gain momentum.

Middle East and Africa Tree Nuts Market Analysis

The tree nuts market in Middle East and Africa is further growing on the grounds that consumers become increasingly health conscious and snacking grows significantly. According to International Nut and Dried Fruit council, in 2021 Middle East held about 12% share of the worldwide consumption of tree nuts including almonds, walnuts, cashews, pistachios, and hazelnuts being the top among them. The Arab Nut and Dried Fruit Association claim that the Middle East region emerged as a significant importing player of tree nuts worth above USD 1 Billion as of 2023, in which the United Arab Emirates, followed by Saudi Arabia, takes the largest share of them. Tree nuts, while gaining popularity as an integrated part of healthy diets worldwide, are being cultured massively in South Africa as this country is just about embarking on growing these locally to meet both markets. Government-backed programs in North Africa are promoting local manufacturing, particularly for nuts like almonds and pistachios. As the region's desire for healthy snacks grows, tree nuts are becoming an integral part providing a positive tree nuts market outlook in the region.

Competitive Landscape:

The tree nuts industry insights indicates that key players in the nut market are continually innovating to meet consumer demands for quality, variety, and sustainability. They are focusing on product development, introducing new flavors, and packaging formats to cater to changing consumer preferences. Additionally, these players are investing in sustainable sourcing practices and environmentally friendly packaging solutions to address growing concerns about ecological impact. Several are also emphasizing health and wellness aspects by highlighting the nutritional benefits of nuts, aligning with the rising demand for healthier snack options. Collaboration with retailers and e-commerce platforms is a common strategy to enhance distribution and reach a broader audience.

The report provides a comprehensive analysis of the competitive landscape in the tree nuts market with detailed profiles of all major companies, including:

- Archer-Daniels-Midland Company

- Blue Diamond Growers

- CG Hacking & Sons Limited

- Diamond Foods LLC

- Kanegrade Ltd.

- Mariani Nut Company Inc

- Montagu Snacks

- Olam International Limited

- Select Harvests Limited

- Sun Valley Limited (Zertus GmbH)

- Voicevale Ltd.

- Waterford Nut Co.

Latest News and Developments:

- April 2025: The Western Agricultural Processors Association officially rebranded as the Western Tree Nut Association (WTNA) to formally incorporate the interests of pistachio, walnut, almond, and pecan growers alongside processors. The move, which received 95%-member support, reflects the organization’s commitment to representing both farming and processing stakeholders across the supply chain. Under its new name, WTNA will continue existing advocacy efforts at the state level while expanding federal policy engagement in Washington, D.C., funded through broader membership contributions.

- February 2025: Austin-based PKN unveiled PKN Zero, a new pecan nut-based non‑dairy milk featuring only four ingredients: filtered water, pecan butter, vanilla extract, and sea salt, delivering a subtle roasted pecan flavor with a buttery texture and no added gums or sugar. The product leverages advanced roasting techniques and upcycled pecan pieces, highlighting both nutritional benefits—rich in flavonoids, antioxidants, omega‑3s, and fiber.

- October 2024: To start the holiday season, Blue Diamond, the top almond marketer and processor globally, recently unveiled a new seasonal flavor: Blue Diamond Frosted Brownie Almonds.

- Sep 2024: Divert, Inc., a technology firm focused on making an impact and dedicated to Protecting the Value of Food™, partnered with Blue Diamond Growers, a cooperative owned by farmers and the top almond producer globally, to convert almond processing byproducts into renewable energy.

- November 2021: Archer-Daniels-Midland Company acquired Deerland Enzymes, Inc. This acquisition is expected to enhance the company’s food processing capabilities.

- May 2021: Olam Food Ingredients (OFI) has revealed its acquisition of Olde Thompson, a prominent U.S.-based private-label producer of spices and seasonings. This move strengthens a partnership spanning 15 years and represents a major step forward for OFI’s spices division.

- November 2021: Zertus expands portfolio with Sun Valley Limited (Zertus GmbH) acquisition. The acquisition complements Zertus’s existing brand portfolio, which include Nomo; Baileys Chocolates, created in partnership with Diageo; The Fruit Factory; and Forest of Hope.

Tree Nuts Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Almonds, Cashews, Walnuts, Pistachios, Hazelnuts, Chestnuts, Brazil Nuts, Others |

| Forms Covered | Whole, Split, Others |

| Distribution Channels Covered | Online, Offline |

| Applications Covered | Direct Consumption/Culinary Purpose, Bakery and Confectionery, Breakfast Cereals, Snacks, Flavored Drinks, Butter and Spreads, Dairy Products, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Archer-Daniels-Midland Company, Blue Diamond Growers, CG Hacking & Sons Limited, Diamond Foods LLC, Kanegrade Ltd., Mariani Nut Company Inc, Montagu Snacks, Olam International Limited, Select Harvests Limited, Sun Valley Limited (Zertus GmbH), Voicevale Ltd, Waterford Nut Co., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the tree nuts market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global tree nuts market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the tree nuts industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The tree nuts market was valued at USD 58.7 Billion in 2025.

The tree nuts market is projected to exhibit a CAGR of 7.31% during 2026-2034, reaching a value of USD 110.8 Billion by 2034.

The tree nuts market is driven by rising consumer awareness of the health benefits of tree nuts, such as improved heart health and weight management, and increasing demand for plant-based and vegan food trends. Additionally, packaging innovations and the push for sustainable farming, and growing disposable incomes leading to higher spending on premium, nutrient-rich snacks.

Europe currently dominates the tree nuts market. This dominance is fueled by a strong health and wellness trend among consumers, rising adoption of vegan and gluten-free diets, and the availability of organic, sustainably sourced nuts.

Some of the major players in the tree nuts market include Archer-Daniels-Midland Company, Blue Diamond Growers, CG Hacking & Sons Limited, Diamond Foods LLC, Kanegrade Ltd., Mariani Nut Company Inc, Montagu Snacks, Olam International Limited, Select Harvests Limited, Sun Valley Limited (Zertus GmbH), Voicevale Ltd, and Waterford Nut Co., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)