Trauma Products Market Size, Share, Trends, and Forecast by Product, Surgical Site, End User, and Region, 2025-2033

Trauma Products Market Size and Share:

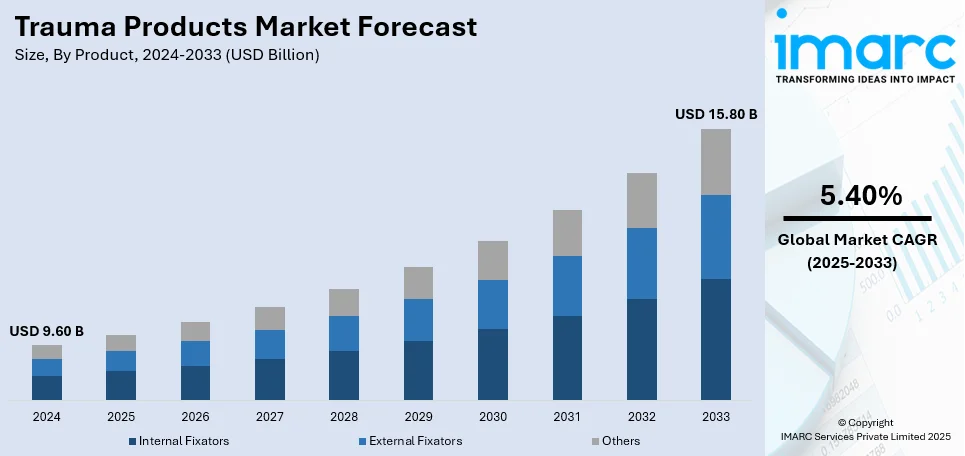

The global trauma products market size was valued at USD 9.60 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 15.80 Billion by 2033, exhibiting a CAGR of 5.40% from 2025-2033. North America currently dominates the market, holding a market share of over 46.3% in 2024. The trauma products market share is expanding, driven by the growing aging population, which is more prone to fractures and orthopedic injuries and requires effective care solutions, along with the rising focus on favorable reimbursement policies and government initiatives that encourage the utilization of reliable trauma items.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 9.60 Billion |

|

Market Forecast in 2033

|

USD 15.80 Billion |

| Market Growth Rate (2025-2033) | 5.40% |

At present, the increasing number of workplace mishaps and sports injuries create the need for effective treatment solutions like trauma products. Besides this, with a rise in the aging population, conditions like osteoporosis make fractures more common, driving the demand for external fixators, internal fixators, and orthopedic implants. Additionally, advancements in medical technology, such as 3D-printed implants and minimally invasive (MI) procedures, are improving patient recovery. Apart from this, expanding healthcare infrastructure, especially in developing regions, is making trauma care more accessible. Government support, insurance coverage, and reimbursement policies further help patients in affording new trauma treatments. Moreover, healthcare professionals are receiving specialized training in trauma care, encouraging the adoption of new surgical techniques and items.

To get more information on this market, Request Sample

The United States has emerged as a major region in the trauma products market owing to many factors. The country’s highly aging population that suffers from osteoporosis and other bone-related conditions is offering a favorable trauma products market outlook. As per the data provided on the official website of the Pew Research Center, as of January 2024, there were approximately 62 Million individuals aged 65 and older residing in the US, representing 18% of the total population. By the year 2054, it is projected that 84 Million adults aged 65 and over will represent approximately 23% of the population. Besides this, the rising number of job site accidents drives the demand for advanced trauma care. Additionally, technological advancements, such as MI surgical procedures, are improving patient recovery. Moreover, leading medical device companies wager on research and development (R&D) activities, introducing reliable items that enhance treatment outcomes.

Trauma Products Market Trends:

Rising Incidences of Traumatic Injuries and Accidents

The increasing cases of road accidents, falls, and sports injuries catalyze the demand for trauma products. Besides this, the elderly population is on the rise worldwide. They are more prone to fractures and orthopedic injuries, hence creating the need for trauma fixation devices like plates and screws. While urbanization and industrialization projects can be seen advancing across the globe, such trends also lead to a higher risk for trauma-related injury where advanced trauma care solutions are necessarily required. The World Health Organization (WHO) reported in 2023 that road traffic accidents result in 1.19 Million deaths each year, with 20-50 Million injuries being non-fatal, a large number of which cause enduring disabilities. This growing trauma-related injury burden is promoting a rapid rise in the need for trauma management solutions, thereby encouraging advancements in orthopedic injury devices and emergency care systems.

Advancements in Trauma Care Technology and Surgical Procedures

Medical technology innovations are impelling the trauma products market growth. The development of MI orthopedic surgeries, bioresorbable implants, and 3D-printed trauma fixation devices has changed the way patient care is provided in operating theaters (OTs) by improving the results of surgeries and reducing the recovery time for patients. Refined imaging techniques include computer-assisted surgery (CAS) and robotic-assisted orthopedic procedures, which lead to better outcomes for patients, increasing their use among healthcare providers. In addition, next-generation materials, such as titanium and bioabsorbable polymers, continue to enhance the strength, toughness, and biocompatibility of trauma implants. These developments encourage medical hospitals and health institutions to acquire trauma care technologies. In June 2021, Zimmer Biomet launched Bactiguard-coated trauma items within Europe, the Middle East, and Africa to prevent contamination, with CE certification made in January 2021 through the ITA. Besides that, in July 2020, Orthofix Medical Inc. launched the JuniOrtho Plating System for complex lower extremity trauma specifically in pediatric patients, further offering innovative solutions.

Growing Investments in Healthcare Infrastructure and Emergency Services

Government agencies and private healthcare organizations are wagering on emergency medical services (EMS) and orthopedic departments to cater to the high trauma products market demand. Countries with higher healthcare expenditures, including the United States, China, and India, are broadening their trauma care infrastructures to handle rising hospitalizations of injuries. Besides this, favorable reimbursement policies and government initiatives, especially in the developing regions also encourage the employment of trauma products. An increase in awareness about the importance of rapid trauma response has, therefore, given rise to more demand for fixation devices in cases of trauma like screws, plates, and external fixation systems. In addition to this, the growing cases of musculoskeletal disorders are promoting the usage of orthopedic trauma products. In 2019, an estimated 528 Million people worldwide were suffering from osteoarthritis. This surged by an astonishing 113% since 1990, according to the WHO. This sharp increase highlights the necessity for advanced trauma care solutions that improve patient outcomes.

Trauma Products Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global trauma products market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, surgical site, and end user.

Analysis by Product:

- Internal Fixators

- Plates

- Screws

- Nails

- Others

- External Fixators

- Unilateral and Bilateral External Fixators

- Circular External Fixators

- Hybrid External Fixators

- Others

Internal fixators (plates, screws, nails, and others) lead the market with 87.8% of the market share in 2024. They provide strong and stable support for broken bones, helping them to heal properly. These devices are placed inside the body to keep fractured bones aligned, reducing movement and speeding up recovery. Unlike external fixators, they offer better comfort and mobility, allowing patients to return to daily activities faster. Surgeons prefer internal fixators because they provide long-term stability and lower the risk of complications, such as infections or improper healing. Advancements in materials like bioabsorbable implants and titanium make them more durable and compatible with the body. With rising cases of fractures from accidents, sports injuries, and aging-related conditions like osteoporosis, the requirement for internal fixators continues to grow. Additionally, developments in surgical techniques and minimally invasive procedures make implantation easier and recovery smoother. As a result, internal fixators remain the top choice.

Analysis by Surgical Site:

- Upper Extremities

- Hand and Wrist

- Shoulder

- Elbow

- Lower Extremities

- Hip and Pelvic

- Foot and Ankle

- Knee

- Others

Lower extremities (hip and pelvic, foot and ankle, knee, and others) account for 88.2% of the market share. Foot and ankle injuries are more common due to accidents, falls, and sports-related activities. Since the lower body supports most of a person’s weight, fractures in these areas require strong and stable fixation for proper healing. Conditions like osteoporosis and arthritis also increase the risk of fractures in older adults, further driving the demand for trauma products. Surgical procedures for lower extremities often involve plates, screws, rods, and other internal fixators to provide stability and restore mobility. Since these injuries take longer to heal and often need surgical intervention, hospitals and orthopedic clinics depend on trauma items for treatment. Additionally, advancements in minimally invasive techniques make surgeries more reliable, lowering recovery time for patients. With the rising number of road accidents and workplace injuries, the demand for lower extremity trauma products continues to grow.

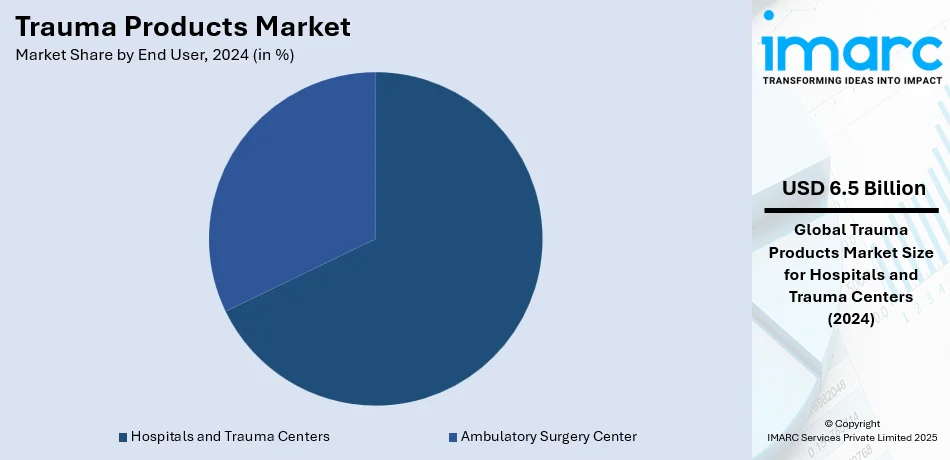

Analysis by End User:

- Hospitals and Trauma Centers

- Ambulatory Surgery Center

Hospitals and trauma centers lead the market with 67.5% of the market share. They handle the highest number of emergency cases, including fractures, accidents, and severe injuries. These facilities are equipped with modern surgical tools, skilled medical professionals, and specialized trauma units to give immediate and effective treatment. Since most trauma cases require surgery or intensive care, hospitals and trauma centers are the primary employers of external fixators, internal fixators, and other trauma products. They also have a steady inflow of patients due to road accidents, sports injuries, and age-related fractures, keeping the demand high. With the growing advancements in orthopedic procedures and minimally invasive surgeries, hospitals are adopting more advanced trauma products to improve patient outcomes. Additionally, government funding and insurance coverage for emergency treatments make hospitals the go-to option for trauma care.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America, accounting for 46.3%, enjoys the leading position in the market. The region is noted for its advanced healthcare system, high rate of accidents, and the growing elderly population prone to fractures. Road accidents, sports injuries, and workplace mishaps are common, creating the need for trauma products like orthopedic implants, internal fixators, and external fixators. According to the information given on the official website of the National Safety Council (NSF), The National Safety Council (NSC) expected motor-vehicle fatalities in the first half of 2024 to be 20,900, almost identical to the revised figure of 20,930 for 2023. The projected mileage death rate for the first half of 2024 was 1.30 fatalities for every 100 Million miles driven, showing a decrease of 1.5% from 1.32 in 2023. This area also has a strong presence of key medical device manufacturers, ensuring continuous innovations and the availability of high-quality trauma solutions. Hospitals and trauma centers in North America are well-equipped with advanced surgical tools and skilled professionals, making treatments more effective and accessible. Additionally, increasing government funding, insurance coverage, and favorable reimbursement policies encourage patients to seek proper medical care. Moreover, the rising adoption of MI procedures and 3D-printed implants fuel the market growth.

Key Regional Takeaways:

United States Trauma Products Market Analysis

The United States hold 90.60% of the market share in North America. In the country, the trauma products market is growing rapidly. Such expansion is attributed to the increasing trauma-related injuries and the growing geriatric population. As reported by the US Department of Transportation, in 2022, 42,514 individuals died on US highways, reflecting a 10% rise from 2020. This high number of road accidents shows the continuous requirement for state-of-the-art trauma care products to treat injuries from road traffic accidents. In addition, the US is experiencing a significant demographic shift. The population aged 65 and older rose by 9.4% from 2020 to 2023, reaching around 59.2 Million, according to the US Census Bureau. This aging population is more prone to fractures, falls, and other trauma-related injuries, which further drives the demand for trauma care solutions. These trends, coupled with enhancements in trauma treatment technologies, including implants and regenerative medicine, fuel the growth of the market.

Europe Trauma Products Market Analysis

The market is gaining momentum in Europe, as more people are becoming victims of road accidents, and the presence of aged population. In fact, according to reports, 20,400 people died on EU roads in 2023, which indicates the continued urgency to have appropriate solutions for trauma care. More injuries due to traffic in the region encourage innovations in trauma products to manage such severe trauma conditions. The European region is also experiencing a rapidly growing aging population. In 2021, the population aged 60 and older in the area was 215 Million, and it is projected to grow to 247 million by 2030 and exceed 300 million by 2050, according to WHO. The shift in demographics means more falls, fractures, and other types of trauma-related injuries, thereby catalyzing the demand for different age groups. This, along with advancements in medical technology, is impelling the growth of the market.

Asia-Pacific Trauma Products Market Analysis

The market is growing significantly in the Asia-Pacific region due to the high healthcare investments and the increasing number of trauma-related injuries. IBEF stated that private equity and venture capital investments in the Indian healthcare sector reached more than USD 1 Billion in the first five months of 2024, marking a 220% rise from the previous year. This surge in funding reflects the heightened investor confidence in medical advancements, which is expected to positively impact trauma care solutions across the region. According to industry reports, India recorded over 4.80 lakh road incidents in 2023, resulting in more than 1.72 lakh fatalities, reflecting a 2.6% increase from 1.68 lakh deaths in 2022. The high incidence of road accidents across the Asia-Pacific countries, including China and Indonesia, creates the need for advanced trauma care solutions. Furthermore, rapid urbanization, a rise in the number of government initiatives promoting emergency medical services, and advancements in surgical technologies are driving the demand for trauma products in the area.

Latin America Trauma Products Market Analysis

The Latin America market is largely witnessing growth owing to the increasing number of road traffic fatalities and an older population. The OECD projected that Colombia experienced 8,146 road traffic deaths in 2022, marking a 24% rise compared to the average between 2017 and 2019 and an increase of 12.5% from 2021. Thus, the high number of fatalities in such accidents necessitates the adoption of modern solutions in trauma care services to manage injuries from road accidents. Also, with the rise of the elderly population in Latin America, the demand for trauma products has increased. Till 2025, people aged 60 and above in the region will increase in substantial numbers, with a rise in falls, fractures, and other trauma injuries. Together, these demographic trends and high levels of road traffic accidents lead to the expansion of the market in Latin America.

Middle East and Africa Trauma Products Market Analysis

The market in the Middle East and Africa (MEA) region is driven by road traffic fatalities and an aging population. In the UAE, traffic crashes cause 5.5 deaths per 100,000 population in 2023. Half of all these deaths occur among youth aged between 18 and 30 years old, according to NIH. This group is a major target population for reliable trauma care solutions to counteract the risk of road traffic injuries. An increasing aging population is another significant reason for the increase in demand for trauma products in the region. As people are living longer, age-related injuries, such as fractures from falls, are also on the rise. This shift in demographics will fuel the growth of the market, especially for orthopedic devices. A high fatality rate related to road traffic and an older population provides favorable conditions for developing the market in this area.

Competitive Landscape:

Key players in the market are working on the development and improvement of medical devices to enhance patient recovery and surgical outcomes. Big companies invest in R&D activities to create advanced implants, bioabsorbable materials, and MI surgical solutions. They also team up with hospitals and trauma centers to provide training and support for healthcare professionals, ensuring better use of their products. Strong distribution networks and partnerships with medical suppliers help to make trauma solutions widely available. Additionally, these companies focus on regulatory approvals and compliance to maintain product quality and safety. Marketing strategies and mergers and acquisitions (M&As) further expand their market presence. With the growing requirement for trauma care due to accidents, sports injuries, and age-related fractures, key players continue to offer reliable and cost-effective solutions that enable better patient recovery. For instance, in October 2024, Globus Medical, Inc., a well-known firm that creates musculoskeletal items, declared the continuous expansion and improvement of its orthopedic trauma product line. The next-gen systems feature CAPTIVATE™ SOLA Headless Screws, AUTOBAHN™ Trochanteric Nail PRO Instruments, and ANTHEM™ II Distal Radius Volar Plates. The inclusion of these items in the firm’s orthopedic trauma collection highlights its ongoing commitment and attentiveness to both surgeons and patients.

The report provides a comprehensive analysis of the competitive landscape in the trauma products market with detailed profiles of all major companies, including:

- Acumed LLC

- Arthrex, Inc.

- B. Braun SE

- Citieffe s.r.l.

- Double Medical Technology Inc.

- Enovis Corporation

- Globus Medical Inc.

- Johnson & Johnson MedTech

- Medartis AG

- Orthofix Medical Inc.

- Smith & Nephew plc

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

Latest News and Developments:

- July 2024: Stryker, a leader in developing and improving medical technologies, successfully finalized its acquisition of Artelon, Inc., a private firm focused on soft tissue products predominantly for foot and ankle and sports medicine applications.

- June 2024: RevelAi Health and Zimmer Biomet, a MedTech firm, entered into a multi-year co-marketing partnership to promote generative artificial intelligence (AI)-driven engagement solutions. It aims to enhance value-based orthopedic care and health equity. Moreover, Zimmer Biomet intends to introduce RevelAi Health's dashboard for care teams and its patient care management platform into the market.

Trauma Products Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Surgical Sites Covered |

|

| End Users Covered | Hospitals and Trauma Centers, Ambulatory Surgery Center |

| Regions Covered | North America, Asia-Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Acumed LLC, Arthrex, Inc., B. Braun SE, Citieffe s.r.l., Double Medical Technology Inc., Enovis Corporation, Globus Medical Inc., Johnson & Johnson MedTech, Medartis AG, Orthofix Medical Inc., Smith & Nephew plc, Stryker Corporation, Zimmer Biomet Holdings, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the trauma products market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global trauma products market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the trauma products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The trauma products market was valued at USD 9.60 Billion in 2024.

The trauma products market is projected to exhibit a CAGR of 5.40% during 2025-2033, reaching a value of USD 15.80 Billion by 2033.

Increasing road accidents, sports injuries, and workplace mishaps are driving a higher demand for trauma products. Besides this, the growing aging population, which is more prone to fractures due to conditions like osteoporosis, arthritis, and weakened bones, is creating the need for trauma solutions. Moreover, innovations, such as bioabsorbable materials and minimally invasive surgical techniques are improving patient outcomes, thereby propelling the market growth.

North America currently dominates the trauma products market, accounting for a share of 46.3% in 2024, driven by its advanced healthcare infrastructure, high accident rates, and the growing aging population prone to fractures. Strong medical research, insurance coverage, and increasing adoption of innovative trauma solutions further fuel the market growth in the region.

Some of the major players in the trauma products market include Acumed LLC, Arthrex, Inc., B. Braun SE, Citieffe s.r.l., Double Medical Technology Inc., Enovis Corporation, Globus Medical Inc., Johnson & Johnson MedTech, Medartis AG, Orthofix Medical Inc., Smith & Nephew plc, Stryker Corporation, Zimmer Biomet Holdings, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)