Transthyretin Amyloidosis Treatment Market Size, Share, Trends and Forecast by Therapy, Type, Disease, Distribution Channel, and Region, 2025-2033

Transthyretin Amyloidosis Treatment Market Size and Share:

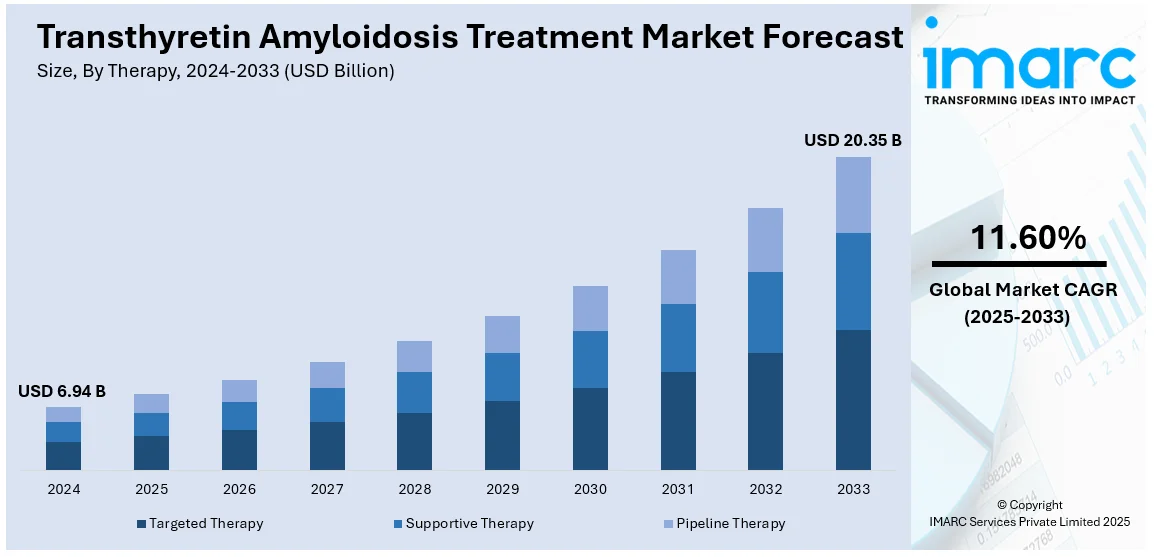

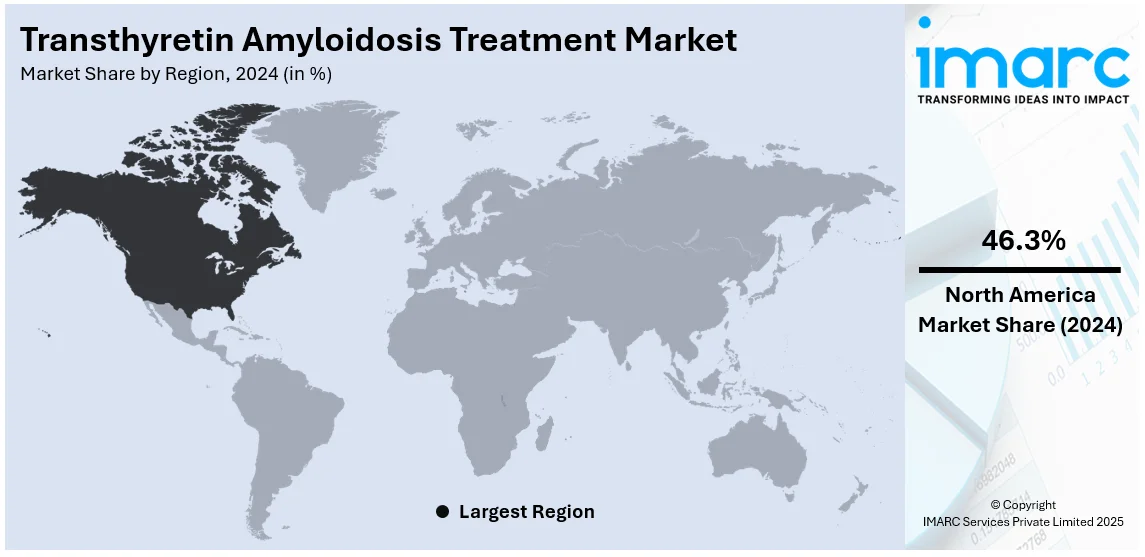

The global transthyretin amyloidosis treatment market size was valued at USD 6.94 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 20.35 Billion by 2033, exhibiting a CAGR of 11.60% from 2025-2033. North America currently dominates the market, holding a market share of over 46.3% in 2024. The market in this region is rapidly expanding, driven by advancements in novel therapies, increased diagnosis rates, rising geriatric populations, growing adoption of RNA-based drugs, the emergence of combination therapies, and the prevalence of patient-centric care models.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.94 Billion |

| Market Forecast in 2033 | USD 20.35 Billion |

| Market Growth Rate (2025-2033) | 11.60% |

Transthyretin amyloidosis (ATTR) predominantly affects geriatric adults, especially those over the age of 60. With populations aging globally, the number of people at risk for ATTR is on the rise. According to the World Health Organization (WHO), it is projected that by 2030, one out of every six individuals worldwide will be 60 years old or older. By 2050, this population of people will double to 2.1 billion. The wild-type form of the disease is particularly associated with aging. This demographic trend directly increases the number of potential patients, creating a growing market for treatment options. Moreover, as people live longer and access better healthcare, chronic conditions like ATTR that might previously have gone unnoticed or untreated are now being managed, further increasing the need for effective therapies.

The United States is a major market disruptor with 78.60% share in North America. The country has been focusing on the approval of innovative therapies that is reshaping the landscape for ATTR treatment. For example, in November 2024, the U.S. Food and Drug Administration (FDA) granted approval to BridgeBio's drug, Attruby (acoramidis), for the treatment of transthyretin amyloid cardiomyopathy (ATTR-CM). This approval provides patients with a new treatment option and highlights the continuous advancements in this area. Moreover, drugs like tafamidis, patisiran, and inotersen have changed the way ATTR is managed, offering disease-modifying options. These drugs target the root causes of ATTR by stabilizing transthyretin proteins or silencing the genes responsible for abnormal protein production. Pharmaceutical companies are increasingly allocating resources to research and development (R&D), resulting in the introduction of more sophisticated treatments. This momentum is further fueled by regulatory incentives, such as orphan drug designations and priority reviews, which encourage companies to develop treatments for rare diseases like ATTR.

Transthyretin Amyloidosis Treatment Market Trends:

Growing Adoption of RNA-Based Therapies

RNA-based treatments are becoming the latest trend in the treatment of ATTR as the patisiran and vutrisiran present the most novel approaches to handling ATTR. This therapy works on the principle of silencing genes that produce faulty transthyretin proteins, thus tackling the root cause of the disease. For example, Alnylam Pharmaceuticals' drug, vutrisiran, has demonstrated encouraging results in lowering the risk of death and cardiovascular events in patients with transthyretin amyloid cardiomyopathy. A study released in June 2024 concluded that vutrisiran markedly reduced deaths due to all causes and cardiovascular events by 28% among all patients who took part in the trial, providing evidence for RNA-based treatments. The success of these treatments has generated great interest in RNA-based approaches, not only for ATTR but also for other genetic and rare diseases. Their strong efficacy and relatively mild side effects make them a compelling choice for both patients and healthcare providers.

Rising Focus on Personalized Medicine

The move toward personalized medicine is transforming ATTR treatment. Genetic testing plays a crucial role in determining whether a patient has hereditary ATTR (hATTR) or wild-type ATTR, enabling tailored treatment plans. Pharmaceutical companies are increasingly emphasizing therapies that address specific genetic mutations or protein misfolding mechanisms, ensuring patients receive the most effective care. Personalized approaches also improve treatment adherence and outcomes, as patients and doctors can see tangible benefits from customized therapies. This focus on precision medicine enhances the attractiveness of advanced drugs and fosters innovation in the market, encouraging more patients to explore treatment options.

Rise of Combination Therapies

Combination therapies are gaining increasing popularity in the treatment of ATTR. Combining multiple mechanisms of action, such as TTR stabilizers and RNA-based treatments, is showing positive results in managing the disease more effectively. The synergistic effects of these therapies are designed to halt disease progression while minimizing side effects. For instance, clinical trials in 2024 explored combining patisiran with tafamidis for more comprehensive treatment approaches, reporting significant improvements in patient outcomes. The success of these studies is driving the adoption of combination therapies.

Transthyretin Amyloidosis Treatment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global transthyretin amyloidosis treatment market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on therapy, type, disease, and distribution channel.

Analysis by Therapy:

- Targeted Therapy

- Vyndaqel/Vyndamax

- Onpattro

- Amvuttra

- Tegsedi

- Wainua

- Supportive Therapy

- Pipeline Therapy

Targeted therapy still holds the most significant market share at 85.6% in 2024, mainly because these drugs address disease causality as opposed to simply managing symptoms of the disease. This category incorporates some of the most innovative treatments in RNA and includes drugs such as patisiran and vutrisiran, along with transthyretin stabilizers like tafamidis. These therapies work through either silencing abnormal gene expression or stabilizing the transthyretin protein, which leads to slowed disease progression and significantly improved patient outcomes. Growth in this segment is also influenced by continued genetic and molecular research and increased adoption among healthcare providers, in addition to robust clinical trial data supporting the drugs' efficacy. The spread of these therapies and awareness around the globe, however, would result in targeted therapy staying at the forefront of ATTR treatments.

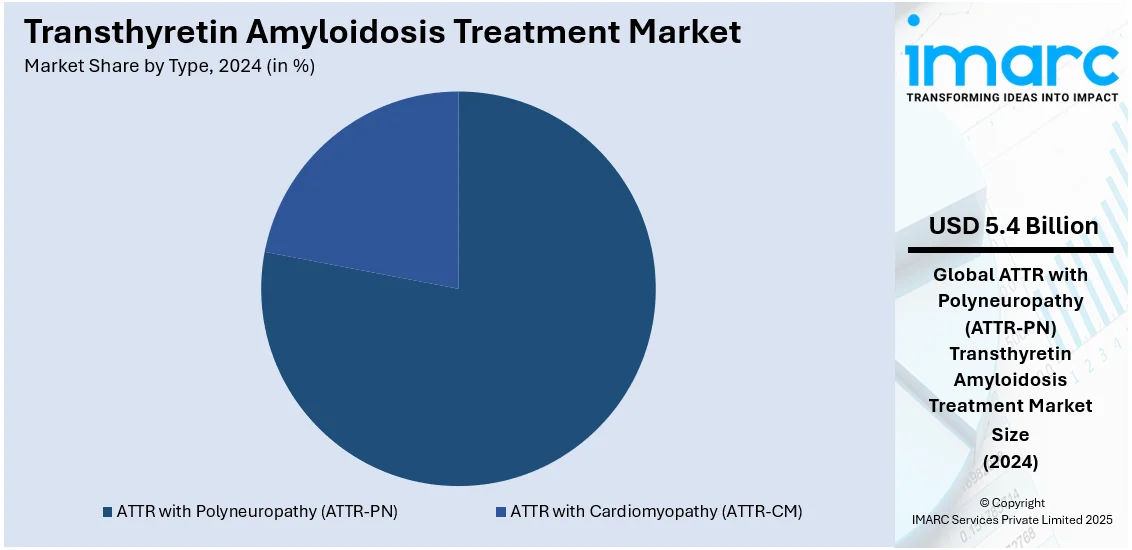

Analysis by Type:

- ATTR with Polyneuropathy (ATTR-PN)

- ATTR with Cardiomyopathy (ATTR-CM)

ATTR with polyneuropathy (ATTR-PN) leads the market share in 2024 with 78.1%. This growth is fueled by the high prevalence of hereditary cases and the debilitating impact of the condition. ATTR-PN is characterized by progressive nerve damage, leading to symptoms such as numbness, pain, and motor impairments, which severely impact quality of life. The development and approval of innovative therapies, such as patisiran and inotersen, specifically targeting the genetic mutations responsible for ATTR-PN, have revolutionized treatment options. The segment's dominance is further bolstered by growing awareness among healthcare providers, earlier diagnoses facilitated by advanced genetic testing, and increasing availability of these targeted therapies globally. As research continues to refine treatments and expand their accessibility, ATTR-PN is expected to sustain its position as the leading market segment.

Analysis by Disease:

- Hereditary Transthyretin Amyloidosis

- Polyneuropathy

- Cardiomyopathy

- Mixed Type

- Wild Type Amyloidosis

In 2024, wild-type amyloidosis accounts for the largest market share with 56.2%. This is primarily due to its high prevalence among the aging population. ATTRwt, often associated with cardiac amyloidosis, occurs without genetic mutations, making it more common yet historically underdiagnosed. Advancements in diagnostic tools, including imaging techniques and biomarkers, have enhanced detection rates, increasing the demand for effective treatments such as tafamidis and emerging RNA-based therapies. This segment benefits from increasing awareness, expanded healthcare access, and targeted therapies that address disease progression rather than just symptoms. As aging populations grow globally and diagnostic accuracy continues to improve, the wild-type amyloidosis segment is set to remain the dominant driver in the ATTR treatment market.

Analysis by Distribution Channel:

- Hospital Pharmacies

- Specialty Pharmacies

- Retail Pharmacies

- Online Pharmacies

Hospital pharmacies lead the market share in 2024 with 48.6%. This is due to the critical role hospitals play in diagnosing and initiating treatment for complex conditions like transthyretin amyloidosis (ATTR). Hospital pharmacies ensure the availability of advanced therapies, including tafamidis, patisiran, and inotersen, which often require specialized handling and administration. Patients diagnosed with ATTR typically begin their treatment journeys in hospitals, where comprehensive care, including consultations with cardiologists and neurologists, is available. Additionally, hospital settings facilitate the management of rare and serious diseases, ensuring access to cutting-edge diagnostic tools and multidisciplinary expertise. The segment's prominence is further reinforced by institutional purchasing power and direct links to specialized care centers, solidifying hospital pharmacies as the primary distribution channel for ATTR therapies.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

In 2024, North America is expected to hold the largest regional market share at 46.3%. This growth is fueled by advanced healthcare infrastructure, heightened disease awareness, and the widespread adoption of innovative therapies. The region benefits from the presence of leading pharmaceutical companies, ongoing clinical trials, and regulatory frameworks that support accelerated drug approvals for rare diseases like transthyretin amyloidosis (ATTR). In the United States, increasing use of tafamidis and RNA-based therapies, coupled with improved diagnostic tools, has significantly enhanced disease management. Moreover, favorable reimbursement policies and the high prevalence of both wild-type and hereditary ATTR cases among aging populations further contribute to the region's dominance. As North America continues to lead in research, development, and patient accessibility, it remains a critical driver of the global ATTR treatment market.

Key Regional Takeaways:

United States Transthyretin Amyloidosis Treatment Market Analysis

In 2024, the United States possessed the largest market share of 78.60% in North America, as a result of its robust healthcare infrastructure, wide awareness among people, and a high engagement toward rare disease management. Advanced diagnostic capabilities such as genetic testing and imaging technologies allow early and accurate diagnosis, especially in cases such as hereditary and wild-type ATTR. Availability of therapies, including tafamidis, patisiran, and vutrisiran, which are some of the FDA-approved drugs currently utilized in the USA is also a contributing factor. The country also has favorable reimbursement policies and a broad insurance footprint that allows a wider patient population to access these therapies. Moreover, the USA accommodates a number of clinical trials that spur innovation and rapid development of new treatments. Growth in the market has also been fueled by the elderly population who are highly prone to wild-type ATTR, along with the rising incidence of hereditary ATTR cases. Approximately, there are 50,000 to 150,000 US adults with ATTR-CM. Report data suggests that ATTR-CM could affect 25% of all individuals who live past the age of 85. This suggests that the prevalence of ATTR-CM in the United States could exceed 1 million individuals. Besides this, the stronghold of major pharmaceutical actors and patient advocacy organizations enhances the focus on ATTR management securing the USA's leading position in the global market.

Asia Pacific Transthyretin Amyloidosis Treatment Market Analysis

Asia Pacific is an emerging market for transthyretin amyloidosis therapy based on developing healthcare infrastructure and increasing awareness about rare disease. With advanced medical technology and greater capabilities concerning genetic testing, countries like Japan, China, and South Korea are experiencing soaring diagnosis numbers. Aging populations especially in Japan are increasing the cases of wild-type ATTR as from September 2023 to September 2024, aged people in Japan increased by 20,000 more to a record-high of 36.25 million, constituting 29.3 percent of the total population. As a result, pharmaceutical companies are now planning their strategic location expansion within this region to provide treatments at lower price points with greater awareness. While still developing, the Asia Pacific market shows significant growth potential.

Europe Transthyretin Amyloidosis Treatment Market Analysis

Europe is a very significant market for treatments of ATTR, owing to its well-established healthcare system and the broad usage of advanced diagnostic tools. Countries display substantial market activity in the field of ATTR management, including Germany, the UK, and France, with active adoption of novel therapies and enrolment in clinical trials. Regulatory incentives, including orphan drug designations from the European Medicines Agency (EMA), are also stimulating research into and accessibility to these therapies. Increased incidence of wild-type ATTR among aging populations and increased awareness and diagnosis of hereditary ATTR have seen a steady growth trend for ATTR treatments across Europe.

Latin America Transthyretin Amyloidosis Treatment Market Analysis

Latin America represents an emerging market for transthyretin amyloidosis treatments because of growing healthcare investments and increased diagnostic capabilities. Brazil and Mexico are among the most active countries in this region, focusing on increasing the awareness and availability of ATTR therapies. The market's growth is constrained by the high cost of treatment and limited insurance coverage. However, improved access to therapies is being achieved through the collaborative efforts of governments, non-profits, and pharmaceutical companies, particularly in subsidized programs and awareness initiatives. With the evolving nature of healthcare systems, the contribution of this region to the global market is also expected to rise.

Middle East and Africa Transthyretin Amyloidosis Treatment Market Analysis

The Middle East and Africa are slowly emerging as a small but growing market for transthyretin amyloidosis therapies. Historically, very little has been achieved in both creating awareness and putting into place diagnostic infrastructure that would have paved the way to the understanding and management of ATTR cases within the region. However, investments towards healthcare facilities, coupled with partnership programs with global pharmaceutical giants, are beginning to open access for advanced treatments. Countries like Saudi Arabia and South Africa are gradually adopting diagnostic technologies and treatments. Nevertheless, major challenges remain with regard to affordability and accessibility. In the next few years, the region stands to improve moderately in accessing better healthcare delivery.

Competitive Landscape:

In order to strengthen their positions, major market participants are concentrating on innovation, international growth, and strategic initiatives. Among the efforts include the advancement of drug development pipelines, with a focus on treatments that address the disease's root causes, such RNA-based therapeutics and protein stability. Businesses are also carrying out in-depth clinical trials to investigate novel uses and combinations of treatments in an effort to enhance effectiveness and patient outcomes. To guarantee early detection and treatment, campaigns are being started to increase public knowledge of ATTR and its symptoms. In addition, collaborations with patient advocacy groups and healthcare professionals are helping support underserved areas and speeding up access to medications. Broader coverage is also becoming possible, especially in emerging nations, because to expanding affordability initiatives and reimbursement mechanisms.

The report provides a comprehensive analysis of the competitive landscape in the transthyretin amyloidosis treatment market with detailed profiles of all major companies, including:

- Akcea Therapeutics, Inc

- Alnylam Pharmaceuticals, Inc.

- AstraZeneca

- BridgeBio, Inc.

- Intellia Therapeutics, Inc

- Pfizer Inc

Latest News and Developments:

- In October 2024, Alnylam Pharmaceuticals, Inc. announced that it had submitted a supplemental New Drug Application (sNDA) to the U.S. Food and Drug Administration (FDA) for vutrisiran, an investigational RNAi therapeutic aimed at treating ATTR amyloidosis with cardiomyopathy (ATTR-CM). The generic name for the drug is AMVUTTRA, which was previously approved by the FDA for treating polyneuropathy in adult patients with hereditary ATTR amyloidosis.

- In September 2024, In September 2024, AstraZeneca announced that its rare disease division, Alexion, had received fast track designation from the FDA for ALXN2220. This treatment is intended for managing transthyretin amyloidosis with cardiomyopathy.

Transthyretin Amyloidosis Treatment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Therapies Covered |

|

| Types Covered | ATTR with Polyneuropathy (ATTR-PN), ATTR with Cardiomyopathy (ATTR-CM) |

| Diseases Covered |

|

| Distribution Channels Covered | Hospital Pharmacies, Specialty Pharmacies, Retail Pharmacies, Online Pharmacies |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Akcea Therapeutics, Inc, Alnylam Pharmaceuticals, Inc., AstraZeneca, BridgeBio, Inc., Intellia Therapeutics, Inc, Pfizer Inc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the transthyretin amyloidosis treatment market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global transthyretin amyloidosis treatment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the transthyretin amyloidosis treatment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global transthyretin amyloidosis treatment market was valued at USD 6.94 Billion in 2024.

The global transthyretin amyloidosis treatment market is estimated to reach USD 20.35 Billion by 2033, exhibiting a CAGR of 11.60% from 2025-2033.

The global transthyretin amyloidosis treatment market is driven by advancements in targeted therapies, increasing disease awareness and diagnosis rates, a growing geriatric population, expanded healthcare access, regulatory support for rare diseases, and rising adoption of RNA-based and personalized treatment approaches.

North America currently dominates the market, holding a market share of over 46.3% in 2024. The market in this region is rapidly expanding, driven by advancements in novel therapies, increased diagnosis rates, rising geriatric populations, growing adoption of RNA-based drugs, the emergence of combination therapies, and the prevalence of patient-centric care models.

Some of the major players in the global transthyretin amyloidosis treatment market include Akcea Therapeutics, Inc, Alnylam Pharmaceuticals, Inc., AstraZeneca, BridgeBio, Inc., Intellia Therapeutics, Inc, Pfizer Inc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)