Transparent Conductive Films Market Size, Share, Trends and Forecast by Material, Application, and Region, 2025-2033

Transparent Conductive Films Market Size and Share:

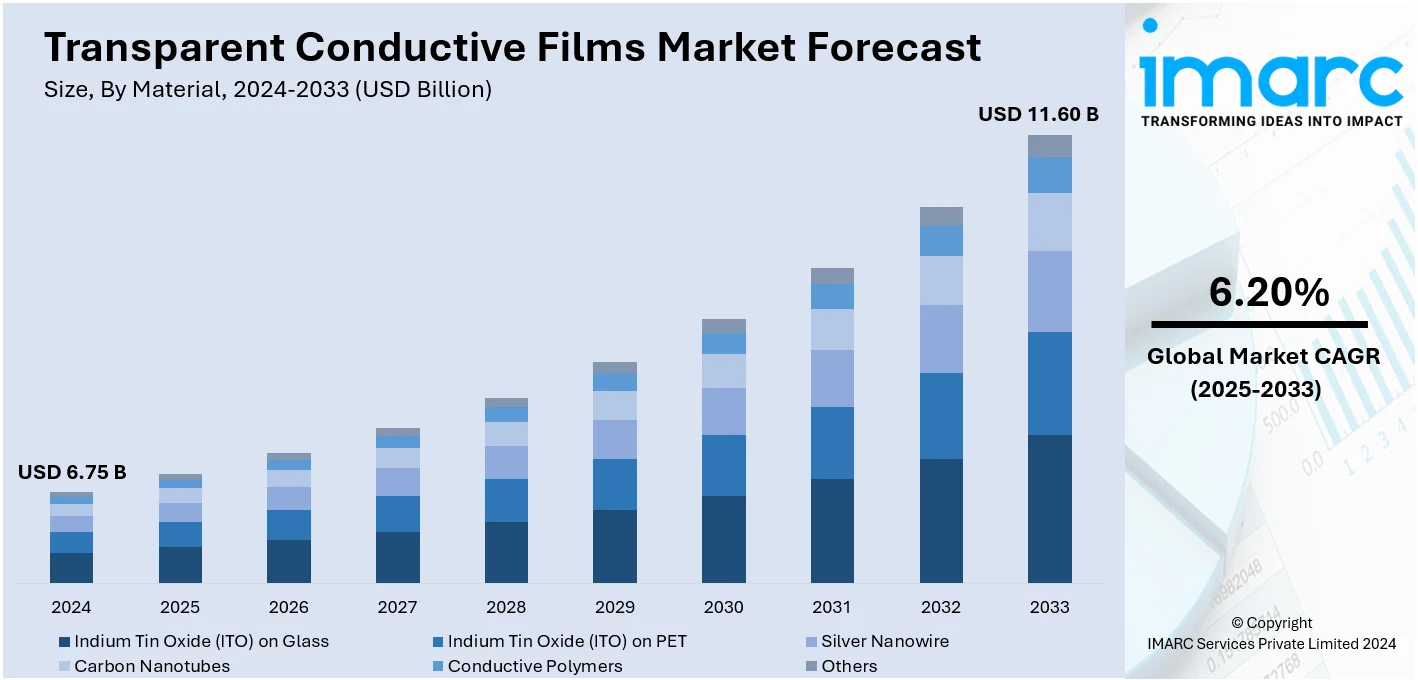

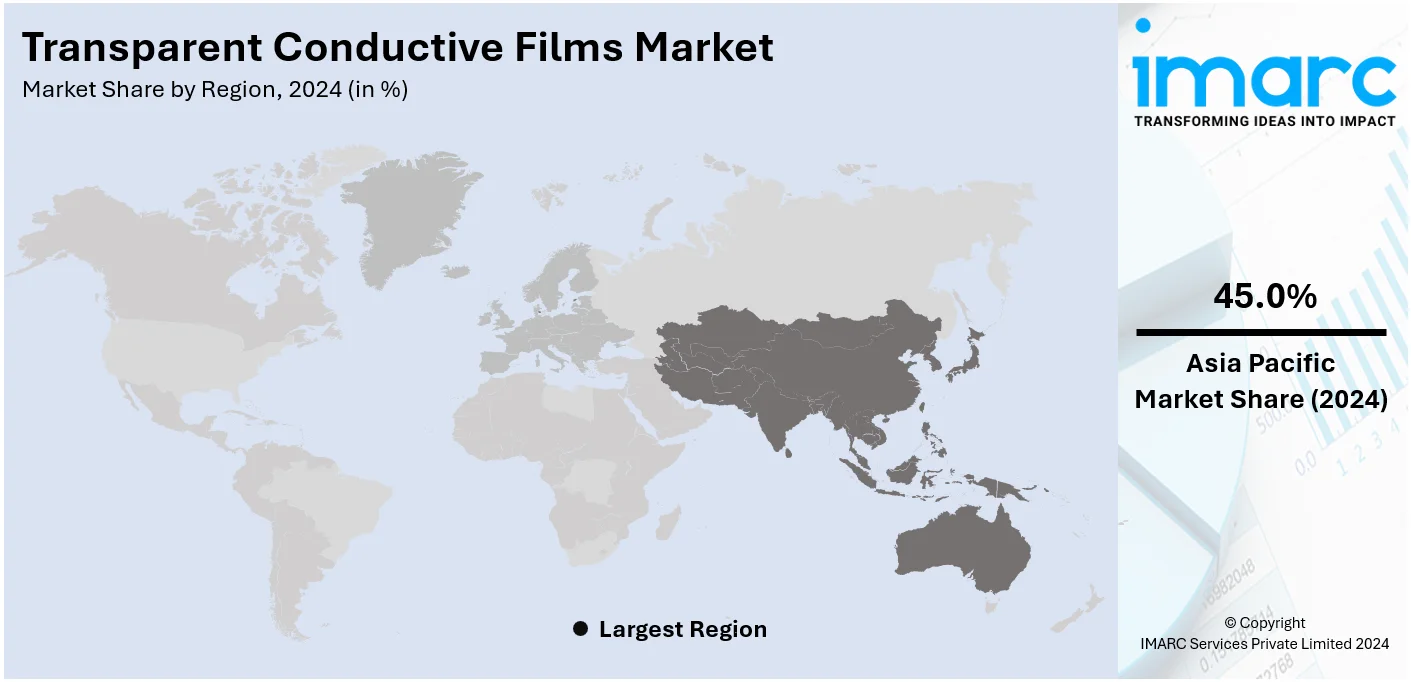

The global transparent conductive films market size was valued at USD 6.75 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 11.60 Billion by 2033, exhibiting a CAGR of 6.20% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 45.0% in 2024. This is mainly due to amplifying requirement from electronics manufacturing and proliferating smartphone production.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.75 Billion |

|

Market Forecast in 2033

|

USD 11.60 Billion |

| Market Growth Rate (2025-2033) | 6.20% |

The global transparent conductive films market is majorly driven by rising demand for touch-enabled devices, such as smartphones, tablets, and wearable electronics, fueled by advancements in consumer technology. The growth of emerging applications, including flexible displays and OLED screens, further boosts the adoption of transparent conductive films due to their lightweight and high-performance properties. Furthermore, expanding use in solar cells and energy-efficient displays aligns with increasing emphasis on renewable energy and sustainability. Additionally, advancements in materials like graphene and silver nanowires are enhancing film performance, supporting broader industrial adoption and driving market expansion across diverse sectors.

The United States plays a pivotal role in the global transparent conductive films market, driven by strong demand from the electronics, automotive, and renewable energy sectors. The country's advanced manufacturing capabilities and high adoption of cutting-edge technologies, including OLED displays and flexible electronics, bolster market growth. For instance, as per industry reports, by 2025, Apple, a dominant U.S.-based consumer electronics company, is expected to transition to OLED screens for its iPhones, phasing out its dependence on LCD technology. Moreover, increasing investments in research and development to enhance film performance and sustainability further strengthen the U.S. market. In addition, the rising demand for touch-enabled devices and smart displays across consumer and industrial applications supports the adoption of transparent conductive films, ensuring steady growth in the region.

Transparent Conductive Films Market Trends:

Increasing Adoption of Consumer Electronics and Touch User Interfaces

The growing reliance on consumer electronics like smartphones, tablets, PCs, and televisions, driven by globalization and rising disposable incomes, is fueling the demand for transparent conductive films (TCFs). According to Deloitte, 96% of people own smartphones, up from 94% last year, with 98% of 18-75-year-olds using them daily. The rise in smartphone usage is driving innovations in transparent conductive films, enabling enhanced display technologies, touchscreens, and flexible electronics, meeting the growing demand for high-performance and energy-efficient devices. Additionally, the shift towards touch user interfaces (UI) for their efficiency, durability, and reliability is boosting the integration of TCFs in handheld devices and touch-enabled LCD panels, meeting the rising demand for energy-efficient and high-performance devices.

Advancements in TCF Materials and Technologies

Traditional TCF materials, such as indium tin oxide (ITO), face limitations due to high costs and limited transparency. This has prompted manufacturers to explore innovative alternatives, including finely printed conductive meshes, silver and copper layers, carbon nanotubes, and graphene. For instance, in April 2024, Canatu and DENSO collaboratively initiated carbon nanotube reactor in Canatu's factory in Finland to expand carbon nanotube film production to address the magnifying requirement for advanced driver assistance systems (ADAS), which majorly includes the use of touch sensors, screens or touchscreens, and display panels for enhanced driver experience. These next-generation materials offer enhanced conductivity, flexibility, and transparency, meeting the requirements of modern electronics. Additionally, advancements in organic transparent conductors are supporting the development of cost-effective and versatile TCFs. These innovations not only address the challenges of conventional materials but also open new opportunities for their application in flexible electronics and energy-efficient devices, driving the market forward.

Rising Integration in Renewable Energy Applications

The transparent conductive films market is experiencing growth driven by their increasing integration into renewable energy technologies, such as photovoltaic cells and solar panels. TCFs improve energy efficiency and enable the development of lightweight, flexible solar modules with enhanced durability and performance. Furthermore, as governments and industries worldwide focus on sustainable energy solutions, demand for TCFs in energy applications is accelerating. For instance, in February 2024, the Government of India launched a renewable energy scheme to deploy rooftop solar panels across the country, enabling 10 million households to receive free electricity. Such initiatives are anticipated to propel the demand for innovative TCFs. Additionally, their role in enabling innovative renewable technologies positions TCFs as a critical component in meeting global sustainability goals, contributing significantly to the market's upward trajectory.

Transparent Conductive Films Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global transparent conductive films market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on material and application.

Analysis by Material:

- Indium Tin Oxide (ITO) on Glass

- Indium Tin Oxide (ITO) on PET

- Silver Nanowire

- Carbon Nanotubes

- Conductive Polymers

- Others

Indium tin oxide (ITO) on glass leads the market with around 29.2% of market share in 2024. This dominance is mainly due to its superior electrical as well as optical properties. Its exceptional conductivity and transparency position it as a preferable material for variety of applications, such as displays, touchscreens, and solar cells. Furthermore, the comprehensive usage of ITO on glass in leading-edge technologies, combined with its versatility to thin-film deposition techniques, fortifies its position in the global market. Although substitutes like graphene and silver nanowires are notably rising, ITO on glass remains the dominant option primarily because of its extensive industrial utilization and robust supply chains. In addition, as innovation boost further cost-efficiency and efficacy in ITO on glass production, its market leadership continues to be strengthened.

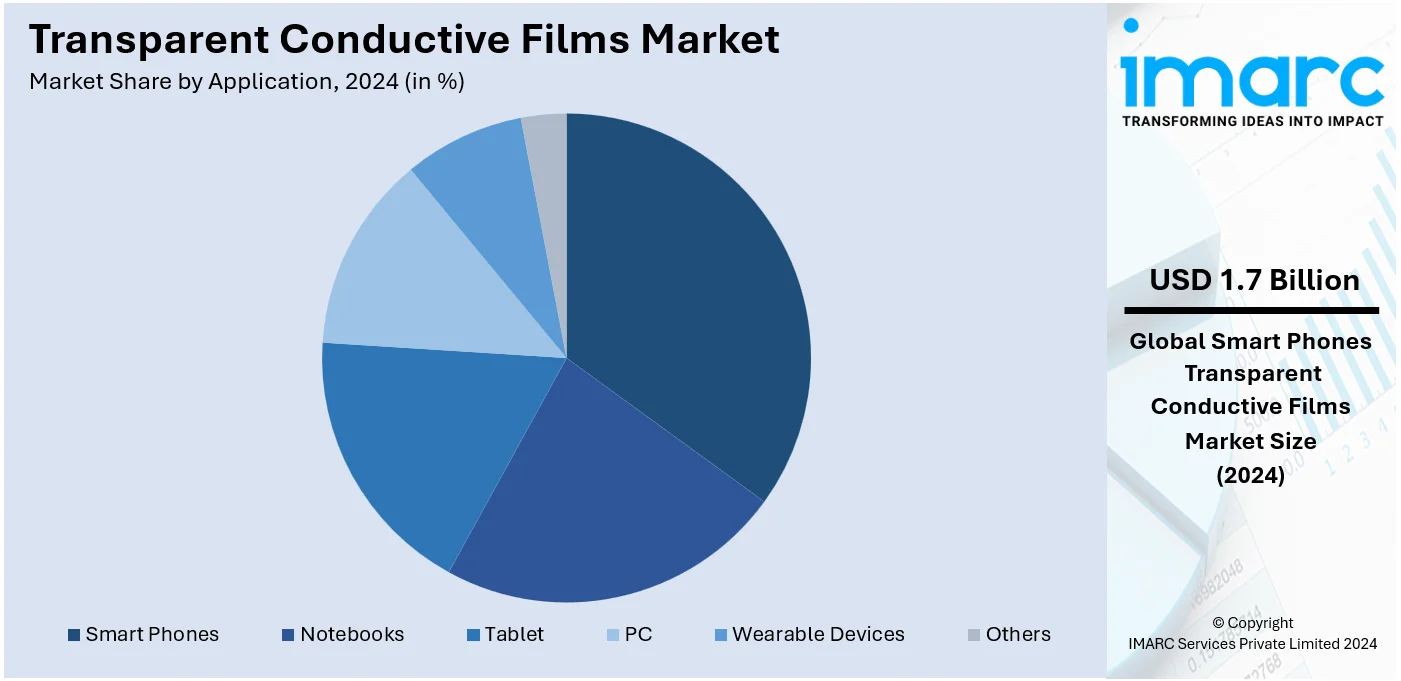

Analysis by Application:

- Smart Phones

- Notebooks

- Tablet

- PC

- Wearable Devices

- Others

Smart phones lead the market with around 24.5% of market share in 2024. This application is primarily driven by the heightening customer need for exceptional-performance touchscreens. Transparent conductive films are requisite in smartphone displays, facilitating excellent optical clarity and responsive touch functionality. Additionally, with the magnifying penetration of smartphones worldwide and the accelerating utilization of cutting-edge display technologies like flexible screens and OLED, the requirement for such films is elevating. Furthermore, various manufacturers are actively focusing on transparent conductive films for their lightweight, durability attributes, along with their exceptional compatibility with modern device designs. The proliferating smartphone user base and magnification of 5G networks further bolster the expansion of this segment, reinforcing its dominance in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 45.0%. Asia-Pacific is witnessing robust growth in the transparent conductive films market, fueled by rapid urbanization and infrastructure development. According to World Bank Group, India's urban population is projected to reach 600 Million by 2036, contributing 70% to GDP, with USD 840 Billion needed for infrastructure investments by then. This rapid urbanization drives demand for transparent conductive films, essential for modern infrastructure and smart technologies. Smart cities and digital signage are gaining traction across emerging economies, boosting the demand for advanced TCFs in public display systems. The burgeoning gaming industry, supported by the increasing adoption of large-format displays, drives innovation in conductive film technology. Automotive manufacturers in the region are increasingly integrating transparent touchscreens and energy-efficient lighting solutions in vehicles, creating a strong market pull. Additionally, the growing popularity of e-readers and advanced televisions in countries like China, Japan, and South Korea further amplifies the need for TCFs. Industrial applications, including advanced manufacturing displays and interactive robotics, also contribute to market demand. Strong government support for local electronics manufacturing under initiatives like "Make in India" and "Made in China 2025" enhances regional production capabilities.

Key Regional Takeaways:

United States Transparent Conductive Films Market Analysis

In 2024, United States accounted for the 85.50% of the market share in North America. The transparent conductive films (TCF) market in the United States is experiencing growth due to the expanding consumer electronics sector. The increasing adoption of touch-enabled devices, including smartphones, tablets, and laptops, is driving demand for TCF as a key component in touchscreens and flexible displays. For instance, smartphone ownership among U.S. adults has surged to 90% in 2023, compared to 59% in 2014, driving demand for Transparent Conductive Films (TCFs) valued at approximately USD 5 Billion, as these films enhance touchscreen functionality and durability. Additionally, the surge in electric vehicle (EV) adoption has heightened the requirement for transparent conductive films in advanced display systems and interactive user interfaces within EVs. The trend towards thinner, lighter, and energy-efficient devices is also boosting demand for TCF in optoelectronic applications. The growing preference for transparent films over traditional indium tin oxide (ITO) due to superior flexibility and lower production costs is spurring further innovations in material science. Research and development initiatives by U.S.-based technology companies and startups are fostering the production of high-performance, durable TCF, strengthening the domestic supply chain for advanced electronics.

North America Transparent Conductive Films Market Analysis

The North America transparent conductive films (TCF) market is poised for significant growth, driven by advancements in consumer electronics, photovoltaics, and automotive applications. Transparent conductive films, known for their high optical transparency and electrical conductivity, are increasingly used in touchscreens, OLED displays, and smart devices. The rising adoption of smart technologies and renewable energy solutions further amplifies demand. For instance, as per industry reports, Canada's renewable energy generation capacity in 2024 was estimated at 388 TWh, accounting for approximately two-thirds of the nation’s overall electricity output. Hydropower remains the primary contributor, positioning Canada as the world’s second-largest producer of hydroelectricity.

Innovations in material technology, such as graphene, silver nanowires, and carbon nanotubes, have diversified application possibilities, enhancing product performance. Key industry players actively focus on research and development to meet stringent performance standards and cater to evolving consumer needs. In addition, the robust presence of electronics manufacturers and a well-established technological ecosystem position North America as a pivotal market. With an expanding range of applications, the region remains a strategic hub for growth and innovation in the transparent conductive films industry.

Europe Transparent Conductive Films Market Analysis

The European market for transparent conductive films is primarily driven by innovations in wearable technology and the rising adoption of smart home devices. With increasing consumer focus on energy efficiency, TCFs are widely used in advanced lighting solutions, including OLEDs and flexible lighting systems for residential and commercial applications. The automotive sector also plays a pivotal role, with a growing demand for transparent touch panels and advanced driver-assistance systems (ADAS) displays in electric and connected vehicles. Additionally, Europe’s leadership in the development of augmented and virtual reality technologies propels the need for highly transparent and flexible conductive films in AR/VR devices. According to the CBI, Europe, the European VR and AR market is projected to grow at an average annual rate of 35% in the coming years. The push for transparent electronics, including interactive displays for museums and exhibitions, reflects the region's commitment to cultural and technological innovation. Furthermore, environmental regulations promoting sustainable and recyclable materials drive the development of eco-friendly TCFs, boosting their adoption across various industries.

Latin America Transparent Conductive Films Market Analysis

In Latin America, the transparent conductive films market is driven by the increasing use of advanced display systems in advertising and retail. The region's expanding e-commerce and retail sectors are fostering demand for transparent touch displays and interactive kiosks. For instance, Brazil's robust e-commerce sector, with 90% penetration among adults, coupled with 96% fintech and banking adoption, drives demand for transparent conductive films, essential for touchscreen devices in online retail and fintech applications. The rise of the automotive industry, particularly in Brazil and Mexico, is encouraging the adoption of TCFs in vehicle infotainment systems and heads-up displays. Furthermore, advancements in entertainment and gaming, with growing investment in smart televisions and digital displays, support the market's expansion. The push for renewable energy solutions, particularly in solar panel technology, is also gaining momentum, enhancing the role of TCFs in improving energy efficiency.

Middle East and Africa Transparent Conductive Films Market Analysis

In the Middle East and Africa, the transparent conductive films market is propelled by increasing investments in smart infrastructure and digital advertising. For instance, Ad spending in the UAE Digital Advertising market is set to hit with mobile contributing 46% and programmatic ads driving 76% of revenue by 2028, fostering demand for transparent conductive films in advanced display technologies. The adoption of interactive digital signage in airports, shopping malls, and urban centers is accelerating, boosting demand for high-performance TCFs. The region’s focus on luxury and high-tech interiors in the hospitality sector, including touch-sensitive control panels, also drives market growth. Additionally, the rising use of advanced display systems in financial services, such as interactive teller machines and digital customer engagement platforms, supports market demand. Solar energy initiatives across countries like the UAE and South Africa further augment the adoption of TCFs in renewable energy projects.

Competitive Landscape:

The market exhibits a spontaneous competitive landscape highlighted by the robust establishment of major players actively emphasizing on technological innovations and product advancements. Numerous companies are heavily investing in substitute materials such as graphene and silver nanowires to mitigate challenges like resource limitations and escalated costs. Furthermore, strategic acquisitions, partnerships, and mergers are highly prevalent as various enterprises strive to extend their market foothold, along with fortifying their distribution networks. For instance, in April 2024, Sino Applied Technology announced a tactical partnership with Zeon Corporation to launch a single-walled carbon nanotube (CNT) conductive paste. This innovative solution is intended to function as a conductive agent additive in lithium-ion battery cathode and anode formulations. Additionally, it finds utility in applications such as transparent films and electromagnetic interference (EMI) shielding. In addition, key industry players are augmenting their portfolios to address the amplifying requirement from applications in flexible displays, smartphones, and wearables. Moreover, various regional manufacturers are also gaining momentum rapidly by providing cost-efficient solutions customized to local markets, elevating competition and bolstering constant product development across the market.

The report provides a comprehensive analysis of the competitive landscape in the transparent conductive films market with detailed profiles of all major companies, including:

- C3Nano Inc.

- Cambrios Technologies Corporation

- Canatu Oy

- Dontech Inc

- DuPont de Nemours Inc.

- Eastman Kodak Company

- Gunze Limited

- Nitto Denko Corporation

- OIKE & Co. Ltd.

- TDK Corporation

- Toyobo Co. Ltd.

Latest News and Developments:

- December 2024: DENSO Corporation has partnered with Finland's Canatu to apply carbon nanotube technology, focusing on transparent conductive films. This collaboration aims to enhance autonomous driving systems by addressing visibility issues caused by frost and condensation. Carbon nanotubes, known for their strength and conductivity, are central to these advancements. The initiative also aligns with DENSO's efforts toward achieving carbon neutrality.

- January 2024: FUJIFILM Corporation revealed plans to invest in its Kumamoto facility to boost the production of electronic materials, including Transparent Conductive Films (TCFs). The move aims to meet rising global demand for advanced electronic components. This growth highlights the company's dedication to strengthening its production capacity. FUJIFILM targets increased efficiency and market share in the TCF sector through this strategic investment.

- September 2023: Panasonic Industry and Meta Materials joined forces to accelerate the transparent conductive film market with NANOWEB films. The partnership spans from design to mass production, enabling advancements in consumer electronics and automotive applications. Key uses include transparent film antennas, electromagnetic shielding, and heaters. This collaboration paves the way for innovative and scalable solutions in the industry.

- May 2023: Canatu and Webasto teamed up to integrate a stationary film heater into the Roof Sensor Module (RSM). This solution, featuring anti-fogging and deicing systems, ensures reliable ADAS sensor performance under adverse weather conditions. The technology also supports camera systems, enhancing safety and visibility. This collaboration highlights Canatu's innovation in automotive sensor functionality.

- October 2022: C3Nano unveiled plans to expand its Ultra-Nanowire range, introducing plated nanowires for advanced applications. These silver nanowires, coated with nano-scale noble metal layers, offer enhanced durability and reliability. They are ideal for conductive coatings, advanced composites, and biocompatible materials. This innovation broadens the scope of nanowire technologies across multiple industries.

Transparent Conductive Films Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Indium Tin Oxide (ITO) on Glass, Indium Tin Oxide (ITO) on PET, Silver Nanowire, Carbon Nanotubes, Conductive Polymers, Others |

| Applications Covered | Smart Phones, Notebooks, Tablet, PC, Wearable Devices, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | C3Nano Inc., Cambrios Technologies Corporation, Canatu Oy, Dontech Inc, DuPont de Nemours Inc., Eastman Kodak Company, Gunze Limited, Nitto Denko Corporation, OIKE & Co. Ltd., TDK Corporation, Toyobo Co. Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the transparent conductive films market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global transparent conductive films market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the transparent conductive films industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Transparent conductive films (TCFs) are thin, optically transparent materials with electrical conductivity, widely used in electronic applications such as touchscreens, displays, solar cells, and LED lighting. These films enable efficient electrical performance while maintaining visual clarity, making them essential components in modern electronic and optoelectronic devices.

The transparent conductive films market was valued at USD 6.75 Billion in 2024.

IMARC estimates the global transparent conductive films market to exhibit a CAGR of 6.20% during 2025-2033.

The market is driven by growing demand for touch-enabled devices, advancements in flexible displays, and increased adoption in consumer electronics. Rising applications in solar panels, wearables, and automotive displays, along with innovations in material technology, further contribute to the market's expansion.

In 2024, indium tin oxide (ITO) on glass represented the largest segment by material, driven by its high conductivity and transparency.

Smart phones lead the market by application, driven by rising consumer demand for advanced displays.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global transparent conductive films market include C3Nano Inc., Cambrios Technologies Corporation, Canatu Oy, Dontech Inc, DuPont de Nemours Inc., Eastman Kodak Company, Gunze Limited, Nitto Denko Corporation, OIKE & Co. Ltd., TDK Corporation and Toyobo Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)